MNI US OPEN - Lingering Uncertainty on 'Liberation Day'

EXECUTIVE SUMMARY

- TRUMP’S TARIFF PLANS STILL IN LIMBO AHEAD OF ROSE GARDEN EVENT – BBG

- LIBERAL WINS WISCONSIN SUPREME COURT RACE IN REBUKE OF TRUMP, MUSK

- IDF EXPANDS GROUND OFFENSIVE IN SOUTHERN GAZA

- BOJ'S UEDA VOICES CONCERN OVER TARIFFS IMPACT

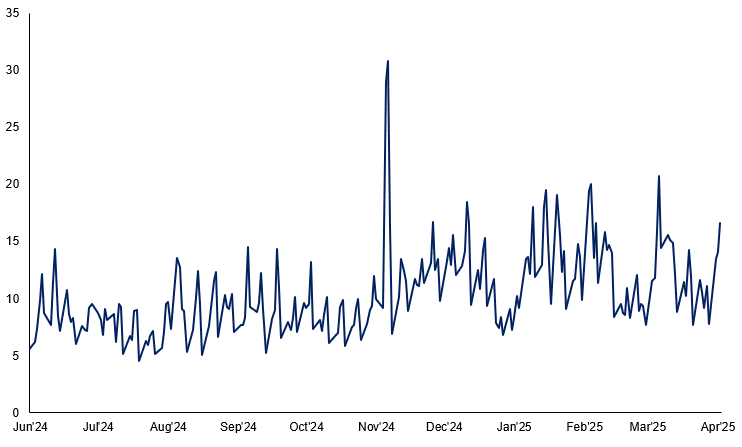

Figure 1: EUR/USD overnight vols spike to highest since Mar 6 German fiscal news

Source: MNI/Bloomberg

NEWS

US (BBG): Trump’s Tariff Plans Still in Limbo Ahead of Rose Garden Event

President Donald Trump’s deliberations over his plans to impose reciprocal tariffs are coming down to the wire, with his team said to be still finalizing the size and scope of new levies he is slated to unveil on Wednesday afternoon. In meetings on Tuesday, Trump’s team continued to hash out their options ahead of a Rose Garden event scheduled to begin as US markets close at 4 p.m. on Wednesday, people familiar with the ongoing discussions said. The White House has not reached a firm decision on their tariff plan, said the people, who spoke on the condition of anonymity, even though Trump himself said earlier in the week that he had “settled” on an approach.

US (WaPo): Trump Aides Draft Tariff Plans as Some Experts Warn of Economic Damage

White House aides have drafted a proposal to impose tariffs of about 20 percent on most imports to the United States, three people familiar with the matter said, as President Donald Trump pushes for the most aggressive overhaul of the global economic system in decades.

One person familiar with the administration's thinking said the White House believes that, combined with additional tariffs on sectors such as automobile and pharmaceutical imports, the tariff plan would raise more than $6 trillion in new federal revenue and amount to the biggest tax hike in decades. Administration officials are also discussing using this revenue to finance a tax rebate or dividend payment to most Americans, but planning around such a measure is highly preliminary, the people said.

US (WSJ): Liberal Wins Wisconsin Supreme Court Race in Rebuke of Trump, Musk

Elon Musk’s massive investment in a Wisconsin Supreme Court election didn’t pay off after a liberal judge secured a victory that could tarnish the billionaire’s political clout and trigger worry for some Republicans about how voters are processing the opening months of President Trump’s new administration. While the Wisconsin contest was the most significant election Tuesday, Republicans won two special House elections in Florida. Those races, in traditionally deeply red congressional districts, were closer than expected.

US (WaPo): White House Studying Cost of Greenland Takeover, Long in Trump’s Sights

The White House is preparing an estimate of what it would cost the federal government to control Greenland as a territory, according to three people with knowledge of the matter, the most concrete effort yet to turn President Donald Trump’s desire to acquire the Danish island into actionable policy. While Trump’s demands elicited international outrage and a rebuke from Denmark, White House officials have in recent weeks taken steps to determine the financial ramifications of Greenland becoming a U.S. territory, including the cost of providing government services for its 58,000 residents, the people said.

ISRAEL (MNI): IDF Expands Ground Offensive in Southern Gaza

Following the issuance of an evacuation order for southern Gaza on 1 April, the Israeli Defence Forces (IDF) have expanded their ground offensive in Rafah and the area leading up to Khan Younis following extensive airstrikes in both locations overnight. Defence Minister Israel Katz has said in a post on social media that "Expanding the operation this morning will increase the pressure on the Hamas murderers and also on the population in Gaza and advance the achievement of the sacred and important goal for all of us."

ECB (BBG): ECB to ‘Maintain Complete Freedom of Action,’ Rehn Says

The European Central Bank isn’t pre-committing to any particular path on interest rates, Governing Council member Olli Rehn reiterated in a speech on the Bank of Finland website. The ECB “will take decisions on rates at each meeting, the next being on 16 April,” Rehn said. “As there is currently pervasive uncertainty, the Governing Council will maintain complete freedom of action in setting its monetary policy”

GERMANY (MNI): IFO Expect US Tariffs to "Only Slightly Reduce German Exports"

IFO sees "new reciprocal US tariffs [to] reduce German exports to the United States by less than three percent. The IFO Institute has simulated these reciprocal tariffs, in other words, if the US were to increase tariffs on products by the amount levied by its trading partners on corresponding US products. If the EU were to take no countermeasures, German exports would fall by 2.4 percent."

GERMANY (MNI): Bankers Pessimistic About Growth Outlook

The Association of German Banks is painting a subdued picture for Germany's economy. Quarterly growth has alternated between positive and negative outcomes since Q4 2022 leaving Q4 2024 down 0.2% y/y and the group is forecasting it to recover to only 0.2% in 2025 revised down from 0.7%, according to projections seen by Reuters. It expects it to improve to 1.4% in 2026 helped by fiscal stimulus.

GREECE (MNI): PM Unveils Multi-Billion Euro 12-Yr Defence Programme

Speaking as part of a parliamentary briefing and debate on defence and armaments, PM Kyriakos Mitsotakis saying that his gov't is planning to spend E25bln as part of a new 12-year defence plan running to 2037. Mitsotakis claims that "There can be no progress without security," and that the moves announced today represent the most "dramatic restructuring of the Armed Forces in modern history."

CHINA (MNI EXCLUSIVE): China to Boost Developer Financing Support Further

MNI discusses potential incoming support aimed at China's property developers. On MNI Policy MainWire now, for more details please contact sales@marketnews.com.

CHINA (MNI): China Outlines More Controls on Prices

MNI (Beijing) China will establish a guideline-based price band mechanism for essential goods and improve emergency response systems to address abnormal price fluctuations, Xinhua reported, citing guidelines issued by General Office of the CPC Central Committee and the State Council on Wednesday. The authorities will align price policies with fiscal, monetary, industrial, and employment goals and set price expectations based on supply-demand dynamics, economic growth, market sentiment, and external inflationary pressures, the Guidelines said.

CHINA (BBG): China’s Government Is Selling Its First Sovereign Green Bond

China kicked off its first-ever sale of a green sovereign bond, as it looks to raise as much as 6 billion yuan ($826 million) in an offering it plans to list in London. The Chinese Ministry of Finance set the initial price guidances of the three-year and five-year offshore yuan-denominated notes at yields of 2.3% and 2.35%, according to a person familiar with the matter. The notes could be priced as early as today, the person added.

BOJ (MNI): BOJ's Ueda Voices Concern Over Tariffs Impact

Bank of Japan Governor Kazuo Ueda on Wednesday voiced concern that U.S. tariffs may have a significant impact on global trade, depending on their range and scale. “The whole picture of the tariffs is still uncertain but it will boost import prices in the short run," Ueda told lawmakers. "But its will restrict economic activity and then will put downward pressure on prices in the long run. Therefore, the uncertainties are high.” Ueda also voiced concern that the tariffs will have an impact on corporate and household sentiment, which would affect spending.

RBA (MNI): RBA to Adjust OMO Pricing From April 9

The Reserve Bank of Australia from April 9 will increase the price of all new open market operation (OMO) repos by 5 basis points to 10bp over the cash rate target as it transitions to an ample reserve system, Chris Kent, assistant treasurer (financial markets) told an industry forum on Wednesday. OMO will continue to be offered at a floating rate and the RBA will also introduce a seven-day term, in addition to the existing 28-day term, at each weekly OMO, Kent noted.

DATA

AUSTRALIA DATA (MNI): Positive Momentum in New Dwelling Approvals

- AUSTRALIA FEB BUILDING APPROVALS -0.3% M/M, +25.7% Y/Y

There was a small payback in February for the sharp rise in non-house building approvals over December/January but looking through the volatility the total number is trending robustly higher. While it fell 0.3% m/m in February, less than expected, it was up 25.7% y/y after 21.6% and 3-month annualised momentum continues to run just under 30%. There has been a significant demand/supply imbalance in Australian housing and the positive trend in building approvals is welcome news.

FOREX: Markets Poised for Liberation Day

- AUD and NZD are outperforming in early trade, with AUD/USD looking to test the 100-dma resistance at 0.6314 on any further strength. The USD is generally subdued, with markets clearly lacking directional conviction headed into today's tariff announcement.

- Trump's Rose Garden appearance at the US cash equity close is the sole focus Wednesday, with markets looking for clarity on 'Liberation Day' and what this means for the global trade order. Options remaining on the table are speculated to be a blanket tariff of ~20% on most US imports, a country-by-country approach or a tiered system. Regardless of the approach the White House go for, tariffs are expected to come into effect immediately, leaving markets fraught with risk through the session.

- Haven currencies are moderately softer - but the likes of CHF and JPY are still well ahead of support, meaning today's step lower in JPY, CHF may not be a direct indicator of risk-on. AUD/CHF has rallied Wednesday, but prices are meeting resistance at the formation of a downtrendline drawn off the early March highs.

- US final durable goods orders, ADP Employment Change and appearances from ECB's Schnabel, Holzmann, Lane & Lagarde are due.

BONDS: Bunds Outperform Ahead of U.S. Tariff Announcements

Bearish moves remain contained as participants await the “Liberation Day” tariff announcements out of the U.S. (scheduled for 16:00 ET/21:00 BST), providing some background demand for core global FI.

- EGBs outperform gilts, given perceptions surrounding higher EU sensitivity to tariffs and assumptions surrounding the prospect for deeper ECB easing if GDP growth is hit hard.

- Still, Bunds have failed to retest recent session highs and yields remain above the March 5 low (2.654%), which represents the base of the range seen since the “whatever it takes” fiscal stance was adopted.

- Yields flat to 2bp lower on the day, curve steepens.

- EGB spreads to Bunds biased wider, aided by a downtick in European equities ahead of the U.S. tariff announcement. Bund supply due shortly.

- ECB commentary fails to add to the debate, generally reaffirming well-documented themes. ~62bp of cuts priced through year-end, with ~19bp priced for this month’s meeting.

- Gilts underperform vs. Bunds (10-Year spread ~2bp wider) and with Tsys off yesterday’s highs.

- Futures within yesterday’s range and downtrend line resistance (92.42 today) remains untested.

- Yields ~2bp higher across the curve.

- 2s a handful of bp above March lows.

- 52bp of BoE cuts priced through year-end.

- ECBspeak from Schnabel, Lane, Holzmann and Escriva scheduled for today. Note that Lane will moderate a panel at the Bank’s AI conference, so don’t expect too much in the way of direct monetary policy comments from him.

- Little of note on the European & UK data calendars, which will leave focus on U.S. tariff decisions and data for much of the session.

EQUITIES: E-Mini S&P Softer Following This Week's Moderate Recovery

Eurostoxx 50 futures traded lower Monday resulting in a breach of key support at 5229.00, the Mar 11 low. The contract has recovered, however, the print below 5229.00 undermines a bullish theme and signals scope for a deeper retracement. The 5200 handle has also been cleared, opening 5079.00, the Feb 3 low. It is still possible that recent weakness is part of a broader correction. Initial firm resistance is 5335.34, the 20-day EMA. S&P E-Minis maintain a softer tone following recent bearish price action. Sights are on key support and the bear trigger at 5559.75, the Mar 13 low. It has been pierced, a clear break of it would confirm a resumption of the downtrend that started Feb 19, and open 5483.30, a Fibonacci projection. MA studies are in a bear-mode position, highlighting a dominant downtrend. Key short-term resistance has been defined at 5837.25, the Mar 25 high.

- Japan's NIKKEI closed higher by 101.39 pts or +0.28% at 35725.87 and the TOPIX ended 11.44 pts lower or -0.43% at 2650.29.

- Elsewhere, in China the SHANGHAI closed higher by 1.692 pts or +0.05% at 3350.127 and the HANG SENG ended 4.31 pts lower or -0.02% at 23202.53.

- Across Europe, Germany's DAX trades lower by 237.57 pts or -1.05% at 22289.64, FTSE 100 lower by 39.42 pts or -0.46% at 8591.22, CAC 40 down 37.44 pts or -0.48% at 7833.9 and Euro Stoxx 50 down 31.2 pts or -0.59% at 5285.1.

- Dow Jones mini down 61 pts or -0.14% at 42177, S&P 500 mini down 11.5 pts or -0.2% at 5663.25, NASDAQ mini down 49.75 pts or -0.25% at 19559.25.

Time: 09:50 BST

COMMODITIES: Gold Trend Remains Bullish Following Sequence of Record Highs

WTI futures traded sharply higher Monday. This undermines the medium-term bearish condition and instead signals scope for a continuation higher near-term. The rally has exposed the next key resistance at $72.91, the Feb 11 high. Clearance of this level would strengthen the bullish theme. On the downside, initial firm support to watch lies at $69.01, the 20-day EMA. A breach of this level would signal a potential reversal. The trend condition in Gold is unchanged, it remains bullish. The latest rally reinforces current conditions and confirms a continuation of the primary uptrend. The rally also once again, highlights fresh all-time highs for the yellow metal. Sights are on the $3151.5, a Fibonacci projection. Support to watch lies at $3004.9, the 20-day EMA. A pullback would be considered corrective.

- WTI Crude down $0.2 or -0.28% at $71.09

- Natural Gas up $0.02 or +0.48% at $3.967

- Gold spot up $20.3 or +0.65% at $3133.08

- Copper up $3.7 or +0.73% at $505.7

- Silver up $0.31 or +0.93% at $34.0041

- Platinum down $6.15 or -0.62% at $985.32

Time: 09:50 BST

| Date | GMT/Local | Impact | Country | Event |

| 02/04/2025 | 1030/1230 | ECB's Schnabel At SciencesPo Conference | ||

| 02/04/2025 | 1100/0700 | ** | MBA Weekly Applications Index | |

| 02/04/2025 | 1215/0815 | *** | ADP Employment Report | |

| 02/04/2025 | 1400/1000 | ** | Factory New Orders | |

| 02/04/2025 | 1405/1605 | ECB's Lane At AI Conference | ||

| 02/04/2025 | 1430/1030 | ** | DOE Weekly Crude Oil Stocks | |

| 02/04/2025 | 2030/1630 | Fed Governor Adriana Kugler | ||

| 03/04/2025 | 2200/0900 | * | S&P Global Final Australia Services PMI | |

| 03/04/2025 | 2200/0900 | ** | S&P Global Final Australia Composite PMI | |

| 03/04/2025 | 0030/1130 | Job Vacancies | ||

| 03/04/2025 | 0030/1130 | ** | Trade Balance | |

| 03/04/2025 | 0030/0930 | ** | S&P Global Final Japan Services PMI | |

| 03/04/2025 | 0030/0930 | ** | S&P Global Final Japan Composite PMI | |

| 03/04/2025 | 0145/0945 | ** | S&P Global Final China Services PMI | |

| 03/04/2025 | 0145/0945 | ** | S&P Global Final China Composite PMI | |

| 03/04/2025 | 0630/0830 | *** | CPI | |

| 03/04/2025 | 0700/0300 | * | Turkey CPI | |

| 03/04/2025 | 0715/0915 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0715/0915 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0720/0920 | ECB's De Guindos On "Financial Stability In Uncertain Times" | ||

| 03/04/2025 | 0745/0945 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0745/0945 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0750/0950 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0750/0950 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0755/0955 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0755/0955 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0800/1000 | ** | S&P Global Services PMI (f) | |

| 03/04/2025 | 0800/1000 | ** | S&P Global Composite PMI (final) | |

| 03/04/2025 | 0830/0930 | Decision Maker Panel data | ||

| 03/04/2025 | 0830/0930 | ** | S&P Global Services PMI (Final) | |

| 03/04/2025 | 0830/0930 | *** | S&P Global/ CIPS UK Final Composite PMI | |

| 03/04/2025 | 0900/1100 | ** | PPI | |

| 03/04/2025 | 0900/1000 | ** | Gilt Outright Auction Result | |

| 03/04/2025 | 1000/1200 | ECB's Schnabel At OECD Seminar | ||

| 03/04/2025 | 1230/0830 | *** | Jobless Claims | |

| 03/04/2025 | 1230/0830 | ** | WASDE Weekly Import/Export | |

| 03/04/2025 | 1230/0830 | ** | International Merchandise Trade (Trade Balance) | |

| 03/04/2025 | 1230/0830 | ** | International Merchandise Trade (Trade Balance) | |

| 03/04/2025 | 1230/0830 | ** | Trade Balance | |

| 03/04/2025 | 1345/0945 | *** | S&P Global Services Index (final) | |

| 03/04/2025 | 1345/0945 | *** | S&P Global US Final Composite PMI | |

| 03/04/2025 | 1400/1000 | *** | ISM Non-Manufacturing Index | |

| 03/04/2025 | 1430/1030 | ** | Natural Gas Stocks | |

| 03/04/2025 | 1530/1130 | ** | US Bill 04 Week Treasury Auction Result | |

| 03/04/2025 | 1530/1130 | * | US Bill 08 Week Treasury Auction Result | |

| 03/04/2025 | 1630/1230 | Fed Vice Chair Philip Jefferson | ||

| 03/04/2025 | 1830/1430 | Fed Governor Lisa Cook |