MNI US OPEN - Risk Rallies on Tariff Legality Judgement

EXECUTIVE SUMMARY

- U.S. TRADE COURT RULES AGAINST TRUMP TARIFFS

- NVIDIA QUARTERLY REVENUE SURGES NEARLY 70% DESPITE CHINA CURBS

- U.S. PAUSES EXPORTS OF AIRPLANE AND SEMICONDUCTOR TECHNOLOGY TO CHINA

- ECB’S KAZIMIR CONVICTED OF BRIBERY AND GIVEN €200,000 FINE

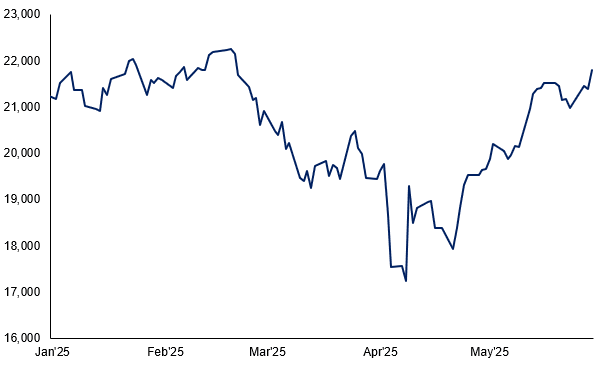

Figure 1: Nasdaq futures rally to 3-month high on U.S. Trade Court ruling and Nvidia earnings beat

Source: MNI/Bloomberg

NEWS

US (MNI): U.S. Trade Court Rules Against Trump Tariffs

The U.S. Court of International Trade ruled Wednesday that President Donald Trump's April 2 tariffs superseded his executive authority and sidelined Congress, a key setback to the administration's agenda that adds a new layer of uncertainty into an already clouded economic outlook. "Worldwide and Retaliatory Tariffs do not comply with the limitations Congress imposed upon the President’s power to respond to balance-of-payments deficits," the court said in its ruling.

US (FT): Nvidia Quarterly Revenue Surges Nearly 70% Despite China Curbs

Nvidia reported a nearly 70 per cent surge in quarterly revenues, as the boom in spending on artificial intelligence chips continued despite rising economic uncertainty and export controls that have dented the chip company’s China sales. Nvidia on Wednesday reported revenue of $44.1bn for the quarter to April 27, up 69 per cent year on year and above Wall Street’s expectations of $43.3bn. But the US chip designer at the heart of a global spending spree on the infrastructure powering AI said it expected revenue of $45bn for the current quarter, plus or minus 2 per cent, slightly below Bloomberg consensus estimates of $45.5bn.

US/CHINA (NYT): U.S. Pauses Exports of Airplane and Semiconductor Technology to China

The Trump administration has suspended some sales to China of critical U.S. technologies, including those related to jet engines, semiconductors and certain chemicals. The move is a response to China’s recent restrictions on exports of critical minerals to the United States, a decision by Beijing that has threatened to cripple U.S. company supply chains, according to two people familiar with the matter. The new limits are pushing the world’s largest economies a step closer toward supply chain warfare, as Washington and Beijing try to flex their power over essential economic components in an attempt to gain the upper hand in an intensifying trade conflict.

US/CHINA (BBG): China Urges US to End Chip Controls, Discriminatory Measures

China has held discussions with the US on multiple occasions since talks in Geneva regarding its export control measures in the semiconductor field, He Yongqian, spokesperson for the Ministry of Commerce, says at a press conference. China urges the US to stop discriminatory and restrictive measures and jointly safeguard consensus reached at the Geneva talks.

US/CHINA (BBG): US to Revoke Chinese Student Visas in Escalating Crackdown

The US plans to start “aggressively” revoking visas for Chinese students, Secretary of State Marco Rubio said, escalating the Trump administration’s push for greater scrutiny of foreigners attending American universities. Rubio said in a statement that students affected would include “those with connections to the Chinese Communist Party or studying in critical fields.” The US will also enhance scrutiny “of all future visa applications from the People’s Republic of China and Hong Kong,” he added. China had the second most students in the US of any country in 2024, behind India.

US/JAPAN (BBG): Japan’s Akazawa Heads to US for Latest Round of Tariff Talks

Japan’s top trade negotiator Ryosei Akazawa is headed to Washington for his fourth round of trade negotiations with the US, signaling that talks will continue as expected despite a US court ruling that declared the tariffs illegal. “We are aware of the reports about the ruling and I will refrain from making any premature comments on the impact this may have on Japan-US negotiations,” Akazawa said Thursday, repeating comments made by the nation’s chief cabinet secretary earlier in the day. “But we intend to thoroughly examine the content of the ruling and its implications and respond appropriately.”

ISRAEL (MNI): Ynet - PM Orders Readiness for Attack on Iran Facilities w/o US Backing

Israel's Ynet reports that Prime Minister Benjamin Netanyahu has instructed the Israeli Defence Forces (IDF) to ensure readiness for aerial attacks on Iran's nuclear facilities, even though the Trump administration has warned Israel off launching strikes without Washington's go-ahead. The report claims that despite President Trump stating on 28 May that "I told [Netanyahu] this would be inappropriate to do right now because we're very close to a solution now", the Israeli gov't is minded to maintain combat readiness. This is because the Netanyahu administration "is convinced: even if we attack without coordination, [the US] will assist in the face of an Iranian counterattack".

ECB (BBG): ECB’s Kazimir Convicted of Bribery and Given €200,000 Fine

European Central Bank Governing Council member Peter Kazimir was found guilty of bribery and handed a €200,000 fine ($225,380), becoming the first Slovak governor to get convicted. A court near Bratislava, where Kazimir also heads the central bank, said Thursday that if he fails to pay the fine he will need to serve a one year sentence in prison. His lawyers said they will advise Kazimir to appeal the verdict. The 56-year-old had denied bribing a senior tax official €48,000 in exchange for expediting VAT refunds for some companies during his tenure as finance minister. Despite the conviction and his term ending on June 1, Kazimir looks set to remain in his post for now — meaning he’ll continue to play a part in ECB decision-making.

GERMANY (MNI): Coalition Measures Include Doubling Down on Infra & Streamlining Taxes

The German government overnight announced a timeline for measures of an "immediate program" to underpin the struggling economy. Most measures flagged appear to have been touted by media reports and/or the coalition agreement before, meaning there are few surprises.

UK (FT): Ministers Look At Softening UK Welfare Cuts to Avert Rebellion by Labour MPs

Ministers are considering a softening of their contentious UK welfare reforms that could allow up to 200,000 people to keep their disability benefits, as the government seeks to stave off a backbench rebellion. In March, Sir Keir Starmer unveiled plans to reform the welfare system to save the government about £5bn a year by scaling back disability benefits known as “personal independence payments”. One of the changes being looked at was a tweak to the proposed Pip assessment rules so that individuals who do not receive at least four points in any category, but do receive a high overall score, would still be eligible, according to two people briefed on the discussions.

BOK (MNI): Bank of Korea Cuts Policy Rate to 2.50%

The Bank of Korea on Thursday decided to lower the base rate 25 basis points to 2.50% on the back of growing concern over slower economy caused by weak domestic demand and exports, driven by U.S. trade policy, Yonhap News Agency reported. The focus has shifted to how Governor Rhee Chang-yong refers to the outlook for further rate cuts at a news conference later today. The next BOK meeting is scheduled for July 10 following the conclusion of the 90-day tariff reprieve announced by U.S. President Donald Trump.

TAIWAN (MNI): CB Sees Financial System Stable Despite Broad FX Losses in April

Taiwan's 2025 financial stability report certainly eyed more carefully after recent currency volatility. The report states the insurance sector suffered a TWD 118bln FX loss in January - April (USD/TWD dropped 3.6% in April alone), but losses would have been well over double that on a pre-hedging basis (TWD 322bln), and as such the financial system remains generally stable.

RBNZ (BBG): RBNZ Governor Hawkesby Says July Rate Cut ‘Is Not a Done Deal’

New Zealand’s central bank could hold the Official Cash Rate steady at its next policy decision in July, Governor Christian Hawkesby said. “The main message we were looking to get to markets was that, when we next meet in July a further cut in the OCR is not a done deal, it’s not something that’s programmed in,” Hawkesby told Bloomberg Television Thursday in Wellington. “We’re really more in a phase where we are taking considered steps, data dependent. The markets need to follow developments really closely to get a feel for what it means for us.”

MNI SARB PREVIEW - MAY 2025: Will SARB Resume Cuts?

Consensus is leaning towards a 25bp cut at South African Reserve Bank’s monetary policy meeting this week, as recent price dynamics have proven relatively benign, with headline inflation tracking below the +3.0-6.0% Y/Y target range. However, the wider perception is that it is a close call, with upside inflation risks further ahead and broader uncertainty around the outlook encouraging the MPC to remain cautious. In the meantime, SARB watchers will be on the lookout for any announcements surrounding ongoing talks with the National Treasury on the inflation target revision.

MNI POLITICAL RISK ANALYSIS: Poland Election Preview - Round Two

Poland’s neck-and-neck presidential race is down to the wire after centrist liberal Rafał Trzaskowski (KO) took an unconvincing lead in the first round. See an updated preview ahead of Sunday's presidential run-off in the link above.

DATA

ITALY DATA (MNI): Confidence Improves in May, but Too Early to Call an Uptrend

Italian business and consumer confidence improved in May, likely supported by signs of easing trade tensions between the US and China. The survey did not capture the announcement and subsequent delay of the US' 50% tariff on EU goods last week. While a positive development, it is still too early to determine whether sentiment has entered a more pronounced uptrend. Consumer confidence jumped to 96.5 (vs 93.0 cons, 92.7 prior), but remains below February's level. There was a sharp rise in the "Economic climate" subcomponent to 97.5 (vs 89.6 prior), while the "personal climate" index also improved. Manufacturing confidence inched up to 86.5 (vs 85.8 prior). The export order subcomponent remains weak at -25.3 (vs -25.6 in April), but has been so since 2023 (i.e. there isn't an obvious tariff impact).

JAPAN DATA (MNI): Japan Consumer Confidence Rises

Japan’s consumer confidence index rose for the first time in six months, climbing 1.6 points to 32.8 in May from 31.2 in April, data released Thursday by the Cabinet Office showed, leading the government to maintain its assessment from the previous month, following a downgrade in the April survey. The improvement in sentiment eased concerns that private consumption may lose further momentum amid persistent pressure from high food prices, particularly rice, and three consecutive months of negative real wage growth. All major sub-indexes, covering overall economic well-being, income expectations, labour conditions, and willingness to purchase durable goods, posted gains.

AUSTRALIA DATA (MNI): Weak Equipment Capex Drives Q1 Investment Lower

Q1 private capital expenditure volumes were weaker than expected falling 0.1% q/q to be down 0.5% y/y driven by a contraction in machinery & equipment investment. Q4 was revised up to +0.2% q/q, there appears to be a trend of upward revisions to the previous quarter as was also the case with construction. Q1 GDP prints on June 4 with the inventory and net export components released on June 3, but currently it is looking soft. Q1 building & structures investment rose 0.9% q/q, third consecutive quarterly increase, to be up 0.6% y/y after falling 0.2% y/y. It was driven by mining projects in oil & gas, gold, and other metal ores with capex up 1.7% q/q while non-mining was +0.4%.

NEW ZEALAND DATA (MNI): Soft Economy but Outlook Improved Later in May

ANZ business confidence fell to 36.6 in May from 49.3, the lowest since July, while the outlook moderated to 34.8 from 47.7. ANZ notes though that the breakdown of responses indicates that the picture is not as soft as the month averages suggest as they improved in the latter part of the month with positive news on trade talks and are "well off their late-April lows". Price/cost components generally fell in May. The survey suggests a gradual, soft recovery with higher costs difficult to pass through, which ANZ believes will allow the RBNZ to cut rates to 2.5%.

FOREX: USD Slips Off Tariff Ruling Overnight High, AUD Benefits

- European desks have been happy to fade the overnight bid in the USD so far this morning, with markets reassessing the implications of the Court of International Trade’s tariff block. Although the ban implies a smaller tariff-related hit to US growth and upside inflation risk than a day ago, it further increases US policy – and political – uncertainty.

- EURUSD had traded lower by as much as 0.7% overnight, but has pared losses to trade in only minor negative territory headed into the Ny crossover. The pair briefly pierced initial support at the 20-day EMA, bringing attention to the more important support at 1.1156, the 50-day EMA. Meanwhile, GBPUSD has also essentially fully unwound the overnight selloff.

- AUD outperforms against broader G10 FX, the primary beneficiary from the slip off overnight highs for the greenback. AUD/USD pressed toward 0.6450 this morning to challenge yesterday's highs, and while the moves may be inconsequential on the week, (AUD/USD is still hugging the 200-dma at 0.6444) the currency is looking more constructive against the likes of JPY, CHF and EUR on the daily charts - against which the underlying positivity and re-correlation with global equities is aiding prices higher.

- Having bounced off pullback lows of 1.7248, EUR/AUD looks to have concluded the corrective bounce, with spot now through 38.2% retracement of the strength. A further stabilisation of global trade themes or persistence of legal challenges against Trump's tariffs would affirm the AUD profile, particularly if the E-mini S&P holds a sustainable break above the 6,000 handle.

- Weekly US jobless claims and the secondary reading for the core PCE price indices are the calendar highlights Thursday. Fed's Barkin, Goolsbee, Kugler & Daly are all set to speak as well as BoE's Bailey. The Ascension day public holiday will thin out liquidity in the European session, even with most domestic markets still open.

EGBS: Curves Bear Flatten on US Court Ruling, but Policy Uncertainty Still High

The German curve has lightly bear flattened, with yields 1-2bps higher on the session. The Court of International Trade’s judgement blocking a significant portion of US tariffs has pushed European yields higher, as it reduces the tariff-implied downside growth/inflation risks facing the Eurozone economy.

- Hawkish impetus is limited by the fact the judgement does not cover sectoral tariffs (e.g. on autos and steel/aluminium). The court ruling should also not be considered set in stone. The US administration has already appealed the judgement, and there are avenues available for tariffs to be ratcheted higher in the meantime - uncertainty remains high.

- Bund futures gapped 23 ticks lower at open, and currently trade -18 ticks versus yesterday’s settlement at 130.65. The contract has moved away from session lows of 130.39. A bullish theme in Bund futures remains intact and the pullback from Tuesday’s lows is considered corrective.

- Liquidity has been thinned out by the Ascension Day public holiday in Germany and France.

- 10-year EGB spreads to Bunds are biased tighter, with the Court judgement supporting risk sentiment (even with European equity futures off overnight highs).

- Italy sold 5/10-year BTPs and a new CCTeu this morning, with the supply digested smoothly. Italian business and consumer confidence improved in May, but it is still too early to determine whether sentiment has entered a more pronounced uptrend.

- Global focus turns to this afternoon’s US GDP, PCE and jobless claims data.

GILTS: Curve Bear Steepens

Gilts hold most of the early losses that stemmed from the Court of International Trade’s judgement blocking a significant portion of the U.S. tariffs (detailed in earlier bullets).

- The Trump administration has already appealed the judgement and there are several channels that Trump could use to levy further tariffs in the interim.

- Futures breached yesterday’s low, basing at 90.69, before a recovery back to ~90.80 at typing.

- Initial support lies at the May 23 low (90.46). Bears remain in technical control.

- Yields are 1-3bp higher, with the curve steeper.

- 10s haven’t challenged resistance at 4.800/809%.

- 2s10s and 5s30s haven’t threatened cycle closing highs.

- 10s vs. Bunds little changed at 217bp, April closing highs remain intact in the spread.

- 0.125% Aug-31 I/L supply was smoothly digested.

- SONIA futures little changed to -2.5.

- BoE-dated OIS still showing ~34bp of cuts, in line with levels seen ahead of the gilt open.

- BoE Governor Bailey will speak after the close (20:00 London).

- Little else of note on the UK calendar before then. That should leave focus on macro matters (namely U.S. data and any Trump comments/action following the previously covered tariff judgement).

BoE Meeting | SONIA BoE-Dated OIS (%) | Difference vs. Current Effective SONIA Rate (bp) |

Jun-25 | 4.218 | +0.7 |

Aug-25 | 4.109 | -10.2 |

Sep-25 | 4.064 | -14.7 |

Nov-25 | 3.926 | -28.5 |

Dec-25 | 3.867 | -34.4 |

Feb-26 | 3.774 | -43.7 |

Mar-26 | 3.764 | -44.7 |

EQUITIES: E-Mini S&P Rallies Above Bull Trigger and $6000 Handle

The trend cycle in Eurostoxx 50 futures remains bullish and the recent pullback appears corrective. Moving average studies are in a bull-mode position, highlighting a clear dominant uptrend. Sights are on 5516.00, the Mar 3 high and the key bull trigger. A break of this level would strengthen a bull theme. Key support to watch lies at 5244.11, the 50-day EMA. Clearance of this average would signal a possible reversal. A bullish trend condition in S&P E-Minis remains intact. Today’s gains have delivered a print above 5993.50, the May 20 high and a bull trigger. The break confirms a resumption of the uptrend and maintains a price sequence of higher highs and higher lows. 6000.00 has been pierced, an extension would open 6057.00 next, the Mar 3 high. Key support lies at 5734.85, the 50-day EMA. A clear break of this average is required to highlight a reversal.

- Japan's NIKKEI closed higher by 710.58 pts or +1.88% at 38432.98 and the TOPIX ended 42.51 pts higher or +1.53% at 2812.02.

- Elsewhere, in China the SHANGHAI closed higher by 23.514 pts or +0.7% at 3363.446 and the HANG SENG ended 315.07 pts higher or +1.35% at 23573.38.

- Across Europe, Germany's DAX trades higher by 78.56 pts or +0.33% at 24116.46, FTSE 100 lower by 14.13 pts or -0.16% at 8711.9, CAC 40 up 43.78 pts or +0.56% at 7831.88 and Euro Stoxx 50 up 29.83 pts or +0.55% at 5408.22.

- Dow Jones mini up 477 pts or +1.13% at 42644, S&P 500 mini up 90.75 pts or +1.54% at 5993.25, NASDAQ mini up 410 pts or +1.92% at 21786.75.

Time: 09:50 BST

COMMODITIES: WTI Futures Trading Above Key Resistance at the 50-Day EMA

WTI futures traded to a fresh S/T cycle high on May 21 before finding resistance. The recovery since Apr 9, appears corrective. Key resistance to watch is $62.60, the 50-day EMA. It has been pierced, a clear break of it would highlight a stronger reversal and open $65.82, Apr 4 high. For bears a reversal lower would refocus attention on $54.33, the Apr 9 low and bear trigger. The price pattern on May 21 is a shooting star - a bearish signal. Recent gains in Gold signal the end of the corrective phase between Apr 22 - May 15. Medium-term trend signals are unchanged, they remain bullish and the latest pullback is considered corrective. Note that moving average studies are in a bull-mode position, highlighting a dominant uptrend. A resumption of gains would open $3435.6 next, the May 7 high. Key support and the bear trigger has been defined at $3121.0, the May 15 low.

- WTI Crude up $0.65 or +1.05% at $62.5

- Natural Gas down $0.02 or -0.42% at $3.541

- Gold spot down $6.84 or -0.21% at $3280.6

- Copper up $4.5 or +0.96% at $471.85

- Silver up $0.32 or +0.97% at $33.305

- Platinum down $1.9 or -0.18% at $1080.15

Time: 09:50 BST

| Date | GMT/Local | Impact | Country | Event |

| 29/05/2025 | 1230/0830 | *** | Jobless Claims | |

| 29/05/2025 | 1230/0830 | * | Current account | |

| 29/05/2025 | 1230/0830 | * | Payroll employment | |

| 29/05/2025 | 1230/0830 | *** | GDP | |

| 29/05/2025 | 1230/0830 | Richmond Fed's Tom Barkin | ||

| 29/05/2025 | 1400/1000 | ** | NAR Pending Home Sales | |

| 29/05/2025 | 1430/1030 | ** | Natural Gas Stocks | |

| 29/05/2025 | 1445/1545 | BOE's Saporta panellist on hedge funds' role in recent crises | ||

| 29/05/2025 | 1500/1100 | ** | DOE Weekly Crude Oil Stocks | |

| 29/05/2025 | 1500/1600 | BOE's Bailey speech and fireside chat at Irish IAIM Dinner | ||

| 29/05/2025 | 1530/1130 | ** | US Bill 04 Week Treasury Auction Result | |

| 29/05/2025 | 1530/1130 | * | US Bill 08 Week Treasury Auction Result | |

| 29/05/2025 | 1700/1300 | ** | US Treasury Auction Result for 7 Year Note | |

| 29/05/2025 | 1800/1400 | Fed Governor Adriana Kugler | ||

| 29/05/2025 | 2000/1600 | San Francisco Fed's Mary Daly | ||

| 30/05/2025 | 2330/0830 | ** | Tokyo CPI | |

| 30/05/2025 | 2330/0830 | * | Labor Force Survey | |

| 30/05/2025 | 2350/0850 | ** | Industrial Production | |

| 30/05/2025 | 2350/0850 | * | Retail Sales (p) | |

| 29/05/2025 | 0025/2025 | Dallas Fed's Lorie Logan | ||

| 30/05/2025 | 0130/1130 | * | Building Approvals | |

| 30/05/2025 | 0130/1130 | ** | Retail Trade | |

| 30/05/2025 | 0600/0800 | *** | GDP | |

| 30/05/2025 | 0600/0800 | ** | Import/Export Prices | |

| 30/05/2025 | 0600/0800 | ** | Retail Sales | |

| 30/05/2025 | 0630/0730 | DMO to release FQ2 (Jul-Sep) issuance ops calendar | ||

| 30/05/2025 | 0700/0900 | *** | HICP (p) | |

| 30/05/2025 | 0700/0900 | ** | KOF Economic Barometer | |

| 30/05/2025 | 0800/1000 | ** | M3 | |

| 30/05/2025 | 0800/1000 | *** | GDP (f) | |

| 30/05/2025 | 0800/1000 | *** | Bavaria CPI | |

| 30/05/2025 | 0800/1000 | *** | North Rhine Westphalia CPI | |

| 30/05/2025 | 0800/1000 | *** | Baden Wuerttemberg CPI | |

| 30/05/2025 | 0900/1100 | *** | HICP (p) | |

| 30/05/2025 | 1000/1200 | ** | PPI | |

| 30/05/2025 | 1200/1400 | *** | HICP (p) | |

| 30/05/2025 | 1230/0830 | ** | WASDE Weekly Import/Export | |

| 30/05/2025 | 1230/0830 | *** | Personal Income and Consumption | |

| 30/05/2025 | 1230/0830 | ** | Advance Trade, Advance Business Inventories | |

| 30/05/2025 | 1230/0830 | *** | GDP - Canadian Economic Accounts | |

| 30/05/2025 | 1230/0830 | *** | Gross Domestic Product by Industry | |

| 30/05/2025 | 1230/0830 | *** | CA GDP by Industry and GDP Canadian Economic Accounts Combined | |

| 30/05/2025 | 1342/0942 | *** | MNI Chicago PMI | |

| 30/05/2025 | 1400/1000 | *** | U. Mich. Survey of Consumers | |

| 30/05/2025 | 1400/1000 | ** | University of Michigan Surveys of Consumers Inflation Expectation | |

| 30/05/2025 | 1500/1100 | Finance Dept monthly Fiscal Monitor (expected) | ||

| 30/05/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 30/05/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 30/05/2025 | 2045/1645 | San Francisco Fed's Mary Daly |