MNI US MARKETS ANALYSIS - Tsys Look Through Trump Transcript

Highlights:

- Treasuries look through Trump's Time interview

- China's foreign ministry denies any trade contact has taken place with the US

- Fed media blackout kicks in at the close

US TSYS: A Latest Bid After Initially Looking Through Trump Interview

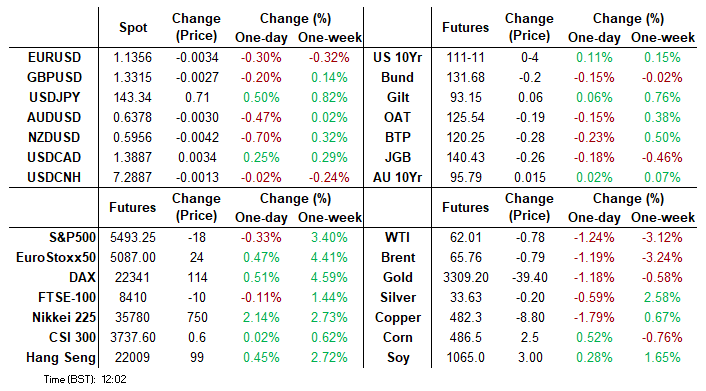

- Treasuries have seen a light bid in latest trading as US desks filter in, albeit under still low volumes.

- The curve is bull flatter with cash yields 1-4bp lower on the day.

- The long end, and 30s in particular, have built on yesterday’s rally but all benchmark tenors remain within Wednesday’s wide ranges.

- There was no initial reaction to publication of President Trump’s interview with Time Magazine from Apr 22, which claimed that China President Xi has called Trump in contradiction to China officials.

- 2s10s trades at 49.8bp (-2.3bp), continuing to firm a pull back from Monday’s latest high of ~66bps. The cycle high was 74bp on Apr 8/9 (depending on time zone).

- TYM5 has recently lifted to session highs of 111-11 (+04), extending yesterday’s climb but still within Wednesday’s wide range. It’s a second overnight session of lows volumes that are still only 250k despite the latest uptick in activity.

- Gains appear corrective. Wednesday’s high of 111-18+ (Apr 23 high) marks initial resistance after which lies 111-25 (50% retrace of Apr 7-11 bear leg), whilst support is seen at 110-15 (Apr 15 low).

- Data: U.Mich consumer survey Apr final (1000ET), KC Fed services Apr (1100ET)

- Fedspeak: None scheduled but note Warsh at 1600ET – see STIR bullet

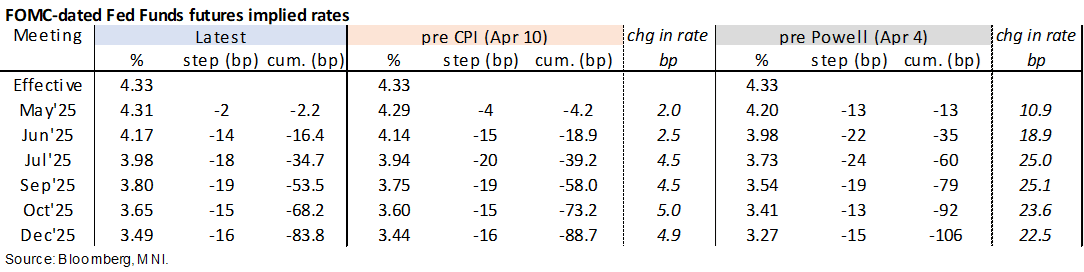

STIR: Fed Rate Path A Touch Higher, Potential Next Fed Chair Warsh Late On

- Fed Funds implied rates for near-term are relatively little changed overnight, between 0-1.5bp higher for 2025 meetings.

- There has been relatively little net impact from Hammack (’26, hawk) saying the FOMC could cut rates in June “if we have clear and convincing data” by then, having reversed much of the initially dovish reaction yesterday.

- Cumulative cuts from 4.33% effective: 2bp May, 16.5bp Jun, 34.5bp Jul, 53.5bp Sep and 84bp Dec.

- The final U.Mich consumer survey headlines today’s docket.

- Special mention also goes to Kevin Warsh speaking late on at 1600ET, speaking at a G30 Spring Lecture on “Central Banking at a Crossroads”. Warsh, a former Fed Governor through 2006-11 (when he resigned), is seen as one of Trump’s top picks for next Fed Chair.

- Trump has recently tried to backtrack from attempts at firing Fed Chair Powell ahead of his term ending May 2026. The WSJ reported Apr 17 that Warsh advised Trump when the two spoke that Powell be allowed to complete his term without interference.

- There is no scheduled Fedspeak today but we won’t be surprised by short notice additions on the sidelines of IMF meetings, such as Gov Waller yesterday.

- The FOMC media blackout starts Sat 0001ET ahead of the May 6-7 meeting.

CANADA: Federal Election Preview

Download Full Report Here

Canada holds elections to its 45th Parliament on Monday, 28 April, amid a political landscape that has changed beyond all recognition since the start of the year. In this Election Preview, we outline how the Canadian electoral system works and how election night will proceed, run through the main political parties contesting the election, provide a chartpack of the latest polls and betting markets, assign probabilities to various election scenarios, and key views from sell-side analysts.

US TSY FUTURES: Long Setting In Belly & Intermediates Dominated On Thursday

OI data points to a mix of net long setting (FV, TY, UXY and WN) and short cover (TU & US) during Thursday’s rally, with the long setting in the belly & intermediates dominating.

| 24-Apr-25 | 23-Apr-25 | Daily OI Change | OI DV01 Equivalent Change ($) |

TU | 4,094,180 | 4,117,136 | -22,956 | -854,386 |

FV | 6,790,060 | 6,742,370 | +47,690 | +2,053,856 |

TY | 4,815,154 | 4,735,671 | +79,483 | +5,068,405 |

UXY | 2,248,157 | 2,248,140 | +17 | +1,502 |

US | 1,794,361 | 1,796,871 | -2,510 | -321,327 |

WN | 1,879,847 | 1,874,220 | +5,627 | +1,067,796 |

|

| Total | +107,351 | +7,015,847 |

STIR: Long Setting Most Prominent In SOFR Futures On Thursday

OI data points to a mix of net long setting and short cover during Thursday's rally in SOFR futures, with the former more prominent in the majority of contracts through the blues.

| 24-Apr-25 | 23-Apr-25 | Daily OI Change |

| Daily OI Change In Packs |

SFRH5 | 1,104,142 | 1,109,091 | -4,949 | Whites | +27,891 |

SFRM5 | 1,254,656 | 1,229,314 | +25,342 | Reds | +34,567 |

SFRU5 | 957,928 | 959,064 | -1,136 | Greens | -6,796 |

SFRZ5 | 1,071,657 | 1,063,023 | +8,634 | Blues | +13,183 |

SFRH6 | 707,431 | 688,964 | +18,467 |

|

|

SFRM6 | 699,409 | 693,357 | +6,052 |

|

|

SFRU6 | 676,653 | 674,355 | +2,298 |

|

|

SFRZ6 | 836,031 | 828,281 | +7,750 |

|

|

SFRH7 | 611,091 | 608,173 | +2,918 |

|

|

SFRM7 | 540,609 | 547,483 | -6,874 |

|

|

SFRU7 | 367,887 | 368,656 | -769 |

|

|

SFRZ7 | 384,462 | 386,533 | -2,071 |

|

|

SFRH8 | 265,236 | 259,381 | +5,855 |

|

|

SFRM8 | 180,806 | 181,504 | -698 |

|

|

SFRU8 | 138,992 | 136,713 | +2,279 |

|

|

SFRZ8 | 160,353 | 154,606 | +5,747 |

|

|

SWITZERLAND: 0.8333 Remains Significant Pivot for USDCHF

- USDCHF rallied across the APAC session amid the overnight strength for global equities, touching a high of 0.8335 before moderating. The inability to break back above the prior breakdown point & 2023 low at 0.8333 remains significant and keeps a sell-on-rallies theme dominant here. Firm resistance is also seen at the 20-day EMA, intersecting at 0.8371.

- President Schlegel earlier today has reiterated that FX intervention is "not about achieving a specific exchange rate target. In principle, Switzerland has flexible exchange rates. However, if exchange rate movements influence monetary conditions in such a way that price stability is threatened, then we react". Sentiment appears in line with recent comments from SNB’s Tschudin and does not represent an escalation of intervention rhetoric in our opinion.

- Domestic sight deposits data Monday will indicate if the SNB (surprisingly) tilted towards action this week. Historically a keenly watched proxy for interventions, data has remained relatively stable through the month.

- Elsewhere, the Swiss government held talks with US' Bessent - President Keller-Sutter commented "it’s good that Switzerland is one of the 15 countries that get, yes, somewhat preferential treatment here".

SWITZERLAND: EURCHF Extends Recovery, Breaches Moving Averages

- Meanwhile, a positive close today for EURCHF would represent five consecutive winning sessions, as the cross continues to erode the post-Liberation Day selloff. Earlier highs of 0.9447 briefly extended the recovery to 2.44%, likely limiting the SNB's concern on Franc valuations for the time being.

- In the process, EURCHF has breached both its 20- and 50-day exponential moving averages, and a close above the 50-day (intersecting at 0.9419), would be a bullish development. The area between 0.9500-20 remains a good short-term pivot, and will be the next chart level of note.

- Any resumption of risk-off sentiment associated to the ongoing tariff, and associated CHF strength would refocus attention on a key cluster of daily lows between 0.9205/20. Indeed, ING comment that "the SNB's FX intervention powers are constrained and that EUR/CHF will quickly trade to 0.92 again should financial market volatility pick up this quarter".

FOREX: Greenback Firmer Amid Conflicting US-China Trade Talk Reports

- The greenback is firmer against all others early Friday, however the USD Index weekly range remains generally contained. Price is yet to re-take the 100.00 level, with market concern remaining on the fraught trade tensions between the US and China. Despite Trump stating yesterday that meetings between unnamed parties had been held, Chinese spokespeople were less positive - with China's foreign ministry this morning stating "China and the US are not having any consultations".

- As a result, the late Thursday equity rally has flattened out, and the USD has edged off the session's best levels into the NY crossover. This leaves focus on any further missives from the US President as well as Canadian retail sales and the final April University of Michigan sentiment index. There are no Fed speakers due today, although any unscheduled comments would be carefully watched given the media blackout period kicks in at the close today, ahead of the Fed's May 7th meeting.

- USD/JPY rallied in Tokyo hours, touching a high of Y143.85 before moderating. Gains for the pair coincides with overnight strength for global equities - which proved sufficient to prompt a +1.9% close for the Nikkei 225. A sell-on-rallies theme remains dominant here, however, with downside momentum in the pair still dominant below Y145.00.

OPTIONS: Expiries for Apr25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1390-00(E1.2bln), $1.1440-50(E1.7bln), $1.1500-15(E800mln)

- USD/JPY: Y140.00($959mln), Y145.00($1.6bln)

- AUD/USD: $0.6425($699mln)

- USD/CAD: C$1.3800($2.0bln), C$1.4000($1.7bln)

- USD/CNY: Cny7.3000($606mln), Cny7.4000($700mln)

EQUITIES: Eurostoxx 50 Futures Pierce Resistance at 50-Day EMA

- Eurostoxx 50 futures have traded higher this week. The contract has cleared the 20-day EMA and has today pierced resistance at the 50-day EMA, at 5100.90. A clear break of this average would strengthen the current bull cycle and signal scope for a continuation of the corrective uptrend. This would open 5165.00 next, the Apr 3 high. On the downside, support to watch lies at 4812.00, the Apr 16 low. Clearance of this level would highlight a reversal.

- The corrective bull cycle in S&P E-Minis that started on Apr 7, remains in play for now. The contract has traded higher this week and in the process breached a number of important short-term resistance points. Price has cleared the 20-day EMA and pierced 5528.75, the Apr 10 high. The next key resistance to watch is 5625.35, the 50-day EMA. Initial key support lies at 5127.25, the Apr 21 low. A break would be bearish.

COMMODITIES: Bearish Theme in WTI Futures Intact, Recovery Appears Corrective

- A bearish theme in WTI futures remains intact and the recovery since Apr 9 appears corrective. The move higher has allowed an oversold trend condition to unwind. Recent weakness resulted in the breach of a number of important support levels, reinforcing a bearish threat. A resumption of the bear cycle would open $53.72, a Fibonacci projection. Resistance to watch is $65.84, the 50-day EMA.

- The trend needle in Gold continues to point north. The latest move down appears corrective and the retracement is allowing an overbought trend condition to unwind. Moving average studies are unchanged, they remain in a bull-mode position highlighting a dominant uptrend. The next objective is $3547.9, a Fibonacci projection. Initial firm support to watch lies at 3208.9, the 20-day EMA.

| Date | GMT/Local | Impact | Country | Event |

| 25/04/2025 | 1230/0830 | ** | Retail Trade | |

| 25/04/2025 | 1230/0830 | ** | Retail Trade | |

| 25/04/2025 | 1400/1000 | *** | U. Mich. Survey of Consumers | |

| 25/04/2025 | 1400/1000 | ** | University of Michigan Surveys of Consumers Inflation Expectation | |

| 25/04/2025 | 1500/1100 | Finance Dept monthly Fiscal Monitor (expected) | ||

| 25/04/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 25/04/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 25/04/2025 | 1915/2015 | BOE's Greene on Inflation, growth and moentary policy | ||

| 25/04/2025 | 2000/1600 | Kevin Warsh |