MNI EUROPEAN OPEN: US Tariffs Introduced, Markets Sell Off

EXECUTIVE SUMMARY

- US RECIPROCAL TARIFFS CAME INTO EFFECT - BBG

- CHINA IS YET TO RESPOND TO ADDITIONAL 50% US TARIFF - BBG

- CHINA CONTINUES TO WEAKEN ITS CURRENCY - BBG

- ITALY’S MELONI TO GO TO US APRIL 17 - POLITICO

- RBNZ CUT RATES, SEES DOWNSIDE RISKS TO INFLATION FROM TARIFFS - MNI

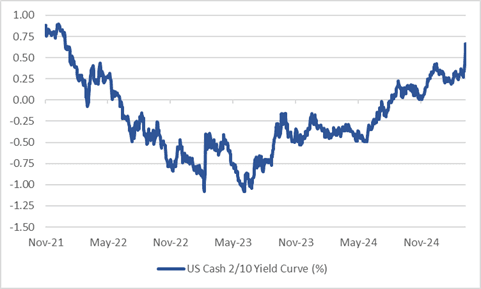

Fig 1: US 2/10 yr yield curve %

Source: MNI - Market News/Bloomberg/Refinitiv.

UK

TRADE (POLITICO): “Prime Minister Keir Starmer has defended his decision to put a review of online safety rules on the table in trade talks with the United States.”

BUSINESS (BBC): “The government is considering nationalising British Steel as fears grow among ministers that the company's blast furnaces in Scunthorpe could run out of raw materials within days.”

RUSSIA (POLITICO): “While Europe’s attention has been focused on Ukraine, tensions in the Western Balkans have been simmering, and leaders in the region — as well as in Britain — worry Russian President Vladimir Putin will use the moment to further exploit fault lines in the former Yugoslavia.”

EU

TRADE (POLITICO): “According to an internal document seen by POLITICO, the Commission is considering slapping tariffs of up to 25 percent on a broad range of exports from the U.S. worth around €22.1 billion based on the EU’s 2024 imports. The list features run-of-the-mill agricultural and industrial commodities such as soybeans, meat, tobacco, iron, steel and aluminum — to hit the American sectors that rely most on transatlantic exports.”

ITALY (POLITICO): “Meloni will visit the White House on April 17 “for an official working visit,” press secretary Karoline Leavitt confirmed during a briefing Tuesday.”

CHINA (POLITICO): “One of Huawei’s most senior executives in Europe is a suspect in the Belgian investigation into alleged corruption at the European Parliament benefitting the Chinese technology company, POLITICO can reveal.”

US

FED (MNI): “The Federal Reserve will need more clarity on Washington's tariff policies to better understand the economic outlook and the landscape that businesses face before the central bank can make policy changes, San Francisco Fed President Mary Daly said Tuesday.”

FED (MNI): “Federal Reserve Bank of Chicago President Austan Goolsbee Tuesday said Washington's conflicting tariff messages are making it harder for businesses to plan and make it unclear how the central bank should respond.”

TRADE (BBG): “President Donald Trump so-called reciprocal tariffs are now in place, dealing a thunderous blow to the world economy as he pushes forward efforts to drastically reorder global trade.”

TRADE (BBG): “US President Donald Trump spent the final hours before his tariffs were set for full implementation lining up negotiations with US allies, but his insistence on pushing forward with sweeping 104% tariffs on many Chinese goods dimmed optimism that a brutal trade war would be avoided.”

TRADE (POLITICO): “President Donald Trump and his top trade officials say they are negotiating with trading partners to reduce the steep tariffs scheduled to go into effect on Wednesday. But many foreign governments who want to talk are still waiting by the phone.”

POLITICS (BBG): “Ultra-conservatives in the US House are threatening to block a budget blueprint to kickstart tax cut negotiations, potentially delaying passage of President Donald Trump’s economic plan.”

POLITICS (BBG): “President Donald Trump cast his tariffs as a political winner in an attempt to assuage fears from wealthy Republican benefactors about the fallout of his signature trade policy just hours before even more sweeping tariffs were due to take effect.”

POLITICS (POLITICO): “Trump is below water with Americans on new foreign policy and trade actions and efforts to tackle ongoing conflicts, the Pew Research Center found in a poll released Tuesday.”

ENERGY (BBG): “President Donald Trump signed a raft of measures he boasted would expand the mining and use of coal inside the US, a bid to power the boom in energy-hungry data centers and revive a flagging US fossil fuel industry.”

IRAN (BBC): “Iran is ready to engage with the US at talks on Saturday over its nuclear programme "with a view to seal a deal", its Foreign Minister Abbas Araghchi has said.”

OTHER

JAPAN (BBG): “The Bank of Japan is closely analysing how U.S. tariffs will affect Japan’s economy and prices, amid growing uncertainty, Governor Kazuo Ueda told lawmakers on Wednesday.”

NEW ZEALAND (MNI): “The Reserve Bank of New Zealand monetary policy committee reduced the official cash rate 25 basis points to 3.5% on Wednesday, noting increased global trade barriers had weakened the outlook for global economic activity.”

ASIA (BBG): “Asia’s trade-sensitive currencies swung around multiyear lows as the region reels from President Donald Trump’s tariff policies that risk pushing the global economy into recession.”

INDIA (BBG): “India’s central bank cut interest rates as expected and signaled more easing to come as it seeks to bolster Asia’s third-largest economy in the face of damaging US tariffs.”

ARGENTINA (BBG): “Argentina reached an agreement with International Monetary Fund staff, a major step before the lender officially votes on a new $20 billion deal for the crisis-prone nation.”

CHINA

FX (BBG): “China’s central bank signaled its tolerance for yuan weakness yet again, after the currency sank to a record low in offshore trading amid escalating tariff threats from President Donald Trump.”

TRADE (BBG): “China hasn’t immediately responded to the new US tariffs, a departure from the last two episodes when President Donald Trump hiked duties and Beijing hit back within minutes.”

TRADE (21ST CENTURY): “An additional 50% U.S. tariff on top of the existing 54% duties against China would trigger significant supply-chain disruptions, though the economic impact may be diminished, according to Zhou Mi, a researcher at the Chinese Academy of International Trade and Economic Cooperation.”

TRADE (XINHUA): “China and the EU are each other's most important trading partners, with highly complementary economies and close interests, Premier Li Qiang told EC President Ursula von der Leyen on a recent phone call.”

ECONOMY (YICAI): “China’s Chief Economist Confidence Index reached 50.33 in April, down from March’s 50.65 but remaining above the breakeven point of 50, Yicai news outlet reported.”

CHINA MARKETS

MNI: PBOC Net Drains CNY111 Bln via OMO Wednesday

MNI (BEIJING) - The People's Bank of China (PBOC) conducted CNY118.9 billion via 7-day reverse repos, with the rate unchanged at 1.50%. The operation led to a net drain of CNY111bn billion after offsetting the maturity of CNY229.9 billion today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.5906% at 09:24 am local time from the close of 1.7767% on Tuesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 50 on Monday, compared with the close of 48 on Tuesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

MNI: PBOC Sets Yuan Parity Higher At 7.2066 Tues; -1.34% Y/Y

MNI (BEIJING) - The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.2066 on Wednesday, compared with 7.2038 set on Tuesday. The fixing was estimated at 7.3387 by Bloomberg survey today.

MARKET DATA

JAPAN MARCH CONSUMER CONFIDENCE 34.1; EST. 34.8; FEB. 34.8

SOUTH KOREA UNEMPLOYMENT RATE MAR. 2.9%; EST. 3.5%; FEB. 3.75%

SOUTH KOREA BANK LENDING TO HOUSEHOLDS MAR. KRW 1145T; FEB. 1143.6T

MARKETS

US TSYS: Haven Demand Under Threat From China Retaliation

TYM5 is 110-12, +1-02 from closing levels in today's Asia-Pac session.

- Cash US tsys have extended yesterday's decline during the Asia-Pac session. The sell-off reflects growing concerns that China may retaliate against tariffs by offloading US assets, including US tsys.

- Alongside the steepening of the curve, interest-rate swaps have extended their recent extreme outperformance of US tsy securities as traders sought to avoid costs associated with holding bonds.

- Cash US tsys are currently trading 2-17bps cheaper across benchmarks, with the curve steeper.

- Yesterday, Trump officials confirmed the 104% tariff on China went into effect at noon. Concurrently, China vowed to "fight to the end".

- On the local front, the focus turns to the March FOMC minute release at 1400ET today, CPI on Thursday and PPI on Friday morning.

- Reminder, banks kick off the latest earnings cycle this Friday with Bank of New York Mellon, Wells Fargo & Co, JPMorgan Chase and Morgan Stanley reporting.

JGBS: Cheaper But Worst Levels, New Cycle High For Long End Bonds

JGB futures are stronger, +34 compared to the settlement levels, after reversing early afternoon session weakness.

- (MNI) The BoJ is closely analysing how US tariffs will affect Japan's economy and prices, amid growing uncertainty, Governor Kazuo Ueda told lawmakers on Wednesday.

- The BoJ will manage monetary policy in an appropriate manner, while carefully monitoring the economy, prices and financial markets, he added, without elaborating on how and when the bank might act.

- Today's weakness in JGBs has been primarily driven by moves in cash US tsys, which have extended their decline during today's Asia-Pac session. The sell-off reflects growing concerns that China may retaliate against tariffs by offloading US assets, including tsys.

- Yesterday, Trump officials confirmed the 104% tariff on China went into effect at noon. Concurrently, China vowed to "fight to the end".

- At present, cash US tsys are trading 3-12bps cheaper across the curve, with the curve steeper. Earlier, the US 30-year yield was up 26bps at 5.02%.

- Cash JGBs have twist-steepened, with yields 3bps lower to 11bps higher. The benchmark 30-year yield is 7.9bps higher at 2.595% after making a new cycle high of 2.809%, the highest since 2004, early in the afternoon session.

- The swaps curve has twist-steepened, with rates 10bps lower to 10bps higher. Swap spreads are tighter.

AUSSIE BONDS: Twist-Steepener Aligns With Global Bonds, RBA Gov Speech Tomorrow

ACGBs (YM +13.0 & XM -16.0) have twist-steepened, aligning with global markets.

- Cash US tsys are currently trading 1-15bps cheaper across benchmarks, with the curve steeper, extending yesterday's decline during the Asia-Pac session.

- The sell-off reflects growing concerns that China may retaliate against tariffs by offloading US assets, including US tsys.

- Alongside the steepening of the curve, interest-rate swaps have extended their recent extreme outperformance of US tsy securities as traders sought to avoid costs associated with holding bonds.

- Yesterday, Trump officials confirmed the 104% tariff on China went into effect at noon. Concurrently, China vowed to "fight to the end".

- On the US front, the focus turns to the March FOMC minute release at 1400ET today, CPI on Thursday and PPI on Friday morning.

- Cash ACGBs are 13bps richer to 18bps cheaper, with the 3/10 curve steeper and the AU-US 10-year yield differential at -2bps, 8bps tighter on the day.

- The bills strip has bull steepened with pricing +13 to +29.

- RBA-dated OIS pricing is 11-30bps softer across meetings today. A 50bp rate cut in May is given a 92% probability, with a cumulative 144bps of easing priced by year-end.

- Tomorrow’s local calendar will see Consumer Inflation Expectations data and a speech from RBA Governor Bullock.

BONDS: NZGBS: Twist-Steepener, RBNZ Cuts But US Long End Yields Rise

NZGBs closed with a dramatic twist-steepening of the curve, with yields 13bps lower to 21bps higher. The short-end finished at its yield lows, while the long-end finished at its yield high.

- The source of the move has been US tsys. Cash US tsys are currently trading 3-20bps cheaper across benchmarks, with the curve steeper.

- US long-end yields have risen for the third straight day amid growing cracks in the haven status of US government debt.

- Alongside the steepening of the curve, interest-rate swaps have extended their recent extreme outperformance of US treasury securities as traders sought to avoid costs associated with holding bonds.

- Yesterday, Trump officials confirmed 104% tariff on China went into effect at noon. Concurrently, China vowed to "fight to the end".

- Meanwhile, the RBNZ cut rates 25bp to 3.5% as was widely projected, due to significant spare capacity and a weaker outlook from “global trade policy” which should result in inflation staying close to the target mid-point.

- Swap rates closed 12bps lower to 14bps higher, with the 2s10s curve steeper and implied long-end swap spreads wider.

- RBNZ dated OIS pricing closed 1-10bps softer across meetings beyond April, with 117bps of easing by November 2025.

- Tomorrow, sell NZ$275mn of the 0.25% May-28 bond and NZ$225mn of the 4.25% May-34 bond.

All eyes today on the USD/CNH as it broke above 7.40 in overnight trading. The market is looking for signs to confirm the PBOC is going to let the Yuan move lower. Chinese Premier Li Qiang said his country has ample policy tools to “fully offset” any negative external shocks.

- EUR/USD - Asian range 1.0951 - 1.1066, going into the London open near the Asian highs around 1.1060. Quite a big range for the EUR in Asia as it benefits from the broad USD sell off.

- GBP/USD - 1.2762 - 1.2856, trading at the day's highs going into the London session. Look for sellers once more back towards 1.2900/50.

- USD/CNH - 7.3712 - 7.4273, finding some support back towards 7.3700 after falling away post the Yuan fix which printed 7.2066. The market views a higher USD/CNH as 1 of the cleanest ways to express 104% tariffs being applied. They need further confirmation from the PBOC to give the green light.

- USD/JPY - 144.58 - 146.36. USD/JPY has been under pressure most of the Asian session as Asian stocks tumbled. A bounce of its lows into the London session to be around 145.20, expect it to continue to trade heavy until we start seeing some actual trade deals done.

- Cross asset : SP -2.6%, Gold 3010.00 + 0.88%, US 10yr 4.42%, BBDXY 1264, Cruse oil 56.85

- Data/Events : FOMC minutes, ECB Knot speaks, ECB Cipollone speaks, BOE FPC meeting record released.

USDCNH

Source: MNI - Market News/Bloomberg

ASIA STOCKS: Down Heavily Again After Yesterday’s Reprieve.

In a sea of red across the region, the onshore equities bourses in China were the sole risers today as state owned asset managers bought the market with inflows into ETF’s linked to the ‘national team’ topped CNY87bn on Tuesday, an all time record.

- The Hang Seng was down in line with other regional indexes, falling -1.55%, whilst the CSI 300 rose +0.30%, Shanghai +0.24% and Shenzhen +0.47% respectively.

- Taiwan’s TAIEX cratered today, falling -5.00% and is down over 15% in recent days.

- The KOSPI has fallen heavily again today after yesterday’ s modest gains, down -1.85%

- The FTSE Straits Times in Singapore was down -2.1%, and is approaching a decline of 15% over the last fortnight.

- Malaysia’s FTSE Bursa KLCI is down -2.7% today having finished virtually flat yesterday.

- The Jakarta Composite is down -0.33%, after yesterday’s decline of -7.90%

- India’s NIFTY 50 is down -0.60% in morning trading, after finishing strongly with gains of +1.6% yesterday.

OIL: Crude Sinks Further As US Tariffs Come Into Effect

Oil prices are down sharply again during today’s APAC session following confirmation that an additional 50% tariff on US imports from China would be charged and then the actual implementation of all reciprocal tariffs at midnight EST. China has not responded yet. There has been a general sell off across markets including commodities which are worried that increased protectionism will significantly reduce demand. The USD index is down 0.4%.

- WTI is down 4.4% to $57.00/bbl following yesterday’s 4.1% decline, remaining above initial support at $56.81. It is off its intraday low of $56.70. The benchmark is now down over 20.0% in April. Brent is 3.7% lower at $60.49 after approaching round-number support of $60 but only falling as far as $60.18. It is now over 19.0% lower this month.

- Price falls have been exacerbated by OPEC’s decision to increase output more than expected this month. At these levels many OPEC countries will face fiscal problems and US drillers won’t invest in new wells.

- Westpac’s Rennie said that if China doesn’t retaliate further, then Brent should be able to hold above $60/bbl (Bloomberg).

- Brent has shifted into bearish contago between December 2025 and December 2026 contracts, according to Bloomberg. Futures structures are showing market conditions easing significantly.

- Industry-based data showed a US crude inventory drawdown of 1.1mn barrels last week. Gasoline rose 200k while distillate fell 1.8mn. The official EIA data is out later today.

- Later the Fed’s Barkin speaks and March FOMC meeting minutes are published. The ECB’s Cipollone participates in a panel and BoE’s FPC meeting record is released.

Gold Rises Again as Equities Struggle

- Gold’s few uncertain days may be behind it as the rally began today as equities retreated.

- As tariff headlines abounded and having opened at US$2,984.58 gold rallied in the Asian trading afternoon back above $3,000 to be $3,009.00

- The White House has said that it will be pursuing tariffs of up to 104% on Chinese goods whilst Chinese Premier Li said that his country had ‘ample tools’ to “fully offset” the tariffs.

- Whilst gold enjoys ‘safe haven’ status amongst investors, in times of high volatility investors seek liquidity, something gold does not exhibit.

- Chinese investors put a record 7.6 billion yuan into gold-backed exchange-traded funds last week, seeking safety amid trade war tensions.

- Gold appears to be the only safe haven at present again as even treasuries are getting caught in the cross fire today.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Country | Event |

| 09/04/2025 | 0900/1000 | ** | Gilt Outright Auction Result | |

| 09/04/2025 | 1100/0700 | ** | MBA Weekly Applications Index | |

| 09/04/2025 | - | Higher Reciprocal Tariffs On Imports | ||

| 09/04/2025 | 1230/1430 | ECB's Cipollone On Macro-Financial Stability Panel | ||

| 09/04/2025 | 1400/1000 | ** | Wholesale Trade | |

| 09/04/2025 | 1430/1030 | ** | DOE Weekly Crude Oil Stocks | |

| 09/04/2025 | 1500/1100 | Richmond Fed's Tom Barkin | ||

| 09/04/2025 | 1700/1300 | ** | US Note 10 Year Treasury Auction Result | |

| 09/04/2025 | 1800/1400 | *** | FOMC Minutes | |

| 10/04/2025 | 2301/0001 | * | RICS House Prices | |

| 10/04/2025 | 0130/0930 | *** | CPI | |

| 10/04/2025 | 0130/0930 | *** | Producer Price Index | |

| 10/04/2025 | 0600/0800 | *** | CPI Norway | |

| 10/04/2025 | 0600/0800 | ** | Private Sector Production m/m | |

| 10/04/2025 | 0800/1000 | * | Industrial Production | |

| 10/04/2025 | - | *** | Money Supply | |

| 10/04/2025 | - | *** | New Loans | |

| 10/04/2025 | - | *** | Social Financing | |

| 10/04/2025 | 1230/0830 | *** | Jobless Claims | |

| 10/04/2025 | 1230/0830 | ** | WASDE Weekly Import/Export | |

| 10/04/2025 | 1230/0830 | * | Building Permits | |

| 10/04/2025 | 1230/0830 | *** | CPI | |

| 10/04/2025 | 1300/1400 | BoE's Breeden at MNI Connect ‘UK economic and Financial Stability prospects’ | ||

| 10/04/2025 | 1330/0930 | Dallas Fed's Lorie Logan | ||

| 10/04/2025 | 1400/1000 | Kansas City Fed's Jeff Schmid | ||

| 10/04/2025 | 1430/1030 | ** | Natural Gas Stocks |