MNI US MARKETS ANALYSIS - EURUSD Eyes 2022 Highs

Highlights:

- China signals that latest tariff rise will be the last, helping support risk

- EURUSD builds on best day since 2015, hitting multi-year highs in the process

- Treasuries reverse early losses, latest steepening pared

US TSYS: Modestly Firmer After Solid Paring Of Early Losses

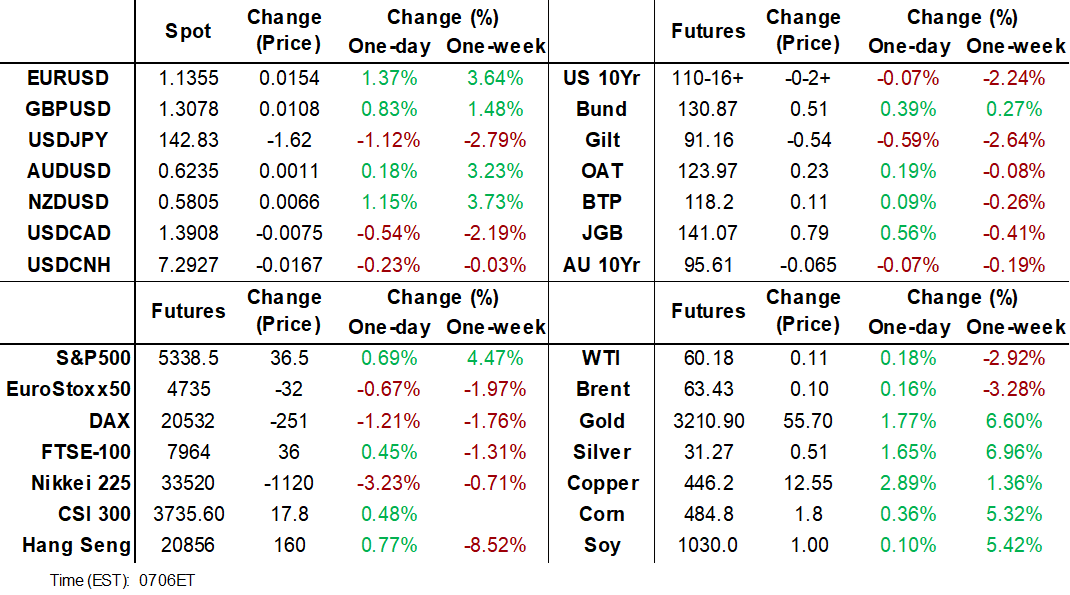

- Treasuries trade modestly firmer on the day considering the huge ranges seen this week, with latest levels masking impressive intraday gains in the long end of the curve.

- Curves have flattened since China’s retaliation of upping tariffs on US imports to 125% and saying that’s the highest it will impose.

- Today sees US PPI and the U.Mich survey, further Fedspeak and additional interest from earnings (MNI full earnings schedule: https://mni.marketnews.com/4cnn1GO).

- There will likely continue to be heightened sensitivity to US policy and trade retaliation headlines, with positioning flows emerging ahead of the weekend.

- Cash yields are 1.7-4.1bp lower on the day, with declines led by 30s.

- 30Y yields hit 4.95% early in Asia trade in a continuation of steepening seen, despite yesterday’s strong auction, but has since pulled back to 4.827% at typing. Recall it briefly topped 5% on Wednesday, broadly meeting the Jan 14, 2025 high at a level last seen in Oct 2023 and before that 2007.

- 5s30s at 78bps has given back some of yesterday’s push higher having closed the gap to pre-90-day pause levels of 85bps via sustained lows of 66-67bps.

- TYM5 trades at 110-17 (-02) off recent highs of 110-21, on solid cumulative volumes of 575k.

- The overnight low of 110-01+ stopped just short of Wednesday’s 110-01 having on three occasions now come close to probing trendline support at 110-00 (drawn from Jan 13 low). Clearance here could open 109-13+ (Feb 24 high) whilst resistance is seen at 112-08 (Apr 8 high).

- Data: PPI Mar (0830ET), U.Mich Apr prelim (1000ET)

- Fedspeak: Kashkari (0800ET), Colins (0900ET), Musalem (1000ET), Williams (1100ET) – see separate post

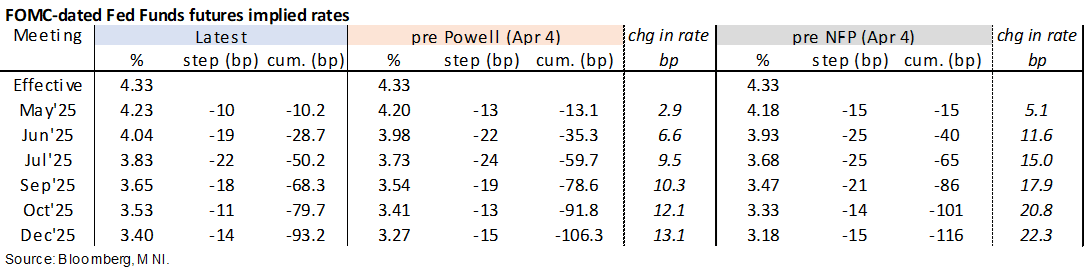

STIR: Fed Rates Slowly Extend Trend Reversal Of Mid-Week Surge

- Fed Funds implied rates are a little lower than levels seen ahead of China tariff retaliation headlines seen in London hours but have reversed most of the decline.

- Whilst back comfortably within ranges, Dec’25 implied rates are still 5bp lower on the day.

- Cumulative cuts from 4.33% effective: 10bp May, 28.5bp Jun, 50bp Jul, 68bp Sep and 93bp Dec.

- Little change in intermeeting cut odds, around 2.5bps priced.

- Terminal rate expectations are little changed on the day, with SOFR implied yields seen bottoming out at 3.25% (-2.5bp, still close to 110bp of cuts) in the SFRU6.

- Today’s data docket sees PPI watched for PCE implications as well as broader tariff impacts on input costs before the April preliminary U.Mich survey with further climbs in inflation expectations expected.

- There’s more Fedspeak ahead after Boston Fed’s Collins (’25 voter, leans dove) yesterday afternoon capped off multiple FOMC member appearances on the need for patience amidst uncertainty.

Note also yesterday afternoon’s addition with Fed Chair Powell set to speak on the economic outlook on Apr 16 at 1330ET.

FED: Watching Williams In Today’s Further Heavy Fedspeak

Today’s Fedspeak sees four different speakers but we focus primarily on NY Fed’s Williams who last spoke Mar 31 and an influential member of the FOMC. Musalem last spoke Apr 9, just before the 90-day pause announcement, whilst Kashkari and Collins have both spoken since. The next major Fedspeak steer is likely to come from Fed Chair Powell however, added to the calendar yesterday for an appearance on Apr 16.

- 0800ET – Kashkari (’26 voter) on CNBC. His initial reaction to Apr 9 tariff retaliation was seeing a little less inflation impact if the tariff pause endures. He still though saw a high bar for cutting rates, having earlier in the day argued against moves in either direction.

- 0900ET – Collins (’25 voter) on Yahoo Finance. She yesterday afternoon capped off various FOMC member appearances on the need for patience amidst uncertainty. Her view of tariffs impacts her economic outlook, concluding that holding rates steady for "a longer time is likely to be appropriate" with there needing to be a “compelling” signal to cut pre-emptively.

- 1000ET – Musalem (’25 voter) on US economy and policy (text + Q&A). He spoke recently, on Apr 9, but before Trump’s China escalation and broader 90-day pause. Typically one of the more hawkish members of the committee, he noted higher inflation risks and that a recession isn't in his baseline in a Reuters interview.

- 1100ET – Williams (permanent voter) on economic outlook and mon pol (text + Q&A). Speaking pre “Liberation Day” on Mar 31, he wanted to watch data to see the impact of tariffs on prices and is keeping an open mind on how long tariff impacts might last. His baseline view was that inflation would be relatively stable but with definitely a risk of higher inflation.

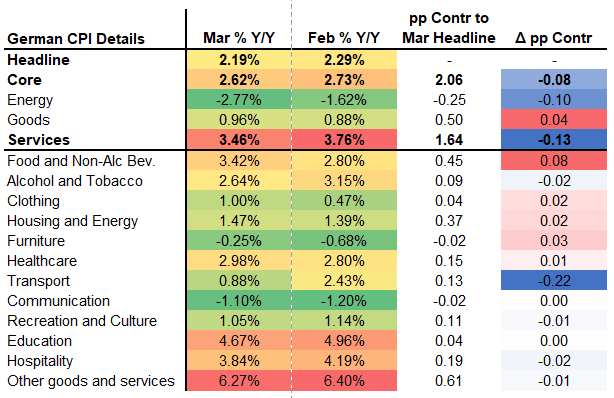

EUROPEAN INFLATION: German Services Moderate But Still Elevated in March [1/2]

German final March HICP was unrevised from the flash readings at 2.3% Y/Y (2.6% prior) and 0.4% M/M (0.5% prior). The final reading of national CPI was also unrevised at 2.2% Y/Y (2.3% prior) and 0.3% M/M (0.4% prior). Core CPI printed at 2.6% Y/Y (0.1pp upwardly revised, 2.7% prior), the lowest rate since June 2021.

- Overall, the CPI data confirms a notable deceleration in services Y/Y inflation (a -0.13pp smaller contribution than in February) but with a caveat that it was mostly driven by airfares with the Easter holidays in April this year vs March last year.

- Goods inflation slightly accelerated (+0.04pp contribution vs prior) as softer energy was not quite able to cancel out firmer food / core goods inflation.

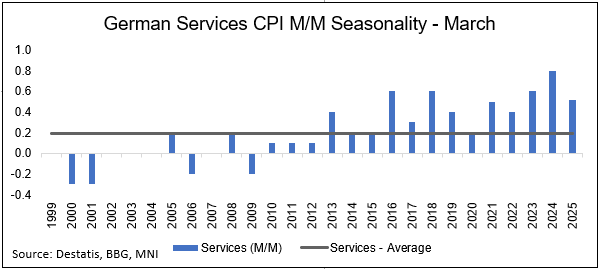

- Echoing January and February's releases, the M/M pace of services has slowed compared to the same period in 2023 and 2024 but remains elevated on a historical comparison - see chart below. The still elevated pace is noteworthy though, especially when considering that the Mar 2024 M/M would have been boosted by the timing of Easter as noted above.

EUROPEAN INFLATION: Mixed Developments In German March Inflation Progress [2/2]

A mixed bag for German inflation in March, including differing Y/Y trends in services-heavy CPI subcategories.

- The mixed-weight transport category (i.e. across goods & services) was key in March at 0.88% Y/Y (state-level data had implied 0.9-1.0%) after 2.4% in Feb. It confirmed that energy (-2.77%, we saw between -2.5% to -3.0% vs -1.6% in Feb) and travel services (airfares -8.04% Y/Y vs 9.26% prior) acted in tandem here.

- Within the services-heavy CPI subcategories, there were some considerable differences in the Y/Y pace since December, as projected by MNI after state-level data. Moderation was seen in education (4.67% Y/Y, MNI saw 4.7% vs 5.0% Feb), restaurants and hotels (3.84%, we saw 3.9% vs 4.2%) and recreation & culture (1.05%, we saw 1.0% vs 1.1%). To the upside however, communications at -1.10% Y/Y (we saw -1.1% vs -1.2%) and healthcare at 2.98% (we saw 3.0% vs 2.8%).

- A material acceleration in food inflation was also confirmed, at 3.4% Y/Y (MNI saw 3.4 to 3.5%) after 2.8% in Feb.

- Categories associated with the core goods sector appear also firmer than before - clothing and footwear came in at 1.0% (we saw 1.2-1.3% after 0.5% prior) and furnishings and household Equipment at -0.25 (we saw -0.24% after -0.7%).

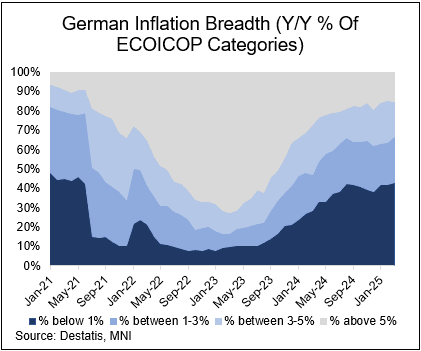

Separately, MNI’s inflation breadth tracker (see chart below) shows disinflation slowly progressing in the low-inflation categories in March, with the percentage of ECOICOP items printing below 1% Y/Y up to 43% from 42% prior. However, disinflation progress stalled in the high-inflation categories, with the percentage above 5% Y/Y holding around 15%.

TARIFFS: China Raises Tariffs On US Goods To 125%

The Chinese State Council Tariff Commission has confirmed that China will impose additional tariffs on US goods from 12 April, with the rate increasing from 84% to 125%. This puts it level with the US's 'reciprocal' tariff, although below the total US tariff rate of 145% due to the additional 20% fentanyl-related tariff. Statement here. Excerpts below:

- "The US's imposition of abnormally high tariffs on China seriously violates international economic and trade rules, basic economic laws and common sense, and is completely a unilateral bullying and coercion."

- "Given that at the current tariff level, there is no market acceptance for US goods exported to China. If the US continues to impose tariffs on Chinese goods exported to the US, China will ignore it."

TARIFFS: China Tariff Response A Reminder Of Trade Elasticity Considerations

- The China MoF statement behind its increase to 125% tariffs on US imports, especially “Given that at the current tariff level, there is no market acceptance for US goods exported to China”, is a timely reminder of the elasticities that need to be considered in effective average tariff rates.

- Trump’s Wednesday announcement of upping reciprocal tariffs to 125% on China (for 145% total) and 10% reciprocal tariffs more broadly amidst a 90-day pause left average tariff rates similar to where they were on Wed morning based on 2024 trade, at circa 24%.

- However, to give an idea of sensitivity to these figures with particular concentration now on China, an extreme case where US imports from China temporarily completely halt would see this effective average tariff rate closer to 12% in the interim.

- In 2024, US imports from China totaled ($439bn) vs ~$3.3trn of total imports. The EU was the largest single entity, with Trump treating it as such in negotiations ($606bn), followed by Mexico ($506bn).

- As for the likelihood of a US response, a second statement attached with the one we first posted contains more colorful language that could provoke President Trump: “Even if the US continues to impose higher tariffs, it will no longer make economic sense and will become a joke in the history of world economy.”

EQUITIES: Light Bid On Report China Restricting Net Sales By Large Investors

MNI (London) - Benchmark global equity indices move further away from session lows as RTRS sources note that “Chinese bourses have set daily restrictions on net share sales by hedge funds and large retail investors”.

- While this isn’t a new method and has been deployed during previous instances of market pressure, it signals that Chinese authorities are becoming more forceful when it comes to preventing further equity weakness in the latest instance.

- The sources suggest that a “soft limit on daily net sales by individual hedge funds and big retail investors - implemented through verbal warnings from brokerages - had been set at 50 million yuan”.

- A reminder that the Chinese sovereign wealth fund has already signalled a higher allocation to equity ETFs, while hopes of deeper monetary and fiscal stimulus (a particular focus is on this month’s Politburo meeting) has also provided some background support.

- Elsewhere, a previous RTRS sources piece noted that “brokerages have been asked to closely monitor transactions by private funds and big retail clients”.

- Note that the recovery rallies in the likes of the S&P 500 e-mini and Euro Stoxx 50 remain relatively shallow intraday, given ongoing geopolitical/trade uncertainty.

FOREX: USDCHF Weakness Extends Following Breach of Major Support

- The Swiss Franc continues to see material safe-haven flows as market worries intensify amid increasing US-China tariff tensions. This led the Citi CHF real effective exchange rate index to spike up to 4.5% to above 104.0 since "Liberation Day" last week, levels just shy of August 2024 highs.

- For USDCHF, price action has remained aggressive following the break of 0.8333 yesterday. The pair continues to trade at fresh ten-year lows, printing 0.8111 this morning. Emphasising the severity of the move, this extends the USDCHF selloff from the February highs to 11.8%, and the next target for the move is at 0.8028 - 1.382 projection of the May 1 '24 - Sep 6 '24 - Jan 13 price swing. The 1m 25 delta risk reversal in the pair stands at -3.24 points - that is also not far off the record low seen 2015.

- EURCHF meanwhile has pared some of its previous losses today as the single currency is the key beneficiary of dollar weakness this morning. Emphasis remains on the 0.9210 double bottom from last year.

- Focus turns to any US response to the latest China tariff increase - particularly as China has indicated that it does not intend to raise its US goods tariffs further as at current levels "there is no market acceptance for US goods exported to China". SNB domestic sight deposits data out Monday will give indication on any potential intervention this week.

FOREX: EURUSD Extends Sharp Gains, Eyes 2022 Highs ~1.1500

- The relentless dollar selling across Thursday has filtered through into Friday’s session, culminating in a further 1.5% depreciation for the US dollar index to levels below the psychological 100.00 mark. Price action has been exacerbated by China announcing additional tariffs on US goods, reaching 125%.

- The Euro has been the key beneficiary of price dynamics this morning. Intra-day EURUSD gains currently stand at ~2%, however spot managed to reach as high as 1.0473, placing the pair at its highest level since early 2022.

- This has substantially narrowed the gap to 1.1495, the Feb 10 2022 high and a key medium term technical point. Should the blowout price action continue, a Fibonacci projection level at 1.1555 is notable. Initial support lies at the 1.1144 breakout level.

- Greenback losses have remained broad based, with the safe haven JPY and CHF also trading in a constructive manner. USDJPY has traded as low as 142.07, extending a clean break below 144 overnight. Sights are on 141.65 next, the Sep 30 ‘24 low.

- For USDCHF, price action has remained aggressive following the break of 0.8333 yesterday. The pair continues to trade at fresh ten-year lows, printing 0.8111 this morning. Emphasising the severity of the move, this extends the USDCHF selloff from the February highs to 11.8%. The next target for the move is at 0.8028 - 1.382 projection of the May 1 '24 - Sep 6 '24 - Jan 13 price swing.

- The China tariff news is weighing on the AUD, a relative underperformer in G10, and even diverging from its antipodean counterpart (AUDNZD down 1.3%).

- US PPI and preliminary U Mich sentiment data highlights the data calendar on Friday.

OPTIONS: Expiries for Apr11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0900(E826mln), $1.0950-60(E1.2bln), $1.1000(E2.1bln), $1.1030-40(E770mln)

- USD/JPY: Y145.30-40($540mln), Y145.95-00($1.0bln)

- AUD/USD: $0.6100(A$844mln), $0.6295-00(A$650mln)

- USD/CAD: C$1.4045($1.8bln)

- USD/CNY: Cny7.3500($1.1bln)

EQUITIES: EuroStoxx Rally Could Signal Start of Correction

- A short-term reversal in S&P E-Minis on Wednesday highlights the start of what appears to be a corrective cycle. The trend condition has been oversold following recent weakness and the move higher is allowing this set-up to unwind.

- Eurostoxx 50 futures have traded in an extremely volatile manner this week and rallied sharply higher from this week’s lows. The climb highlights the start of a corrective cycle and if this is correct, marks an unwinding of the recent oversold trend condition.

COMMODITIES: Bearish Oil Theme Intact

- The trend condition in Gold remains bullish and this week’s rally confirms and reinforces this condition. The yellow metal has traded through $3167.8, the Apr 3 high, to resume the primary uptrend and trade to fresh all-time highs.

- A bearish theme in WTI futures remains intact and Wednesday’s rally from the day low is - for now - considered corrective. The move higher is allowing an oversold trend condition to unwind.

| Date | GMT/Local | Impact | Country | Event |

| 11/04/2025 | 1230/0830 | *** | PPI | |

| 11/04/2025 | 1400/1000 | *** | U. Mich. Survey of Consumers | |

| 11/04/2025 | 1400/1000 | ** | University of Michigan Surveys of Consumers Inflation Expectation | |

| 11/04/2025 | 1400/1000 | St. Louis Fed's Alberto Musalem | ||

| 11/04/2025 | 1500/1100 | New York Fed's John Williams | ||

| 11/04/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 11/04/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 12/04/2025 | 0630/0730 | BoE's Greene on ‘The dynamics of monetary policy’ |