MNI: Govt Debt On Path To WWII Levels In IMF Danger Scenario

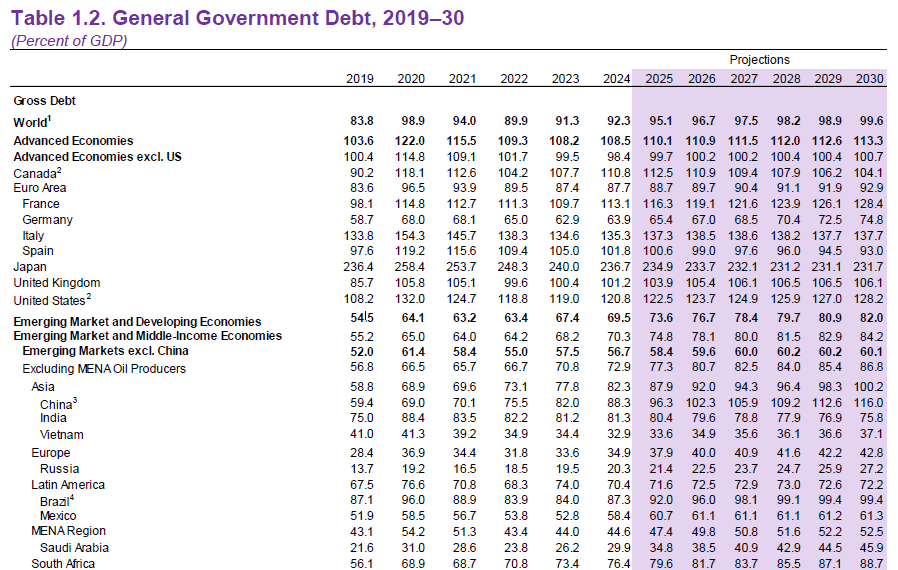

Global government debts are set to reach almost 100% of GDP by the end of this decade and in a negative scenario will surge to World War II levels, with major economies like the U.S. and China accounting for much of the deterioration, according to an IMF report Wednesday.

The Fiscal Monitor says global public debt will increase 2.8 percentage points this year, more than twice the estimates for 2024, to more than 95% of GDP. The baseline path will take debt levels beyond highs seen during the Covid pandemic.

"Major economies, such as Brazil, China, France, South Africa, the United Kingdom, and the United States, are key contributors to the increase in global public debt," the report said. "In a severely adverse scenario global public debt could reach 117% of GDP by 2027. This would represent the highest level since World War II, exceeding reference projections by almost 20 percentage points."

The U.S. deficit in 2024 was little changed at 7.3% of GDP and the projected decline to 6.5% this year rests on volatile estimates of tariff revenue, the IMF said. China’s deficit increased by 0.6 pp of GDP in 2024 to 7.3% and "elevated deficits are expected to push public debt to 116% of GDP by 2030" the report showed. U.S. debt is seen rising from 120.8% of GDP last year to 128.2% by 2030.

Noting recent market instability the IMF said "an increase of 10 percentage points of GDP in US public debt between 2024 and 2029 could lead to a 60-basis-point rise in the 5-year forward to 10-year rate. Similar results hold for the 10-year Treasury nominal yield." (See: MNI INTERVIEW: US Bond Selloff A 'Stern Warning' To Fed -Stein)