MNI EUROPEAN OPEN: Strong Risk Off Post Reciprocal Tariffs

EXECUTIVE SUMMARY

- TRUMP TARIFFS EVERYONE, WITH RATE ON CHINA SET TO SOAR ABOVE 50% - BBG

- EU VOWS TO RESPOND WITH COUNTERMEASURES TO TRUMP’S 20% TARIFFS - BBG

- MNI DISCUSSES NEAR-TERM BOJ RATE HIKE CHANCES - MNI

- CHINA TO FIGHT AGAINST U.S. TARIFF: MOFCOM - MNI BRIEF

- RBA TO REVEAL BOARD TRANSPARENCY PLANS IN H2 - MNI

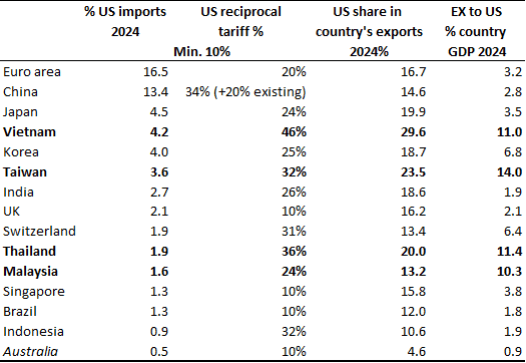

Fig 1: US Reciprocal Tariff Levels & Exposure To US By Country

Source: MNI - Market News/Bloomberg/Refinitiv.

UK

TRADE (BBC): “The government will keep pushing for a deal to avoid a "trade war" after US President Donald Trump imposed new tariffs globally, the UK business secretary has said.”

TRADE (BBC): “Northern Ireland goods entering the US will face a 10% tariff from Thursday after President Donald Trump imposed a sweeping round of protectionist trade measures. Goods from the Republic of Ireland will be hit with a 20% tariff as part of measures Trump has imposed on the EU.”

TECH (POLITICO): “Ministers are planning a fresh round of reviews they hope will mollify lawmakers nervous about controversial plans to overhaul U.K. copyright laws to facilitate AI innovation.”

EU

TARIFFS (MNI): EU retaliation against the reciprocal tariffs to be announced by US President Trump in his 'Liberation Day" announcement later today may take about a month and a half to implement at the earliest.

ECB (MNI BRIEF): Bank of France President Francois Villeroy said on Wednesday that the latest inflation data should give the ECB confidence it can cut rates again soon.

TRADE (BBG): “European Commission President Ursula von der Leyen said the EU is preparing for further countermeasures to protect its interests and businesses if negotiations fail. The EU trade ministers are due to meet on April 7 to discuss the US measures and the EU's response, with von der Leyen promising a firm and proportionate response to the tariffs.”

TRADE (POLITICO): “President Donald Trump dumped the European Union in the worst category of America’s trade partners Wednesday, hitting the bloc with a 20 percent tariff on all imports.”

NATO (POLITICO): “When United States Secretary of State Marco Rubio joins European allies in Brussels on Thursday, both sides will do their best to smile for the cameras and promise that all is well in NATO.”

NATO (POLITICO): “NATO is rock solid and so is the United States' commitment to the alliance, NATO Secretary-General Mark Rutte said today, a reaction to growing worry about American disengagement from Europe under President Donald Trump.”

GERMANY (WSJ): “ Volkswagen will add an "import fee" to the stickers on its cars that are affected by the 25% vehicle tariff, the German automaker told its dealers.”

EU (POLITICO): “Europe's most famous technology law, the GDPR, is next on the hit list as the European Union pushes ahead with its regulatory killing spree to slash laws it reckons are weighing down its businesses.”

EU (POLITICO): “The European Commission is considering revising landmark energy legislation as part of its drive to ease requirements on the EU’s struggling businesses, according to several people familiar with the plans.”

ITALY (POLITICO): “Europe's massive rearmament plans — and the EU's role in Ukraine — are turning into a splitting political headache for Italian Prime Minister Giorgia Meloni as she grapples to hold her right-wing coalition government together.”

GREECE (POLITICO): “Greece will spend €25 billion as part of a 12-year defense strategy, in the “most drastic transformation in the history of the country’s armed forces,” Prime Minister Kyriakos Mitsotakis announced in parliament on Wednesday.”

US

TARIFFS (BBG): “President Donald Trump imposed the steepest American tariffs in a century, stepping up his campaign to reshape the global economy and unnerving investors who see a trade war as a risk to US growth. Trump announced Wednesday he will apply at least a 10% tariff on all exporters to the US, with even higher duties on some 60 nations to counter large trade imbalances with the US. That includes some of the country’s biggest trading partners, such as China — which now faces a tariff of well above 50% on many goods — as well as the European Union, Japan and Vietnam.

TARIFFS (RTRS): "The latest round of U.S. trade tariffs unveiled on Wednesday will sap yet more vigour from a world economy barely recovered from the post-pandemic inflation surge, weighed down by record debt and unnerved by geopolitical strife."

TARIFFS (MNI BRIEF): U.S. President Donald Trump unveiled Wednesday at the White House a new 10% baseline tariff on all imported goods, in addition to reciprocal tariffs on around 60 countries, and other sectoral tariffs from autos to semiconductors.

FED (MNI BRIEF): Federal Reserve Governor Adriana Kugler said Wednesday the central bank's framework, which is currently under review, must be broad enough to apply to varying economic scenarios.

OTHER

MIDDLE EAST (BBG): “The Israeli army carried out multiple airstrikes in different parts of Syria on Wednesday, including the capital Damascus, and “almost completely destroyed” a military airport in another major city as Israel continues to degrade the war-torn country’s military capabilities.”

JAPAN (MNI): MNI discusses the BOJ's near-term rate hike chances. On MNI Policy MainWire now, for more details please contact sales@marketnews.com.

AUSTRALIA (MNI): MNI Looks At The RBA's Board's Plans For Greater Transparency. On MNI Policy MainWire now, for more details please contact sales@marketnews.com.

CHINA

TARIFFS (MNI BRIEF): China will fight back against the U.S.'s so called reciprocal tariffs revealed Wednesday local time and take decisive countermeasures to safeguard its interests, said the Ministry of Commerce in a statement on Thursday.

CHINA MARKETS

MNI: PBOC Net Injects CNY4.9 Bln via OMO Thursday

MNI (BEIJING) - The People's Bank of China (PBOC) conducted CNY223.4 billion via 7-day reverse repos, with the rate unchanged at 1.50%. The operation led to a net injection of CNY4.9 billion after offsetting the maturity of CNY218.5 billion today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.6481% at 09:49 am local time from the close of 1.8418% on Wednesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 40 on Wednesday, compared with the close of 44 on Tuesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

MNI: PBOC Sets Yuan Parity Higher At 7.1889 Thurs; -0.53% Y/Y

MNI (BEIJING) - The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1889 on Thursday, compared with 7.1793 set on Wednesday. The fixing was estimated at 7.2624 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND CORELOGIC HOME VALUES MAR. +0.5% M/M; FEB. +0.4%

NEW ZEALAND ANZ COMMODITY PRICES MAR. -0.4%; FEB. +3.0%

AUSTRALIA FEB. EXPORTS FALL 3.6% M/M; JAN. +0.8%

AUSTRALIA FEB. IMPORTS RISE 1.6% M/M; JAN. -0.4%

AUSTRALIA FEB. TRADE SURPLUS A$2.968B; EST. A$5.400B; JAN. A$5.156B

AUSTRALIA Q1 JOB VACANCIES -4.5% Q/Q; Q4 +5.2%

AUSTRALIA MAR. F S&P GLOBAL COMPOSITE PMI 51.6; PRE. 51.3; FEB. 50.6

AUSTRALIA MAR. F S&P GLOBAL SERVICES PMI 51.6; PRE. 51.2; FEB. 50.8

JAPAN JIBUN BANK MAR. F SERVICES PMI 50.0; PRE. 49.5; FEB. 53.7

JAPAN JIBUN BANK MAR. F COMPOSITE PMI 48.9; PRE. 48.5; FEB. 52.0

CHINA MAR. CAIXIN COMPOSITE PMI 51.8; FFEB. 51.5

CHINA MAR. CAIXIN SERVICES PMI 51.9; EST. 51.5; FEB. 51.4

SOUTH KOREA MAR. FOREIGN EXCHANGE RESERVES $409.66B; FEB. $409.21B

MARKETS

US TSYS: Cash Yields Gap Lower As Tariff Details Digested

US 10-year futures (TYM5) are dealing sharply higher in today's Asia-Pac session higher at 112-19, +1-02+ from closing levels.

- Cash Us tsys are dealing 5-8bps richer in today’s Asia-Pac session after finishing with modest gains yesterday following US President Trump's announcement on reciprocal tariffs.

- In early Asia Pac trading, there is a strong risk off tone, as markets digest the announcement. Broadly the universal tariff of 10% on all US imports was lower than feared, but the reciprocal tariff levels for some regions/countries were notably higher. For China it was 34%, which came on top of the existing 20% tariff level. The EU's reciprocal tariff was 20%, while Japan's was 24%.

- Yesterday, US tsys had been grinding cheaper going into the announcement but reversed direction to finish modestly richer. The US 2- and 10-year yields finished 2bps and 4bps lower respectively.

- Key US data tonight will be the ISM Services Index.

JGBS: Sharply Richer Led By 7Y & 10Y, HH Spend Data Tomorrow

In Tokyo afternoon trade, JGB futures are sharply higher, +130 compared to settlement levels, and approaching session highs after paring gains into today’s 10-year auction.

- Today’s auction displayed mixed demand metrics, with the low price falling short of expectations at 99.87, according to the Bloomberg dealer poll. However, the cover ratio increased to 3.1475x from 2.6566x, the weakest since October 2021, and the tail shortened to 0.11 from 0.21.

- Nevertheless, futures have largely re-gained lost ground in afternoon dealing, assisted by cash US tsys, which are dealing 6-9bps richer in today's Asia-Pac session.

- There is a strong risk-off tone, as markets digest US President Trump's announcement on reciprocal tariffs. Broadly the universal tariff of 10% on all US imports was lower than feared, but the reciprocal tariff levels for some regions/countries were notably higher. For China it was 34%, which came on top of the existing 20% tariff level. The EU's reciprocal tariff was 20%, while Japan's was 24%.

- Cash JGBs are 6-14bps richer across benchmarks, with the futures-linked 7-year and 10-year leading. The benchmark 10-year yield is 13.0bps lower at 1.343% versus the cycle high of 1.596%, set last week.

- Swap rates are 7-13bps lower.

- Tomorrow, the local calendar will see Household Spending data.

AUSSIE BONDS: Sharply Richer, HH Spending & Nov-31 Supply Tomorrow

ACGBs (YM +17.0 & XM +15.5) are sharply higher and back near session highs.

- While the local calendar saw Trade Balance, Job Vacancies and PMI data, the focus has been abroad with markets digesting President Trump's reciprocal tariffs.

- Broadly the universal tariff of 10% on all US imports was lower than feared, but the reciprocal tariff levels for some regions/countries were notably higher. For China it was 34%, which came on top of the existing 20% tariff level. The EU's reciprocal tariff was 20%, while Japan's was 24%.

- Cash US tsys are dealing 6-8bps richer in today's Asia-Pac session. The US 10-year yield is currently at 4.05%, trading below the key 4.10% level, with the 3.60-3.80% zone as the next major support area.

- Cash ACGBs are 15-16bps richer.

- Swap rates are 13-15bps lower, with the 3s10s curve steeper.

- The bills strip has dramatically bull-flattened with pricing +7 to +17.

- RBA-dated OIS pricing is 4-17bps richer across meetings today. A 25bp rate cut in May is given a 91% probability, with a cumulative 86bps of easing priced by year-end.

- Tomorrow, the local calendar will see Household Spending alongside AOFM’s planned sale of A$600mn of the 1.0% Nov-31 bond.

BONDS: NZGBS: Closed Sharply Richer But Post-Tariff Gains Pared

NZGBs closed 6-11bps riche but well off session bests of 10-14bps richer. The move away from yield lows tracked the slight paring in gains by US tsys through today’s Asia-Pac session. Cash US tsys are currently dealing 5-7bps richer in today's Asia-Pac session.

- There has been a strong risk-off tone in today’s Asia-Pac session as markets digest US President Trump's announcement on reciprocal tariffs. That said, US equity futures are off their worst levels at the time of writing.

- Broadly the universal tariff of 10% on all US imports was lower than feared, but the reciprocal tariff levels for some regions/countries were notably higher. For China it was 34%, which came on top of the existing 20% tariff level. The EU's reciprocal tariff was 20%, while Japan's was 24%.

- Swap rates closed 6-10bps lower, with the 2s10s curve flatter.

- RBNZ dated OIS pricing closed 2-6bps softer across meetings. 26bps of easing is priced for April, with a cumulative 77bps by November 2025.

- Tomorrow, the local calendar will be empty.

FOREX: USD Index Falls, Yen Outperforms, A$ & NZD Lag

The BBDXY opened just above 1270 and has quickly fallen to its lows around 1263, where we currently hover going into the London open. We are off around 0.60%. Dollar highs came not long after reciprocal tariffs were announced, which were generally above market expectations. China's total tariff rate will 54%, while the EU's is at 20%, Japan 24%. Lower US yields, coupled with sharp equity future falls, has further dented the US exceptionalism theme and weighed on the USD as the session progressed.

- JPY and CHF are the strongest performers. USD/JPY is down to 147.25/30 in latest dealings, 1.3% stronger in yen terms. USD/CHF was last near 0.8755/60, up 0.70% in CHF terms. For USD/JPY, downside focus may rest with 146.54 level, the Mar 11 low and bear trigger.

- Cross asset sentiment trades very poorly, with US equity futures around 3% down, huge demand for treasuries (cash yields down 6-8bps), while gold is continuing to make new highs.

- EUR and EU bloc currencies have also recovered strongly from earlier lows, while GBP is also up firmly.

- EUR/USD - after rejecting the initial move towards 1.0925 and moving back to 1.0805 as the true extent of the tariffs were unveiled, the EUR has spent most of the Asian session climbing back to once more challenge the 1.0925 area. An end to US exceptionalism, with hopes of further EU equity outperformance post the tariff news, may be a factor for EUR's rebound today.

- GBP/USD - goes into the London open trading at its highs around 1.03070

- AUD/USD - has not been able to challenge the highs it saw initially and trades someway off from 0.6341 to go into the London session around 0.6275, similarly with the NZD around 0.5740. Both currencies are being more challenged by some of their biggest export destinations being hit hardest by the tariffs, such as China.

- USD/CNH - a huge spike to print close to 7.3500 on the Tariff news, it has spent most of Asia giving back some of this move, no doubt helped by some smoothing by officials. China has committed itself to a stable currency and USD/CNH will continue to be managed to reflect that. The previous highs around 7.3650/3700 will be keenly watched. We were last near 7.3100, around +0.20% firmer versus end NY levels from Wednesday.

- Looking ahead, we get final PMI reads for the EU and UK. In the US, the ISM services print, along with initial jobless claims will be in focus. Country/region responses to the US reciprocal tariff announcement will also be a watch point.

ASIA STOCKS: Key Bourses Down on Tariff Announcement.

With the announcement of tariffs there was little place to hide for Asian stocks today with major bourses falling across eh region.

Gold stocks were one of the few bright spots with key gold stocks in Australia seeing gains of up to 5% whilst Gold related stocks in Hong Kong were up 4%.

The tariff announcement was worse than expected prompting a response from Chinese authorities vowing to enact measures in response.

- China’s key bourses were led lower by the Hang Seng which is down -1.5%, the CSI 300 down -1.3%, Shanghai down -0.50% and Shenzhen down -1.3%.

- Korea’s KOSPI is down for a second straight day. Having declined -0.6% yesterday, it has followed that up with a fall of -0.80% today.

- Malaysia’s FTSE KLCI Index had a very strong day yesterday after being closed for holidays but couldn’t back that up today falling -0.30%.

- In Singapore the FTSE Straits Times was one of the regions best performing bourses, down just -0.06%, whilst the Philippines fell heavily by -1.4% and after receiving some of the largest tariffs from the White House Vietnam’s index is down over -6%.

- India’s NIFTY 50 put in a strong day yesterday as ongoing speculation continues about a trade deal, but hasn’t been able to back that up in their morning trading session down -0.15%

OIL: Crude Down Sharply On Global Growth Worries, Next Event US Payrolls

Oil prices are sharply lower today following the US announcement of reciprocal tariffs. Another 34% was added to the existing 20% tariff on China, the world’s largest crude importer. All US imports face a minimum 10% trade tax but US energy imports are exempt. Markets have been focussed on the impact of tighter sanctions on global oil supply but worries about the effect of tariffs on demand have returned with today’s statement. The USD index is down 0.6%.

- WTI is off its intraday low of $69.27/bbl reached early in the session but it is still down 2.4% today to $69.96 after breaking above $70 briefly. It has remained above initial support at $69.01, 20-day EMA.

- Brent troughed at $72.52/bbl earlier but has recovered to $73.24 to be down 2.3% on the day. The benchmark also remains above initial support at 72.29, 20-day EMA.

- Bloomberg reported that trading volumes during today’s APAC session have been above average across contracts for both benchmarks.

- With oil & gas exempt from US tariffs, the main impact on energy will be from slower global growth which will depend on any retaliatory measures. Some smaller countries, such as Malaysia, have said they won’t retaliate. The EU will negotiate but if that fails, it has a response planned. China has promised countermeasures but didn’t provide details. Despite the imminent implementation, it appears that major negotiations are ongoing.

- Supply uncertainty persists with OPEC saying it will be stricter on those exceeding quotas and Trump threatening both Russia and Iran.

- Later the Fed’s Jefferson and Cook speak and March Challenger job cuts, February trade, March services indices and jobless claims print. Given current heightened uncertainty, oil markets will focus now on Friday’s March payroll data.

- The ECB’s de Guindos and Schnabel appear today and the latest meeting accounts are published, there are also European March services/composite PMIs and February PPI data.

GOLD: Another Day, Another High for Gold.

- As the Federal Reserve left rates on hold and cautioned on inflation gold’s recent good performance continued, reaching new highs.

- Gold is up over 16% year to date and touched a new high of US$3,057.44, before giving up gains to finish at $3,044.89.

- Gold activity globally is heating up as the Swiss Federal Customs Administration released details of their exports to the US remaining elevated at 147.4 tonnes, over US$14bn in value whilst shipments to India and Hong Kong fell.

- Yesterday in China, the China Securities Journal ran an article warning retail investors on investing in gold as they expect prices to be volatile going forward.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Country | Event |

| 03/04/2025 | 0630/0830 | *** | CPI | |

| 03/04/2025 | 0700/0300 | * | Turkey CPI | |

| 03/04/2025 | 0715/0915 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0715/0915 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0720/0920 | ECB's De Guindos On "Financial Stability In Uncertain Times" | ||

| 03/04/2025 | 0745/0945 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0745/0945 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0750/0950 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0750/0950 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0755/0955 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0755/0955 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0800/1000 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0800/1000 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0830/0930 | Decision Maker Panel data | ||

| 03/04/2025 | 0830/0930 | ** | S&P Global Services PMI (Final) | |

| 03/04/2025 | 0830/0930 | *** | S&P Global/ CIPS UK Final Composite PMI | |

| 03/04/2025 | 0900/1100 | ** | PPI | |

| 03/04/2025 | 0900/1000 | ** | Gilt Outright Auction Result | |

| 03/04/2025 | 1000/1200 | ECB's Schnabel At OECD Seminar | ||

| 03/04/2025 | 1230/0830 | *** | Jobless Claims | |

| 03/04/2025 | 1230/0830 | ** | WASDE Weekly Import/Export | |

| 03/04/2025 | 1230/0830 | ** | International Merchandise Trade (Trade Balance) | |

| 03/04/2025 | 1230/0830 | ** | Trade Balance | |

| 03/04/2025 | 1345/0945 | *** | S&P Global Services Index (final) | |

| 03/04/2025 | 1345/0945 | *** | S&P Global US Final Composite PMI | |

| 03/04/2025 | 1400/1000 | *** | ISM Non-Manufacturing Index | |

| 03/04/2025 | 1430/1030 | ** | Natural Gas Stocks | |

| 03/04/2025 | 1530/1130 | ** | US Bill 04 Week Treasury Auction Result | |

| 03/04/2025 | 1530/1130 | * | US Bill 08 Week Treasury Auction Result | |

| 03/04/2025 | 1630/1230 | Fed Vice Chair Philip Jefferson | ||

| 03/04/2025 | 1830/1430 | Fed Governor Lisa Cook | ||

| 04/04/2025 | 2330/0830 | ** | Household spending | |

| 04/04/2025 | 0545/0745 | ** | Unemployment | |

| 04/04/2025 | 0600/0800 | Flash CPI | ||

| 04/04/2025 | 0600/0800 | ** | Manufacturing Orders | |

| 04/04/2025 | 0600/0800 | *** | Flash Inflation Report | |

| 04/04/2025 | 0630/0730 | DMO announce Apr-Jun issuance operations | ||

| 04/04/2025 | 0645/0845 | * | Industrial Production | |

| 04/04/2025 | 0700/0900 | ** | Industrial Production | |

| 04/04/2025 | 0730/0930 | ** | S&P Global Final Eurozone Construction PMI | |

| 04/04/2025 | 0800/1000 | * | Retail Sales | |

| 04/04/2025 | 0800/1000 | ECB's De Guindos Gives Lecture In Barcelona | ||

| 04/04/2025 | 0830/0930 | ** | S&P Global/CIPS Construction PMI | |

| 04/04/2025 | 1230/0830 | *** | Employment Report |