MNI EUROPEAN OPEN: USD Losses Continue

EXECUTIVE SUMMARY

- FED GOOLSBEE: APR 2 TARIFFS MATERIALLY INCREASE INFLATION - MNI

- MNI OBTAINS EXCLUSIVE COMMENTS FROM THE WHITE HOUSE ON CHINA AND FX POLICY - MNI INTERVIEW

- XI SET TO HOST EU LEADERS IN JULY, SCMP SAYS - SCMP/BBG

- FACING TRUMP TARIFFS, VIETNAM EYES CRACKDOWN ON SOME CHINA TRADE - RTRS

- JAPAN FORMS TARIFF TASKFORCE AS CALLS RISE FOR RELIEF MEASURES - BBG

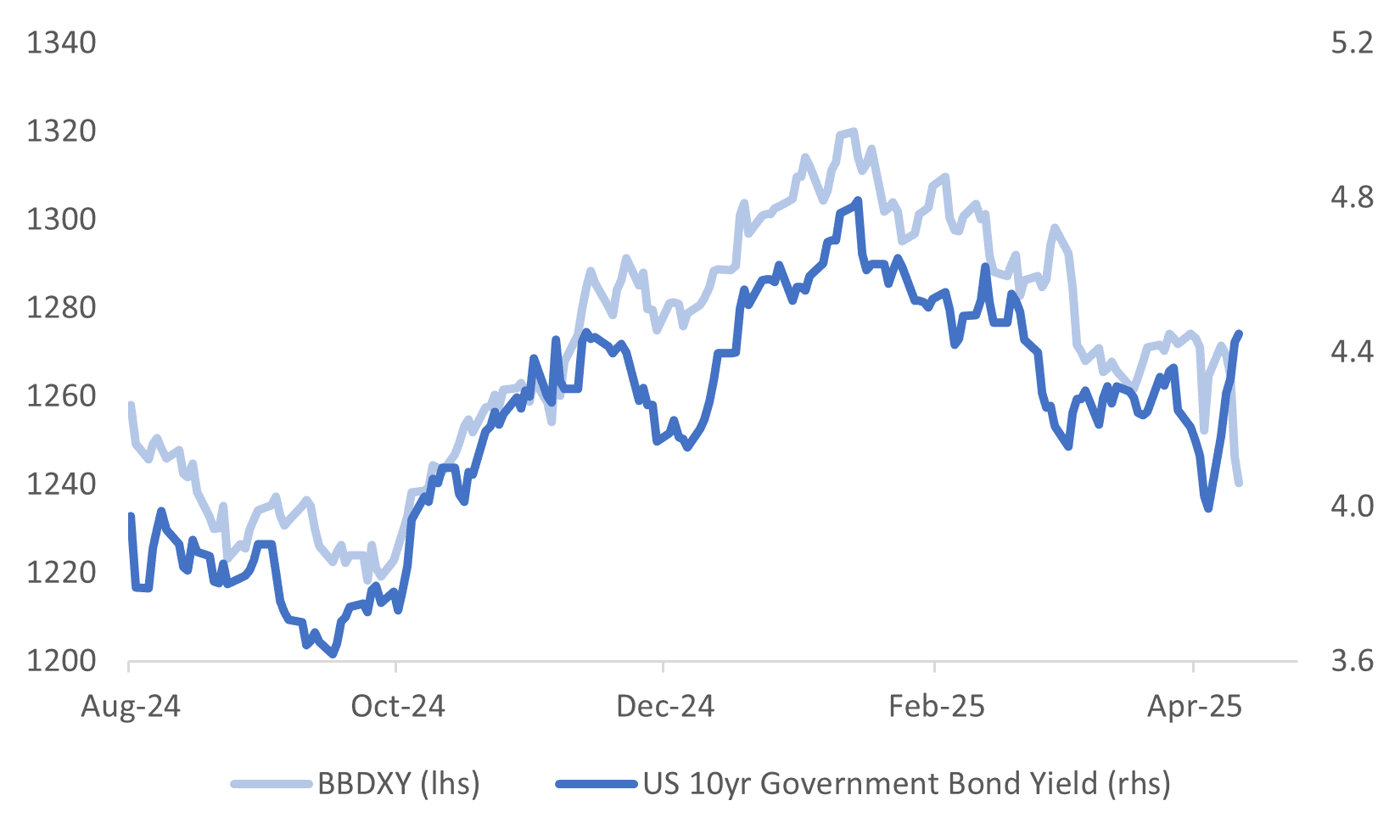

Fig 1: USD & US Tsy Yields Diverging

Source: MNI - Market News/Bloomberg/Refinitiv.

UK

JOBS (BBG): “ The pool of candidates looking for a job in Britain grew the most since the pandemic, one of the clearest signs yet that the labor market is cooling amid cost pressures for firms at home and a worrying global outlook. “

BOE (BBG): “Bank of England Deputy Governor Sarah Breeden said policymakers are monitoring a potential weakening in the pound for signs of how to respond to US President Donald Trump’s trade war.”

EU

EU/CHINA (SCMP/BBG): “ Top European Union officials are making plans to visit China for a meeting with President Xi Jinping , the South China Morning Post reports — a sign Brussels may be keen to develop better ties with Beijing amid the Trump administration’s tariff onslaught.”

ECB (BBG): "European Central Bank officials are likely to cut borrowing costs twice more, though they will ultimately take their cue from US President Donald Trump, according to a Bloomberg survey of economists."

US

FED (MNI): President Trump's sweeping April 2 tariffs on dozens of trading partners, most of which have since been put on hold for 90 days, would materially increase inflation and drag down growth, Chicago Fed President Austan Goolsbee said Thursday.

FED (MNI INTERVIEW): An intervention by the Federal Reserve in strained Treasury markets would give the appearance of policy easing, something that officials are keen to avoid at this point, Chicago Booth economist Anil Kashyap told MNI, as he urged the U.S. central bank to consider a special facility to undertake Treasury-futures basis trades instead.

TARIFFS (BBG): “President Donald Trump said his tariffs may cause “transition problems” but expressed confidence in his plan, after the White House clarified US tariffs on China rose to 145%.”

TARIFFS (RTRS): “U.S. President Donald Trump's about-face on sweeping import tariffs did little to soothe companies' worries about the fallout from his trade war and its chaotic implementation: soaring costs, falling orders and snarled supply chains.”

FISCAL (MNI BRIEF): The United States saw a USD1.307 trillion federal budget deficit in the first half of fiscal year 2025, the largest deficit for the first six months of the year in history outside of 2021 Covid spending, according to Treasury Department data released Thursday that also showed a USD161 billion deficit in the month of March.

OTHER

US/CANADA (MNI BRIEF): The United States would likely retreat from new global tariffs after the 90-day pause if there is coordinated retaliation among key trading partners, Canada's top negotiator during Donald Trump's first term said Thursday.

JAPAN (MNI INTERVIEW): A former chief economist discusses the BOJ's future policy rate strategy. On MNI Policy MainWire now, for more details please contact sales@marketnews.com

JAPAN (BBG): "Japan’s Prime Minister Shigeru Ishiba created a taskforce to deal with the fallout from US tariffs as pressure mounts to boost aid to households ahead of a summer election."

VIETNAM (RTRS): "In hope of avoiding punishing U.S. tariffs, Vietnam is prepared to crack down on Chinese goods being shipped to the United States via its territory and will tighten controls on sensitive exports to China, according to a person familiar with the matter and a government document seen by Reuters."

CHINA

YUAN (MNI INTERVIEW): MNI obtains exclusive comments from White House on China and FX policy -- On MNI Policy MainWire now, for more details please contact sales@marketnews.com

TARIFFS (MNI INTERVIEW): MNI discusses the PBOC's next steps with BOC's research chief. On MNI Policy MainWire now, for more details please contact sales@marketnews.com

PROPERTY (SECURITIES TIMES): “More cities will promote home purchase subsidies to stimulate demand, Securities Times reported, citing expectations from Chen Wenjing, research director of China Index Academy.”

INFLATION (SECURITIES DAILY): “China’s CPI contracted 0.1% y/y in March, narrowing from the -0.7% in February, mainly driven by base effects, according to Feng Lin, executive director at Orient Securities. Price levels in April are expected to remain unchanged y/y given recent trends, Feng added.”

SOUTH EAST ASIA (RTRS): “Chinese President Xi Jinping will embark on a three-nation Southeast Asia tour next week in his first overseas trip this year to consolidate ties with some of China's closest neighbours as trade tensions with the United States escalate.”

CHINA MARKETS

MNI: PBOC Net Injects CNY28.5 Bln via OMO Friday

MNI (BEIJING) - The People's Bank of China (PBOC) conducted CNY28.5 billion via 7-day reverse repos, with the rate unchanged at 1.50%. The operation led to a net injection of CNY28.5 billion as no reverse repo matures today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.5571% at 09:56 am local time from the close of 1.7114% on Thursday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 48 on Thursday, compared with the close of 43 on Wednesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

MNI: PBOC Sets Yuan Parity Lower At 7.2087 Fri; -1.47% Y/Y

MNI (BEIJING) - The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.2087 on Friday, compared with 7.2092 set on Thursday, marking the first day of strengthening in seven trading days. The fixing was estimated at 7.3506 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND BUSINESSNZ MANUFACTURING PMI 53.2; PRIOR 54.1

JAPAN MARCH M3 MONEY STOCK Y/Y 0.4%; PRIOR 0.7%

SOUTH KOREA APRIL 10 DAYS EXPORTS Y/Y 13.7%; PRIOR 2.9%

SOUTH KOREA APRIL 10 DAYS IMPORTS Y/Y 6.5%; PRIOR 7.3%

MARKETS

US TSYS: Twist-Steepener As Chinese Retaliation Remains In Focus

TYM5 is dealing at 110-09, -0-10 from closing levels in today's Asia-Pac session, after hitting a low of 110-01.

- Cash US tsys are showing a twist-steepener in today's Asia-Pac session, with benchmark yields 4bps lower to 3bps higher, pivoting at the 7-year.

- Sentiment toward longer-dated US tsys has weakened this week, as markets grow concerned about potential Chinese retaliation in response to US tariffs on Chinese goods.

- US bond auctions will be closely monitored going forward given the sales are seen as the first line of offence should foreign central banks decide to reject US tsys. Nonetheless, if overseas holders are indeed buying fewer US tsys, or actually becoming net sellers, it could be a while before it clearly shows up in the data.

- To that end, yesterday’s auction of 30-year bonds was met with strong demand. The $22B 30Y auction re-open stopped through: 4.813% high yield vs. 4.838% WI; 2.43x bid-to-cover vs. 2.37x in the prior month. Peripheral measures saw an indirect take-up 61.88% vs. 60.45% prior; direct bidder take-up 25.82% vs. 22.65% prior; primary dealer take-up 12.30% vs. 16.89% prior.

- Aside from headline risk, the focus turns to Friday's data: PPI at 0830ET and University of Michigan Sentiment at 1000ET.

JGBS: Follows US Tsys Lead With A Twist-Steepener

JGB futures remain stronger, +55 compared to settlement levels, but well off the session’s best level.

- Outside of the previously outlined Money Stock data, there hasn't been much by way of domestic drivers to flag.

- “Japanese entertainment giants Nintendo Co. and Sony Group Corp. are likely to raise prices on their game consoles in response to US tariffs.” (per BBG)

- Cash US tsys are showing a twist-steepener in today's Asia-Pac session, with benchmark yields 2bps lower to 4bps higher, pivoting at the 5-year.

- Sentiment toward longer-dated US tsys has weakened this week, as markets grow concerned about potential Chinese retaliation in response to US tariffs on Chinese goods.

- US bond auctions will be closely monitored going forward given the sales are seen as the first line of offence should foreign central banks decide to reject US tsys.

- The cash JGB curve has twist-steepened, with benchmark yields 5bps lower to 7bps higher. The benchmark 10-year yield is 2.2bps higher at 1.37% versus the cycle high of 1.596%.

- The swaps curve has also twist-steepened, with rates 5bps lower to 8bps higher.

- On Monday, the local calendar will see Industrial Production and Capacity Utilization data.

AUSSIE BONDS: Light Calendar, Narrow Ranges, Twist-Steepener With US Tsys

ACGBs (YM +8.0 & XM -7.5) are holding a twist-steepener after dealing in narrow ranges in today’s Sydney session.

- The local calendar has been light apart from the AOFM's sale of A$600mn of the 2.75% 21 June 2035 bond, which showed solid demand despite this week’s souring in sentiment towards longer-dated US tsys. Markets have grown concerned about potential Chinese retaliation in response to US tariffs on Chinese goods.

- Cash US tsys are showing a twist-steepener in today's Asia-Pac session, with benchmark yields 4bps lower to 3bps higher, pivoting at the 7-year.

- Cash ACGBs are 8bps richer to 8bps cheaper with the AU-US 10-year yield differential at -4bps.

- Swap rates are 4bps lower to 11bps higher, with EFPs substantially wider.

- The bills strip is richer, with pricing +7 to +9.

- RBA-dated OIS pricing is 4-10bps softer across meetings today. A 50bp rate cut in May is given a 47% probability, with a cumulative 128bps of easing priced by year-end.

- The local calendar will be empty on Monday, ahead of the release of the RBA Minutes for the April Meeting on Tuesday.

- The AOFM plans to sell A$1000mn of the 3.50% 21 December 2034 bond on Wednesday.

BONDS: NZGBS: Followed Global Lead And Closed With Twist-Steepener

NZGBs closed showing a twist-steepening, with benchmarks 4bps richer to 9bps cheaper. The 2-year finished near its best while the 10-year closed near its worst. Nevertheless, the NZ-US 10-year yield differential narrowed 7bps on the day to +30bps.

- The local calendar was relatively light today even though the BusinessNZ Performance of Manufacturing Index fell to 53.2 in March from 54.1 in February.

- The NZGB short end was likely supported by Wednesday’s signalling by the RBNZ that there is room for further easing, citing global trade tensions as a threat to growth and inflation.

- The key driver of today’s market movements once again has come from abroad. Cash US tsys are showing a twist-steepening in today's Asia-Pac session, with benchmark yields 4bps lower to 3bps higher, pivoting at the 7-year. Aside from headline risk, the focus turns to Friday's data: PPI and University of Michigan Sentiment.

- Swap rates closed 4bps lower to 10bps higher, with implied swap spreads little changed.

- RBNZ dated OIS pricing closed flat to 6bps softer across meetings. 33bps of easing is priced for May, with a cumulative 84bps by November 2025.

- On Monday, the local calendar will see the Performance Services Index, Card Spending and Net Migration data.

FOREX Wrap - USD’s Move Lower Starts To Accelerate

Broad USD weakness overnight was given a tailwind from the CPI miss. The FED’s Kansas City President Jeff Schmid said he would be prioritizing reining in inflation, and is concerned about inflation expectations rising. The BBDXY has seen another leg lower in Asia as the market grapples with what many traders think is the end of US exceptionalism.

- EUR/USD - Asian range 1.1191 - 1.1383, Eur was bought from the start and was up almost 1.7% today, this is a very unusual move for Asia and points to some decent stops having been triggered as we break some big weekly resistance. These sort of moves normally have a decent correction as we head into London, but as the USD selloff intensifies the EUR looks to be one of the main beneficiaries.

- GBP/USD - Asian range 1.2968 - 1.3048, trading just off the day's highs going into the London session.

- USD/CNH - Asian range 7.2903 - 7.3347, tested below the 7.3000 area going into the fix but has since bounced very strongly from there. USD/CNH goes into the London open near the session highs. The market views a higher USD/CNH as one of the cleanest ways to express 145% tariffs being applied.

- USD/JPY - Asian range 142.89 - 144.64, was under pressure from the open making a low below 143.00 before some demand returned into the Japanese fix. It could not hold onto these gains and the appetite to buy JPY looks set to continue as the USD rout picks up pace. Huge support level around 140, a break here could see the move gather momentum though

- Cross asset : SPX flat, Gold 3213.00 + 1.17%, US 10yr 4.44%, BBDXY 1240, Crude oil 59.90.

- Data/Events : UK Ind Prod, UK Man Prod, Ger CPI, Spain CPI. In the US it will be PPI and the April read of U. Of Mich. consumer sentiment.

Fig 1: EUR/USD Spot

Source: MNI - Market News/Bloomberg

FOREX: Antipodean Wrap - AUD & NZD holding onto gains

The AUD and NZD have both held onto their respective gains, with the NZD price action in particular looking ominous as it extends to new highs in Asia. Broad USD weakness overnight was given a tailwind from the CPI miss. RBA governor Bullock urged patience while markets got a handle on tariff driven volatility, “it will take time to see how all of this plays out” (BBG).

- AUD/USD - Asian range 0.6204 - 0.6259, AUD retraced early from the overnight highs but good buying emerged back towards the 0.6200 area and it has traded with a solid bid from there moving above the highs to go into London around 0.6220.

- AUD/JPY - Asian range 88.81 - 90.12, AUD/JPY retraced early in the session breaking the overnight lows before buyers reemerged. Some consolidation after the big moves yesterday, price goes into the London open around 89.35

- NZDUSD - Asian range 0.5735 - 0.5800, NZD did not even get a dip before the overnight price action continued with a relentless bid, looking very much like a Time Weighted Algorithm being executed over the last 27/28 hours. NZD printing around 0.5800 going into London, the market is short and the price action poor, watch the 0.5850 area for the next potential level to trigger short covering risks.

- AUD/NZD - Asian range 1.0770 - 1.0862, the cross drifted lower in the Asian session breaking the overnight lows around 1.0810 and extending lower. The cross is going into London trading heavy as the NZD with a smaller liquidity pool is starting to outpace the AUD as shorts are beginning to be covered.

Fig 1: Spot NZD/USD

Source: MNI - Market News/Bloomberg

ASIA STOCKS: China Bourses Defy Tariffs Whilst Others Mixed.

China’s Hang Seng defied the ongoing tariff headlines to finish the week positively, whilst regional peers fell.

In what has been a challenging week for the region, some markets are down significantly and struggling again today.

- Leading China’s bourses, the Hang Seng is up +0.56% despite being down -9% on the week. The CSI 300 is marginally lower by -0.10%, and down just -3.3% for the week. Shanghai is up +0.12% whilst lower by -3.4% for the week and Shenzhen is up +0.33%, whilst lower by -5.9% on the week.

- Taiwan’s TAIEX is one of the strongest in the region today up +1.7%, but one of the biggest fallers for the week, down -9.2%

- The KOSPI has fallen again today by -0.90% and yet only down -1.7% for the week following Thursdays exceptionally rally.

- The FTSE Malaysia Bursa KLCI struggled again today, losing -0.5% and set to be down -3.3% for the week.

- Indonesia’s Jakarta Composite had a shortened, but challenging week and is up today by +0.22%, whilst down -3.1% on the week.

- India’s NIFTY 50 has opened very strong this morning, rallying +1.8% following a cut in rates by the RBI, yet is down -1.8% for the week.

Oil Hits New Lows as Sell Off Gathers Momentum.

- Oil’s sell off continued in Asia as new lows were hit.

- After a very strong rally Wednesday oil declined almost 4% yesterday, consistent with daily falls seen over the last few weeks.

- WTI finished the day at US$60.24 bbl a near term low, moving lower throughout the Asia trading day to reach $59.95; a loss of -3.3% for the week

- Brent opened at US$63.42, moving lower throughout to reach $63.20; a loss of -3.6% for the week

- The move has crashed oil through all major moving averages.

- All major moving averages are trending downwards indicating the bearish momentum is gathering pace.

- The US has dramatically cut is forecasts for the demand for oil demand globally with the EIA outlook forecasting 400k less demand than previously forecast.

- GS forecasts that the Saudi budget deficit could reach US$67bn on lower oil prices

- Kazakhstan is negotiating with its oil companies to reduce production to ensure compliance with OPEC+ limits.

- Fund managers have upped their shorts on oil to the highest level since 2018.

Gold Delivers Strong Weekly Gain.

- Gold’s rally to new heights continued today in Asia trading as tariff anxiety fueled the 'safe haven' status of bullion.

- The rally today may have many forecasters restating their year end expectations as gold blasted above US$3,200 for the first time.

- The 90-day tariff pause on higher tariffs on trading partners gave markets a short respite mid-week but concerns about the potential impact on global growth remain.

- Gold’s ascent was gradual throughout the trading day in Asia trading higher again at $3,215.10

- Gold is on course to deliver a weekly gain of over +5.5%, despite falling on Monday.

- Gold stocks too benefited from bullions ascent with the VanEck Gold Miners ETF up over +3.5% on Thursday, hitting new highs.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Country | Event |

| 11/04/2025 | 0600/0700 | ** | UK Monthly GDP | |

| 11/04/2025 | 0600/0800 | *** | Final Inflation Report | |

| 11/04/2025 | 0600/0700 | ** | Trade Balance | |

| 11/04/2025 | 0600/0700 | ** | Index of Services | |

| 11/04/2025 | 0600/0700 | *** | Index of Production | |

| 11/04/2025 | 0600/0800 | *** | HICP (f) | |

| 11/04/2025 | 0600/0700 | ** | Output in the Construction Industry | |

| 11/04/2025 | 0700/0900 | *** | HICP (f) | |

| 11/04/2025 | 0940/1040 | BoE's Saporta on 'How financial crisis reshape market and strategies’ | ||

| 11/04/2025 | 0945/1145 | ECB's Lagarde at Eurogroup Press Conference | ||

| 11/04/2025 | - | *** | Money Supply | |

| 11/04/2025 | - | *** | New Loans | |

| 11/04/2025 | - | *** | Social Financing | |

| 11/04/2025 | 1230/0830 | *** | PPI | |

| 11/04/2025 | 1400/1000 | *** | U. Mich. Survey of Consumers | |

| 11/04/2025 | 1400/1000 | ** | University of Michigan Surveys of Consumers Inflation Expectation | |

| 11/04/2025 | 1400/1000 | St. Louis Fed's Alberto Musalem | ||

| 11/04/2025 | 1500/1100 | New York Fed's John Williams | ||

| 11/04/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 11/04/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 12/04/2025 | 0630/0730 | BoE's Greene on ‘The dynamics of monetary policy’ |