MNI US OPEN - Appeals Court Keeps Trump's Tariffs in Play

EXECUTIVE SUMMARY

- TRUMP'S TEAM PLOTS PLAN B FOR IMPOSING TARIFFS, WSJ REPORT

- BESSENT SAYS US-CHINA TALKS ‘STALLED,’ PUSHES FOR TRUMP-XI CALL

- BOJ TO WATCH JGB MOVES, REVIEW TAPERING, UEDA SAYS

- MNI PROJECTS 2.0-2.1% Y/Y GERMAN NATIONAL CPI, CORE 2.8%

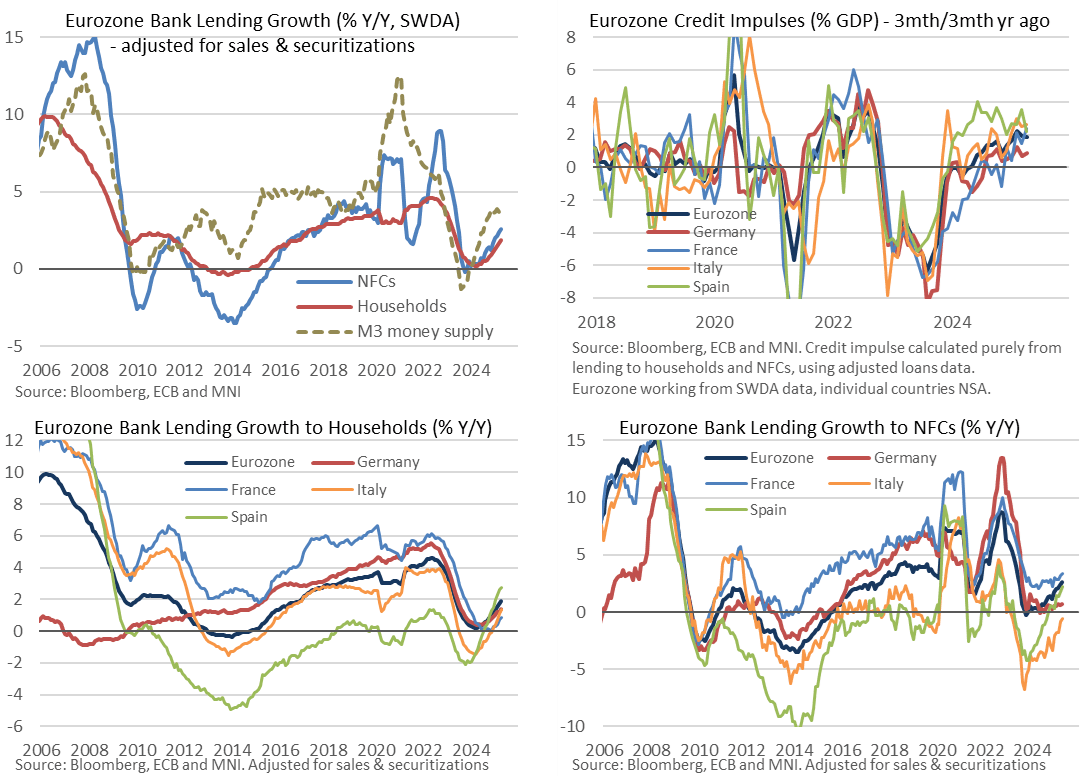

Figure 1: Eurozone lending growth to private sector accelerated in April, setting fresh highs since mid-2023

NEWS

US (RTRS): Trump’s Tariffs to Remain in Effect After Appeals Court Grants Stay

A federal appeals court temporarily reinstated the most sweeping of President Donald Trump's tariffs on Thursday, a day after a U.S. trade court ruled that Trump had exceeded his authority in imposing the duties and ordered an immediate block on them. The United States Court of Appeals for the Federal Circuit in Washington said it was pausing the lower court's ruling to consider the government's appeal, and ordered the plaintiffs in the cases to respond by June 5 and the administration by June 9.

US (WSJ): Trump's Team Plots Plan B for Imposing Tariffs

The administration's tariff strategy was undermined when a court this week found it was illegal for Trump to impose sweeping duties by using emergency economic powers. A federal appeals court on Thursday allowed his duties to stay in effect while the administration's appeal moves forward, but U.S. officials are weighing their options should they need to find a new legal authority to impose the president's steep tariffs, which he argues will help rebalance trade in America's favor. The potential pivot reflects the challenges to Trump's aggressive trade policy, which relied on a novel interpretation of trade law. Typically, tariffs are imposed using targeted authority delegated to the president by Congress, but Trump's team relied on little-used emergency powers to impose the bulk of his wide-ranging second-term tariffs quickly.

With that strategy under threat, the president's team is weighing a twofold response, according to people familiar with the matter. First, the administration is considering a stopgap effort to impose tariffs on swaths of the global economy under a never-before-used provision of the Trade Act of 1974, which includes language allowing for tariffs of up to 15% for 150 days to address trade imbalances with other countries, the people said. That would then buy time for Trump to devise individualized tariffs for each major trading partner under a different provision of the same law, used to counter unfair foreign trade practices.

US/EU (MNI): Senior Officials to Meet Next Week as Appeals Court Keeps Tariffs in Place

EU Trade Commissioner Maros Sefcovic posts on X: "Another call with US Secretary Howard Lutnick. Our time and effort fully invested, as delivering forward-looking solutions remains a top EU priority. Staying in permanent contact." Earlier in the week, Sefcovic confirmed that direct calls between the two sides would be taking place every other day. Lutnick and US Trade Representative Jamieson Greer are expected to meet with the Trade Commissioner in Paris next week. This will take place on the sidelines of the Organisation for Economic Co-operation and Development (OECD) Ministerial Council Meeting running 3-4 June.

US/CHINA (BBG): Bessent Says US-China Talks ‘Stalled,’ Pushes for Trump-Xi Call

US Treasury Secretary Scott Bessent said trade talks with China are “a bit stalled,” and that a call between President Donald Trump and his counterpart Xi Jinping may be needed for the world’s two largest economies to reach a deal. “I would say that they are a bit stalled,” Bessent said of the talks in an interview with Fox News Thursday. Bessent, who traveled to Switzerland earlier this month for talks with Chinese officials that saw both sides retreat from tariffs over 100% on each other’s goods, said he believes more talks will happen with Chinese officials “in the next few weeks.” Still, Bessent said he sees the personal involvement of both country leaders as essential.

FED (MNI): Policy Clarity Could Take 'Quite Some Time' - Fed's Logan

It could take quite some time for Federal Reserve officials to gain clarity on the economic outlook, but monetary policy is well-placed to respond to heightened risks for employment and inflation related to trade policy uncertainty, Dallas Fed President Lorie Logan said Thursday. "For now, with the labor market holding strong, inflation trending gradually back to target, and risks to the FOMC’s objectives roughly balanced, I believe monetary policy is in a good place. It could take quite some time to know whether the balance of risks is shifting in one direction or another," she said in prepared remarks to a business conference in Waco, Texas.

FED (BBG): Fed’s Kashkari Says Tariffs Are Likely Pushing Up Inflation

Federal Reserve Bank of Minneapolis President Neel Kashkari said tariffs, and the uncertainty around them, is likely weighing on growth and boosting inflation. “Now we have these tariffs — that’s created a lot of uncertainty, probably pushing down economic activity, probably pushing up inflation,” Kashkari said Wednesday in Tokyo at an event at Keio University.

US (FT): Foreign Tax Provision in Trump Budget Bill Spooks Wall Street

Wall Street is warning that a little-publicised provision in Donald Trump’s budget bill that allows the government to raise taxes on foreign investments in the US could upend markets and hit American industry. Section 899 of the bill that passed the House of Representatives last week would allow the US to impose additional taxes on companies and investors from countries that it deems to have punitive tax policies. It could raise taxes on a wide range of foreign entities, including US-based companies with foreign owners, international firms with American branches and investors.

US (BBG): Trump Will Hold Press Conference With Musk as He Departs DOGE

President Donald Trump will hold a news conference at the White House alongside Elon Musk on Friday to mark the departure of the world’s richest man from his official role leading an effort to slash the size and scope of the US government. “This will be his last day, but not really, because he will, always, be with us, helping all the way. Elon is terrific! See you tomorrow at the White House,” Trump said in a Thursday night post on his Truth Social platform.

UKRAINE (MNI): Turkey Looks to Host US, Russia, Ukraine Leaders After Next Talks

Speaking in Kyiv, Turkish Foreign Minister Hakan Fidan says that "I hope technical talks [on a peace deal] will largely be completed in the next round of talks, and [then] Turkey can host the leaders of the US, Russia, and Ukraine." Adds that "Ukraine's NATO membership is an issue of debate within the alliance given the ongoing war", and that "the issue was not brought up during talks in Moscow this week." Fidan says, "Turkey is ready to host the Russian and Ukrainian sides." Fidan: "As long as both sides remain at the negotiating table, there can be progress."

UK/EU (BBG): BOE’s Bailey Urges Closer EU Trade to Reverse Brexit Damage

Bank of England Governor Andrew Bailey urged the government to strike a deeper trade deal with the European Union to improve growth and “minimize negative effects” of Brexit. In speech at the Irish Association of Investment Managers on Thursday in Dublin, Bailey said “the evidence on Brexit suggests that the changing trade relationship has weighed” on the UK economy by putting up barriers and hampering productivity. He welcomed the recent agreement with Brussels to reduce border checks on food, and rejoin the EU’s electricity market and emissions trading system in exchange for 12 years of access to UK fisheries, and called on officials to go further.

BOE (FT): Bank of England Policymaker Plays Down Inflation Risk in Call for Rate Cuts

Alan Taylor told the Financial Times that the current upsurge in inflation was being driven by one-off factors as he stressed the drag on growth from uncertainty generated by US President Donald Trump’s trade war. While there had been some “welcome” developments in trade, including the UK-EU reset deal, these only affected a small part of UK trade, added Taylor, an external member of the MPC since September. Asked whether he would back a rate cut at the next BoE meeting in June, Taylor — who voted for a half-point reduction this month — said: “I’m not going to pre-emptively announce my vote, but I think I indicated in my dissent that I thought we needed to be on a lower [monetary] policy path.

ECB (MNI): Monetary Policy in Next Months “Far From Easy" - ECB's Panetta

Charting the course of monetary policy in coming months will be far from easy, Bank of Italy Governor Fabio Panetta said Friday, noting that despitefurther deflationary risks, “previous cuts leave less room for reducing interest rates further”. “However, the macroeconomic outlook remains weak and trade tensions could cause a deterioration,”Panetta said, admitting that it was hard to know how and when and for this reason the European Central Bank should maintain a “pragmatic and flexible approach” while closely monitoring liquidity conditions and signals from financial and credit markets.

BOJ (MNI EXCLUSIVE): BOJ Could Buy More JGBs, Keep Lowering Holdings

BOJ (MNI EXCLUSIVE): BOJ Doubts Swift Rice Price Drop in CPI

MNI looks at rising rice prices in Japan. On MNI Policy MainWire now, for more details please contact sales@marketnews.com.

BOJ (MNI): BOJ to Watch JGB Moves, Review Tapering - Ueda

The Bank of Japan is closely monitoring developments in the JGB market, including its overall functioning, amid growing concerns over worsening supply-demand dynamics, Governor Kazuo Ueda told lawmakers Friday. The BOJ will conduct an interim assessment of its JGB tapering program at the June 16-17 policy meeting based on feedback from financial institutions and recent market conditions, he said. JGBs have risen recently, reflecting concerns over deteriorating bond supply-demand conditions. Market participants have pointed to a decline in demand from major life insurers, typically buyers of longer-dated JGBs, who are now holding back due to heightened worries over unrealised losses.

RBNZ (MNI INTERVIEW): RBNZ's Uncertainty to Persist - Chief Economist

MNI discusses the RBNZ's next moves. On MNI Policy MainWire now, for more details please contact sales@marketnews.com

RBNZ (BBG): RBNZ Needs More Time to Decide on Path for Cash Rate, Silk Says

The Reserve Bank of New Zealand needs more time to assess the impact of global trade turmoil on the local economy before deciding on the appropriate path for the Official Cash Rate, Assistant Governor Karen Silk said. “Absolutely we do,” Silk said in an interview with Bloomberg Friday in Wellington. The RBNZ’s central projection for the OCR “has got significant uncertainty around it” and “that fog is quite thick,” she said.

DATA

GERMANY DATA (MNI): MNI Projects 2.0-2.1% Y/Y German National CPI, Core 2.8%

From state-level data that equates to 89.1% weighting of the national May flash German CPI print (due at 13:00 GMT / 14:00 CET), MNI estimates that national CPI (non-HICP print) printed around 0.0-0.1% M/M and rose 2.0-2.1% Y/Y (April 2.1%). See the tables below for full calculations. Analyst consensus stands at 2.1% Y/Y and 0.1% M/M, so there might be some slight downside risks to headline inflation. We had initially seen some marginal upside risks, but since then Rhineland-Palatinate, Berlin and

Saarland data all came in softer than the 2.1% Y/Y consensus figure. Either way, the magnitude of risks vs consensus appears contained this month. Current tracking of Core CPI (ex-energy and food, based on 50% of the national index) implies around 2.8% (2.9% in April) and 0.1-0.2% M/M.

EUROZONE DATA (MNI): Lending Growth Accelerates Again, Impulse Maintained

Eurozone lending growth to the private sector accelerated a touch further in April, setting fresh highs since mid-2023 at 2.7% Y/Y or 2.2% Y/Y when adjusting for sales & securitization. Germany continues to lag in credit impulse metrics, not helping by a continuation of what has been a particularly tepid trend in lending to non-financial corporates. Sticking to a sales & securitization adjusted basis, lending to non-financial corporates (NFCs) increased 2.6% Y/Y in April after an upward revised 2.4% (initial 2.3) for a fresh high since Jun 2023. Lending to households meanwhile increased 1.9% Y/Y in April after 1.7% for its fastest since May 2023. It's an eight consecutive monthly acceleration for the Y/Y.

SPAIN DATA (MNI): HICP Softer Than Expected, Lower Leisure/Culture, Transport

- SPAIN MAY FLASH HICP -0.1% M/M, +1.9% Y/Y

- SPAIN MAY FLASH CPI +0% M/M, +1.9% Y/Y

- SPAIN MAY FLASH CORE CPI +2.1% Y/Y

Spain's May preliminary HICP came in a tenth lower than expected on the yearly rate at 1.9% Y/Y (vs 2.0% cons; 2.2% prior) and the sequential reading at -0.1% M/M (vs 0.0% cons; 0.6% prior). The national CPI also came in 2 tenths below expectations on the yearly rate at 1.9% Y/Y (vs 2.1% cons; 2.2% prior) and a tenth below on the sequential comparison at 0.0% M/M (vs 0.1% cons; 0.6% prior). Core CPI (not HICP) came in below expectations, also, at 2.1% Y/Y (vs 2.2% cons; 2.4% prior). The headline rate was driven lower by leisure and culture prices, as well as transportation costs (to a lesser extent), INE adds. Electricity also contributed negatively to the Y/Y rate in May.

ITALY DATA (MNI): Q1 GDP at 0.3% Q/Q; Superbonus Expiry Headwind Shows Signs of Fading

Italian Q1 GDP confirmed flash estimates at 0.3% Q/Q (0.26% unrounded), above Q4's downwardly revised 0.2% reading. Although growth is still subdued compared to Southern European peers such as Spain, the Q1 reading is nonetheless a little stronger than might have been implied by the Bank of Italy's Ita-coin nowcast and EC sentiment data. Consumption growth was 0.2% Q/Q, adding 0.1pp to the quarterly print, Meanwhile government consumption fell 0.3% Q/Q, subtracting 0.1pp.

SWEDEN DATA (MNI): Investment Drags Heavily on Q1 GDP

- SWEDEN FLASH Q1 GDP +0.9% Y/Y

Gross fixed capital investment was the largest drag on Swedish Q1 GDP, falling 3.8% Q/Q (vs 0.7% prior) and pulling quarterly GDP down 1.0pp. All sub-components of GFCF saw negative sequential quarterly readings, but most notably buildings and construction at -7.5% Q/Q (vs 1.8% prior). Consumption fell 0.2% Q/Q (vs 0.6% prior), pulling quarterly GDP down 0.1pp. That's despite the monthly household consumption indicator rising 0.7% 3m/3m as of March. Goods consumption fell 0.3% Q/Q (vs +0.1% prior) while services fell -0.1% Q/Q (vs +0.9% prior).

SWITZERLAND DATA (MNI): KOF Indicator Should Not Be a Surprise to SNB

- SWISS KOF MAY ECONOMIC BAROMETER 98.5

The Swiss KOF Economic Barometer recovered in May, to 98.5 (vs consensus of 98.4) but was not able to make up for April's drop from 103.3 to 97.1 following the deterioration in global trade conditions. "The indicator bundle for manufacturing included in the Barometer shows particularly positive developments. The demand-side indicator bundles for foreign demand and private consumption, however, are under pressure." Note that SNB Chairman Schlegel mentioned on May 19 that Swiss growth is

likely to be lower than thought "a few weeks ago" - the SNB March 2025 growth forecast was for 1.0-1.5%, while Q1 growth was strong, at 0.7% Q/Q.

JAPAN DATA (MNI): Japan May Tokyo Core CPI Rises 3.6% vs. April 3.4%

- JAPAN MAY TOKYO CORE CPI +3.6% Y/Y; APRIL +3.4%

- JAPAN MAY TOKYO CORE-CORE CPI +3.3% Y/Y; APRIL +3.1%

- JAPAN MAY SERVICES PRICES +2.2% Y/Y; APRIL +2.0%

Tokyo’s year-on-year core inflation rate accelerated to 3.6% in May from 3.4% in April, remaining above the Bank of Japan’s 2% target for the seventh consecutive month, data from the Ministry of Internal Affairs and Communications showed on Friday. The May figure marked the highest level since January 2023, when inflation hit 4.3%, driven largely by a 6.9% rise in food prices excluding perishables, up from 6.4% in April. This was despite a slightly smaller increase in energy prices, which rose 8.7% compared to 9.4% the previous month. Core-core CPI, which strips out fresh food and energy and is closely watched by the BOJ as a gauge of underlying inflation, rose 3.3% year-on-year in May, accelerating from 3.1% in April and staying above 2% for the third straight month.

JAPAN DATA (MNI): Japan April Factor Output Posts 1st Drop in 3 Mths

- JAPAN APRIL FACTORY OUTPUT -0.9% M/M; MARCH +0.2%

Japan’s industrial production declined 0.9% month-on-month in April, marking the first drop in three months following a modest 0.2% gain in March, data from the Ministry of Economy, Trade and Industry (METI) showed Friday. A 1.1% fall in automobile production, which contracted for a second straight month after a 5.9% drop in March, led the decline. The weakness reflected the impact of U.S. tariffs on Japanese auto exports. In contrast, production of electronic parts and devices posted a modest rise. Bank of Japan economists closely monitor industrial output as a key indicator of domestic and external demand.

AUSTRALIA DATA (MNI): Retail Sales Surprise Lower, Weather May Have Influenced

- AUSTRALIA APR RETAIL SALES -0.1% M/M

Australian April retail sales were weaker than forecast, falling 0.1% m/m, against a +0.3% forecast, which was also the March outcome. Data on building approvals was also weaker than forecast, down 5.7% m/m, against a 3.0% forecast rise. The prior month was -7.1% m/m, slightly better than originally reported. Private sector home approvals were better at +3.1% m/m (versus -1.9% m/m in March). Private sector credit was +0.7% m/m, better than the 0.5% forecast. For retail sales, the industry break down saw food off 0.3% m/m, while apparel and department stores were both down 2.5% in the month. This follows falls for these segments in March as well.

RATINGS: S&P on France Set to Headline After Close

Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Moody’s on Hungary (current rating: Baa2; Outlook Negative)

- S&P on France (current rating: AA-; Outlook Negative), Latvia (current rating: A; Outlook Stable) & Lithuania (current rating: A; Outlook Stable)

- Morningstar DBRS on Germany (current rating: AAA, Stable Trend) & Spain (current rating: A (high), Stable Trend)

- Scope Ratings on Greece (current rating: BBB; Outlook Stable) & Turkey (current rating: BB-; Outlook Stable)

Please use this link to access the indicative sovereign rating review schedule covering the five most notable rating agencies for 2025. Note that this schedule is indicative only and ratings can be reviewed on an ad-hoc basis. Rating agencies may also adjust their schedules during the year.

FOREX: Greenback Retraces Small Part of Thursday Weakness

- The greenback is retracing a small part of the acute weakness posted on Thursday, dragging EUR/USD off the overnight high of 1.1390. Newsflow and headlines have been few and far between, with the temporary reinstatement of Trump's tariff regime containing uncertainty through the appeals process and putting markets on a steadier footing into the final session of the week.

- JPY is firmer against all others. USD/JPY has traded either side of the Y144.00 handle, with markets conscious of the printing of a shooting star candle on the daily chart Thursday. This could signal a bearish short-term reversal for the pair, highlighting the Y142.12 level as key on the downside. A break below here would resume the bear trend posted off the May high, and the March/January highs further out.

- The EUR is more mixed. Having outperformed on tariff uncertainty yesterday (most notably against GBP), the single currency has faded slightly, but the case for EUR as a haven currency through trade volatility remains in place. Equity futures in the US are modestly lower, but well within range of the Thursday close, leaving today's run of data as the key input.

- The German national CPI print is up next, with MNI projecting 2.0-2.1% for the Y/Y rate after this morning's mixed regional inflation prints. Canadian Q1 GDP is also due, seen slowing to 1.7% from 2.6% prior, while US PCE price index data, the final University of Michigan print and the MNI Chicago PMI are set for release.

EGBS: Little Impact From Regional Data; Equities and Crude Apply Pressure

- Bund futures have traded in a modest 37 tick range, currently -12 at 131.08, just off session lows of 131.02. Somewhat weaker-than-expected country-level flash inflation data has not shifted sentiment materially, with confidence in the Eurozone inflation outlook already baked into market prices.

- Instead, firmer equity and crude oil prices appear to have applied pressure to EGBs. First support in Bunds lies at 130.39, the May 29 low.

- We’ve seen some early roll activity in futures this morning, ahead of next week’s June 6 expiry.

- German yields are 1.5-2.5bps higher on the session.

- 10-year EGB spreads to Bunds are up to 0.5bps tighter. Institutional books for the 7-year BTP Italia are open, and will close at 1100BST.

- Despite the ECB being in its pre-meeting quiet period, Bank of Italy Governor Panetta still commented on the need for a pragmatic and flexible approach on rates.

- Spanish May flash HICP was slightly below consensus at 1.9% Y/Y, the same annual rate as Italy which was in line with forecasts. MNI estimates that there may be some slight downside risks to the German national CPI consensus of 2.1% Y/Y and 0.1% M/M, following state-level data this morning.

- Eurozone lending growth to the private sector accelerated a touch further in April, setting fresh highs since mid-2023. Italian GDP confirmed flash estimates at 0.3% Q/Q.

- Global focus turns to the US April PCE report at 1330BST.

GILTS: Away From Early Highs as Equities & Crude Tick Higher

Gilts trade away from early session highs, with a bounce in crude oil and European equities countering the early bid that seemed to centre on a U.S. federal appeals court allowing the White House to temporarily suspend the lower court's order that ruled most of President Trump’s tariffs illegal.

- Futures traded as high as 91.79 but have faded back to 91.60 last.

- Resistance at the May 20 high (91.87) remains untouched, with our technical analyst suggesting that recent gains in the contract only appear corrective.

- Yields now 0.5-2.0bp higher across the curve, 5s under the most pressure.

- 2s10s hovers around 64bp (little changed) vs. cycle closing highs of 78.5bp.

- 5s30s trades at ~125bp (-1.5bp on the day) vs. cycle closing highs of 138.6bp.

- Note that the DMO’s FQ2 (July to Sep) issuance plan broadly met our expectations, details available in an earlier string of bullets.

- Month-end projections for gilt benchmarks point to mild reductions of index duration.

- SONIA futures -1.0 to +2.5, light twist flattening on the strip.

- BoE-dated OIS little changed vs. opening levels, showing ~38bp of cuts through year-end.

- Late Thursday/overnight comments from BoE’s Bailey & Taylor were not market moving.

- There is little of note on the UK calendar for the remainder of today, which will leave focus on cross-market and macro/tariff cues.

BoE Meeting | SONIA BoE-Dated OIS (%) | Difference vs. Current Effective SONIA Rate (bp) |

Jun-25 | 4.217 | +0.6 |

Aug-25 | 4.103 | -10.7 |

Sep-25 | 4.057 | -15.4 |

Nov-25 | 3.909 | -30.1 |

Dec-25 | 3.835 | -37.6 |

Feb-26 | 3.725 | -48.6 |

Mar-26 | 3.707 | -50.4 |

EQUITIES: Recent Pullback for Eurostoxx 50 Futures Appears Corrective

The trend cycle in Eurostoxx 50 futures is unchanged, it remains bullish and the recent pullback appears corrective. Moving average studies are in a bull-mode position, highlighting a clear dominant uptrend. Sights are on 5516.00, the Mar 3 high and the key bull trigger. A break of this level would strengthen a bull theme. Key support to watch lies at 5249.44, the 50-day EMA. Clearance of this average would signal a possible reversal. A bullish trend condition in S&P E-Minis remains intact. Thursday’s initial gains delivered a print above 5993.50, the May 20 high and a bull trigger. The break highlights a resumption of the uptrend and maintains a price sequence of higher highs and higher lows. 6000.00 has been pierced, an extension would open 6057.00 next, the Mar 3 high. Key support lies at 5742.22, the 50-day EMA. A clear break of this average is required to highlight a reversal.

- Japan's NIKKEI closed lower by 467.88 pts or -1.22% at 37965.1 and the TOPIX ended 10.45 pts lower or -0.37% at 2801.57.

- Elsewhere, in China the SHANGHAI closed lower by 15.959 pts or -0.47% at 3347.487 and the HANG SENG ended 283.61 pts lower or -1.2% at 23289.77.

- Across Europe, Germany's DAX trades higher by 176.07 pts or +0.74% at 24108.97, FTSE 100 higher by 45.01 pts or +0.52% at 8761.43, CAC 40 up 12.19 pts or +0.16% at 7791.91 and Euro Stoxx 50 up 15.06 pts or +0.28% at 5386.16.

- Dow Jones mini down 50 pts or -0.12% at 42217, S&P 500 mini down 10.25 pts or -0.17% at 5912.5, NASDAQ mini down 44.5 pts or -0.21% at 21363.75.

Time: 09:55 BST

COMMODITIES: Medium-Term Trend Signals for Gold Remain Bullish

WTI futures traded to a fresh short-term cycle high on May 21 before finding resistance. A bear threat remains intact and the recovery since Apr 9, appears corrective. Key resistance to watch is $62.54, the 50-day EMA. A clear break of it would highlight a stronger reversal and open $65.82, the Apr 4 high. For bears a reversal lower would refocus attention on $54.33, the Apr 9 low and bear trigger. A bullish theme in Gold remains intact and recent gains signal the end of the corrective phase between Apr 22 - May 15. Medium-term trend signals are bullish too - moving average studies are in a bull-mode position, highlighting a dominant uptrend. A resumption of gains would open $3435.6 next, the May 7 high. Key support and the bear trigger has been defined at $3121.0, the May 15 low.

- WTI Crude up $0.19 or +0.31% at $61.17

- Natural Gas up $0.03 or +0.71% at $3.551

- Gold spot down $21.42 or -0.65% at $3297.02

- Copper up $1.55 or +0.33% at $468.95

- Silver down $0.14 or -0.42% at $33.184

- Platinum down $7.27 or -0.67% at $1078.83

Time: 09:55 BST

| Date | GMT/Local | Impact | Country | Event |

| 30/05/2025 | 1000/1200 | ** | PPI | |

| 30/05/2025 | 1200/1400 | *** | HICP (p) | |

| 30/05/2025 | 1230/0830 | ** | WASDE Weekly Import/Export | |

| 30/05/2025 | 1230/0830 | *** | Personal Income and Consumption | |

| 30/05/2025 | 1230/0830 | ** | Advance Trade, Advance Business Inventories | |

| 30/05/2025 | 1230/0830 | *** | GDP - Canadian Economic Accounts | |

| 30/05/2025 | 1230/0830 | *** | Gross Domestic Product by Industry | |

| 30/05/2025 | 1230/0830 | *** | CA GDP by Industry and GDP Canadian Economic Accounts Combined | |

| 30/05/2025 | 1342/0942 | *** | MNI Chicago PMI | |

| 30/05/2025 | 1400/1000 | *** | U. Mich. Survey of Consumers | |

| 30/05/2025 | 1400/1000 | ** | University of Michigan Surveys of Consumers Inflation Expectation | |

| 30/05/2025 | 1500/1100 | Finance Dept monthly Fiscal Monitor (expected) | ||

| 30/05/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 30/05/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 30/05/2025 | 2045/1645 | San Francisco Fed's Mary Daly | ||

| 30/05/2025 | 2330/1930 | Chicago Fed's Austan Goolsbee | ||

| 31/05/2025 | 0130/0930 | *** | CFLP Manufacturing PMI | |

| 31/05/2025 | 0130/0930 | ** | CFLP Non-Manufacturing PMI |