MNI EUROPEAN OPEN: Trump States No Intention To Fire Powell

EXECUTIVE SUMMARY

- TRUMP SAYS HE HAS ‘NO INTENTION’ TO FIRE POWELL - MNI BRIEF

- WHITE HOUSE WANTS USD TO REMAIN RESERVE CURRENCY - MNI BRIEF

- FED’S KUGLER - STEADY RATE UNTIL INFLATION RISKS EBB - MNI

- TRUMP FLOATS CUTTING CHINA TARIFFS ‘SUBSTANTIALLY’ IN TRADE DEAL - BBG

- IMF SLASHES GLOBAL OUTLOOK AS WHITE HOUSE SAYS TRADE TALKS PICK UP PACE - RTRS

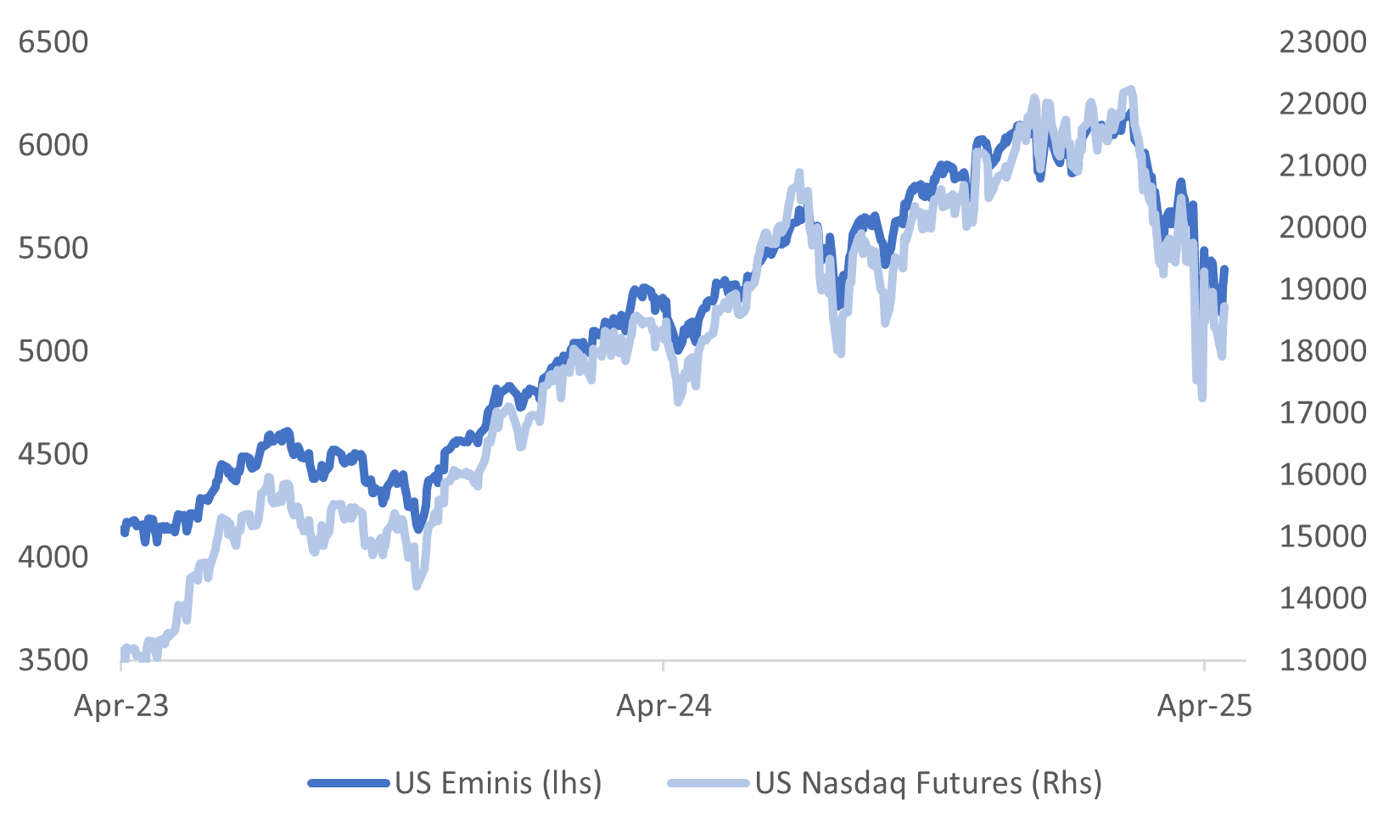

Fig 1: US Equity Futures Firmer

Source: MNI - Market News/Bloomberg/Refinitiv.

UK

TRADE (BBG): “ UK Chancellor of the Exchequer Rachel Reeves will make a personal appeal for a trade deal to US Treasury Secretary Scott Bessent in Washington this week, aiming to “defend British interests” and secure preferential treatment on tariffs. “

TRADE (POLITICO): “Chancellor Rachel Reeves has warned that Donald Trump’s trade war will have a “profound impact” on the U.K. economy, as she heads to Washington grappling with downgraded domestic growth forecasts.”

EU

FX (BBG): “European Central Bank Vice President Luis de Guindos said the euro could become an alternative to the dollar as a reserve currency if Europe increases its integration efforts.”

RUSSIA (BBG): “ The European Union is preparing to discuss the idea of a ban on spot purchases of natural gas from Russia as part of a plan to phase out energy imports from the country.”

UKRAINE (POLITICO): “Ukrainian President Volodymyr Zelenskyy has said Kyiv is ready to negotiate directly with Moscow to end the war if Russia first agrees to a full ceasefire.”

UKRAINE (RADIO FREE EUROPE): “Top European and Ukrainian officials are set to meet in London on April 23 for yet another round of talks aimed at trying to halt Europe’s largest land war since World War II. However, top US officials will not attend.”

BUSINESS (POLITICO): “Hermès said Tuesday it will open a new factory in France, hiring 260 artisans to staff a leather workshop in Normandy just as its just as its main competitor, LVMH, is threatening to increase production to the United States at Europe's expense.”

US

FED (MNI BRIEF): President Donald Trump said Tuesday he does not intend to fire Federal Reserve Chair Jerome Powell, but again complained about interest rates being too high and said the central bank should preemptively cut rates.

FED (MNI): The Federal Reserve should keep interest rates on hold at current levels until the looming threat of higher inflation, including from tariff policies, abates, Fed Governor Adriana Kugler said Tuesday.

FED (MNI BRIEF): Central bank independence is key to ensuring the Federal Reserve can keep inflation low and stable in the long run, Minneapolis Fed President Neel Kashkari said Tuesday.

DOLLAR (MNI BRIEF): White House Press Secretary Karoline Leavitt told reporters Tuesday that President Donald Trump wants to see the dollar remain the world's reserve currency.

TARIFFS/CHINA (BBG): “President Donald Trump said he plans to be “very nice” to China in any trade talks and that tariffs will drop if the two countries can reach a deal, a sign he may be backing down from his tough stance on Beijing amid market volatility.”

CORPORATE (BBG): “Elon Musk vowed to pull back “significantly” from his work with the US government to concentrate on Tesla Inc., easing concerns of investors who lamented his time in Washington as a distraction.”

CORPORATE (BBG): “Intel Corp. is poised to announce plans this week to cut more than 20% of its staff, aiming to eliminate bureaucracy at the struggling chipmaker, according to a person with knowledge of the matter.”

OTHER

GLOBAL GROWTH (RTRS): “Worldwide economic output will slow in the months ahead as U.S. President Donald Trump's steep tariffs on virtually all trading partners begin to bite, the International Monetary Fund said on Tuesday, as global finance chiefs swarmed Washington seeking deals with Trump's team to lower the levies.”

CANADA (MNI BRIEF): Conservative Leader Pierre Poilievre's election platform excluded a fresh mention of his previous strong pledges to get rid of Bank of Canada Governor Tiff Macklem, shifting the blame for rapid inflation to Liberal budget deficits.

SOUTH KOREA (RTRS): “Beijing recently asked South Korean companies not to ship products containing China's rare earth minerals to U.S. defence firms, the Korea Economic Daily reported on Tuesday, citing government and company sources.”

IRAN (ECONOMIST): “On Wednesday Iran’s foreign minister will visit Beijing. The trip comes after a second round of nuclear talks with America, in Rome on April 19th, and a stop in Moscow the day before. His travels are connected. Russia and China are friendly to Iran; they are also parties to a nuclear deal signed in 2015 and abandoned by Donald Trump three years later.

CHINA

US/CHINA (BBG): US Treasury Secretary Scott Bessent told a closed-door investor summit Tuesday that the tariff standoff with China cannot be sustained by both sides and that the world’s two largest economies will have to find ways to de-escalate.

POLICY (YICAI): “China should prioritise countercyclical policy, especially lowering the policy interest rate and expanding public investment, to drive a significant increase in social income and consumption in the short term, in response to declining external demand amid U.S. tariff disruptions, according to a report by China Finance 40 Forum.”

YUAN (SECURITIES DAILY): “The stability of the yuan and sound operation of the foreign exchange market will be supported by additional measures to be introduced in a timely manner as needed, as China takes expanding domestic demand as a long-term strategy, said Li Bin, deputy director and spokesperson of the State Administration of Foreign Exchange.”

CHINA MARKETS

MNI: PBOC Net Injects CNY3.5 Bln via OMO Wednesday

MNI (BEIJING) - The People's Bank of China (PBOC) conducted CNY108 billion via 7-day reverse repos, with the rate unchanged at 1.50%. The operation led to a net injection of CNY3.5 billion after offsetting the maturities of CNY104.5 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.5138% at 09:35 am local time from the close of 1.7079% on Tuesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 46 on Tuesday, compared with the close of 50 on Monday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

MNI: PBOC Sets Yuan Parity Higher At 7.2116 Weds; -0.93% Y/Y

MNI (BEIJING) - The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.2116 on Wednesday, compared with 7.2074 set on Tuesday. The fixing was estimated at 7.3417 by Bloomberg survey today.

MARKET DATA

AUSTRALIA S&P GLOBAL APRIL PRE MFG PMI 51.7; MAR. 52.1

AUSTRALIA S&P GLOBAL APRIL PRE SERVICES PMI 51.4; MAR. 51.6

AUSTRALIA S&P GLOBAL APRIL PRE COMPOSITE PMI 51.4; MAR. 51.6

JAPAN JIBUN BANK APRIL PRE MFG PMI 48.5; MAR. 48.4

JAPAN JIBUN BANK APRIL PRE SERVICES PMI 52.2; MAR. 50

JAPAN JIBUN BANK APRIL PRE COMPOSITE 51.1; MAR. 48.9

JAPAN TERTIARY INDEX FEB. 0.0% M/M; EST. +0.4%; JAN. +1.4%

SOUTH KOREA CONSUMER CONFIDENCE APR 93.8; MAR. 93.4

MARKETS

US TSYS: Asia Wrap - Yields Drift Lower In The Long End

TYM5 has traded higher with a range of 110-20 to 111-00+ during the Asia-Pacific session. It last changed hands at Heading 110-29, up 0.04 from the previous close.

- The US 10-year yield is drifting lower, dealing around 4.34%, down from its open around 4.40%

- The US 2-year yield is unchanged, dealing around 3.81%

- Risk has reversed higher as Trump makes a U-turn saying he won’t fire Powell and made comments that seemed to soften his stance towards China.

- Block Curve flattener flows : SELL 8200 of USM5 traded at 108-06, post-time 01:25:20 BST (DV01 $353,017). BUY 2800 of USM5 traded at 114-22, post-time 01:25:20 BST (DV01 $353,492).

- 10-year Yields, having bounced off their support around the 4.25 area, yields are consolidating with the range looking something like 4.25/4.50% for now.

- Data/Events : US S&P Global Services & Manufacturing PMI, New Home sales

JGBS: Futures Off Lows, Twist-Flattener Remains, PPI Services Tomorrow

JGB futures are weaker but at session highs, -14 compared to settlement levels

- Risk-on sentiment extended into today's Asia-Pacific session after US President Trump stated that he had no intention of firing Fed Chair Powell.

- Trump also stated that the final tariff number for China wouldn't be near the current 145%.

- Cash US tsys have twist-flattened in today's Asia-Pac session, with yields 2bps higher to 8bps lower.

- While attention has been mostly focused abroad, the latest Reuters Poll on the BoJ Outlook showed: 84% of economists expect the BoJ to keep the key interest rate at 0.50% through end-June. 52% predict a rate hike to 0.75% in Q3, down from 70% in the March poll. Only 28% now expect a July hike, compared to 70% in March; 23% foresee the next hike happening in 2026 or later. 87% say Japan is unlikely to enter a recession in 2025.

- The cash JGB curve has twist-flattened, pivoting at the 20-year, with yields 2bps higher to 6bps lower.

- The swaps curve has also twist-flattened, with rates 2bps higher to 5bps lower.

- Tomorrow, the local calendar will see PPI Services, International Investment Flow and Machine Orders data alongside 2-year supply.

AUSSIE BONDS: Twist-Flattener, IMF Panel Discussion For RBA Gov

ACGBs (YM -6.0 & XM +1.5) are dealing mixed on a data light Sydney session, with the short-end under pressure as markets re-assess tariff-tied risks to global trade and the Trump Admin's efforts to meddling with the Federal Reserve's independent policy making.

- Risk-on sentiment extended into today's Asia-Pacific session after US President Trump stated that he had no intention of firing Fed Chair Powell.

- Trump also stated that the final tariff number for China wouldn't be near the current 145%.

- Cash US tsys have twist-flattened in today's Asia-Pac session, with yields 2bps higher to 8bps lower.

- Cash ACGBs are 5bps cheaper to 1bp richer with the AU-US 10-year yield differential at -10bps.

- Today’s auction of the Apr-29 bond saw the weighted average yield settle 0.88bps below the prevailing mid-yield. However, the cover ratio declined dramatically to 3.2200x from 4.2143x at the previous auction.

- Swap rates are flat to 5bps higher, with the 3s10s curve flatter.

- The bills strip is cheaper with pricing -4 to -9.

- RBA-dated OIS pricing is 2-11bps firmer across meetings today. A 50bp rate cut in May is given a 13% probability, with a cumulative 114bps of easing priced by year-end.

- Tomorrow morning, RBA Governor Bullock will participate in a panel discussion at the IMF Spring Meetings.

BONDS: NZGBS: Closed Slightly Cheaper, Focus Abroad As Risk-On Extends

NZGBs closed slightly cheaper, with benchmark yields 1-2bps cheaper. With the local calendar light today, the domestic market has focused its attention abroad.

- Risk-on sentiment extended into today's Asia-Pac session after US President Trump stated that he had no intention of firing Fed Chair Powell.

- Trump also stated that the final tariff number for China wouldn't be near the current 145%. He also expressed optimism around trade deals with lots of countries and spoke of the large investment agreements reached for flows into the US.

- Cash US tsys have twist-flattened in today's Asia-Pac session, with yields 2bps higher to 8bps lower.

- The NZ–US 10-year yield differential widened by 6bps to +14bps. This places the spread roughly where it was in early March, though it's about 20bps narrower than its levels in early April.

- Swap rates closed flat to 3bps higher, with the 2s10s curve flatter.

- RBNZ dated OIS pricing closed flat to 3bps firmer across meetings, with late 2025 leading. 27bps of easing is priced for May, with a cumulative 80bps by November 2025.

- Tomorrow, the local calendar will see ANZ Consumer Confidence.

- The NZ Treasury plans to sell NZ$250mn of the 4.50% May-30 bond and NZ$250mn of the 4.25% May-36 bond tomorrow.

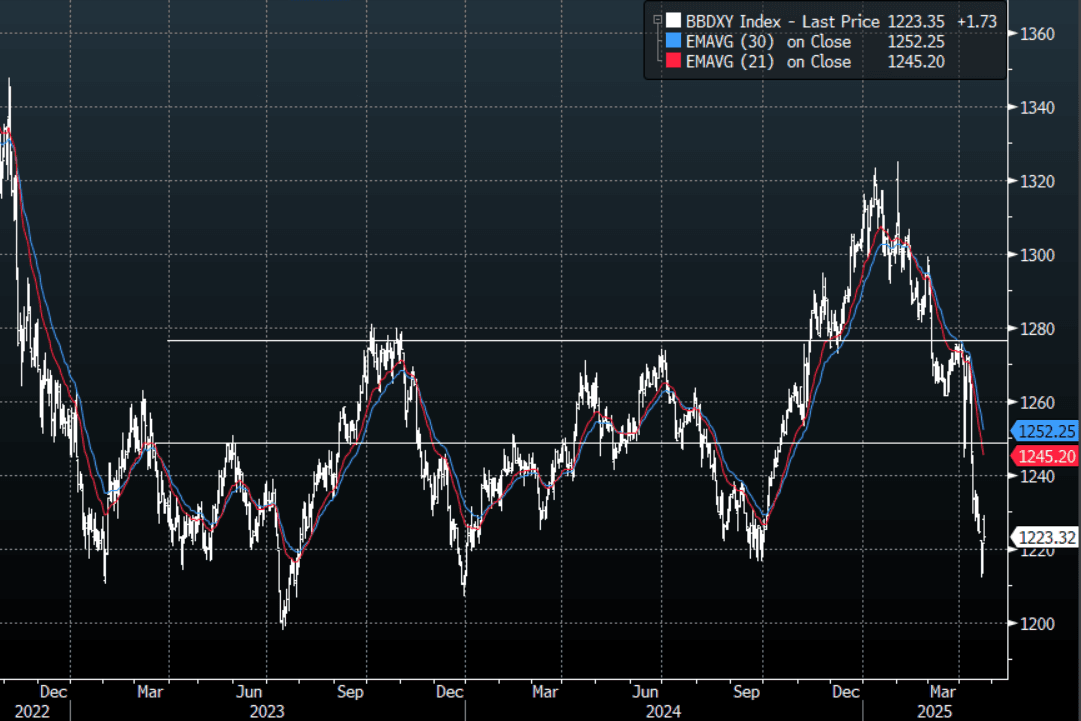

The BBDXY had an Asian range of 1221.87 - 1229.02. With risk turning around on Trump’s U-turn on Powell and China, as well as Tesla soaring on Elon Musk saying he would be pulling back significantly from DOGE, the USD has had a decent bounce. Is this move sustainable ? Should risk continue to rally we could see some relief from short-term oversold levels but the market will see a decent bounce as an opportunity to once again fade. Bloomberg reports Emmanuel Macron is exploring the possibility of dissolving parliament and holding snap elections as soon as this fall.

- EUR/USD - Asian range 1.1308 - 1.1429, has given back all of Mondays gains and more. The EUR comes off from levels that are overbought, it's been a huge move when you consider it was trading sub 1.0400 the beginning of March. The consensus trade is now to be short USD, a short term rally would be healthy. Demand should remerge on dips back to 1.1100.

- GBP/USD - Asian range 1.3234 - 1.3338, like the EUR Asia looked to be stopping out weaker hands. Dips should be supported, first around 1.3200 then the big support towards 1.3000.

- USD/JPY - Asian range 141.49 - 143.22, large gap higher in the Asian open in what looked to be stops being executed as risk rallied. Supply returned above 143.00 and we have drifted lower for the session from then onwards. USD/JPY’s fate is tied to whether risk is able to hold onto these gains and begin a sustained rally or if this is just another bounce to be faded.

- AUD/USD - Asian Range 0.6349 - 0.6405, The initial leg higher in risk saw the AUD move lower as the USD got bought. Decent buyers emerged around 0.6350 and the AUD has moved back towards 0.6400 going into London.

- USD/CNH - Asian range 7.2922 - 7.3156, the USD/CNY fix printed at 7.2116. USD/CNH continues to trade sideways and find support towards 7.2800.

- Cross asset : SPX +1.58%, Gold 3340, US 10yr 4.35%, BBDXY 1223, Crude oil 64.22.

- Data/Events : US S&P Global Services & Manufacturing PMI, FRA PMI’s, GER PMI’s, EC PMI’s, EC Trade Balance

Fig 1 : BBDXY Daily Chart

Source: MNI - Market News/Bloomberg

ASIA STOCKS: All In The Green Amid Tariff Hopes/Trump Call On Powell

Asia Pac equity markets are all in the green, led by tech related plays and Hong Kong markets. We had strong cash gains in US markets on Tuesday, while US futures are firmly in the first part of Wednesday trade. Trump remarks have dominated sentiment, with the US President stating he had no intention of firing Fed Chair Powell (which has been a source of concern for markets recently), while also stating final tariff levels on China will be lower than the 145% that currently prevails. This followed reported comments from US Tsy Secretary Bessent that the tariff standoff is unsustainable, and he expects de-escalation with China.

- Eminis are up over 1.5%, but the contract has been unable to sustain +5400 levels. A move into 5500/5600 region would likely be needed to unnerve recent shorts for this benchmark. Nasdaq futures are +1.8% at this stage.

- Japan markets are up over 2% at this stage, with the NKY 225 trending back towards 35000. The Taiex has outperformed in Taiwan up nearly 4%, while the South Korean Kospi is up around 1.5%, above 2500 in index terms.

- Hong Kong markets have the HSI up 2.4% at the break, with the tech sub index over 3%.

- Despite appearing to soften his stance on China, onshore China markets are only a touch higher at this stage. The CSI 300 up +0.22%, lagging the gains seen elsewhere.

- Trends are slightly more modest in SEA markets, the Singapore Straits Times up around 1%, same too for JCI in Jakarta, +1.2%. Gains elsewhere though are under 1%, while Philippine markets are down slightly.

OIL: Crude Higher Again But Iran Outlook Highly Uncertain, US EIA Data Out Later

Oil prices have continued trending higher during APAC trading as risk appetite improved in relief following President Trump’s comments that he wouldn’t sack Fed Chair Powell and that China’s tariffs would finish below the current 145%. China is the world’s largest importer of crude. The USD index is off today’s high but still up 0.2%.

- WTI is 0.9% higher today to $64.23/bbl after a peak of $64.48 and is now up slightly this week but still down sharply in April. Brent is up 0.8% to $67.98 with gains above $68.00 unsustained but is currently steady on the week. The prompt spread structure is in bullish backwardation, according to Bloomberg.

- With demand/supply concerns persisting, US inventory data remain in focus. US industry-based figures showed a sharp drawdown in crude and both gasoline and distillate, suggesting demand remains solid which has contributed to today’s higher oil prices. The official EIA data is out later today.

- Significant uncertainty around the outlook for Iran’s oil exports persists after the US Treasury said there would be stricter enforcement of sanctions and introduced measures against an LPG magnate with a large shipping fleet. Iran’s foreign minister is headed to China following recent talks with the US. China is the main buyer of its oil.

- Later there is more Fedspeak with Goolsbee, Musalem, Waller, Hammack and Kugler appearing. US preliminary April S&P Global PMIs, March housing data and the Fed’s Beige Book are released. European April PMIs and euro area February trade print.

- The IMF/World Bank & G20 finance ministers/central bank governors meetings take place. The ECB’s Lane and Cipollone participate in panels and BoE’s Bailey and Breeden also appear, while BoE’s Pill speaks at another event.

GOLD: Tracking Lower For 2nd Straight Session, But Still Well Above Key Support

Gold made lows just under $3316 in the first part of trade, where liquidity was lighter amid strong USD gains. We stabilized since then but found selling interest above $3386. We last racked near $3340, still off 1.20% for the session.

- Gold has been moving in lock step with USD weakness recently, so it no surprise that we have corrected lower for bullion as USD sentiment has stabilized. Trump remarks, particularly around having no intention to fire Fed Chair Powell, has aided USD sentiment, but we sit off earlier highs though for the BBDXY index (last under 1224).

- Gold is still in a technical bullish uptrend though. Focus will be on re-testing $3500 on the upside. Initial firm support lies at $3163.5, the 20-day EMA.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Country | Event |

| 23/04/2025 | 0600/0700 | *** | Public Sector Finances | |

| 23/04/2025 | 0630/0730 | DMO remit revision following FY24/25 CGNCR | ||

| 23/04/2025 | 0715/0915 | ** | S&P Global Services PMI (p) | |

| 23/04/2025 | 0715/0915 | ** | S&P Global Manufacturing PMI (p) | |

| 23/04/2025 | 0730/0930 | ** | S&P Global Services PMI (p) | |

| 23/04/2025 | 0730/0930 | ** | S&P Global Manufacturing PMI (p) | |

| 23/04/2025 | 0800/1000 | ** | S&P Global Services PMI (p) | |

| 23/04/2025 | 0800/1000 | ** | S&P Global Manufacturing PMI (p) | |

| 23/04/2025 | 0800/1000 | ** | S&P Global Composite PMI (p) | |

| 23/04/2025 | 0800/1000 | ECB Wage Tracker | ||

| 23/04/2025 | 0830/0930 | *** | S&P Global Manufacturing PMI flash | |

| 23/04/2025 | 0830/0930 | *** | S&P Global Services PMI flash | |

| 23/04/2025 | 0830/0930 | *** | S&P Global Composite PMI flash | |

| 23/04/2025 | 0900/1100 | ** | Construction Production | |

| 23/04/2025 | 0900/1100 | * | Trade Balance | |

| 23/04/2025 | 1030/1130 | BOE's Pill speech at University of Leeds | ||

| 23/04/2025 | 1100/0700 | ** | MBA Weekly Applications Index | |

| 23/04/2025 | 1300/0900 | Chicago Fed's Austan Goolsbee | ||

| 23/04/2025 | 1330/0930 | St. Louis Fed's Alberto Musalem | ||

| 23/04/2025 | 1330/0930 | Fed Governor Christopher Waller | ||

| 23/04/2025 | 1345/0945 | *** | S&P Global Manufacturing Index (Flash) | |

| 23/04/2025 | 1345/0945 | *** | S&P Global Services Index (flash) | |

| 23/04/2025 | 1400/1000 | *** | New Home Sales | |

| 23/04/2025 | 1400/1000 | Treasury Secretary Scott Bessent | ||

| 23/04/2025 | 1430/1030 | ** | DOE Weekly Crude Oil Stocks | |

| 23/04/2025 | 1530/1130 | ** | US Treasury Auction Result for 2 Year Floating Rate Note | |

| 23/04/2025 | 1700/1300 | * | US Treasury Auction Result for 5 Year Note | |

| 23/04/2025 | 1715/1815 | BOE's Bailey at Institute of International Finance | ||

| 23/04/2025 | 1800/1400 | Fed Beige Book | ||

| 23/04/2025 | 1800/1900 | BOE's Breeden on Monetary Policy and Financial Stability | ||

| 23/04/2025 | 1915/2115 | ECB's Lane in panel on Central Bankers' Dilemmas Amid Changing Liquidity | ||

| 23/04/2025 | 1945/2145 | ECB's Cipollone in panel on Tokenization and the Financial System | ||

| 23/04/2025 | 2230/1830 | Cleveland Fed's Beth Hammack | ||

| 24/04/2025 | 0645/0845 | ** | Consumer Sentiment | |

| 24/04/2025 | 0700/0900 | ** | PPI | |

| 24/04/2025 | 0800/1000 | *** | IFO Business Climate Index | |

| 24/04/2025 | 0900/1000 | ** | Gilt Outright Auction Result | |

| 24/04/2025 | 1000/1100 | ** | CBI Industrial Trends | |

| 24/04/2025 | 1230/0830 | *** | Jobless Claims | |

| 24/04/2025 | 1230/0830 | ** | WASDE Weekly Import/Export | |

| 24/04/2025 | 1230/0830 | * | Payroll employment | |

| 24/04/2025 | 1230/0830 | ** | Durable Goods New Orders | |

| 24/04/2025 | 1300/1500 | ** | BNB Business Confidence | |

| 24/04/2025 | 1300/1500 | ECB's Lane at Peterson Institute Webcast on Monetary Policy Strategy | ||

| 24/04/2025 | 1325/1425 | BOE's Lombardelli on Monetary Policy Strategy |