MNI US OPEN - OPEC+ Discussing Another Output Hike in July

EXECUTIVE SUMMARY

- TRUMP TELLS EUROPEAN LEADERS IN PRIVATE THAT PUTIN ISN’T READY TO END WAR

- HOUSE DEBATING GOP MEGABILL, VOTE EXPECTED AROUND 05:00 ET

- OPEC+ DISCUSSES ANOTHER SUPER-SIZED OUTPUT HIKE FOR JULY

- FRENCH FLASH PMI DETAILS POINT IN A DOVISH DIRECTION

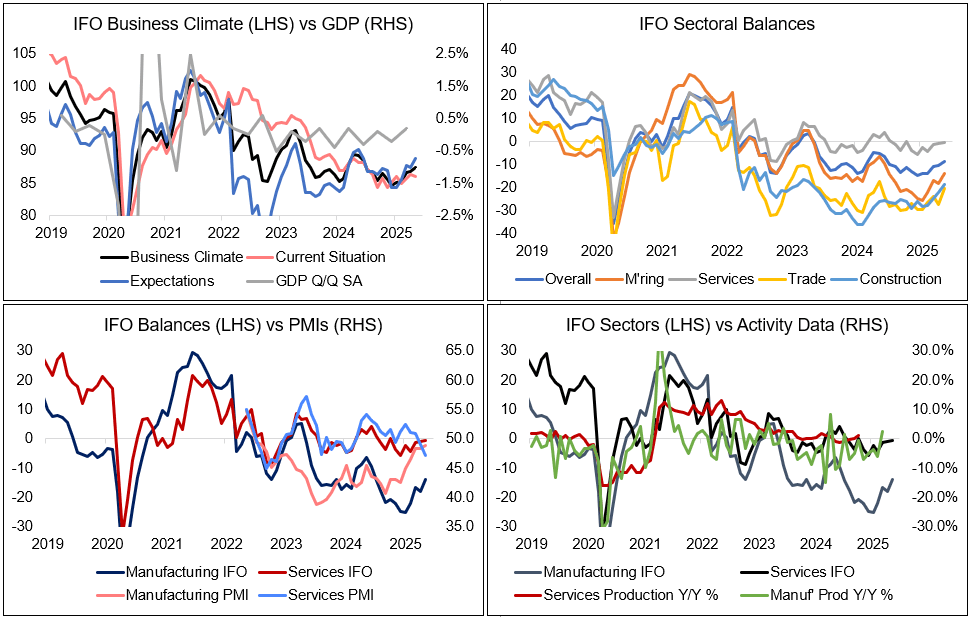

Figure 1: German IFO continues upward grind in May with firmer expectations

NEWS

US/RUSSIA/UKRAINE (WSJ): Trump Tells European Leaders in Private That Putin Isn’t Ready to End War

On a call Monday, President Trump told European leaders that Russian President Vladimir Putin isn’t ready to end the Ukraine war because he thinks he is winning, according to three people familiar with the conversation. The acknowledgment was what European leaders had long believed about Putin—but it was the first time they were hearing it from Trump. It also ran counter to what Trump has often said publicly, that he believes Putin genuinely wants peace.

US (MNI): House Debating GOP Megabill, Vote Expected Around 05:00 ET

The US House of Representatives is currently debating the Republican tax and spending reconciliation bill known as the 'One Big Beautiful Bill', with a roll call vote on final passage of the package expected at around 05:00 ET 10:00 BST. The vote comes after a marathon standoff between GOP leadership and Republican conservatives in the House Rules Committee, which was resolved by an intervention from President Donald Trump. A final procedural vote to advance the package for a full House approved the bill 217-212, with Rep Thomas Massie (R-KY) the only Republican to vote 'no'. The vote saw key conservative holdout Rep Chip Roy (R-TX) vote 'yes', suggesting the bill is on track to pass.

US (BBG): Trump Tax Bill Holdouts Lured With SALT Hike, Medicaid Cuts

House Republican leaders released a new version of President Donald Trump’s massive tax and spending bill with a higher limit on the deduction for state and local taxes and other changes in a bid to win over warring GOP factions to support the legislation. The updated legislation released Wednesday night also would speed up cuts to Medicaid and elimination of Biden-era clean energy tax breaks, a demand of hardline conservatives. A White House official said Wednesday night that Trump was very supportive of the revised bill. Yet it wasn’t immediately clear whether the revisions would attract enough support to pass the House, where Republicans hold a slender majority and can only afford to lose a few votes.

OIL (BBG): OPEC+ Discusses Another Super-Sized Output Hike for July

OPEC+ members are discussing making a third consecutive oil production surge in July, to be decided at the group’s meeting in just over a week, delegates said. An output hike of 411,000 barrels a day for July — triple the amount initially planned — is among options under discussion, although no final agreement has yet been reached, said the delegates, asking not to be named because the information is private. A final decision is due to be taken at a gathering on June 1.

ECB (BBG): ECB’s Vujcic Says Inflation Is Slowly Converging to 2% Target

European Central Bank Governing Council member Boris Vujcic said consumer-price growth is heading toward the 2% goal. “Inflation is slowly but systemically converging to our target,” he said in Opatija, Croatia. “We expect to get close to that target at the end of 2025, and to reach target in early 2026.” Vujcic’s comments chime with the ECB’s March projections, which will be updated in two weeks time at the next interest-rate decision. Several of his colleagues have been more confident on reaching the target this year already, with some even warning of the danger of undershooting that level.

UK (MNI): UK High Court Temporarily Bans Chagos Island Handover

The UK High Court has issued a temporary ban on the British gov't concluding talks with Mauritius that would see the Chagos Islands (formally 'the British Indian Ocean Territory') transferred to Mauritian sovereignty. The ban delivers "interim relief" to Chagossian Bertrice Pompe, who is engaged in legal action against the Foreign Office. The transfer of the Islands has been a political hot topic in the UK since the Labour gov't came to power in July 2024. Critics argue that giving the Islands, which are the location of a major joint UK and US naval and air force base on Diego Garcia, to a country that is seen as a close ally of China in the region represents a security risk.

FRANCE (BBG): France Urged to Ramp Up Debt-Cutting Push in IMF Budget Warning

France will achieve the smaller deficit it aims for this year but must be ready to make further significant efforts in the future to tackle rising debt, the International Monetary Fund said. In its Article IV review, the Washington-based institution said the country’s shortfall gap is on track to narrow to the government’s target of 5.4% of economic output this year. It forecast growth just 0.1 point shy of the 0.7% in the public finances law.

JAPAN (BBG): Japan’s Largest Business Lobby Reports Pay Hikes Exceeding 5%

Japan’s top business lobby reported that workers at affiliated companies won pledges for pay hikes exceeding 5% for a second consecutive year, an outcome that points to continued momentum in wage increases fueled by the worsening labor crunch. Some 620,000 workers at 97 major companies affiliated with the Japan Business Federation, or Keidanren, saw average pay raises of 5.38% as a result of this year’s wage negotiations, the group reported Thursday in a preliminary tally. While slightly below last year’s corresponding figure of 5.58%, the outcome was more than twice the 20-year average of approximately 2.3%.

BOJ (MNI): BOJ's Noguchi Calls for Measured Rate Hikes

The Bank of Japan will adjust its policy interest rate cautiously and in stages to ensure inflation stabilises around 2%, noting the path forward will depend on underlying economic trends, board member Asahi Noguchi told business leaders in Miyazaki City Thursday. “In doing so, I believe it is crucial that the Bank take a measured, step-by-step approach as follows,” Noguchi said, declining to specify the timing or scale of future hikes. He emphasised that each policy rate increase should be followed by a thorough review of economic conditions. “The Bank takes sufficient time to examine the economic impact of the rate hike each time it raises the policy interest rate; the Bank then decides on the next policy rate hike after adequately assessing both upside and downside risks at each point in time,” he said.

RBA (BBG): RBA’s Hauser Sees US-China Trade Dispute Aiding Australian Firms

Australian iron ore miners, steelmakers and other firms see potential opportunities in the US-China trade rift, with many upbeat about the outlook, according to Reserve Bank Deputy Governor Andrew Hauser. Hauser visited the RBA’s team in Beijing during the week after President Donald Trump announced massive new import duties on China, which in turn retaliated against the US. Since then, the two countries have agreed to a 90-day moratorium and temporarily reduced tariffs on each others’ goods to allow space to negotiate.

DATA

GERMANY DATA (MNI): Prices Soft; Manufactured Goods Exports to the US Strong

- GERMANY MAY FLASH MANUF PMI 48.8 (48.8 FCAST, 48.4 APRIL)

An unexpected German flash PMI report with the headline manufacturing index in line with expectations but misses of around 2 points versus consensus for services and composite. On the price front there was an easing of output prices while input prices were also subdued. That was similar to in France. However, there were strong export orders for manufactured goods, particularly from the US - which was not expected and which keeps the manufacturing index in line with expectations. "On the price front, May saw the rate of inflation in average charges for goods and services ease to a seven-month low, with slower service sector price increases coinciding with a renewed decline in manufacturing factory gate charges."

GERMANY DATA (MNI): IFO Continues Upward Grind in May With Firmer Expectations

- GERMANY MAY IFO BUSINESS CLIMATE INDEX 87.5

Germany's IFO Business Climate Index in May continued its upward grind seen since January, at 87.5 (86.9 prior), slightly surpassing expectations of 87.3 for its highest since Jun 2024 (2015=100). The print appears more optimistic than the flash PMI release earlier today, with both services and manufacturing sentiment rising according to IFO. Overall, "the German economy is slowly regaining its footing", IFO comments. Higher expectations of 88.9 (vs 88.0 cons; 87.4 prior) were responsible for the overall uptick, while the current assessment deteriorated slightly to 86.1 (vs 86.6 cons; 86.4 prior).

FRANCE DATA (MNI): Flash PMI Details Point in a Dovish Direction

- FRANCE MAY FLASH MANUF PMI 49.5 (48.9 FCAST, 48.7 APRIL)

The underlying details of the French flash PMIs point in a dovish direction with the sharpest fall in selling prices since January 2021 and expectations for activity over the next 12 months negative for the first time in 6 months and the future activity index at the lowest level since April 2020. "Restricting business activity levels was another marked reduction in new order intakes, with services companies reporting the more pronounced drop in sales out of the two monitored sectors. Competition for work prompted the sharpest monthly fall in selling prices since January 2021."

FRANCE MAY MANUF SENTIMENT AT 97 (MNI)

UK DATA (MNI): Flash PMI Details Point to High Costs and Low Demand

- UK MAY FLASH MANUF PMI 45.1 (46.1 FCAST, 45.4 APRIL)

Downside surprise of a point to flash manufacturing PMI (45.1 vs 45.4 prior, 46.1 exp) with the composite and services PMIs coming broadly in line with expectations. There was poor demand from the US for exports (in contrast to Germany) while private second new work fell the most for 2 and a half years. Costs saw sharp increases (albeit smaller than April). Overall, a rather stagflationary print. "Measured overall, new work across the private sector economy fell to the greatest extent for two-and-a-half years. This was often attributed to cutbacks to non-essential spending and delayed investment decisions among clients amid rising global economic uncertainty."

UK APR PSNCR GBP9.12 BN (MNI)

UK APR PSNB GBP+20.16 BN (MNI)

UK APR CGNCR GBP15.7 BN (MNI)

UK APR PSNB-X GBP+20.16 BN (MNI)

CHINA DATA (MNI): China Outbound Investment Up 7.5% Y/Y

MNI (Beijing) China’s total outbound direct investment reached USD57.5 billion between January and April, up 7.5% y/y, the country’s Ministry of Commerce announced on Thursday, noting USD51 billion represented non-financial investment, up 5.6% y/y. Investment in countries participating in the Belt and Road Initiative (BRI) reached USD12.7 billion, up 16.4%, while China’s overseas contracted engineering projects’ turnover reached USD47 billion, up 6.8% y/y, the ministry said.

CHINA DATA (MNI): China Power Capacity Up 15.9% Y/Y

MNI (Beijing) China’s total installed power generation capacity reached 3.5 billion kilowatts at the end of April, up 15.9% y/y, data released by the National Energy Administration showed on Thursday. Installed solar power capacity hit 990 million kilowatts, up 47.7% y/y, while wind power achieved 540 million kilowatts, an increase of 18.2% y/y, the data showed. On Tuesday, the administration announced national electricity consumption totalled 772.1 billion kilowatt hours in April, up 4.7% y/y, while January to April demand rose 3.1% y/y.

JAPAN DATA (MNI): March Core Machine Orders Well Above Estimates

- JAPAN MARCH CORE MACHINE ORDERS +13.0% M/M; FEB +4.3%

Japan core machine orders for March printed well above market estimates. The m/m outcome was+13% against a -1.6% forecast, while prior was 4.3%. In y/y terms we rose 8.4%, against a -1.8% forecast and 1.5% prior. Still, given the Q2 outlook and beyond is being impacted by tariffs and trade uncertainty, the result is unlikely to shift steady BoJ thinking in the near term. The detail showed manufacturing orders up a strong 8.0% in m/m terms

JAPAN DATA (MNI): Preliminary May PMIs Mixed, Manufacturing Edges Up, Services Weaker

Japan preliminary PMIs for May were mixed. The manufacturing read was 49.0 versus 48.7 in April (per Jibun Bank). The index has been sub 50 since mid last year. The services PMI fell to 50.8 from 52.4 in March, which dragged down the composite read to 49.8 form 51.2 prior. In terms of the detail, manufacturing output fell to 48 from 48.9, but new orders did rise. On the services side, employment edged down to 51 from 52.1 (per BBG), while prices charged were also down on the April read.

AUSTRALIA DATA (MNI): Q2 Slowdown Suggested by PMI Data

The preliminary May S&P Global composite PMI showed a moderation in growth with the index easing to 50.6 from 51, the lowest since February. The quarterly averages are showing that after a slight pickup in private sector growth in Q1 it likely slowed a bit in Q2. The manufacturing PMI was stable at 51.7, while services eased to 0.5 points to 50.5, lowest since November.

NEW ZEALAND DATA (MNI): Growth Environment Drives Weaker Public Finance Outlook

The NZ government continues to expect the budget to be in surplus in FY29, while the timing is unchanged the amount has been revised down and is flat as a share of GDP. From FY26 deficits were revised higher due to weaker revenue as growth was revised down near-term and unemployment higher. A similar pattern is likely in the updated RBNZ staff forecasts released May 28. CPI inflation was revised up this financial year but still around the mid-point of the target band over the forecast horizon.

FOREX: USD Index Off Lows as Yield Curve Consolidates Steepening

- The USD Index trades higher, with the greenback gaining against most others in G10 as the long-end of the yield curve consolidates after yesterday's upside. The 30y yield hit 5.1% at the high, and holds within range of that level into the NY crossover, as angst over the White House's fiscal plans continues to play out in bond markets. A vote on the Big Beautiful Bill could come imminently as the House pulls an all-nighter, leaving ample headline risk ahead of the Thursday opening bell.

- USD/JPY makes light work of overnight lows following the European PMIs. German and French prelim data held up well for manufacturing, but showed a services sector that remains weaker than forecast. This morning's price action sees spot drift through downtrendline support drawn off the May 14 low on the 15-minute candle chart (trendline last at 142.99), extending the downside scope to include layered support between 141.99 - 142.36.

- The strong co-movement between USD/JPY and longer-end US yields remain the key driver here, a relationship that's firmed since mid-March - and the cemented break above 5% in 30-year yields this week poses further downside risks for USDJPY.

- Prelim US PMI numbers due later today are expected to show US activity broadly inline with April - showing generally few material signs of an economic slowdown as a result of Trump's tariffs. Existing home sales and weekly jobless claims data are also due. The central bank speaker slate is busier, with BoE's Breeden, Dhingra & Pill all set to speak - and comment touching on this week's higher-than-expected UK inflation print will be carefully watched. Fed's Barkin & Williams are also set to make appearances, as well as ECB's Elderson, de Guindos & Nagel.

EGBS: Spreads to Bunds Little Changed, SPGB & OAT Auctions Pass Smoothly

EGB spreads to Bunds little changed to 1bp wider, with the modest widening mostly driven by the dip in equities and presence of supply, in addition to wider pressure stemming from U.S. fiscal concerns & tepid demand at the latest 20-Year Tsy auction.

- The 10-Year BTP/Bund spread continues to hover around 100bp.

- We have previously argued that sustained moves below 100bp likely require more meaningful progress in EU-U.S. trade talks.

- We also highlighted that positive action from Moody's at tomorrow’s scheduled rating review of Italy could also provide a catalyst for further narrowing.

- On that update, Citi suggest that “recent fiscal developments should be supportive for an upward move, especially as Moody’s currently rates Italy below both S&P and Fitch. Still, the key criteria set in March for an upgrade was some evidence that the economy could grow at a sustainably stronger pace beyond the NGEU-stimulus, especially in the light of an ageing population, which remains a hurdle. On balance, the recent fiscal trajectory perhaps supports a change in the outlook to positive, potentially as soon as this week. Such an outcome could support further richening for BTP on ASW given how cheap they remain compared to their other EMU counterparts”.

- OAT and SPGB supply passed smoothly enough, helping to remove any pre-auction concession.

- No reaction in OATs to recent comments from the IMF suggesting that France is on track to meet it 5.4% deficit goal for the current year. The Fund also underscored the need for further French fiscal efforts.

GILTS: Longer Term Uptrend In 10s Reasserts Itself

10-Year gilt yields have broken above the short-term downtrend line drawn off the early ’25 high over the past couple of sessions, allowing the longer-term uptrend to reassert itself, after hawkish BoE developments, firmer-than-expected UK CPI data and sensitivity to U.S. fiscal worries pushed yields higher in recent weeks.

- Next upside targets of note located at the April (4.800%) & March (4.809%) highs, with benchmark 10s last trading at 4.765% vs. session highs of 4.788%.

Figure 2: 10-Year Gilt Yields

Source: MNI/Bloomberg

EQUITIES: Bullish Theme in E-Mini S&P Intact Despite Recent Pullback

Eurostoxx 50 futures continue to trade at their recent highs and a bullish theme remains intact. The contract is extending the recent breach of 5263.01, 76.4% of the Mar 3 - Apr 7 bear leg, and maintains the sequence of higher highs and higher lows. Sights are on 5516.00, the Mar 3 high and the key bull trigger. Key support to watch lies at 5211.33, the 50-day EMA. Clearance of this level would signal a possible reversal. A bullish trend condition in S&P E-Minis remains intact and the latest pullback is considered corrective. An important resistance at 5837.25, the Mar 25 high and a bull trigger, has recently been cleared. This has strengthened the current bullish theme, and paves the way for a continuation near-term. Sights are on the 6000.00 handle next. Initial firm support to watch lies at 5703.54, the 50-day EMA. A clear break of it would highlight a potential reversal.

- Japan's NIKKEI closed lower by 313.11 pts or -0.84% at 36985.87 and the TOPIX ended 15.79 pts lower or -0.58% at 2717.09.

- Elsewhere, in China the SHANGHAI closed lower by 7.385 pts or -0.22% at 3380.188 and the HANG SENG ended 283.47 pts lower or -1.19% at 23544.31.

- Across Europe, Germany's DAX trades lower by 144.2 pts or -0.6% at 23977.95, FTSE 100 lower by 56.61 pts or -0.64% at 8730.02, CAC 40 down 54.89 pts or -0.69% at 7855.6 and Euro Stoxx 50 down 38.53 pts or -0.71% at 5415.93.

- Dow Jones mini down 15 pts or -0.04% at 41933, S&P 500 mini up 10.5 pts or +0.18% at 5871.5, NASDAQ mini up 55.5 pts or +0.26% at 21212.25.

Time: 10:00 BST

COMMODITIES: Reversal Signal in WTI Strengthens a Bearish Theme

WTI futures traded to a fresh short-term cycle high Wednesday before finding resistance. The recovery since Apr 9, still appears corrective. Key resistance to watch is $62.82, the 50-day EMA. It has been pierced, a clear break of it would highlight a stronger reversal and open $65.82, Apr 4 high. For bears a reversal lower would refocus attention on $54.33, the Apr 9 low and bear trigger. Yesterday’s price pattern is a shooting star candle - a reversal signal. Gold has recovered from its recent lows and is again trading higher, today. The climb signals the end of the corrective phase between Apr 22 - May 15. Medium-term trend signals remain bullish - moving average studies are in a bull-mode position highlighting a dominant uptrend. A continuation would open $3435.6 next, the May 7 high. Key support and the bear trigger has been defined at $3121.0, the May 15 low.

- WTI Crude down $0.68 or -1.1% at $60.86

- Natural Gas down $0.04 or -1.25% at $3.326

- Gold spot down $4.45 or -0.13% at $3312.64

- Copper up $1.3 or +0.28% at $468.4

- Silver down $0.04 or -0.12% at $33.355

- Platinum down $3.69 or -0.34% at $1073.6

Time: 10:00 BST

| Date | GMT/Local | Impact | Country | Event |

| 22/05/2025 | 1000/1100 | ** | CBI Industrial Trends | |

| 22/05/2025 | 1050/1150 | BOE's Breeden On Climate Panel | ||

| 22/05/2025 | 1100/1200 | BOE's Dhingra On UK Productivity Panel | ||

| 22/05/2025 | 1130/1330 | ECB April Minutes Released | ||

| 22/05/2025 | 1200/0800 | Richmond Fed's Tom Barkin | ||

| 22/05/2025 | 1230/0830 | *** | Jobless Claims | |

| 22/05/2025 | 1230/0830 | ** | WASDE Weekly Import/Export | |

| 22/05/2025 | 1230/0830 | * | Industrial Product and Raw Material Price Index | |

| 22/05/2025 | 1230/1330 | BOE's Pill At MonPol Conference (Text 16:30BST) | ||

| 22/05/2025 | 1300/1500 | ** | BNB Business Confidence | |

| 22/05/2025 | 1345/0945 | *** | S&P Global Manufacturing Index (Flash) | |

| 22/05/2025 | 1345/0945 | *** | S&P Global Services Index (flash) | |

| 22/05/2025 | 1400/1000 | *** | NAR existing home sales | |

| 22/05/2025 | 1400/1000 | * | Services Revenues | |

| 22/05/2025 | 1430/1030 | ** | Natural Gas Stocks | |

| 22/05/2025 | 1500/1100 | ** | Kansas City Fed Manufacturing Index | |

| 22/05/2025 | 1500/1700 | ECB's Elderson Dinner Speech at Biodiversity Day | ||

| 22/05/2025 | 1530/1130 | ** | US Bill 04 Week Treasury Auction Result | |

| 22/05/2025 | 1530/1130 | * | US Bill 08 Week Treasury Auction Result | |

| 22/05/2025 | 1535/1735 | ECB's de Guindos Speech in Madrid | ||

| 22/05/2025 | 1700/1300 | ** | US Treasury Auction Result for TIPS 10 Year Note | |

| 22/05/2025 | 1800/1400 | New York Fed's John Williams | ||

| 22/05/2025 | 1900/1500 | New York Fed's Roberto Perli | ||

| 23/05/2025 | 2301/0001 | ** | Gfk Monthly Consumer Confidence | |

| 23/05/2025 | 2330/0830 | *** | CPI | |

| 23/05/2025 | 0600/0800 | ** | Unemployment | |

| 23/05/2025 | 0600/0700 | *** | Retail Sales | |

| 23/05/2025 | 0600/0800 | *** | GDP (f) | |

| 23/05/2025 | 0645/0845 | ** | Consumer Sentiment | |

| 23/05/2025 | 0830/1030 | ECB's Lane Inflation Lecture in Florence | ||

| 23/05/2025 | 1230/0830 | * | Quarterly financial statistics for enterprises | |

| 23/05/2025 | 1230/0830 | ** | Retail Trade | |

| 23/05/2025 | 1230/0830 | ** | Retail Trade | |

| 23/05/2025 | 1335/0935 | Kansas City Fed's Jeff Schmid | ||

| 23/05/2025 | 1400/1000 | *** | New Home Sales | |

| 23/05/2025 | 1400/1000 | *** | New Home Sales | |

| 23/05/2025 | 1600/1800 | ECB's Schnabel Speech on Financial Education and Monpol | ||

| 23/05/2025 | 1600/1200 | Fed Governor Lisa Cook | ||

| 23/05/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 23/05/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly |