MNI US MARKETS ANALYSIS - EUR Slips on Softening CPI Pressure

Highlights:

- EUR slips on softer inflationary pressures

- PCE next market focus, with core PCE expected to remain robust

- Treasury curve sits bull flatter, prices underperform EGBs

US TSYS: Off Highs But Holding Bull Flattening With PCE Eyed

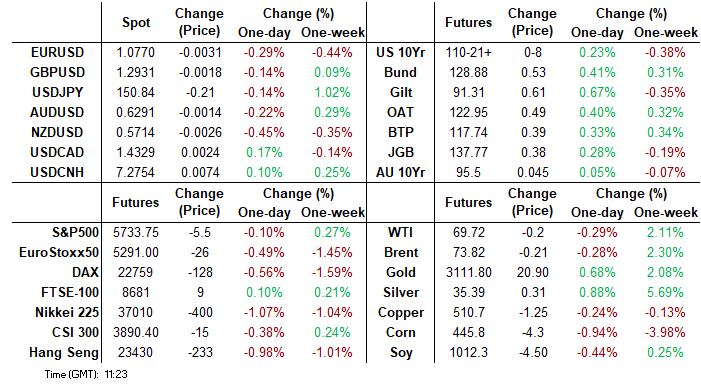

- Treasuries trade bull flatter, with the front-end awaiting data steers but the long end extending gains after yesterday’s lows provided enticing levels.

- Treasuries underperform EGBs as US equity futures continue to prove more resilient than their European counterparts following Wednesday's auto tariffs announcement.

- Today’s session is centered around the February PCE report, with core PCE expected to print a robust pace and consumption strength assessed, along with sensitivity to any pre-weekend tariff comments ahead of the approaching Apr 2 reciprocal announcement.

- Cash yields are 0.4bp to 3.9bp lower, with largest declines in 30s.

- 2s10s at 34.6bp (-2.3bp) has pulled away from yesterday’s high of 38.4bp that marked its steepest since mid-January.

- TYM5 trades at 110-20+ (+07) on average cumulative volumes of 315, having eased off an earlier high of 110-24.

- It has lifted off yesterday’s low of 110-06 which probed support at 110-07 (50-day EMA), with any further downside watched with key support at 110-00 (Feb 7 high). Resistance meanwhile is seen at 110-26 (Mar 25 high) before 111-17+ (Mar 20 high).

- Data: PCE Feb (0830ET), U.Mich consumer survey Mar final (1000ET), KC Fed services Mar (1100ET)

- Fedspeak: Barr (1215ET), Bostic (1545ET) – see STIR bullet

STIR: Fed Rate Path At Middle Of Week’s Range Ahead Of PCE Report

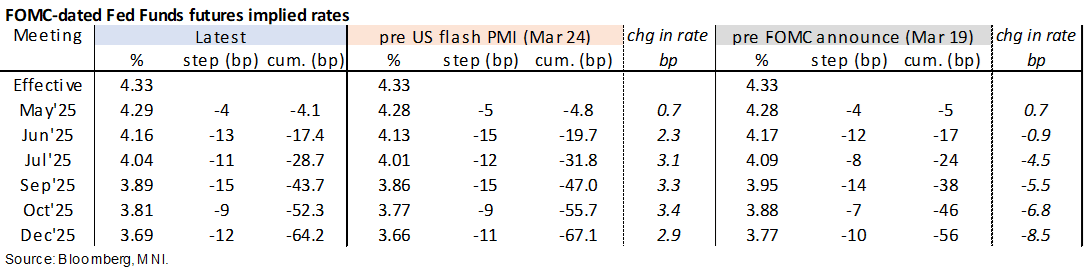

- Fed Funds implied rates are little changed overnight as they hold within yesterday’s range.

- Today sees focus on the monthly PCE report plus any notable revisions to the final U.Mich survey. Unrounded analyst estimates put core PCE inflation at a 'high' rounded 0.3% and recent consumption trends will be watched closely amidst declining consumer sentiment.

- Cumulative cuts from 4.33% effective: 4bp May, 17.5bp Jun, 29bp Jul and 64bp Dec. There have been between 70bp and 59bp of cuts priced for 2025 over the course of this week.

- Yesterday say Collins (’25 voter, dovish leaning) reiterate her patient stance on potential future rate cuts amid uncertainty, noting that her view of tariffs impacts saw her conclude that holding rates steady for "a longer time is likely to be appropriate". Barkin (non-voter, hawkish leaning) remains cautious on the rate path ahead and appeared to be one of the 8 FOMC members who at the March meeting pencilled in either one or no cuts by the end of 2025.

- Barr (permanent voter) and Bostic (non-voter) both speak today although we’ve already heard from them since last week’s FOMC decision, albeit in a more limited mon pol capacity for Barr.

- 1215ET – Barr gives speaks on banking policy (Q&A only). He’s no longer VC for supervision but will talk on banking policy. He said Mar 24 that lending standards become tight in the pandemic and remain so, noting that interest rates overall are still high for businesses.

- 1545ET – Bostic moderates panel on housing finance (Q&A only). He told BBG on Mar 24 that he reduced his 2025 rate cut expectations to 1 in March's SEP versus 2 previously, "because I think we will see inflation be very bumpy", and delayed inflation progress warranted pushing back the path to neutral rates. This puts him among the 8 most hawkish FOMC members for 2025 (of 19 participants, 4 saw 1 cut, 4 saw none).

US TSY FUTURES: Mix Of Net Long & Short Setting Seen Thursday

OI data points to a mix of net long (TU) and short setting (FV, TY, UXY, US & WN) during Thursday’s twist steepening of the curve, with the most prominent positioning swing coming via the net short setting seen in FV futures.

| 27-Mar-25 | 26-Mar-25 | Daily OI Change | OI DV01 Equivalent Change ($) |

TU | 3,940,317 | 3,915,097 | +25,220 | +971,119 |

FV | 6,437,288 | 6,387,729 | +49,559 | +2,152,120 |

TY | 4,953,016 | 4,930,027 | +22,989 | +1,491,076 |

UXY | 2,288,739 | 2,276,134 | +12,605 | +1,116,775 |

US | 1,806,141 | 1,803,067 | +3,074 | +397,757 |

WN | 1,793,133 | 1,786,234 | +6,899 | +1,324,564 |

|

| Total | +120,346 | +7,453,413 |

STIR: Mix Of Positioning Swings Seen In SOFR Futures On Thursday

OI data points to a mix of net long and short setting through most of the SOFR futures strip on Thursday, with net long cover seen in most of the blues.

- The most prominent positioning swings came via net long setting in SFRU6 & Z6.

| 27-Mar-25 | 26-Mar-25 | Daily OI Change |

| Daily OI Change In Packs |

SFRH5 | 1,178,354 | 1,177,944 | +410 | Whites | +19,233 |

SFRM5 | 1,289,384 | 1,282,116 | +7,268 | Reds | +41,319 |

SFRU5 | 960,566 | 953,748 | +6,818 | Greens | +10,050 |

SFRZ5 | 1,094,824 | 1,090,087 | +4,737 | Blues | -2,601 |

SFRH6 | 647,619 | 642,175 | +5,444 |

|

|

SFRM6 | 670,682 | 662,347 | +8,335 |

|

|

SFRU6 | 642,725 | 630,739 | +11,986 |

|

|

SFRZ6 | 820,099 | 804,545 | +15,554 |

|

|

SFRH7 | 502,827 | 498,915 | +3,912 |

|

|

SFRM7 | 500,868 | 499,198 | +1,670 |

|

|

SFRU7 | 323,489 | 322,147 | +1,342 |

|

|

SFRZ7 | 425,941 | 422,815 | +3,126 |

|

|

SFRH8 | 225,144 | 220,685 | +4,459 |

|

|

SFRM8 | 190,340 | 192,144 | -1,804 |

|

|

SFRU8 | 130,006 | 132,623 | -2,617 |

|

|

SFRZ8 | 135,705 | 138,344 | -2,639 |

|

|

GERMANY: Leader-Level Coalition Negotiation Group Meets For 1st Time

The 19-member main negotiating group will meet for the first time this afternoon as the centre-right Christian Democratic Union/Christian Social Union (CDU/CSU) and centre-left Social Democratic Party (SPD) continue efforts to try and reach a coalition agreement. Following weeks of work in smaller issue and department-specific working groups, these will be leader-level talks and include chancellor-in-waiting Friedrich Merz (CDU), Markus Söder (CSU), and Lars Klingbeil and Saskia Esken for the SPD.

- Today's talks will take place at the SPD's HQ, Willy Brandt House, alternating in location with the CDU's Konrad Adenauer House and the Representation of Bavaria in Berlin. The talks will remain confidential and are set to resume early next week given the scale of differences still evident on tax and migration policy.

- Earlier, speaking on ARD Söder bluntly rejected the prospect of tax hikes, saying "We won't do that. We need tax cuts," but sought to downplay the risk of a collapse in talks by adding an agreement will be reached "absolutely. Not just because we have to, but also because we want to, I'm sure we'll succeed,".

- Following the 23 Feb federal election, Merz pushed the idea that a gov't should be in place by Easter (20 April), in what would represent a rapid agreement of terms between the two main political rivals. However, he has not spoken of this deadline recently, potentially indicating that negotiations may need to be extended. During this period, Chancellor Olaf Scholz's gov't remains in its caretaker position.

FOREX: Softer Eurozone Inflation Prints Moderately Weigh on EUR

- Softer inflation prints from both France and Spain have moderately weighed on the Euro this morning, taking EURUSD around 30 pips lower from 1.0800 to 1.0770 at typing. Dampened sentiment for equities across APAC has spilled over to the major benchmarks, contributing to a leg lower for EURJPY, which sits 0.55% in the red on Friday.

- Despite USDJPY showing some tentative signs of a bullish breakout on Thursday, a reversal back below 151.00 during APAC today has seen this momentum stall. The renewed pessimism in the equity space has prompted an extension lower for USDJPY to the 150.50 region.

- Risk sensitive currencies are suffering the most in G10, and the New Zealand dollar is the weakest performer, as NZDUSD tracks back to 0.5710/20, off ~0.40% for the session. Overnight, weaker ANZ consumer confidence, along with barely positive filled jobs growth, has provided a headwind for the kiwi, combining with the slump in regional equities. For NZDUSD current levels are close to week to date lows and also the 50-day EMA support point. Earlier March lows were just under 0.5600. NZDJPY is one of the weakest crosses today, declining 0.67% ahead of the NY crossover.

- GBP trades more resiliently around 1.2950 following a constructive set of retail sales / activity data, consolidating some moderate gains on the week. Approaching yesterday’s value date month- and quarter end fixing window, GBP appeared to particularly benefit as the market shrugged off the bullish dollar signals, although 1.3000 has capped the GBPUSD topside for now.

- Moving average studies are in a bull-mode position highlighting a dominant uptrend for cable. A continuation higher and a breach of 1.3015, the Mar 20 high and bull trigger, would initially target 1.3048.

- Highlighting the Friday calendar is monthly GDP from Canada, is scheduled, the US PCE report and the U. of Mich index final read for March. Fedspeak from Barr and Bostic is also on tap.

OPTIONS: Expiries for Mar28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E1.4bln), $1.0750(E790mln), $1.0800(E2.7bln)

- USD/JPY: Y150.40($863mln), Y151.00($1.3bln)

- EUR/GBP: Gbp0.8450(E604mln)

- USD/CAD: C$1.4145-50($1.2bln), C$1.4330-50($1.2bln), C$1.4400($601mln)

- USD/CNY: Cny7.3800($812mln)

EQUITIES: E-Mini S&P Extends Pullback From Tuesday's High

- The medium-term trend direction in Eurostoxx 50 futures is up and recent short-term weakness - for now - appears corrective. Support to watch is the 50-day EMA, at 5296.44. It has been pierced. A clear break of it would highlight a stronger short-term bear threat and expose 5229.00, the Mar 11 low and a bear trigger. On the upside, the bull trigger is 5516.00, the Mar 3 high. Clearance of this level would resume the uptrend.

- S&P E-Minis have pulled back from Tuesday’s high. The trend condition is bearish and gains since Mar 13 are considered corrective. However, note that the 20-day EMA has recently been breached. A resumption of gains would open 5864.25, the Jan 13 low. Moving average studies are in a bear-mode set-up, highlighting a dominant downtrend. A stronger reversal lower would refocus attention on 5559.75, the Mar 13 low and bear trigger.

COMMODITIES: WTI Futures Remain Above Key Resistance at 50-Day EMA

- Despite recent gains, a bearish trend condition in WTI futures remains intact, and gains this month are considered corrective. However, a key resistance at $69.17, the 50-day EMA, has been pierced. The breach strengthens a bullish theme and opens $70.98, the Feb 25 high. For bears, a reversal lower would expose the bear trigger at $64.85, the Mar 5 low. Clearance of this level would resume the downtrend and open $63.73, the Oct 10 ‘24 low.

- The trend condition in Gold is unchanged, it remains bullish. Today’s strong gains have resulted in a clear breach of $3057.5, the Mar 20 high and a bull trigger. This confirms a resumption of the primary uptrend and also highlights fresh all-time highs for the yellow metal. Sights are on the $3100.0 handle and $3106.8, a Fibonacci projection. Support to watch lies at $2982.7, the 20-day EMA.

| Date | GMT/Local | Impact | Country | Event |

| 28/03/2025 | 1100/1200 | ** | PPI | |

| 28/03/2025 | 1230/0830 | *** | Personal Income and Consumption | |

| 28/03/2025 | 1230/0830 | *** | Gross Domestic Product by Industry | |

| 28/03/2025 | 1400/1000 | *** | U. Mich. Survey of Consumers | |

| 28/03/2025 | 1400/1000 | ** | University of Michigan Surveys of Consumers Inflation Expectation | |

| 28/03/2025 | 1500/1100 | Finance Dept monthly Fiscal Monitor (expected) | ||

| 28/03/2025 | 1615/1215 | Fed Governor Michael Barr | ||

| 28/03/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 28/03/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 28/03/2025 | 1930/1530 | Atlanta Fed's Raphael Bostic |