MNI US OPEN - Electronics Granted Tariff Reprieve... For Now

EXECUTIVE SUMMARY:

- ELECTRONICS GRANTED TARIFF REPRIEVE, BUT TRUMP WARNS MEASURES COMING

- CHINA COULD CUT RATES, RRR IF GROWTH SLOWS ACCORDING TO STATE-BACKED PAPER

- CHINA'S MARCH EXPORTS SURGE IN PRE-TARIFF RUSH

- SINGAPORE REDUCES SLOPE OF SGD BAND

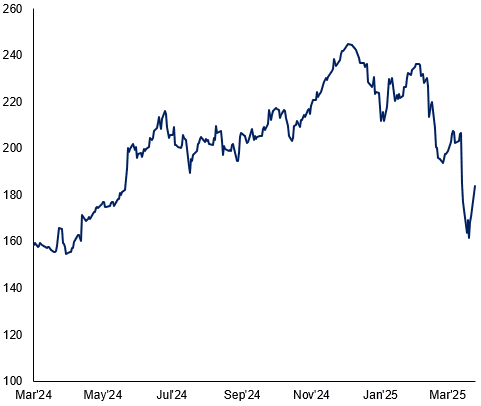

Figure 1: Apple's German listing snaps higher on electronics tariff reprieve

NEWS

US (BBG): Trump Warns Tariffs Coming for Electronics After Reprieve

President Donald Trump pledged he will still apply tariffs to phones, computers and popular consumer electronics, downplaying a weekend exemption as a procedural step in his overall push to remake US trade. The late Friday reprieve is temporary and a part of the longstanding plan to apply a different, specific levy to the sector. Trump doubled down on the plan Sunday.

US (BBG): Apple, Nvidia Score Relief From US Tariffs With Exemptions

President Donald Trump’s administration exempted smartphones, computers and other electronics from its so-called reciprocal tariffs, representing a major reprieve for global technology manufacturers including Apple Inc. and Nvidia Corp. even if it proves a temporary one. The exclusions, published late Friday by US Customs and Border Protection, narrow the scope of the levies by excluding the products from Trump’s 125% China tariff and his baseline 10% global tariff on nearly all other countries.

US (MNI): US To Seek Currency Commitments - USTR Greer

The United States will be looking to see if other countries will be willing to include commitments not to lower the value of their currency relative to the dollar as part of various trade negotiations, U.S. Trade Representative Jamieson Greer said Sunday, adding that he expects "meaningful deals" with several countries in the "next few weeks."

JAPAN (MNI): BOJ To Manage Policy Timely For 2% Target - Ueda

The Bank of Japan will manage monetary policy appropriately to achieve the 2% price target in a sustainable and stable manner, Governor Kazuo Ueda told lawmakers Monday. The BOJ will examine the future economy, prices and financial markets without precondition, he added.

US/IRAN (BBG): Iran Says Any Future US Sanctions Relief Must Be Guaranteed

Iran said that it’s “extremely important” that any sanctions relief agreed with the US as part of a potential future nuclear deal is “guaranteed” to last. Iran expects the Trump administration to provide assurances that any sanctions it agrees to lift can’t be easily reimposed by future US governments.

UK/CHINA (The Times): British Steel tries to reverse ‘sabotage’ of Scunthorpe furnace

British Steel should be the “canary in the coalmine” that forces ministers to remove Chinese companies from critical infrastructure, they have been told. The government was forced to take direct control of the company amid concern that its Beijing-based owners would not keep the plant running at Scunthorpe. Ministers feared the company planned to “sabotage” the site to increase British reliance on cheap Chinese imports, The Times understands.

CHINA (BBG): China May Cut Rate, RRR If Tariffs Hit Growth: PBOC-Backed Paper

The People’s Bank of China may cut interest rates and the reserve requirement ratio if the economy suffers from the negative impact of external shocks such as US tariffs, the PBOC-backed Financial News cites former central bank adviser Yu Yongding as saying.

SINGAPORE (BBG): MAS Reduces Slope of SGD Band; Keeps Width, Center

“Amid the weakening external outlook, Singapore’s output gap will turn negative. Consequently, imported and domestic cost pressures will remain low and MAS Core Inflation is forecast to stay well below 2%. The risks to inflation are tilted towards the downside,” Monetary Authority of Singapore says in a statement.

JAPAN (BBG): Japan In No Rush to Compromise Days Ahead of US Tariff Talks

Japan’s prime minister said he won’t rush to compromise in high-stakes trade negotiations with the US this week, which may set the tone for nations around the world that are seeking a reprieve from President Donald Trump’s tariff campaign.

UKRAINE/RUSSIA (The Times): Russian missile strike kills at least 34 in Ukraine’s Sumy

More than 30 people were killed and dozens wounded after Russia launched a ballistic missile attack on the northern Ukrainian city of Sumy as worshippers headed to church on Palm Sunday. Two Iskander missiles landed in the busy city centre and one hit a trolley bus filled with passengers.

EQUITIES (BBG): Citigroup Turns Cold on US Equities, Joining Wall Street Peers

Equity strategists at Citigroup Inc. lowered their view on US equities, saying the case to diversify away from the asset class is strengthening as the trade war undermines economic growth and earnings. Cracks in “US exceptionalism” will persist with the emergence of China’s DeepSeek artificial intelligence model, Europe’s fiscal expansion and rising trade tensions that will hit American companies harder than peers in Japan and Europe.

MNI POLICY: Export Uncertainty Dampens BOJ's Hike Appetite

Japan's uncertain export market is creating challenges for the BOJ's strategy. On MNI Policy MainWire now, for more details please contact sales@marketnews.com

DATA

China's exports grew 12.4% y/y to USD313.91 billion in March, higher than the 4.4% y/y consensus, according to data released by China Customs on Monday. The month-over-month growth recorded a 46.0% surge, the second highest reading on record after the 47.5% increase in Mar 2023, when China first eased pandemic-related controls.

China’s imports fell 6% y/y in March in yuan terms as falling international commodity prices lowered the value of inbound shipments, Lu Daliang, spokesman of the General Administration of Customs told reporters on Monday. Lu highlighted Q1's average import price of iron ore and coal dropped by more than 2%, while crude oil and soybeans fell 5.7% and 16.6%.

BONDS: Gilts Unwind A Portion Of Last Week's Selloff, Outperforming Bunds

The 10-year Gilt/Bund spread has tightened 5bps to 213bps, with UK paper staging a light relief rally alongside USTs this morning. Market moving headline flow has been relatively limited, with participants assessing weekend rhetoric from US officials on consumer electronics tariffs alongside the highly volatile nature of last week’s moves.

- Gilt yields are 3.5-9.5bps lower across the curve, bull flattening. 2s30s has fallen 6bps to ~141bps, unwinding last week’s notable steepening.

- German yields are flat to 3bps lower, with the belly outperforming.

- Futures volumes are comfortably below recent averages. Bunds are -14 ticks at 130.84 (Initial resistance at the Apr 11 high of 131.42; Support at the 20-day EMA of 129.59). Gilts are +66 at 91.30 (Initial resistance at the 20-day EMA of 91.84; Support at Apr 11 low of 90.47).

- Strength in US equity futures has fed well into outperformance for cash European indices this morning. The reprieve for electronics imports from China into the US is the driver here. That helps 10-year EGB spreads to Bunds tighten.

- BTPs outperform, also aided by S&P’s upgrade of Italy's sovereign rating to BBB+ (Outlook Stable) after hours on Friday.

- This week’s regional calendar is headlined by UK labour market (Tues) and inflation (Weds) data and the ECB decision (Thurs).

FOREX: Broad Greenback Weakness Resumes Amid Equities Rally

- Carryover from the tariff reprieves for key tech products (released late on Friday) has aided sentiment to start the week, with the major equity benchmarks rallying and the greenback trading with an offered tone. This has allowed the USD index edge back below the 100.00 mark, narrowing the gap to Friday’s cycle low at 99.01. 10-year treasury yields are 4bps lower on the session, providing an additional dollar headwind.

- The key mover on the session is the Japanese yen once again. After gapping higher at the open to levels around 144.30, USDJPY has steady sold off, seeing the pair reach as low as 142.24 before stabilising. Price action fell just short of the 142.02 lows from last week. The trend condition remains bearish, and sights are on 141.65 next, the Sep 30 ‘24 low.

- Boosted risk sentiment has provided another boost for NZDUSD, which has risen ~1% Monday. The recovery seems to have boosted by further short covering above 0.5850 and returns to levels last seen in December, just below the 0.5900 mark.

- In tandem, GBP has been another beneficiary as cable approaches the 1.32 handle once more. Overall, with reciprocal tariffs delayed, GBP is rallying well - underscoring GBP's correlation with risk - which looks through only marginal tweaks to monetary policy pricing. Technically, moving average studies remain in a bull mode position that highlights a dominant uptrend. An extension higher would open key resistance and the bull trigger is 1.3207, the Apr 3 high.

- EURUSD has tracked back to the 1.14 handle, however, the pair remains comfortably off the 1.1473 cycle highs. As a reminder, most recent price action has seen EURUSD substantially narrow the gap to 1.1495, the Feb 10 2022 high and a key medium term technical point. Should the volatile price action continue, a Fibonacci projection level at 1.1555 is notable above here. Initial support lies at the 1.1144 breakout level.

- Highlights on Monday will be on central bank speakers, with Fed’s Waller and Harker scheduled.

EQUITIES: Pre-Market Surge for Apple Follows Sectoral Reprieve

- Strength in US equity futures has fed well into outperformance for cash European indices this morning. The reprieve for electronics imports from China into the US is the driver here, evident in early strength in the likes of Apple - whose supply chain is now spared from not only the 145% tariffs on China, but also the 10% blanket tariff applied to all other territories.

- As a result, Apple's German listing has rallied near 9%, while their US shares are higher by over 6% pre-market. Similarly, NVIDIA are higher by 3%, Intel by 2.7% and Qualcomm by 2.1%.

- Naturally, the NASDAQ-100 future is leading the bounce - higher by 1.9% to extend the bounce off the low to over 15%. A further 3% rally in the index would erase the Liberation Day sell-off.

- Equity volatility now looks to earnings season this week - (our schedule here: https://mni.marketnews.com/4cnn1GO ). Highlights are:

- Monday: Goldman Sachs

- Tuesday: J&J, Bank of America, Citigroup

- Wednesday: Abbott Labs, Progressive Corp

- Thursday: American Express, Charles Schwab, UnitedHealth, Netflix

EQUITIES: Climb for EuroStoxx50 Highlights Start of Corrective Cycle

A short-term reversal in S&P E-Minis last week highlights the start of what appears to be a corrective cycle. The trend condition has been oversold following recent weakness and the move higher is allowing this set-up to unwind. Eurostoxx 50 futures traded in an extremely volatile manner last week and rallied sharply higher from recent lows. The climb highlights the start of a corrective cycle.

- Japan's NIKKEI closed higher by 396.78 pts or +1.18% at 33982.36 and the TOPIX ended 21.6 pts higher or +0.88% at 2488.51.

- Elsewhere, in China the SHANGHAI closed higher by 24.581 pts or +0.76% at 3262.808 and the HANG SENG ended 502.71 pts higher or +2.4% at 21417.4.

- Across Europe, Germany's DAX trades higher by 496.08 pts or +2.43% at 20871.52, FTSE 100 higher by 151.38 pts or +1.9% at 8116.64, CAC 40 up 146.37 pts or +2.06% at 7252.36 and Euro Stoxx 50 up 105.65 pts or +2.21% at 4894.76.

- Dow Jones mini up 397 pts or +0.98% at 40785, S&P 500 mini up 79 pts or +1.47% at 5471, NASDAQ mini up 333.25 pts or +1.77% at 19144.5.

COMMODITIES: Bearish WTI Theme Extends

The trend condition in Gold remains bullish and last week’s rally confirms and reinforces this condition. The yellow metal has traded through $3167.8, the Apr 3 high, to resume the primary uptrend and trade to fresh all-time highs. A bearish theme in WTI futures remains intact and last Wednesday's rally is - for now - considered corrective. The move higher is allowing an oversold trend condition to unwind. Recent weakness has resulted in the breach of several important support levels.

- WTI Crude up $0.14 or +0.23% at $61.59

- Natural Gas down $0.06 or -1.7% at $3.464

- Gold spot down $13.65 or -0.42% at $3223.89

- Copper up $3.05 or +0.67% at $455.35

- Silver down $0.02 or -0.07% at $32.2695

- Platinum up $8.18 or +0.86% at $956.57

| Date | GMT/Local | Impact | Country | Event |

| 14/04/2025 | 1230/0830 | ** | Wholesale Trade | |

| 14/04/2025 | 1500/1100 | ** | NY Fed Survey of Consumer Expectations | |

| 14/04/2025 | 1530/1130 | * | US Treasury Auction Result for 26 Week Bill | |

| 14/04/2025 | 1530/1130 | * | US Treasury Auction Result for 13 Week Bill | |

| 14/04/2025 | 1700/1300 | Fed Governor Christopher Waller | ||

| 14/04/2025 | 2200/1800 | Philly Fed's Pat Harker | ||

| 15/04/2025 | 2301/0001 | * | BRC-KPMG Shop Sales Monitor | |

| 14/04/2025 | 2340/1940 | Atlanta Fed's Raphael Bostic | ||

| 15/04/2025 | 0130/1130 | RBA Meeting Minutes | ||

| 15/04/2025 | 0600/0700 | *** | Labour Market Survey | |

| 15/04/2025 | 0645/0845 | *** | HICP (f) | |

| 15/04/2025 | 0800/1000 | ** | ECB Bank Lending Survey | |

| 15/04/2025 | 0900/1100 | ** | Industrial Production | |

| 15/04/2025 | 0900/1100 | *** | ZEW Current Expectations Index | |

| 15/04/2025 | 0900/1000 | ** | Gilt Outright Auction Result | |

| 15/04/2025 | 1215/0815 | ** | CMHC Housing Starts | |

| 15/04/2025 | 1230/0830 | *** | CPI | |

| 15/04/2025 | 1230/0830 | ** | Monthly Survey of Manufacturing | |

| 15/04/2025 | 1230/0830 | ** | Import/Export Price Index | |

| 15/04/2025 | 1230/0830 | ** | Empire State Manufacturing Survey | |

| 15/04/2025 | 1255/0855 | ** | Redbook Retail Sales Index | |

| 15/04/2025 | 1300/0900 | * | CREA Existing Home Sales | |

| 15/04/2025 | 1530/1130 | ** | US Treasury Auction Result for 52 Week Bill |