MNI US OPEN - Germany's Merz Falls Short in First Round Voting

EXECUTIVE SUMMARY

- MERZ FALLS SHORT IN FIRST ROUND OF CHANCELLOR VOTING

- ROMANIAN PREMIER RESIGNS AS FAR-RIGHT SURGE TRIGGERS TURMOIL

- INDIA OFFERS ZERO-FOR-ZERO TARIFFS ON AUTO PARTS, STEEL FROM US

- PAKISTAN SAYS INDIA CHOKES RIVER FLOW AS TENSIONS RISE

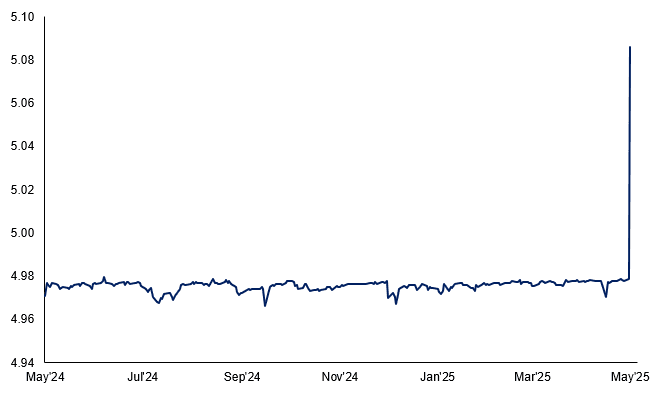

Figure 1: EUR/RON spikes over 2% following 1st round of presidential election

NEWS

GERMANY (MNI): Merz Falls Short in First Round of Chancellor Voting

In a shock result, Friedrich Merz, leader of the centre-right Christian Democratic Union (CDU), has fallen short of the required overall majority in the first round of voting in the Bundestag. He achieved 310 votes in favour, with 307 against, three abstentions and one invalid vote. The CDU, its Bavarian sister party the Christian Social Union, and the centre-left Social Democrats hold 328 seats between them, well above the 316 majority threshold. The first-round result would therefore indicate a sizeable number of SPD lawmakers refusing to back the conservative Merz, despite the approval of their party's leadership for the gov't programme. Under Germany's Basic Law, a second round of voting can take place, once again requiring an absolute majority of 316 in favour. If this threshold cannot be reached then a third round can take place in which only a relative majority of those voting is required. The second round must take place within 14 days.

GERMANY (MNI): Second Round of Chancellor Voting Today - FAZ

FAZ reports that there will not be a second round of voting for a new chancellor today following centre-right Christian Democatic Union (CDU) leader Friedrich Merz's unexpected defeat in the first round of voting in the Bundestag a short time ago. The next vote has to take place within two weeks, once again with an absolute majority (316 votes) required. Merz won just 310 in the first ballot. Taggespiegel: "... according to an SPD parliamentary group spokesperson, the [second round] election could not take place until Friday at the earliest." Meanwhile, a POLITICO reporter says: "The AfD wants to vote for the deadline reduction — then a second round of voting would be possible today or tomorrow"

ROMANIA (BBG): Romanian Premier Resigns as Far-Right Surge Triggers Turmoil

Romania’s prime minister announced his resignation after a Donald Trump-aligned far-right leader scored a resounding first-round presidential victory, throwing the Black Sea nation into a fresh round of political turmoil ahead of a runoff ballot later this month. Marcel Ciolacu said his coalition was unable to move forward after its preferred candidate in the presidential contest was eliminated. He signaled that the alliance of his Social Democrats with Romania’s Liberals and another party may resume after a May 18 presidential runoff produces a winner, who will nominate a new premier.

US/INDIA (BBG): India Offers Zero-for-Zero Tariffs on Auto Parts, Steel From US

India has proposed zero tariffs on steel, auto components and pharmaceuticals on a reciprocal basis up to a certain quantity of imports in its trade negotiations with the US, people familiar with the matter said. Beyond this threshold, imported industrial goods would attract the regular level of duties, the people said, asking not to be identified as the discussions are private. The offer was made by Indian trade officials visiting Washington late last month to expedite negotiations on a bilateral trade deal expected by fall this year, the people said.

US/EU (BBG): EU Sees Broader Trump Tariffs Hitting €549 Billion of Its Goods

The European Union expects President Donald Trump’s trade investigations to boost the amount of the bloc’s goods facing US tariffs to €549 billion ($622 billion), escalating the transatlantic conflict as the two sides are trying to negotiate a reduction in levies. The US has said it may impose tariffs on imports of lumber, pharmaceuticals, semiconductors, critical minerals and trucks, which would amount to an additional €170 billion of EU goods impacted, about 97% of its total exports to the US, the bloc’s trade chief, Maros Sefcovic, said during a speech on Tuesday.

US/CANADA (MNI): Carney Looks to Dial Down Temperature at First White House Meeting

US President Donald Trump and Canadian Prime Minister Mark Carney will meet today for the first time since the latter spearheaded a Liberal comeback at Canadian elections last week. Trump will greet Carney at the White House at 11:30 ET 16:30 BST for a bilateral meeting and working lunch. There is no joint press conference scheduled, but there is likely to be a press spray at the top.

TAIWAN (MNI): CB Confirms 80% of FX Reserves Held in US Bonds

The Forex Official for Taiwan's central bank confirms that 80% of Taiwan's FX reserves are held in US bonds. Taiwan's CB have been active in the market in the past few months - their April FX reserves were ~$582bln and yesterday held an impromptu press conference to address the unusual spike in the TWD - much of which was pinned on the hedging activity of life insurers as well as broad speculative activity

HONG KONG (MNI): HKMA Diversifies Away From USD, Reduces UST Duration in Holdings

HKMA chief Eddie Yue states that the HKMA Exchange Fund has been reducing duration in UST holdings, and has been diversifying into non-US assets. They also note they've been diversifying their FX exposure across the investment portfolio in order to manage risks. HKMA's Exchange Fund holds assets totalling HKD 4trl ($525bln) as of end-2024, of which over half is 'Debt Securities', in which USTs would likely be the bulk of the category. HKMA's Exchange Fund has an objective of ensuring the "entire

Monetary Base, at all times, is fully backed by highly liquid US dollar-denominated assets" as well as ensuring "sufficient liquidity for the purpose of maintaining monetary and financial stability".

SNB (MNI): Schlegel Acknowledges CHF Strength - Media

The Swiss Franc has appreciated 'really a lot', SNB Chairman Schlegel said this morning in Zurich according to media reports. Chairman Schlegel is usually not known for such pronounced commentary on CHF valuations. That follows CHF REER having temporarily peaked to highest levels since end-2023 in the last weeks - Schlegel also highlights again they 'intervene in FX as needed' - that is in line with previous rhetoric. There was no indication of recent material SNB intervention apparent in domestic sight deposit data.

INDIA/PAKISTAN (BBG): Pakistan Says India Chokes River Flow as Tensions Rise

Pakistan alleged that India has almost entirely stopped the flow of water across the border through the Chenab river as fears of a clash between the two neighbors mount following a deadly attack in Kashmir. Since Sunday morning, the water flow has been throttled by almost 90% of the usual volume that passes to Pakistan, according to Muhammad Khalid Idrees Rana, spokesman for Pakistan’s Indus River System Authority. The nation had anticipated water supplies to farms would be short by a fifth for the next two months even before this curtailment, he said.

DATA

EUROZONE DATA (MNI): Similar Themes in April Services PMI to Manufacturing

The Eurozone April services PMI saw very similar themes to last week's manufacturing PMI round: Spain weaker than expected, Italy stronger than expected and upward revisions in France/Germany. That sees the Eurozone-wide PMI inch back into expansionary territory to 50.1 (vs 49.7 flash, 51.0 prior). There has been little net impact on ECB implied rates, with OIS still pricing ~60bps of easing through year-end.

EUROZONE MAR PPI -1.6% M/M, +1.9% Y/Y (MNI)

SPAIN DATA (MNI): April Services PMI Still Expansionary, But Momentum Waning Slightly

Another weaker-than-expected Spanish April PMI print following last week's anufacturing PMI, with the services PMI at 53.4 (vs 54.0 cons, 54.7 prior) - the lowest since November 2024. The services PMI has been in expansionary territory for 27 of the last 28 months, but momentum has waned slightly in recent releases. This is echoed in the latest flash national accounts data, with Q1 services value added at 0.3% Q/Q, down from 0.9% in Q4.

ITALY DATA (MNI): Stronger-Than-Expected April Services PMI, but Export Demand Soft

The Italian services PMI was 52.9 in April, above the 51.3 expected and 52.0 prior. It's broadly back in line with February's 53.0 reading, allowing the PMI to remain in expansionary territory for the fifth month. Despite this, the latest flash national accounts suggested the services industry made no contribution to sequential value-added growth in Q1. The press release suggests further weakness in export demand, usually an important source of Italian growth.

FRANCE MAR INDUSTRIAL PRODUCTION +0.2% M/M, +0.2% Y/Y (MNI)

FRANCE MAR MANUFACTURING OUTPUT +0.6% M/M, +0% Y/Y (MNI)

SWEDEN DATA (MNI): Weakest Services PMI Since September 2023

The Swedish April services PMI fell further into contractionary territory to 48.4 (vs 49.3 prior), the lowest since September 2023. The three analyst forecasts submitted to BBG had a range of 49.0-50.5. The release appears broadly consistent with the April Economic Tendency Indicator services sub-component, and underscores the downside risks to economic activity stemming from US tariff-related uncertainty. The Riksbank are unanimously expected to hold rates at 2.25% on Thursday, but growth risks leave scope for a dovish guidance tilt.

SWISS APR UNEMPLOYMENT RATE +2.8% (MNI)

SWISS APR UNEMPLOYMENT -1.9% M/M, +21.6% Y/Y (MNI)

AUSTRALIA DATA (MNI): House Approvals Weak in March

- AUSTRALIA MAR BUILDING APPROVALS -8.8% M/M, +13.4% Y/Y

Building approvals in March were significantly weaker than expected falling 8.8% m/m with the more stable private houses component down 4.5% m/m. Multi-dwelling approvals fell 15.1% m/m, the second consecutive monthly fall. Housing shortages persist and this is an unfortunate development but appears also to have been impacted by Cyclone Alfred with Queensland recording a drop in house approvals but Victoria was also weak. Total building approvals are now up 13.4% y/y after 26.5% y/y in February with private houses down 3.3% y/y, the lowest since November 2023, but apartments still up 47.1% y/y.

AUSTRALIA DATA (MNI): Q1 Spending Volumes Flat, March Saw Cyclone Impact

March household spending was weaker-than-expected falling 0.3% m/m to be up 3.5% y/y after an upwardly-revised +0.3% m/m & 3.6% y/y. Q1 volume data was also released, which is now seasonally adjusted. It showed no growth on the quarter, in line with retail sales, to be up only 0.9% y/y after +1.6% q/q & 2.3% y/y in Q4, consistent with the view that the RBA is likely to ease 25bp on May 20. Private consumption in the national accounts is likely to be close to flat in Q1 when it is released on June 4.

FOREX: Fragility Returns, Pointing to Negative Open on Wall Street

- Equity markets globally are softer, with US futures on the backfood and pointing to a lower open on Wall Street later today. Markets trade with a risk-off feel as further signs of fragility begin to show in global markets. EUR/RON has spiked as much as 2% on local political uncertainty, the Hong Kong Monetary Authority are to diversify their FX holdings away from USD-denominated assets and Germany's Merz has faltered in his first step toward taking the Chancellery, as he fails to pass a first vote in parliament.

- As a result, the JPY is firmer against all others in G10 FX, with USD/JPY through yesterday's lows and only finding support at 142.90, the 50% retracement for the upleg posted off the April pullback low. Clearance through here will shift focus again to recent lows - with 139.89 the real bear trigger.

- AUD is the poorest performer in G10 as the currency retraces a small part of the election-triggered rally from Monday. The risk-off feel for markets will also be hampering the currency.

- Lastly, CHF underperforms - breaking the correlation with JPY as SNB's Schlegel talks up the possibility of negative rates again in the future should the economic situation warrant it.

- US and Canadian trade balance data mark the key releases for Tuesday trade, with the central bank speaker slate empty - the Fed remain inside their pre-decision media blackout period ahead of tomorrow's rate decision.

EGBS: Bund Futures Temporarily Spike as Merz Falls Short of Chancellor Majority

Bund futures spiked from ~130.75 to a session high of 131.08 after German CDU leader Merz failed to be approved as Chancellor in the first round of Bundestag voting. However, RXM5 has since eased back to 130.89 (-17 ticks versus yesterday’s settlement levels), with Merz still expected to be confirmed as Chancellor in subsequent votes despite the embarrassing first round result.

- The light upside in Bunds, relative to before the initial headlines crossed, reflects slightly increased risks of more contained German fiscal easing in the coming years than had previously been expected.

- The German curve has twist steepened, with Schatz yields down 0.5bps and 30-year Bunds up 2.5bps.

- The political volatility comes against a backdrop of sizeable German supply: A 30-year syndicated tap (MNI expects E4-6bln) and E4.5bln of the 2.40% Apr-30 Bobl (bidding deadline at 1030BST).

- Austria sold RAGBs earlier this morning.

- Data has not been market moving: The Eurozone April services PMI saw very similar themes to last week’s manufacturing PMI round, with Spain weaker than expected, Italy stronger than expected and upward revisions seen in France/Germany. Eurozone March PPI was softer-than-expected at -1.6% M/M (vs -1.4% cons, 0.2% prior).

- 10-year EGB spreads to Bunds have widened modestly, with European equities weakening through the course of the morning, exacerbated by the latest German headlines.

GILTS: Early Losses Intact, BoE Eyed Later This Week

Gilts hold the bulk of their early sell off, with no real spill over from the tepid recovery in lows seen in German equivalents as political uncertainty comes back to the fore in the largest EU economy.

- Gilts adjusted to the weakness seen in wider core global markets over the long UK weekend at the open.

- Futures have broken through Friday’s low (92.84) and the 20-day EMA (92.65), basing at 92.32 before a recovery to trade at ~92.45 last.

- Next support of note located at the April 17 low (91.73).

- Yields 1-5bp higher, curve steeper.

- 10s last ~4.56% after basing at 4.408% last week.

- Curves remain within multi-week ranges, 2s10s and 5s30s over 10bp off cycle highs.

- Gilt/Bunds ~4bp wider than Friday’s closing levels

- BoE-dated OIS little changed on the day, with the modest hawkish adjustment seen at the open unwound. A 25bp cut later this week is fully discounted, with 92bp of easing priced through year-end.

- SONIA futures are under a little more pressure, last little changed to -6.0

- We expect a 25bp cut this week, in line with market pricing and all sell-side views we have read.

- We have outlined some potential dovish tweaks to the Bank’s guidance verses in the statement, which could pave the way for consecutive rate cuts over the next 3 meetings.

BoE Meeting | SONIA BoE-Dated OIS (%) | Difference vs. Current Effective SONIA Rate (bp) |

May-25 | 4.203 | -25.6 |

Jun-25 | 4.077 | -38.2 |

Aug-25 | 3.879 | -58.0 |

Sep-25 | 3.741 | -71.8 |

Nov-25 | 3.585 | -87.4 |

Dec-25 | 3.540 | -91.9 |

EQUITIES: Eurostoxx 50 Futures Holding Onto Latest Gains

Eurostoxx 50 futures maintain a positive tone and the contract is holding on to its latest gains. Price has recently cleared both the 20- and 50-day EMAs, and attention is on 5263.01, 76.4% of the Mar 3 - Apr 7 bear leg. It has been pierced, a clear break of it would pave the way for a climb towards 5341.00, the Mar 27 high. Initial support to watch lies at 5067.15, the 20-day EMA. Clearance of this level would signal a possible reversal. The latest recovery in the e-mini S&P reinforces current bullish conditions.The contract has breached the 50-day EMA, at 5622.87. A continuation of the bull phase would expose 5837.25 next, the Mar 25 high and a bull trigger. It is still possible that the entire rally since Apr 7 is a correction. A reversal lower would signal the end of this corrective phase and expose initially, support at 5127.25, the Apr 21 low.

- In China the SHANGHAI closed higher by 37.083 pts or +1.13% at 3316.114 and the HANG SENG ended 158.03 pts higher or +0.7% at 22662.71.

- Across Europe, Germany's DAX trades lower by 260.12 pts or -1.11% at 23085.01, FTSE 100 higher by 3.66 pts or +0.04% at 8600.28, CAC 40 down 40.58 pts or -0.53% at 7687.35 and Euro Stoxx 50 down 34.91 pts or -0.66% at 5248.14.

- Dow Jones mini down 224 pts or -0.54% at 41093, S&P 500 mini down 37.25 pts or -0.66% at 5634.5, NASDAQ mini down 181.5 pts or -0.91% at 19874.

Time: 10:15 BST

COMMODITIES: Short-Term Gains for WTI Futures Considered Technically Corrective

A medium-term bearish trend in WTI futures remains intact and short-term gains are considered corrective. The move down that started Apr 23 signals the end of the correction between Apr 9 - 23. That cycle higher allowed an oversold condition to unwind. Attention is on $54.67, the Apr 9 low and a bear trigger. Clearance of this level would resume the downtrend and open $53.72, a Fibonacci projection. Resistance to watch is $64.32, the 50-day EMA. Gold has recovered from its recent lows and this suggests the correction between Apr 22 - May 1, is over. A continuation higher would refocus attention on key resistance and the bull trigger at $3500.1, the Apr 22 high. Clearance of this level would confirm a resumption of the primary uptrend. Key short-term support has been defined at $3202.0, the May 1 low. A break of this level is required to signal scope for a deeper retracement.

- WTI Crude up $1.46 or +2.56% at $58.49

- Natural Gas up $0.08 or +2.37% at $3.632

- Gold spot up $43.23 or +1.3% at $3377.06

- Copper down $1.15 or -0.24% at $468.85

- Silver up $0.56 or +1.73% at $33.0628

- Platinum up $14.78 or +1.53% at $979.36

Time: 10:15 BST

| Date | GMT/Local | Impact | Country | Event |

| 06/05/2025 | - | FOMC Meeting | ||

| 06/05/2025 | 1230/0830 | ** | International Merchandise Trade (Trade Balance) | |

| 06/05/2025 | 1230/0830 | ** | Trade Balance | |

| 06/05/2025 | 1230/0830 | ** | International Merchandise Trade (Trade Balance) | |

| 06/05/2025 | 1255/0855 | ** | Redbook Retail Sales Index | |

| 06/05/2025 | 1400/1000 | * | Ivey PMI | |

| 06/05/2025 | 1700/1300 | ** | US Note 10 Year Treasury Auction Result | |

| 07/05/2025 | 0030/0930 | ** | S&P Global Final Japan Services PMI | |

| 07/05/2025 | 0030/0930 | ** | S&P Global Final Japan Composite PMI | |

| 07/05/2025 | 0600/0800 | ** | Manufacturing Orders | |

| 07/05/2025 | 0600/0800 | *** | Flash Inflation Report | |

| 07/05/2025 | 0645/0845 | * | Foreign Trade | |

| 07/05/2025 | 0730/0930 | ** | S&P Global Final Eurozone Construction PMI | |

| 07/05/2025 | 0800/1000 | * | Retail Sales | |

| 07/05/2025 | 0830/0930 | ** | S&P Global/CIPS Construction PMI | |

| 07/05/2025 | 0900/1100 | ** | Retail Sales | |

| 07/05/2025 | 0900/1000 | ** | Gilt Outright Auction Result | |

| 07/05/2025 | 1100/0700 | ** | MBA Weekly Applications Index | |

| 07/05/2025 | 1400/1000 | Treasury Secretary Scott Bessent | ||

| 07/05/2025 | 1430/1030 | ** | DOE Weekly Crude Oil Stocks | |

| 07/05/2025 | 1800/1400 | *** | FOMC Statement | |

| 07/05/2025 | 1900/1500 | * | Consumer Credit |