MNI US OPEN - Japan Secure Priority Status in Trade Talks

EXECUTIVE SUMMARY:

- JAPAN TO GET PRIORITY IN TRADE TALKS

- TRUMP DISMISSES LAST-GAP EU PUSH AGAINST TARIFFS

- EU REACHES OUT TO CHINA TO AVOID REDIRECTED TRADE FLOWS TO EUROPE

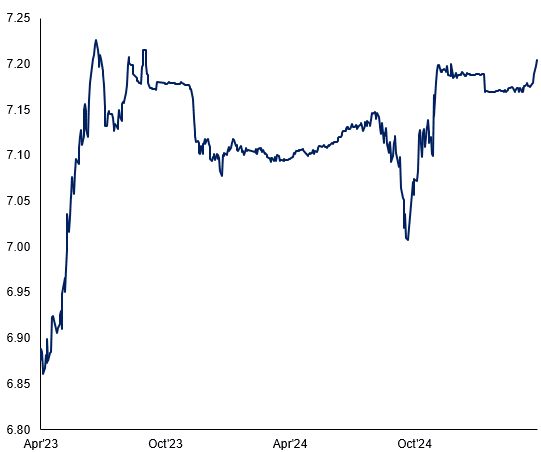

- USDCNY FIX HIGHEST IN NEARLY TWO YEARS ON TRADE WAR PRESSURES

Figure 1: USD/CNY midpoint set at the highest level in almost two years

NEWS:

Japan looks set to get priority in US tariff talks, moving to the front of a long line of countries seeking to roll back President Donald Trump’s so-called reciprocal duties, which are scheduled to kick in on Wednesday. Treasury Secretary Scott Bessent, who along with US Trade Representative Jamieson Greer will lead the American side of the negotiations, said: “I would expect that Japan is going to get priority” among trading partners for coming forward very quickly.

EU/US (BBG): Trump Dismisses Last-Gasp EU Push to Stop Tariffs Kicking In

President Donald Trump rejected a European Union proposal to drop tariffs on all bilateral trade in industrial goods with the US, meaning that his 20% tariff on all EU imports is due to come into force Wednesday. Speaking at the White House on Monday, Trump said the offer from European Commission President Ursula von der Leyen is not enough to reset the transatlantic trading relationship, accusing the EU of maintaining other barriers to trade.

US (WaPo): Musk Made Direct Appeals to Trump to Reverse Sweeping New Tariffs

Over the weekend, as Elon Musk launched into a barrage of social media posts criticizing one of the lead White House advisers for President Donald Trump's aggressive tariff plan, Musk was going over that same official's head — and making personal appeals to Trump. The attempted intervention, confirmed by two people familiar with the matter who spoke on the condition of anonymity to discuss private talks, has not brought success so far.

US/ASIA (BBG): US Treasury Holds Closed-Door Tariff Talks With Asean Officials

A US Department of the Treasury representative met with senior Southeast Asian officials in Kuala Lumpur to apprise them of President Donald Trump’s sweeping global tariffs, Bernama reported. The Treasury’s Deputy Assistant Secretary for Asia Robert Kaproth shared Washington’s policy outlook and discussed the effects of the tariffs on member states of the Association of Southeast Asian Nations during a meeting with the region’s finance and central bank deputies in Kuala Lumpur on Monday, according to the Malaysian state news agency.

EU/CHINA (WSJ): EU Urges China to Address Possible Trade Diversion Caused By Tariffs

The European Union is concerned that high U.S. tariffs on China could redirect trade flows to Europe, where duties are much lower, and lead to a spike in low-cost imports. In a phone call, von der Leyen and Li discussed setting up a mechanism to track possible trade diversion during their call, the commission said in a statement Tuesday.

The number of German companies becoming insolvent rose again in March, with industry worst affected, although fewer jobs were lost than in February, Leibniz Institute for Economic Research Halle (IWH) data showed on Tuesday.

Christian Hawkesby has been appointed as Governor of the Reserve Bank of New Zealand for a six-month term by the Minister of Finance Nicola Willis, upon the recommendation of the RBNZ Board.

The People’s Bank of China set its U.S. dollar, yuan fixing at its highest level in 19 months as the currency suffered downward pressure amid an escalating trade war.

China’s state-backed Central Huijin Investment fund said on Tuesday it would scale up purchases of exchange-traded funds (ETFs) as equity markets suffer shocks from the China-U.S. trade war. According to a statement, the company pledged to work as a quasi-stabilisation fund and a “national team” to counteract any irrational fluctuations in equity markets.

CHINA (MNI): China To Fight Back On Any New U.S. Tariffs

China will resolutely take countermeasures to safeguard its own rights and interests should the U.S. further escalate tariffs, said spokesman of the Ministry of Commerce in a statement on the ministry website Tuesday.

CHINA (MNI): China Boosts Insurance Funds' Equity Allocation

China has raised insurance funds' equity asset allocation corresponding to certain solvency ratios by 5%, the National Financial Supervisory and Administration Bureau said on Tuesday, aiming to raise support for the capital market and the real economy.

MNI: EU Opts For Longer Wait Before Targeting U.S. Services

EU trade officials discuss ways of retaliating against U.S. tariffs-- On MNI Policy MainWire now, for more details please contact sales@marketnews.com

MNI POLICY: Hawkish Fed To Drive BOJ Caution

The BOJ is keeping an eye on Fed hawkishness. On MNI Policy MainWire now, for more details please contact sales@marketnews.com

DATA:

Japan's sentiment index for the current economic climate stood at a seasonally adjusted 45.1 in February, down from 45.6 in March, while the outlook index for two-three months ahead fell 1.4 points to 45.2 in March from 46.6 in February, the Economy Watchers report released by the Cabinet Office showed Tuesday.

EGBS: Bunds Weaker On Signs Of Risk Stabilisation, Underperforming Gilts

Today’s 77 tick range in Bund futures pales in comparison to the prior two sessions, with risk sentiment showing signs of stabilising amid a lack of further escalation in trade tensions – for now. Bund futures are -43 ticks at 129.93, after finding support at the 50-day EMA of 129.83. A move to fresh intraday lows (below 129.81) would expose firm support at 129.15, the 20-day EMA.

- German paper underperforms Gilts, particularly at the short-end, following dovish commentary from ex-BOE officials earlier today.

- The 2-year Gilt/Schatz spread is 11.5bps tighter at typing, with the 10-year spread 4.5bps narrower at 196bps.

- The 2.50% Feb-35 Green Bund auction saw somewhat weaker bid-to-cover and bid-to-offer ratios than the previous re-opening in January, and may have weighed on futures in the run-up to the 1030BST bidding deadline.

- Conventional supply from Austria and the Netherlands has also passed this morning, while the spread has been set at today’s dual tranche EU-bond syndication.

- ECB’s Simkus offered support for a 25bp cut in April (which is essentially fully priced in OIS), while Stournaras provided familiar dovish rhetoric. De Guindos’ tone was less committal, but he nonetheless considers the latest US tariffs as a “paradigm shift”.

- 10-year EGB spreads to Bunds have tightened on the back of the stabilisation in risk, but markets remain highly sensitive to US tariff developments.

GILTS: 10s30s above 72bp - a level we haven't closed 2 days above since 2016:

- 2-year gilts are outperforming both USTs and Schatz this morning, largely due to the Guardian article out earlier with comments from former MPC members (who were both dovish) calling for larger / earlier cuts - see 9:00BST comment for our views on that. The 1.25% Jul-27 gilt has seen yields fall as low as 3.712% today from a close yesterday of 3.797% (an 8.5bp move at it's maximum today) although around half of the move has been retraced and we now trade around 3.75% at writing.

- We are also seeing 10s30s steepen more for gilts than for Germany or the US. This move was largely ahead of the 4.375% Jul-54 gilt auction (which was actually pretty strong). Post-auction there was a bit of a relief rally, but this was seen across the curve and left 10s30s little changed post vs pre-auction. The steepening of 10s30s has reached new highs for gilts (but not the other two markets this morning). 10s30s are trading around 73.6bp at writing - moving above 72bp for the first time since 2024. Note that we haven't closed two consecutive days above 72bp since 2016 - so this is a significant level.

- Helped by some post-auction relief (which included a 25 tick move higher in futures) and the moves in 2-year gilts, 10-year gilts are outperforming both USTs and Bunds.

- Later today, we will also hear from Lombardelli after the gilt market closes.

FOREX: Looking to Gauge Sustainability of the Bounce

- Markets are bouncing Tuesday, led higher by the reversal off Monday's pullback lows for US stock futures. The E-mini S&P has bounced off yesterday's 4832.00 to reclaim near 350 points to point to a steadier outlook into the NY crossover today.

- For currencies, this has translated to AUD and NZD strength: AUD/USD has shown back above $0.6050 NZD/USD back above $0.5600. While these recoveries amount to over 1.5%, they still nurse significant losses off last week's highs, meaning any fade in the corrective bounce will have markets re-considering recent lows.

- This leaves the USD as the poorest performing currency in G10, although the ability of the market to hold above 103.00 keeps the market technically constructive in the short-term.

- Datapoints are few and far between Tuesday, keeping market focus on the sustainability of this recovery from lows. Monday's acute volatility is another sign that markets will read credibly into any well-sourced reports of policy U-turns, keeping attention on the US news cycle and any signals from the President.

- Trump's schedule Tuesday sees numerous events - most consequential of which are his executive order signing event at 1500ET/2000BST and comments set to be made at an NRCC dinner after markets close.

EQUITIES: Stocks Undergo Corrective Bounce, But Vol Here to Stay

S&P E-Minis continues to trade in a volatile manner. A bearish theme remains intact and the latest fresh cycle lows, strengthen current conditions. Scope is seen for an extension towards the 4800.00 handle next. Eurostoxx 50 futures remain in a bear cycle following the latest impulsive sell-off. Monday’s move down resulted in a breach of a key support at 4699.00, the Nov 19 ‘24 low (cont).

- Japan's NIKKEI closed higher by 1876 pts or +6.03% at 33012.58 and the TOPIX ended 143.36 pts higher or +6.26% at 2432.02.

- Elsewhere, in China the SHANGHAI closed higher by 48.973 pts or +1.58% at 3145.549 and the HANG SENG ended 299.38 pts higher or +1.51% at 20127.68.

- Across Europe, Germany's DAX trades higher by 116.75 pts or +0.59% at 19914.58, FTSE 100 higher by 95.42 pts or +1.24% at 7796.36, CAC 40 up 29.74 pts or +0.43% at 6956.66 and EuroStoxx 50 up 18.1 pts or +0.39% at 4673.9.

- Dow Jones mini up 671 pts or +1.76% at 38804, S&P 500 mini up 73.75 pts or +1.45% at 5185, NASDAQ mini up 232.5 pts or +1.32% at 17772.

COMMODITIES: Gold Still Bullish Despite Fast Fade Off Highs

The trend condition in Gold remains bullish and the latest pull back appears corrective. Moving average studies are in a bull-mode position highlighting a dominant uptrend and positive market sentiment. A bearish theme in WTI futures remains intact following the recent impulsive sell-off. The move down has resulted in the breach of a number of important support levels. The break reinforces a bearish threat and, despite being in oversold territory, signals scope for a continuation of the bear leg.

- WTI Crude down $0.07 or -0.12% at $60.53

- Natural Gas down $0.01 or -0.16% at $3.643

- Gold spot up $20.88 or +0.7% at $3006.13

- Copper up $11.9 or +2.84% at $430.65

- Silver up $0.1 or +0.35% at $30.1951

- Platinum up $5.61 or +0.61% at $925.35

| Date | GMT/Local | Impact | Country | Event |

| 08/04/2025 | 0900/1000 | ** | Gilt Outright Auction Result | |

| 08/04/2025 | 0900/1100 | ECB's De Guindos At Spanish Banking Association Meeting | ||

| 08/04/2025 | 1000/0600 | ** | NFIB Small Business Optimism Index | |

| 08/04/2025 | 1255/0855 | ** | Redbook Retail Sales Index | |

| 08/04/2025 | 1400/1000 | * | Ivey PMI | |

| 08/04/2025 | 1400/1600 | ECB's Cipollone at ECON Hearing On Digital Euro | ||

| 08/04/2025 | 1400/1000 | United States Trade Representative Jamieson Greer | ||

| 08/04/2025 | 1600/1700 | BoE's Lombardelli on 'What can the UK learn from the US' | ||

| 08/04/2025 | 1700/1300 | *** | US Note 03 Year Treasury Auction Result | |

| 08/04/2025 | 1800/1400 | San Francisco Fed's Mary Daly | ||

| 09/04/2025 | - | Reserve Bank of New Zealand Meeting | ||

| 09/04/2025 | 0200/1400 | *** | RBNZ official cash rate decision | |

| 09/04/2025 | 0900/1000 | ** | Gilt Outright Auction Result | |

| 09/04/2025 | 1100/0700 | ** | MBA Weekly Applications Index | |

| 09/04/2025 | - | Higher Reciprocal Tariffs On Imports | ||

| 09/04/2025 | 1230/1430 | ECB's Cipollone On Macro-Financial Stability Panel | ||

| 09/04/2025 | 1400/1000 | ** | Wholesale Trade | |

| 09/04/2025 | 1430/1030 | ** | DOE Weekly Crude Oil Stocks | |

| 09/04/2025 | 1500/1100 | Richmond Fed's Tom Barkin | ||

| 09/04/2025 | 1700/1300 | ** | US Note 10 Year Treasury Auction Result | |

| 09/04/2025 | 1800/1400 | *** | FOMC Minutes |