MNI US OPEN - Expectations Managed Ahead of Europe-Iran Talks

EXECUTIVE SUMMARY

- IRAN FOREIGN MINISTER DIALS DOWN EXPECTATIONS AHEAD OF GENEVA TALKS

- CHINA FLEXES CHOKEHOLD ON RARE-EARTH MAGNETS AS EXPORTS PLUNGE IN MAY

- JAPAN SET TO CUT SUPER-LONG BOND ISSUANCE BY MORE THAN EXPECTED

- UK RETAIL SALES LOWER ON "INFLATION AND CUSTOMER CUTBACKS"; CONCERN FOR MPC

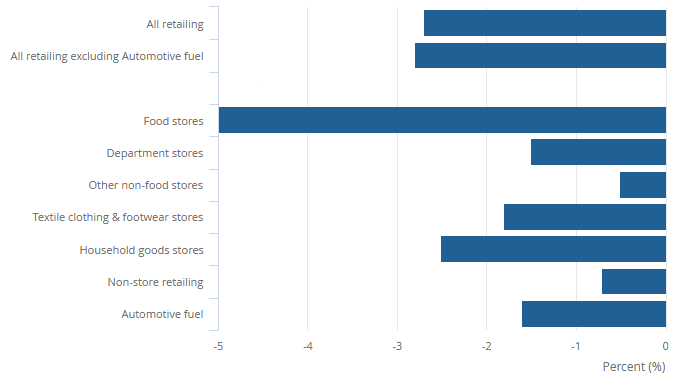

Figure 1: UK retail sales fall across all sectors in May; data concerning for BoE

Source: ONS

NEWS

MIDEAST (MNI): Iran FM Araghchi Dials Down Expectations Ahead Of Geneva Talks

Iran's Foreign Minister Abbas Araghchi has tempered expectations of a breakthrough at diplomatic talks with European counterparts in Geneva today, saying Iran is "not prepared for talks with anyone while Israeli attacks continue," per Iranian state television. Araghchi said, "after our resistance against Israel, I think countries will distance themselves from this 'aggression.' There is no room for negotiations with the US until the Israeli aggression stops." UK Foreign Minister David Lammy said after a White House meeting with US Secretary of State Marco Rubio and President Donald Trump's Middle East Envoy, Steve Witkoff, yesterday: "A window now exists within the next two weeks to achieve a diplomatic solution," referring Trump's delay on joining Israeli strikes.

US/MIDEAST (BBG): Trump Signals He’ll Hold Off Iran Strike to Give Diplomacy Time

President Donald Trump will decide within two weeks whether to strike Iran, his spokeswoman said, as Israel hit more Iranian nuclear sites and warned its attacks may bring down the leadership in Tehran. “Based on the fact that there’s a substantial chance of negotiations that may or may not take place with Iran in the near future, I will make my decision whether or not to go within the next two weeks,” Trump said in a dictated message, according to White House spokeswoman Karoline Leavitt.

US/CHINA (WSJ): China Flexes Chokehold on Rare-Earth Magnets as Exports Plunge in May

China’s exports of rare-earth magnets plummeted after it imposed controls on their overseas sale, emphasizing Beijing’s dominance of a critical input into electric vehicles and jet fighters that has taken center stage in tensions with the U.S. Total export volumes of rare-earth magnets from China fell 74% in May from a year earlier, according to a Wall Street Journal analysis of Chinese customs data. That was the biggest percentage decline on record dating back to at least 2012. Exports had fallen 45% in April in year-over-year terms. The 1.2 million kilograms of rare-earth magnets exported in May marked the lowest level since February 2020, during the Covid pandemic.

US/CHINA (BBG): US Tariff Spike Hits China’s Small Parcels, Squeezing Exporters

US tariff hikes on small packages from China triggered a slump in shipments last month, contributing to a huge drop in bilateral trade and roiling exporters like Shein Group Ltd. The value of small parcels sent from China to the US fell to just over $1 billion in May, the least since early 2023, according to customs data released Friday. The 40% plunge from the same month last year marks a sharp reversal for a booming trade route, coming just as the US government eliminated a long-standing tariff loophole.

US/JAPAN (BBG): Japan Won’t Fixate on July 9 in US Trade Talks, Akazawa Says

Japan won’t fixate on the looming date for so-called reciprocal tariffs to go back to higher levels, Tokyo’s top trade negotiator said, signaling that the Asian nation stands ready for the possibility that talks will drag on. “To avoid any misunderstanding, I would like to confirm that I have not said at all that July 9 is the deadline for negotiations between Japan and the US,” Economic Revitalization Minister Ryosei Akazawa told reporters on Friday in Tokyo. “Japan and the US are in regular communication through various channels, and we will continue to consider what is most effective and engage in appropriate consultations.”

US (BBG): Trump Allowed to Keep Using National Guard in LA for Now

President Donald Trump can continue to use National Guard troops to respond to protests in Los Angeles as a legal challenge over his use of the military proceeds, a federal appeals court ruled. In a win for the White House, a three-judge panel in San Francisco on Thursday said the Trump administration can keep using California National Guard troops to respond to the protests. In effect, it doesn’t change the situation on the ground in Los Angeles, where the federal government has been deploying the military for more than a week.

JAPAN (BBG): Japan Set to Cut Super-Long Bond Issuance by More Than Expected

Japan is planning to cut the issuance of super-long bonds this year by more than earlier reported, after record highs in super-long yields in recent months stoked market concerns. The Finance Ministry proposed reducing the issuance of 20-, 30- and 40-year bonds by a total of ¥3.2 trillion ($22 billion) through the end of March 2026, according to a plan presented by the ministry during a meeting with primary dealers on Friday. Markets were broadly expecting a total reduction of ¥2.3 trillion in super-long issuance this fiscal year, following media reports including those by Bloomberg.

BOJ (MNI): BOJ's Ueda Sticks to Gradual Hike View

Bank of Japan Governor Kazuo Ueda on Friday reaffirmed that the BOJ will raise the policy interest rate to adjust the degree of monetary easing if the outlook for the economy and prices is realised, noting that real interest rates remain significantly low. However, he downplayed the likelihood of an imminent hike, citing the need to monitor domestic and global economic and price conditions carefully, as well as financial market developments, amid high uncertainty. The BOJ will manage policy appropriately in line with evolving conditions to achieve its 2% inflation target, Ueda said at a meeting of shinkin bank associations.

CHINA (MNI): China's June LPR Holds Steady

MNI (Shanghai) China's Loan Prime Rate held steady on Friday, in line with expectations following the 10 basis-points cut in May, according to a People's Bank of China statement. Loan Prime Rate remained unchanged at 3.0% for the one-year maturity and 3.5% for the five-year tenor and over on Friday. Both rates fell in May by 10bp after the PBOC lowered the 7-day reverse repo rate – its benchmark policy rate – 10bp to 1.4% on May 8, followed by a 50bp reduction to the reserve requirement ratio on May 15.

RUSSIA/UKRAINE (MNI): Kremlin Expects to Agree on Next Round of Ukraine Talks, Next Week

Kremlin spokesperson Dmitri Peskov has spoken on conflicts in the Middle East and Ukraine. Peskov declined to predict a meeting between Russian President Vladimir Putin and US President Donald Trump happening this year, noting "complex work" is needed before a meeting could take place, per Reuters. Peskov said the Kremlin hopes to agree on a new date soon to resume talks with US on removing "irritants" in relations. Peskov noted that "dialogue with Ukraine continues," and the Kremlin expects to "agree next week" on a date for the next round of talks.

THAILAND (BBG): Thai PM Visits Troops as Rivals Plan New Protests for Her Ouster

Thai Prime Minister Paetongtarn Shinawatra visited troops at a border post to ease public backlash over her criticism of the army in a leaked phone call, as pro-royalist groups threatened to intensify protests demanding her resignation. Paetongtarn, accompanied by government ministers and military officials, traveled to an army base near Cambodia on Friday to show support for soldiers involved in a border standoff. She was scheduled to hold a strategy meeting with the region’s army commander, according to a government statement.

DATA

UK DATA (MNI): Sales Lower on "Inflation and Customer Cutbacks"; Concern for MPC

- UK MAY RETAIL SALES -2.7% M/M, -1.3% Y/Y

- UK MAY RETAIL SALES EX-FUEL -2.8% M/M, -1.3% Y/Y

This is much more significant than most retail sales reports. Retail sales fell across all sectors, with good stores seeing the biggest falls and "other non-food stores" and "non-store retailing" seeing the smallest falls. The ONS notes that part of this pullback is due to the high April print that had been partly attributed to the good weather and the fall in May also being put down to consumer concerns about "inflation and customer cutbacks, alongside reduced sales of alcohol and tobacco products." Retailers also noted that there was reduced footfall in non-food stores and that customers had reported completing "home projects earlier than usual this year because of good weather."

UK JUN GFK CONSUMER CONFIDENCE INDEX -18 (MNI)

UK MAY CGNCR GBP24.02 BN (MNI)

UK MAY PSNB GBP+17.69 BN (MNI)

UK MAY PSNB-X GBP+17.69 BN (MNI)

UK MAY PSNCR GBP20.94 BN (MNI)

FRANCE DATA (MNI): Weak June Manufacturing Sentiment Bodes Ill for Monday's PMIs

- FRANCE JUN MANUF SENTIMENT AT 96

French manufacturing sentiment slipped to 95.9 in June, down from 97.1 prior for the second consecutive increase. The index is at its lowest since January, and printed below the 98.0 (rounded consensus). The details of the release were soft, and do not bode well for the June flash manufacturing PMI due on Monday. There is no BBG consensus for that release yet. The May PMI was 49.8 (vs 48.7 prior), the highest since January 2023.

JAPAN DATA (MNI): Japan May Core CPI Rises 3.7% vs. April 3.5%

- JAPAN MAY CORE CPI +3.7% Y/Y; APRIL +3.5%

- JAPAN MAY CORE-CORE CPI +3.3% Y/Y; APRIL +3.0%

- JAPAN MAY SERVICES PRICES +1.4% Y/Y; APRIL +1.3%

Japan’s annual core consumer inflation rate accelerated to 3.7% y/y in May from 3.5% in April, driven by rising food prices excluding perishables, particularly higher rice costs, data from the Ministry of Internal Affairs and Communications showed Friday. The index remained above the Bank of Japan’s 2% target for the 38th straight month and the May index is the highest level since January 2023 when it rose 4.2%. Core inflation excluding perishables rose 7.7% y/y in May, up from 7.0% in April, while energy price growth slowed to 8.1% from 9.3%.

RATINGS: Scope on China Potentially After Hours

Sovereign rating reviews of note scheduled for after hours on Friday include:

- Scope Ratings on China (current rating: A; Outlook Stable)

FOREX: USD Drifts on Trump Delay, Prevents USD Index Test of Resistance

- The two-week delay for Trump's decision on whether to intervene in Iran has granted some reprieve for oil markets, with Brent crude off ~2% at typing, despite continued reports of conflict and exchanges of fire between Iran and Israel. This has worked against the USD Index, which dips through yesterday's low and prevents - for now - any test of the downtrending 50-dma, today at 99.479.

- EUR has been favoured, putting the single currency higher against all others in G10, however momentum has been lacking across the European morning. This lack of momentum leaves EURUSD just 25 pips lower on the week, a very positive sign for market participants looking for further appreciation in H2. Moving average studies continue to display a dominant uptrend, with corrective dips remaining well supported. Scope is seen for a climb towards 1.1696, a Fibonacci projection, while initial firm support moves up to 1.1436, the 20-day EMA.

- GBP trades well, holding just below the 1.35 level despite a very poor set of retail sales numbers for May, with the details showing broad-based slowdowns in consumption across all categories - adding to the growing evidence that the UK consumer is curtailing purchases in the face of inflation and tax pressures. For now, support at the 50-day EMA, at 1.3357, remains intact. Key trend signals remain bullish - moving average studies are in a bull-mode position highlighting a dominant uptrend.

- Canadian retail sales data and the Philly Fed Business Outlook for June are the data highlights Friday. There are no key central bank speakers due, despite the Fed existing their media blackout after Wednesday's rate decision.

EGBS: Early Rally in Bunds Fades; Focus on Fresh Middle East Catalysts

The early rally in Bund futures has faded, now +6 ticks at 131.02. Bunds are in consolidation mode and continue to trade below the Jun 13 high. For now, the latest move down appears to be a correction. Key short-term support to watch remains at 130.12, the Jun 5 low.

- Broader focus remains on the Israeli-Iran conflict, but today’s headline flow has done little to meaningfully move FI markets. Overnight US President Trump said he would decide within two weeks whether to strike Iran.

- German yields are up to 1bp lower.

- 10-year EGB spreads to Bunds are biased tighter, with European equity futures up 0.8%. After widening 3.5bps yesterday, the OAT/Bund spread has narrowed 1.5bps to 73bps.

- Flash Eurozone consumer confidence is due at 1500BST, with consensus looking for a slight improvement to -14.9 (vs -15.2 prior). More focus is on Monday’s June flash PMIs.

GILTS: Off Highs as Impact of Retail Sales Fades

Global cues help unwind the rally that followed the retail sales data, with oil off lows and ongoing focus on Israeli-Iran tensions.

- Futures registered a high at 93.05, leaving Wednesday’s high (93.09) and Fibonacci resistance (93.13) intact. Contract last ~92.75.

- Yields 0.5bp lower across the curve.

- 2s10s sticks to multi week range, set to close the week above 60bp, while 5s30s is set to close below 125bp after the failed break above.

- SONIA futures flat to -2.0.

- Just under 50bp of BoE cuts once again priced through December, with the next 25bp move fully discounted through the end of September (~19bp priced for August).

- An isolated retail sales release won’t be a key driver for the MPC over the longer run, but a soft run of releases would add to the dovish case, at least at the margin.

- Comments from BoE Governor Bailey were not market moving.

- The BoE will announce its Q3 APF sales schedule at 16:30 London.

- The main question here is whether there are two long dated operations in the quarter alongside one medium dated operation or will there be one operation of each bucket in the quarter. We haven't seen strong opinions on this yet.

- On the wider APF we don’t expect to see any guidance on whether or not active QT will definitely continue past the upcoming quarter nor on the potential size of the sales programme. This will not be announced until the September MPC meeting but balance sheet focus is increasing in prominence as a speech topic recently, suggesting it is on the MPC’s minds.

EQUITIES: Eurostoxx 50 Futures Recover Moderately From Thursday's Lows

Eurostoxx 50 futures maintain a softer tone and the contract traded lower yesterday. Recent weakness has resulted in a breach of the 50-day EMA, at 5293.56. Price has also traded through 5255.00, the May 23 low. A clear break of both support points signals a S/T top and highlights scope for a deeper retracement. Sights are on 5178.00, the May 6 low and 5081.16, a Fibonacci retracement. Initial resistance is 5333.37, the 20-day EMA. The trend condition in S&P E-Minis remains bullish. For now, the most recent shallow pullback is considered corrective. The contract has pierced support at 6006.73, the 20-day EMA. A clear breach of this average would suggest potential for a deeper retracement and expose the 50-day EMA, at 5902.27. Key short-term resistance and the bull trigger has been defined at 6128.75, the Jun 11 high.

- Japan's NIKKEI closed lower by 85.11 pts or -0.22% at 38403.23 and the TOPIX ended 20.82 pts lower or -0.75% at 2771.26.

- Elsewhere, in China the SHANGHAI closed lower by 2.212 pts or -0.07% at 3359.896 and the HANG SENG ended 292.74 pts higher or +1.26% at 23530.48.

- Across Europe, Germany's DAX trades higher by 154.44 pts or +0.67% at 23212.6, FTSE 100 higher by 29.26 pts or +0.33% at 8820.99, CAC 40 up 36.74 pts or +0.49% at 7590.19 and Euro Stoxx 50 up 35.54 pts or +0.68% at 5232.57.

- Dow Jones mini down 106 pts or -0.25% at 42082, S&P 500 mini down 19.75 pts or -0.33% at 5961.75, NASDAQ mini down 68.25 pts or -0.31% at 21652.

Time: 10:00 BST

COMMODITIES: Bull Cycle in WTI Futures Remains Intact

A bull cycle in WTI futures remains intact and the contract is trading closer to its recent high. Price action is likely to remain volatile near-term, and from a technical standpoint, the trend is in an extreme overbought position. A continuation higher would expose the $80.00 handle. A firm support is noted at $67.11, the Jun 13 low. A breach of this level would signal scope for a deeper retracement. A bullish theme in Gold remains intact and this week’s pullback is considered corrective. Medium-term trend signals are bullish too - moving average studies are in a bull-mode position, highlighting a dominant uptrend. Resistance at $3435.6, the May 7 high, has been pierced. A clear break of this level would strengthen the uptrend and open $3500.1, the Apr 22 all-time high. Initial key support to monitor is $3279.3, the 50-day EMA.

- WTI Crude up $0.52 or +0.69% at $75.66

- Natural Gas up $0.09 or +2.33% at $4.081

- Gold spot down $20.92 or -0.62% at $3349.84

- Copper down $6.7 or -1.37% at $483.45

- Silver down $0.44 or -1.2% at $35.9913

- Platinum down $11.39 or -0.87% at $1292.04

Time: 10:00 BST

| Date | GMT/Local | Impact | Country | Event |

| 20/06/2025 | - | ECB de Guindos at ECOFIN Meeting | ||

| 20/06/2025 | 1230/0830 | * | Industrial Product and Raw Material Price Index | |

| 20/06/2025 | 1230/0830 | ** | WASDE Weekly Import/Export | |

| 20/06/2025 | 1230/0830 | ** | Philadelphia Fed Manufacturing Index | |

| 20/06/2025 | 1230/0830 | ** | Retail Trade | |

| 20/06/2025 | 1400/1600 | ** | Consumer Confidence Indicator (p) | |

| 20/06/2025 | 1530/1630 | BOE to announce Q3 APF sales schedule | ||

| 20/06/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 20/06/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 22/06/2025 | 1715/1315 | San Francisco Fed's Mary Daly |