MNI Eurozone Inflation Insight – March 2025

Apr-02 11:42By: Moritz Arold

Inflation+ 5

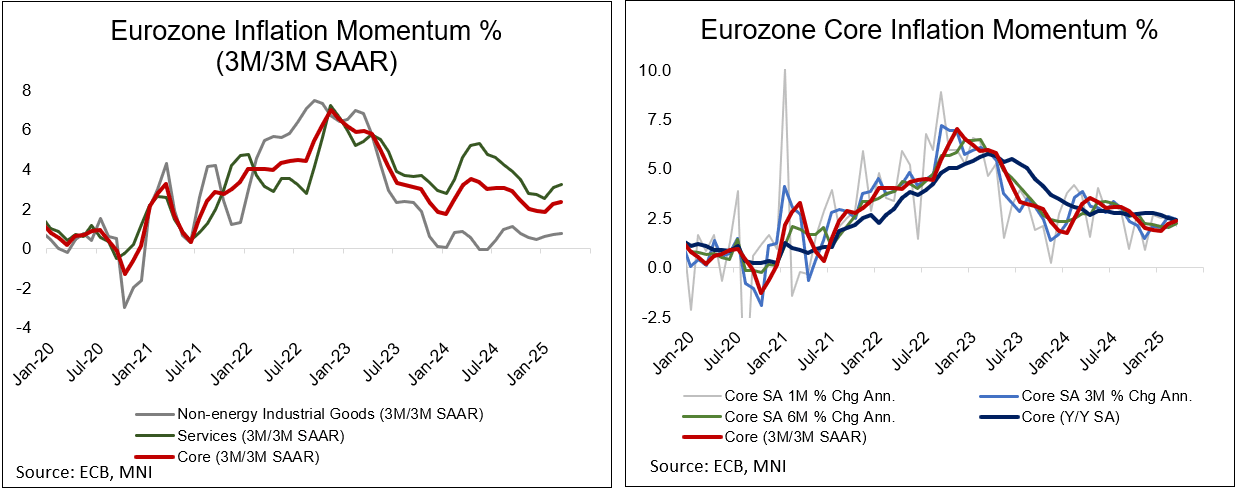

- While Eurozone headline HICP met expectations in March’s flash estimate, at 2.2% Y/Y, the more dovish cohort of the ECB is likely to be encouraged by the continued moderation in the year-over-year services inflation rate seen this time; its slowdown to 3.4% marks its joint slowest pace since January 2022.

- However, data including the seasonal-adjusted measures from the ECB indicate that the current pace in the category remains elevated. That could underpin the governing council’s level of weariness level after a potential April cut, which markets view as the base case for the ECB for now.

- The market reaction to the flash inflation round was mixed across key countries, with notable deviations from consensus in different countries. France surprised with a negative 0.2pp deviation (as it did last time), recording a 0.9% Y/Y headline rate, and was followed by Spain coming in at 2.5% with a -0.3pp deviation. Germany also surprised consensus to the downside, by 0.1pp at 2.3% Y/Y, but both the Netherlands and Italy came in firmer than expected (+0.1pp at 3.4% and +0.3pp at 2.1pp, respectively).

Related stories

Related by topic

Inflation

European Central Bank

Schatz

Germany

Bobl

Bunds