MNI US MARKETS ANALYSIS - Poised for Liberation Day

Highlights:

- Markets poised for Liberation Day, with overnight vols well bid

- Risk knocked as China restrict US-bound investment

- ADP Employment Change to provide insight into Friday's Payrolls

US TSYS: Opening Losses More Than Reversed With Risk-Off On “Liberation Day"

- Treasuries have more than reversed losses seen with the Asia open, leaving them more firmly back within yesterday’s range.

- Risk-off flow in European hours helped, eliciting screen buying across TU, FV and TY futures ahead of the European cash equity open, before a further rally on headlines that China is to restrict companies from investing in the US.

- This all comes ahead of “Liberation Day” tariff announcements due 1600ET, although futures volumes have still been reasonably elevated overnight despite this upcoming event risk.

- Cash yields are 0.8-2.8bp lower, with declines led by 5s and 30s lagging the move.

- 2s10s at 29.3bp (+0.4bp) broadly consolidates the week’s flattening from 35bp early Monday.

- TYM5 has climbed 11 ticks off overnight lows back to 111-26 for just +01 on the day, on solid cumulative volumes of 465k.

- Yesterday’s high of 111-30+ marked another step closer to key resistance at 112-01 (Mar 4 high and bull trigger) after which lies 112-13 (Fibo projection). To the downside, support at 110-26+ (20-day EMA).

- Data: MBA mortgage data (0700ET), ADP employment Mar (0815ET), Factory orders Feb (1000ET)

- Fedspeak: Kugler on inflation expectations (1630ET, text + Q&A) – see STIR bullet

- Bill issuance: US Tsy $60B 17W bill auction (1130ET)

STIR: Than Three Cuts Priced For 2025 Ahead Of Tariff Announcement

- Fed Funds implied rates have slipped 1-1.5bp on recent headlines that China is to restrict companies from investing in the US.

- The implied rate path sits towards the middle of the week’s already reasonably wide range ahead of today’s “Liberation Day” tariff announcements due 1600ET, but are still dovish by post Trump inauguration standards.

- Cumulative cuts from 4.33% effective: 5bp May, 21.5bp Jun, 37.5bp Jul and 78bp Dec.

- The 77.5bp of cuts for the year compares with Monday’s 72.5-81.5bp range.

- The SOFR implied terminal yield meanwhile, at 3.37% in the U6 contract, is just 0.5bp higher than yesterday’s fresh lowest close since Oct 2024 (i.e. prior to the Nov presidential election).

- Today’s data provides near-term focus with ADP employment and final durable goods but with attention firmly on the tariffs announcement at 1600ET.

- The latter are likely to overshadow Fed Gov. Kugler (permanent voter) speaking on inflation expectations and policy making at 1630ET (text + Q&A). She last spoke Mar 25 when we interestingly honed in on core goods inflation, saying recent prints have been unhelpful and affect expectations. She was watching the pick-up in inflation and inflation expectations and reiterated that the Fed can hold rates steady for “some time”.

CHINA: Stocks Slip as China Restrict US Investments

China are reportedly restricting companies from investing in the US - potentially giving Beijing more flexibility in future negotiations, according to Bloomberg. The headlines prompt a new daily low in the e-mini S&P at 5640.75.

- Chinese investment headed to the US was already tilting lower through the election (data shows Chinese investment into the US was just $191mln in Q4 2024) - but this would represent an acceleration of that trend. The move would also limit Chinese firms' ability to skirt sanctions pressure by re-shoring manufacturing into the US, potentially hindering one of Trump's main policy objectives with tariffs.

- Modest bid in bonds alongside the headline, but yesterday’s highs remain untested across TY, Bund & gilt futures.

STIR: Mix Of Short Cover & Long Setting Seen In SOFR Futures On Tuesday

OI data points to net short cover dominating in the very front of the SOFR futures strip on Tuesday, before net long setting became more prominent further out.

| 01-Apr-25 | 31-Mar-25 | Daily OI Change |

| Daily OI Change In Packs |

SFRH5 | 1,156,697 | 1,184,944 | -28,247 | Whites | -67,069 |

SFRM5 | 1,288,145 | 1,339,157 | -51,012 | Reds | +4,172 |

SFRU5 | 955,068 | 933,926 | +21,142 | Greens | +54,739 |

SFRZ5 | 1,075,144 | 1,084,096 | -8,952 | Blues | +10,814 |

SFRH6 | 646,380 | 650,168 | -3,788 |

|

|

SFRM6 | 689,069 | 690,662 | -1,593 |

|

|

SFRU6 | 629,802 | 628,856 | +946 |

|

|

SFRZ6 | 788,730 | 780,123 | +8,607 |

|

|

SFRH7 | 517,426 | 491,451 | +25,975 |

|

|

SFRM7 | 486,031 | 470,791 | +15,240 |

|

|

SFRU7 | 323,669 | 314,033 | +9,636 |

|

|

SFRZ7 | 431,241 | 427,353 | +3,888 |

|

|

SFRH8 | 229,707 | 230,364 | -657 |

|

|

SFRM8 | 191,929 | 191,123 | +806 |

|

|

SFRU8 | 134,761 | 128,687 | +6,074 |

|

|

SFRZ8 | 140,445 | 135,854 | +4,591 |

|

|

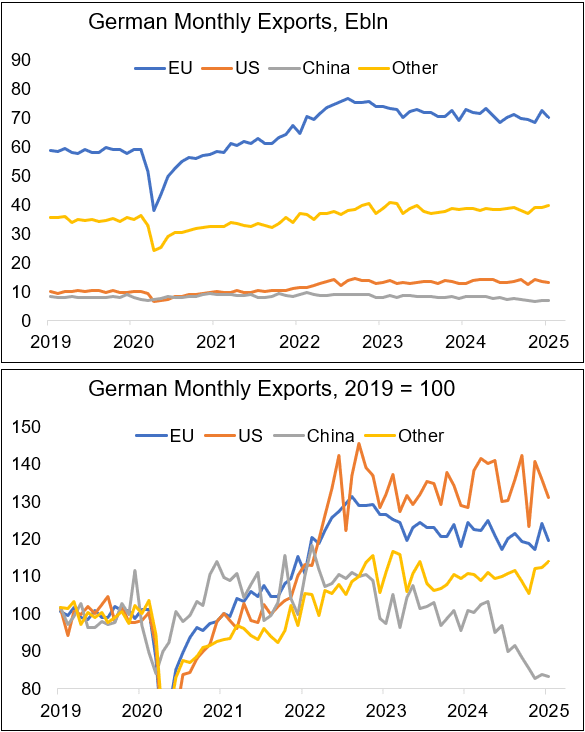

GERMANY: IFO Sees US Tariffs To "Only Slightly Reduce German Exports"

IFO sees "new reciprocal US tariffs [to] reduce German exports to the United States by less than three percent. The IFO Institute has simulated these reciprocal tariffs, in other words, if the US were to increase tariffs on products by the amount levied by its trading partners on corresponding US products. If the EU were to take no countermeasures, German exports would fall by 2.4 percent."

- "However, the impact of reciprocal tariffs would be significantly lower for Germany [relative to] a blanket US tariffs increase of 20 percent [...] because the gap in tariffs between the US and the EU is relatively small at 0.5 percent", IFO adds. Full report here: https://www.cesifo.org/en/publications/2025/working-paper/us-reciprocal-tariffs-and-their-erosion-global-trade-rules

- German exports to the US have seen some volatility in recent months but appear to have not exhibited a clear directional trend since mid-2022 in real terms.

- IFO export expectations have risen most recently, reaching their highest level since early 2024 but remain in negative territory at -1.6 point (up from -4.7 in February). IFO flagged that sentiment in the automotive industry has "turned around" recently although the outlook there remains cautious. "The outlook for the metal sector is still pessimistic, but no longer as pronounced as in previous months. The same applies to clothing manufacturers", they added.

US TSY FUTURES: Long Setting Most Prominent On Tuesday

OI data points to net long setting across most contracts daring Tuesday’s rally, with modest net short cover in TY providing the only exception to the wider theme.

- Net long setting in US & WN provided the most meaningful DV01 equivalent positioning swings

| 01-Apr-25 | 31-Mar-25 | Daily OI Change | OI DV01 Equivalent Change ($) |

TU | 3,919,492 | 3,914,677 | +4,815 | +185,170 |

FV | 6,520,775 | 6,486,976 | +33,799 | +1,475,981 |

TY | 4,890,597 | 4,899,400 | -8,803 | -569,479 |

UXY | 2,323,239 | 2,318,865 | +4,374 | +393,612 |

US | 1,844,360 | 1,824,491 | +19,869 | +2,633,213 |

WN | 1,814,377 | 1,804,151 | +10,226 | +2,003,337 |

|

| Total | +64,280 | +6,121,834 |

FOREX: Markets Poised for Liberation Day

- AUD and NZD are outperforming in early trade, with AUD/USD looking to test the 100-dma resistance at 0.6314 on any further strength. The USD is generally subdued, with markets clearly lacking directional conviction headed into today's tariff announcement.

- Trump's Rose Garden appearance at the US cash equity close is the sole focus Wednesday, with markets looking for clarity on 'Liberation Day' and what this means for the global trade order. Options remaining on the table are speculated to be a blanket tariff of ~20% on most US imports, a country-by-country approach or a tiered system. Regardless of the approach the White House go for, tariffs are expected to come into effect immediately, leaving markets fraught with risk through the session.

- Haven currencies are moderately softer - but the likes of CHF and JPY are still well ahead of support, meaning today's step lower in JPY, CHF may not be a direct indicator of risk-on. AUD/CHF has rallied Wednesday, but prices are meeting resistance at the formation of a downtrendline drawn off the early March highs.

- US final durable goods orders, ADP Employment Change and appearances from ECB's Schnabel, Holzmann, Lane & Lagarde are due.

OPTIONS: Expiries for Apr02 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0790-00(E1.9bln)

- USD/JPY: Y149.80-95($577mln)

- USD/CAD: C$1.3780($1.1bln), C$1.4400-15($924mln)

- USD/CNY: Cny7.3500($1.3bln)

EQUITIES: E-Mini S&P Softer Following This Week's Moderate Recovery

- Eurostoxx 50 futures traded lower Monday resulting in a breach of key support at 5229.00, the Mar 11 low. The contract has recovered, however, the print below 5229.00 undermines a bullish theme and signals scope for a deeper retracement. The 5200 handle has also been cleared, opening 5079.00, the Feb 3 low. It is still possible that recent weakness is part of a broader correction. Initial firm resistance is 5335.34, the 20-day EMA.

- S&P E-Minis maintain a softer tone following recent bearish price action. Sights are on key support and the bear trigger at 5559.75, the Mar 13 low. It has been pierced, a clear break of it would confirm a resumption of the downtrend that started Feb 19, and open 5483.30, a Fibonacci projection. MA studies are in a bear-mode position, highlighting a dominant downtrend. Key short-term resistance has been defined at 5837.25, the Mar 25 high.

COMMODITIES: Gold Trend Remains Bullish Following Sequence of Record Highs

- WTI futures traded sharply higher Monday. This undermines the medium-term bearish condition and instead signals scope for a continuation higher near-term. The rally has exposed the next key resistance at $72.91, the Feb 11 high. Clearance of this level would strengthen the bullish theme. On the downside, initial firm support to watch lies at $69.01, the 20-day EMA. A breach of this level would signal a potential reversal.

- The trend condition in Gold is unchanged, it remains bullish. The latest rally reinforces current conditions and confirms a continuation of the primary uptrend. The rally also once again, highlights fresh all-time highs for the yellow metal. Sights are on the $3151.5, a Fibonacci projection. Support to watch lies at $3004.9, the 20-day EMA. A pullback would be considered corrective.

| Date | GMT/Local | Impact | Country | Event |

| 02/04/2025 | 1100/0700 | ** | MBA Weekly Applications Index | |

| 02/04/2025 | 1215/0815 | *** | ADP Employment Report | |

| 02/04/2025 | 1400/1000 | ** | Factory New Orders | |

| 02/04/2025 | 1405/1605 | ECB's Lane At AI Conference | ||

| 02/04/2025 | 1430/1030 | ** | DOE Weekly Crude Oil Stocks | |

| 02/04/2025 | 2030/1630 | Fed Governor Adriana Kugler | ||

| 03/04/2025 | 2200/0900 | * | S&P Global Final Australia Services PMI | |

| 03/04/2025 | 2200/0900 | ** | S&P Global Final Australia Composite PMI | |

| 03/04/2025 | 0030/1130 | Job Vacancies | ||

| 03/04/2025 | 0030/1130 | ** | Trade Balance | |

| 03/04/2025 | 0030/0930 | ** | S&P Global Final Japan Services PMI | |

| 03/04/2025 | 0030/0930 | ** | S&P Global Final Japan Composite PMI | |

| 03/04/2025 | 0145/0945 | ** | S&P Global Final China Services PMI | |

| 03/04/2025 | 0145/0945 | ** | S&P Global Final China Composite PMI | |

| 03/04/2025 | 0630/0830 | *** | CPI | |

| 03/04/2025 | 0700/0300 | * | Turkey CPI | |

| 03/04/2025 | 0715/0915 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0715/0915 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0720/0920 | ECB's De Guindos On "Financial Stability In Uncertain Times" | ||

| 03/04/2025 | 0745/0945 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0745/0945 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0750/0950 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0750/0950 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0755/0955 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0755/0955 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0800/1000 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0800/1000 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0830/0930 | Decision Maker Panel data | ||

| 03/04/2025 | 0830/0930 | ** | S&P Global Services PMI (Final) | |

| 03/04/2025 | 0830/0930 | *** | S&P Global/ CIPS UK Final Composite PMI | |

| 03/04/2025 | 0900/1100 | ** | PPI | |

| 03/04/2025 | 0900/1000 | ** | Gilt Outright Auction Result | |

| 03/04/2025 | 1000/1200 | ECB's Schnabel At OECD Seminar | ||

| 03/04/2025 | 1230/0830 | *** | Jobless Claims | |

| 03/04/2025 | 1230/0830 | ** | WASDE Weekly Import/Export | |

| 03/04/2025 | 1230/0830 | ** | International Merchandise Trade (Trade Balance) | |

| 03/04/2025 | 1230/0830 | ** | International Merchandise Trade (Trade Balance) | |

| 03/04/2025 | 1230/0830 | ** | Trade Balance | |

| 03/04/2025 | 1345/0945 | *** | S&P Global Services Index (final) | |

| 03/04/2025 | 1345/0945 | *** | S&P Global US Final Composite PMI | |

| 03/04/2025 | 1400/1000 | *** | ISM Non-Manufacturing Index | |

| 03/04/2025 | 1430/1030 | ** | Natural Gas Stocks | |

| 03/04/2025 | 1530/1130 | ** | US Bill 04 Week Treasury Auction Result | |

| 03/04/2025 | 1530/1130 | * | US Bill 08 Week Treasury Auction Result | |

| 03/04/2025 | 1630/1230 | Fed Vice Chair Philip Jefferson | ||

| 03/04/2025 | 1830/1430 | Fed Governor Lisa Cook |