MNI US MARKETS ANALYSIS - Off Lows, But Fragility Here to Stay

Highlights:

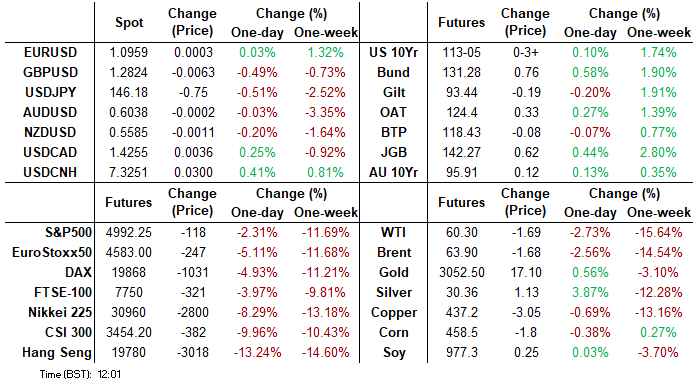

- Bear cycle still gripping markets, but futures off lows headed into US open

- Trump signals tariffs here to stay, seems unperturbed by market fallout

- EU meeting continues, retaliation likely, but countermeasures could take time

US TSYS: Reversal Of Large Overnight Rally

- Treasuries sit twist steeper after a paring or full reversal of large overnight gains as equities lift off lows, helped in part by Italy Finance Minister Tajani pointing to a potential delay in EU tariff retaliation.

- A light docket sees tariff and broader-US policy headlines firmly in the driving seat.

- Cash yields are 4bp lower (2s) to 5bp higher (20s/30s), pivoting at 7s.

- 2s10s at 41.1bp (+6bp) has retreated from ~45bp for fresh highs since May 2022.

- TYM5 is back little changed on the day at 113-02+ (+01) after a high of 114-10 almost immediately with the Asia open. It’s been another huge overnight session for overnight volumes, standing at 1.35mln.

- The impulsive bull cycle has continued to punch through resistance levels, with 114-10 now latest resistance before 114-16 (Fibo projection of the Jan-Feb price swing). There is a sizeable gap to support at 112-01 (Mar 4 high and recent breakout level).

- Data: Consumer credit Feb (1500ET)

- Fedspeak: Kugler (1030ET)

- Bill issuance: US Tsy $76B 13W, $68B 26W bill auctions (1130ET), US Tsy $50B 14D CMB (1300ET)

STIR: Large Paring Of Overnight Rally, Fed Intermeeting Cut Odds Fade

- Fed Funds implied rates are firmly off overnight lows, paring a sharp move lower at the open after Trump’s weekend tariff rhetoric including: “I don’t want anything to go down. But sometimes you have to take medicine to fix something.”

- Most recent intraday increases have been helped by Italy pointing to a potential delay in EU tariff retaliation.

- Cumulative cuts from an assumed 4.33% effective: 16bp May, 40.5bp Jun, 66bp Jul and 112bp Dec.

- The rate path for 2025 meetings is still solidly lower on the day but roughly back to levels seen prior to Friday’s payrolls report, some at-the-time tariff optimism and a patient sounding Fed Chair Powell [see comparison table below].

- Inter-meeting cut odds have been pared back to 2bp of cuts priced in the April FF contract vs closer to 6.5bp of cuts early this morning.

- Further out the curve, SOFR implied yields are still seen bottoming in the SFRU6, off lows but at 2.95% still 11.5bp lower from Friday’s close and ~45bp lower since “Liberation Day” tariffs.

- Ahead, Fed Gov. Kugler (permanent voter) speaks on inflation dynamics and the Phillips curve (1030ET – Q&A only). She said Apr 2 before the Liberation Day announcements that the Fed should hold rates as long as inflation upside risks continue and that data suggest progress toward 2% inflation may have stalled. The tariff threat could be longer if longer-term inflation expectations rise.

MACRO ANALYSIS: MNI US Employment Insight: Solid But ‘Stale’

We have published and e-mailed to subscribers the MNI US Employment Insight.

Please find the full report including MNI analysis and summary views from sellside analysts here: https://media.marketnews.com/US_Employment_Report_Apr2025_03f502392c.pdf

Trump administration officials dismissing recession fears over the weekend has seen 18bp of cuts priced for the next FOMC decision in May although most analysts see a Fed May cut as unlikely.

EQUITIES: Megacaps Weak Pre-Market, But Recovery Should Support Indices

- Index futures are off lows, but still sustaining heavy losses on the day and pointing to another step lower for cash equities at today's open. Pre-market trade among megacap names has again been brutal (NVIDIA -3.4%, Tesla -5.2%, Microsoft -2.6%, Meta Platforms -2.5%, Amazon -2.5%, Apple -2.1%, Alphabet -2.7%), but prices are off their pre-market lows on heavy volumes.

- Needless to say, tariff concerns are driving prices here - with focus on the shape and structure of the EU response the next market focus. Those comments from Italy's Tajani could further prove supportive if confirmed by other leaders at their meeting in Poland today. Post-meeting press conference expected at ~1440CET (0840ET, 1340BST).

- Bear market count: NASDAQ Comp, NASDAQ-100, DAX (briefly), Russell 2000, Nikkei 225, Hang Seng Index - S&P 500 and Dow Jones may well hit the required levels at the cash open today (S&P 500: 4915.75, Dow Jones: 36,040)

- Price action has confirmed market is happy to look through oversold conditions, making 4,760.88 the next support for the e-mini S&P (1.618 proj of the Feb 19 - Mar 13 - 25 price swing) and 4372.46 the level to watch in the Eurostoxx futures (76.4% retracement of the Oct ‘23 - Mar ‘25 bull cycle).

FOREX: Bear Cycle Grips Markets, AUDJPY at a New Low

- The bear cycle for equities continues to grip markets, with no end in sight for the aggressive risk sell-off. European equity markets have dropped a further 5% from the open Monday, with Asia-Pac markets particularly weak. Hong Kong's Hang Seng Index stepped lower by 13% into the close, entering a bear market and shrugging off any support garnered from Chinese state-run institutions openly buying in mainland equity markets.

- With European equities gapping lower at the open, it's no surprise to see JPY getting further support through Asia-Pac trade and maintaining that poise into early Europe. There is little sign that the risk-off trade has bottomed, evident in the new pullback low for AUDJPY at Y86.15 overnight, the lowest print since Mar'23's Y86.06, and 2022 before that.

- NOK/CHF trades similarly, defining both ends of the G10 FX table today, making for a convincing break through the 8.00 handle at the open as the cross becomes another strong indicator of risk.

- Focus turns to the imminent meeting of European leaders in Poland, at which the EU are said to be open to all options for retaliation against Trump's trade measures detailed last week. Options include a raise on levies for US goods headed to Europe, as well as more stringent regulation on big tech firms, and profits earned by US firms on the continent.

- The US President's schedule today consists of a meeting with the Israeli Prime Minister, but any comments concerning tariffs and the sensitivity of global markets will be carefully watched. Fed's Kugler is set to be speaking, commenting on inflation dynamics and the Phillips curve at 1530BST/1030ET.

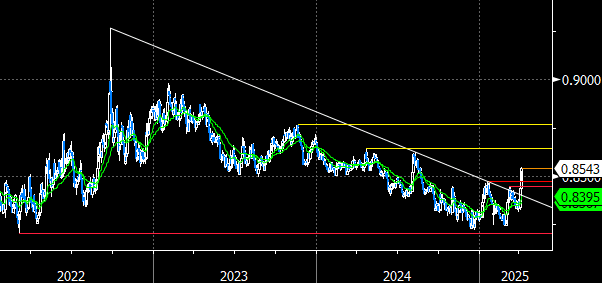

FOREX: EURGBP Edging Higher, Clears Key Resistance

- The focus for FX markets in recent sessions has been on the impressive moves lower for the likes of AUD and NZD, and the haven flows which continue to bolster the JPY and CHF. While these moves dominate the headlines, EURGBP has been steadily moving higher and in the process has cleared some key resistance levels.

- The latest rally has seen the cross rise above 0.8474, the Jan 20 high. Clearance of this hurdle highlights an important technical breach and strengthens a bullish condition.

- While sights are now on 0.8593 next, the Aug 14 ‘24 high, it is worth noting spot is in overbought territory, and a pullback would allow this condition to unwind. Targets for a stronger move higher include 0.8645 and 0.8768.

- Monthly UK GDP and its subcomponents for February are due for release on Friday. At its March meeting the BOE noted that it was looking for GDP for Q1 to come in around 0.25%Q/Q but that business surveys were tracking more consistently with 0.0-0.1%.

CHF: Swiss Franc Strength Persists, AUDCHF Extends 3-Day Slide to 8%

- CHF tops the G10 leaderboard on Monday, as the seismic hit to risk sentiment continues to bolster FX safe havens. This has once again been most notable in AUDCHF extending a three-day slide for the cross to 8.2%, with only the psychological 0.50 mark of note on the downside.

- Swissie strength has been broad based, with a near 1% advance against both the Euro and USD. EURCHF picked up downside momentum on a break back below 0.9500 Friday and now resides comfortably back below pre-German fiscal announcement levels. Weakness this morning took EURCHF to a fresh 2025 low below 0.9300, signalling scope for a more to firm double bottom support, at the 2024 lows around 0.9210.

- For USDCHF, price action last week to the pair below the US election lows, resulting in a resumption of this year’s downtrend. Note that moving average studies remain in a bear-mode position and this continues to highlight a dominant medium-term downtrend.

- Following the break of 0.8570 (76.4% retracement of the Sep ‘24 - Jan bull cycle), key medium targets include 0.8375 (Sep 6 '24 low) and 0.8333, the Dec 28 '23 low and the medium-term bear trigger.

- It is worth highlighting that Goldman Sachs have adjusted their 12m USDCHF forecast to 0.79 from 0.88.

USD: Goldman Sachs Significantly Revise US Dollar Forecasts Lower

- While the greenback received a moderate boost during the APAC session on the risk off flows, broad dollar indices have since turned lower, weigh by the likes of USDCHF and USDJPY, which have declined ~1% and ~0.5% respectively to start the week.

- Notably, Goldman Sachs have made significant downward revisions to their dollar forecasts over the next 12 months, as they cite the greenback’s exceptionalism as having been eroded. GS cite three major reasons for their decisive shift.

- First of all, the combination of an unnecessary trade war and other uncertainty raising policies is severely eroding consumer and business confidence. Secondly, the negative trends in US governance and institutions are eroding the exorbitant privilege long enjoyed by US assets. Finally, the implementation of the tariffs themselves is eroding the ability of investors to price these, underpinning the rising recession risks.

- GS have revised their EURUSD forecasts to 1.12, 1.15 and 1.20 in 3, 6 and 12 months (from 1.07, 1.05 and 1.02 previously) and revise their USDJPY forecasts to 138, 136, and 135 in 3, 6 and 12 months (from 150, 151 and 152 previously). GS believe this would bring the Dollar closer to measures of long-run fair value.

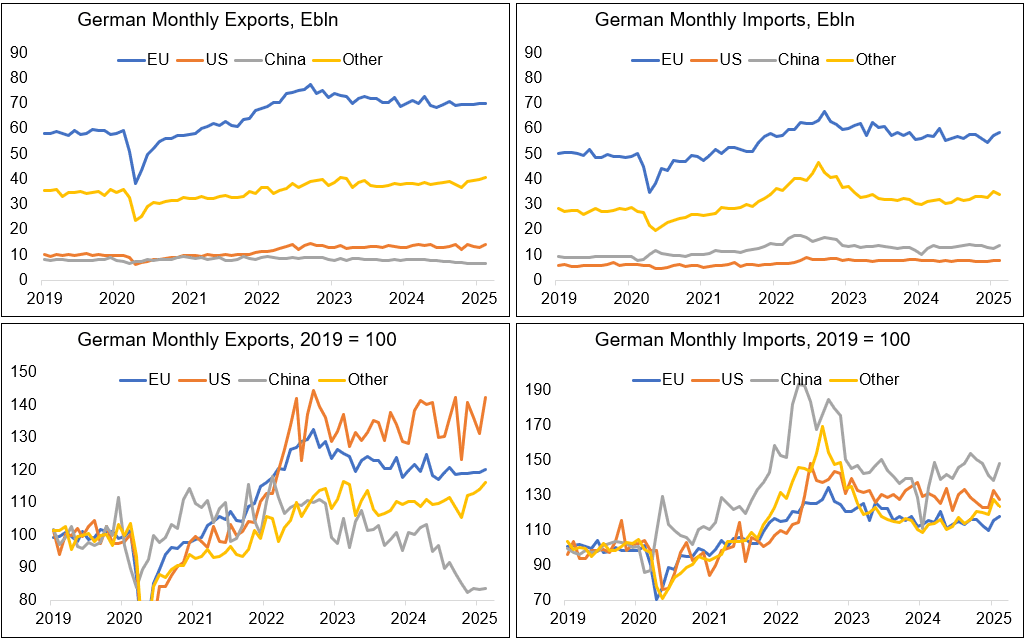

GERMAN DATA: Trade Surplus As Rolling 12m of GDP Decreases in February [1/2]

The German trade balance underperformed expectations in February at E17.7bln (seasonally-adjusted, vs E18.5bln cons) but the surplus ticked higher from January (E16.2bln, revised from E16.0bln). The increase came as a 1.8% M/M increase in exports (1.5% cons; 0.0% prior, revised from -2.5%) outpaced a 0.7% M/M uptick in imports (-0.4% cons; 5.0% prior, revised from 1.2%). Revisions to the long-term historical data meant that while the nominal trade numbers appear lower now on the margin and individual M/M prints changed considerably, the overall relative trajectory of trade trends across countries appears little changed, leaving no materially different conclusion on the underlying conclusions from the data.

However, today's data meant that the German trade surplus as a % of nominal GDP on a 12-month rolling basis declined to 5.3% in February - despite a recovery from its 2.0% October 2022 low, the series was never able to recover to its pre-pandemic highs, and started to drift lower again since September 2024's 5.9% high.

- Looking at the country split, the 8.5% M/M rise in exports to the US stands out, but that follows weaker December / January data, so we will wait for the March print to indicate if there has been material tariff front-running to the US. Exports to the EU have been slightly positive throughout in recent months.

- On imports, trends were mixed but February's values came in within recent ranges across the main countries / aggregates (see bottom right chart).

GERMAN DATA: Chinese Dynamics / US Tariffs Provide Downside Risk [2/2]

- Looking ahead, the March rise in German IFO export expectations may be highly discounted after the US administration's tariff announcements last week.

- Outside of the downside risks of German exports to the US, also note that a significant downside driver to the German trade balance since 2022 were exports to China (they fell 26% when comparing the latest three months available to Jan-Mar 2022), while imports from the country broadly sidelined since 2023. This comes against the backdrop of reports (here, here) suggesting China has built significant manufacturing overcapacity in recent years, indicated by domestic supply rising faster global demand, rising numbers of lossmaking industrial firms in the country, as well as declining capacity utilization.

- Against the backdrop of high US tariffs on Chinese goods, this poses further downside risk to the German trade surplus (and industrial production), as a) there appears to be no imminent rationale for Chinese demand for German industrial products to pick up materially again and b) lower US demand for Chinese manufacturing exports might mean higher supply at lower prices of these products in Germany.

EQUITIES: Eurostoxx 50 Sell-Off Deepens, Making Light Work of Technical Levels

- Eurostoxx 50 futures remain in a bear cycle following the latest impulsive sell-off. Last week’s move down resulted in a break of 5229.00, the Mar 11 low. Today’s sell-off has resulted in a breach of a key support at 4699.00, the Nov 19 ‘24 low, as well as the 4600.00 handle and 4494.00, the Aug 5 ‘24 low. The contract is oversold, a recovery would allow this condition to unwind. Initial resistance is 4809.00, the Dec 20 ‘24 low (cont).

- S&P E-Minis continue to trade in a volatile manner and are once again lower, today. A bearish theme remains intact and the latest fresh cycle lows, strengthens current conditions. Scope is seen for an extension towards the 4800.00 handle next. Moving average studies are in a bear-mode position, highlighting a dominant downtrend. Key short-term resistance has been defined at 5837.25, the Mar 25 high.

COMMODITIES: Recent Pullback in Gold Considered Corrective For Now

- The impulsive sell-off in WTI futures continues to accelerate and last week’s move down resulted in the breach of a number of important support levels. The break reinforces a bearish threat and, despite being in oversold territory, signals scope for a continuation of the bear leg. Sights are on $59.39 next, a Fibonacci projection (pierced). Initial resistance is seen at $64.85, the Mar 5 low and a recent breakout level.

- The trend condition in Gold remains bullish and the latest pull back - for now - appears corrective. Moving average studies are in a bull-mode position highlighting a dominant uptrend and positive market sentiment. Price has traded through the 20-day EMA. The next key support to watch lies at 2943.78, the 50-day EMA. A resumption of gains would refocus attention on $3196.2, a Fibonacci projection. The bull trigger is 3167.8, the Apr 3 high.

| Date | GMT/Local | Impact | Country | Event |

| 07/04/2025 | 1430/1030 | Fed Governor Adriana Kugler | ||

| 07/04/2025 | 1430/1030 | ** | BOC Business Outlook Survey | |

| 07/04/2025 | 1530/1130 | * | US Treasury Auction Result for 26 Week Bill | |

| 07/04/2025 | 1530/1130 | * | US Treasury Auction Result for 13 Week Bill | |

| 07/04/2025 | 1700/1300 | * | US Treasury Auction Result for Cash Management Bill | |

| 07/04/2025 | 1900/1500 | * | Consumer Credit | |

| 08/04/2025 | 0500/1400 | Economy Watcher's Survey | ||

| 08/04/2025 | 0645/0845 | * | Foreign Trade | |

| 08/04/2025 | 0900/1000 | ** | Gilt Outright Auction Result | |

| 08/04/2025 | 0900/1100 | ECB's De Guindos At Spanish Banking Association Meeting | ||

| 08/04/2025 | 1000/0600 | ** | NFIB Small Business Optimism Index | |

| 08/04/2025 | 1255/0855 | ** | Redbook Retail Sales Index | |

| 08/04/2025 | 1400/1000 | * | Ivey PMI | |

| 08/04/2025 | 1400/1600 | ECB's Cipollone at ECON Hearing On Digital Euro | ||

| 08/04/2025 | 1600/1700 | BoE's Lombardelli on 'What can the UK learn from the US' | ||

| 08/04/2025 | 1700/1300 | *** | US Note 03 Year Treasury Auction Result | |

| 08/04/2025 | 1800/1400 | San Francisco Fed's Mary Daly |