MNI US OPEN - Tariff Deadline Looms

EXECUTIVE SUMMARY

- TRUMP TEAM WEIGHS BROADER, HIGHER TARIFFS – WSJ

- TRUMP THREATENS RUSSIA OIL PENALTIES, CITING ANGER WITH PUTIN

- FRANCE’S LE PEN FOUND GUILTY OF EMBEZZLEMENT

- GERMAN STATE CPI DATA BROADLY IN LINE WITH EXPECTATIONS

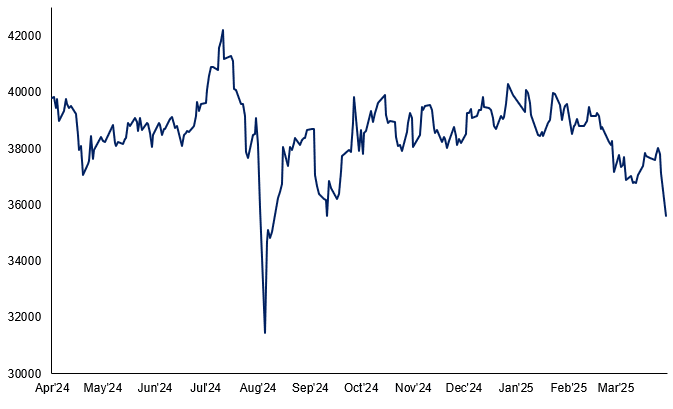

Figure 1: Nikkei 225 sinks 4%, extends slump from December high to 12%

Source: MNI/Bloomberg

NEWS

US (WSJ): Trump Team Weighs Broader, Higher Tariffs

The Trump administration is scrambling to determine the specifics of its new tariff agenda ahead of its self-imposed deadline of Wednesday, weighing options as the president has promised to remake the American economy with a swath of new levies. One key point of debate is whether to impose individualized tariff rates for U.S. trading partners, as President Trump has previewed in recent weeks, or revert to his campaign pledge for an across-the-board tariff that would affect virtually every country doing business with the U.S., say people familiar with the conversations.

US/RUSSIA (BBG): Trump Threatens Russia Oil Penalties, Citing Anger With Putin

President Donald Trump threatened “secondary tariffs” on buyers of Russian oil if Vladimir Putin refuses a ceasefire with Ukraine, adding later that he didn’t think the Russian president would “go back on his word.” In comments reported by NBC News, Trump said he was “pissed off” and “very angry” at Putin for casting doubt on Ukrainian President Volodymyr Zelenskiy’s legitimacy as a negotiating partner, and threatened curbs on “all oil coming out of Russia.” The US president appeared to then temper his remarks on possible sanctions or other measures when speaking to reporters aboard Air Force One, suggesting some room for negotiation and prompting oil prices to pare early gains in Asia.

US (BBG): Trump’s Reciprocal Tariffs Set to Start With All Countries

President Donald Trump said he plans to start his reciprocal tariff push with “all countries,” tamping down speculation that he could limit the initial scope of tariffs set to be unveiled April 2. “You’d start with all countries, so let’s see what happens,” Trump told reporters aboard Air Force One. “I haven’t heard a rumor about 15 countries, 10 or 15.”

US (FT): Trump Says He Is ‘Not Joking’ About Seeking a Third Term in Office

Donald Trump said he was “not joking” about serving a third term, adding that there were “methods” by which he could bypass the constitutional prohibition on US presidents being elected three times. In a phone interview with NBC News on Sunday, Trump said “it is far too early to think about it”, but confirmed that he was entertaining the possibility. “A lot of people want me to do it,” said Trump, 78.

US (NYT): White House Weighs Helping Farmers as Trump Escalates Trade War

Ahead of President Trump’s plan to impose sweeping tariffs across the globe this week, his administration is weighing a new round of emergency aid to farmers, who are likely to be caught in the middle if America’s trading partners retaliate. The early discussions offer a tacit acknowledgment that Mr. Trump’s expansive tariffs could unleash financial devastation throughout the U.S. agricultural industry, a crucial voting base that the president similarly tried to safeguard during his 2018 trade war with China.

US (WSJ): Mike Waltz Is Losing Support Inside the White House

President Trump has decided for now not to fire his national security adviser over the revelation that he included a journalist on a group text chat to discuss and execute a military strike, but the damage to Mike Waltz’s reputation has put him on shaky ground in the White House, senior U.S. officials said. Despite repeated messages of support by Trump, Waltz has lost sway with the president and the backing of senior aides within the White House, officials said, just as the administration struggles to broker peace deals and faces the threat of further war in the Middle East.

US/UK (BBG): Starmer Holds ‘Productive’ Talks With Trump Ahead of Tariff Hit

UK Prime Minister Keir Starmer held “productive” discussions about “an economic prosperity deal” on a call with US President Donald Trump Sunday evening ahead of a crunch week in which the government hopes to carve out exemptions from looming US tariffs. A statement from Downing Street said the two leaders agreed that negotiations “will continue at pace this week” and that they will “stay in touch in the coming days.”

US/UK (Telegraph): Starmer Ready to Use ‘Sharp Teeth’ if Trump Hits UK With Tariffs

Sir Keir Starmer is ready to deploy “sharp teeth” against the US if Donald Trump hits the UK with tariffs this week. The Prime Minister is understood to have plans in place to punish the US president if he includes Britain in his raid on global imports, planned to take effect on Wednesday. A Downing Street source said UK negotiators were approaching last-ditch talks to secure a carve-out for Britain with “cool, calm heads”, but were prepared to deploy “sharp teeth” if needed.

US/IRAN (BBG): Iran’s Leader Pledges ‘Firm Retaliatory Response’ to US, Israel

Iran’s Supreme Leader Ayatollah Ali Khamenei said any attack by the US or Israel would be met with “a firm retaliatory strike,” after US President Donald Trump threatened to bomb Iran unless it signs a deal renouncing nuclear weapons. Still, in the televised remarks on Monday, Khamenei downplayed the likelihood of such an outcome, characterizing it as “highly unlikely.” His remarks follow a period of heightened tensions between Tehran and Washington. Iranian Foreign Minister Abbas Araghchi said last week that there would be no direct negotiations with the US as long as the Trump administration maintains its “military threats.”

ECB (BBG): ECB’s Lagarde Says Keeping Prices in Check ‘Constant Battle’

President Christine Lagarde said that the European Central Bank can’t relent on inflation, with the US administration’s trade policy creating uncertainty. “It is a daily struggle,” she told France Inter Radio on Monday. “We are almost where we should be, but we have to remain there, so that’s why I say it’s a constant battle.” “We are all absolutely determined to arrive at this target, which is a target of 2%” on inflation, Lagarde said. “In terms of the path to get there, some want to gallop, to go very fast. Others say let’s do a small trot, let’s wait to see what the obstacles are along the way.”

ECB (MNI): Loan Dynamics Still Feel Tightening - Panetta

Euro area credit and loans dynamics are still feeling the impact of monetary tightening from previous years and also from the current weakness in this economic cycle, Bank of Italy Governor Fabio Panetta said during the bank’s budget presentation Monday. Panetta also noted that the fight to bring inflation to 2% is not finished yet, adding that future monetary policy decisions should balance between economic weakness and geopolitical tensions that are slowing consumption and investment and uncertainty around trade policy that imposes caution on the easing path.

FRANCE (MNI): Le Pen Found Guilty of Embezzlement

Wires reporting that far-right Rassemblement National (RN, National Rally) figurehead Marine Le Pen, along with eight RN MEPs, has been found guilty of embezzlement in relation to jobs for party officials at the European Parliament. Le Monde reports "The sentences will be detailed individually, but are not yet known." Focus will now turn to whether the court imposes a ban on Le Pen running for office as part of her sentence. This ruling would upend the 2027 presidential election, where Le Pen is the current frontrunner.

JAPAN (BBG): Japan to Approve Budget Just a Day Before New Fiscal Year Begins

Japan’s parliament is set to pass an initial budget after multiple revisions, easing some of the pressure on Prime Minister Shigeru Ishiba as he faces a host of domestic and diplomatic challenges. Parliament is expected to pass the ¥115.2 trillion ($772 billion) budget in a plenary session on Monday, finalizing the bill just one day before the start of the new fiscal year. Originally approved by the Cabinet late last year, the budget underwent several modifications in both the lower and upper houses.

JAPAN (MNI): GPIF Formally Keep Asset Allocations Unchanged, as Expected

Japan's GPIF pension fund maintain their asset allocation targets as part of their mandate update - keeping both Japanese and foreign stocks at 25% allocation. They tweak their deviation limits slightly: switching their deviation limits on both equities and bonds to 9% from 11%. These headlines are inline with expectations, as had been noted in the Nikkei newspaper earlier this month. Headlines coincide with the local equity close, which puts the Nikkei 225 10% lower off the December high, and as such formally in correction territory.

BOJ (BBG): BOJ Cuts Buying of Super-Long Bonds for First Time in a Year

The Bank of Japan is set to slow purchases of super-long bonds for the first time in more than a year, according to a statement. The BOJ will buy ¥405 billion of debt due in 10 to 25 years a month in 2Q, down from ¥450 billion in the 1Q plan. It’s the first time since January last year that the central bank slowed buying of super-long bonds.

MNI RBA PREVIEW - MARCH 2025: April Hold, Watch Pre-May 20 Data

The next RBA decision is on April 1 and it is widely expected to keep rates at 4.10% after sounding very cautious when it cut 25bp on February 18. Governor Bullock warned that one rate cut did not mean another would automatically follow as “upside risks remain” and that market pricing was too optimistic. The Board is likely to reiterate its data dependence, while the economy since February has developed broadly as it expected. Given that unchanged policy is projected, the statement will be scrutinised for any moderation in February’s cautious tone.

RBNZ (BBG): RBNZ to Review Capital Requirements Amid Political Pressure

New Zealand’s central bank will review its bank capital requirements amid pressure from the government and following the unexpected resignation of its governor. The Reserve Bank will conduct an assessment of key capital settings and engage independent international experts to support this process, it said in a statement Monday in Wellington. The review will include looking at risk weights for residential mortgages, corporate and rural lending, and community housing, it said.

ISRAEL (BBG): Netanyahu Names New Intelligence Agency Chief, Defying Court

Israel named Eli Sharvit as the new head of the country’s domestic intelligence agency after political rifts led to the dismissal of his predecessor. Sharvit, a former naval commander, will take up his new role as head of the Shin Bet after 36 years serving in the Israeli military, a statement from the office of Prime Minister Benjamin Netanyahu said. Netanyahu fired Sharvit’s predecessor Ronen Bar earlier this month after quarreling with him over responsibility for failing to prevent the Oct. 7 attack by Hamas as well as issues over hostage negotiations and a probe about Qatar.

S. KOREA (BBG): South Korea Spent Big to Defend Won Amid Turmoil in Late 2024

South Korea mounted the most vigorous defense of the won in months late last year to shield its economy from a strong dollar and a market rout triggered by President Yoon Suk Yeol’s brief imposition of martial law. Authorities in Seoul sold a net $3.8 billion to limit volatility in the exchange rate in the fourth quarter, data from the Bank of Korea on Monday showed. That’s the highest quarterly tally since the net $5.8 billion recorded for the second quarter of 2024, based on statistics previously published on the central bank’s website.

SOUTH AFRICA (MNI): Optimism on Budget Talks Lifts Sentiment

The rand received a boost from the news that last-ditch negotiations between the African National Congress (ANC) and Democratic Alliance (DA) on the 2025 National Budget seemingly brought some progress. The DA's spokesperson said that there was a "good chance" of an agreement between the two largest parties in the Government of National Unity (GNU), while President Cyril Ramaphosa said that he was confident that coalition partners would be able to "develop a shared approach." Separately, News24 reported that the ANC and DA were "close" to a deal on the future of the economy, following their revived talks held on Sunday afternoon.

DATA

GERMANY DATA (MNI): State CPI Data Broadly in Line With Expectations

- BAVARIA MAR CPI +0.3% M/M, +2.3% Y/Y

- NRW MAR CPI +0.3% M/M, +1.9% Y/Y

The first few German state CPIs look broadly in line with expectations. We have received states which make up around 85% of the index and it is currently tracking at 0.32% M/M. In the Bloomberg survey German national CPI (not HICP) estimates were split between 0.2-0.4% M/M: the median estimate is 0.3% M/M but the modal estimate is 0.4% M/M. So we are broadly in line with expectations. The Y/Y is also tracking at 2.20% (consensus is 2.2%). Note that surprises in state CPI do not always fully correlate with surprises in HICP.

ITALY DATA (MNI): HICP Surprises to the Upside; EZ HICP Still Tracking Marginally Soft

- ITALY MAR FLASH HICP +1.6% M/M, +2.1% Y/Y

Italy HICP surprised to the upside coming in a 2.1%Y/Y - but we note the Bloomberg consensus was 2.0%Y/Y while Reuters consensus was 1.8%Y/Y - so there is a bit of a disparity between the size of the surprise here, depending upon which survey you follow. Assuming that Dutch and German HICP come in in line with consensus and there are no big changes to the Y/Y rates of Austria, Ireland and Portugal (the former two out at 11:00BST) we see the EZ print tracking at broadly 2.1-2.2%. The Bloomberg median is at 2.2% - but there are more analysts forecasting 2.3%Y/Y than 2.1%, so there may be some very modest downside risks.

UK JAN M4 MONEY SUPPLY +0.2% M/M, +3.8% Y/Y (MNI)

UK BOE JAN MORTGAGE APPROVALS 65,481 (MNI)

UK BOE JAN CONSUMER CREDIT GBP1.36 BLN (MNI)

UK BOE JAN SECURED LENDING GBP3.29 BLN (MNI)

CHINA DATA (MNI): China Steel PMI Rises Two Consecutive Months

- CHINA MAR MANUFACTURING PMI 50.5 VS 50.2 IN FEB

China’s steel industry PMI reached 46% in March, up 0.9 percentage points from February, marking the second month of improvement but below the expansion mark of 50, the China Logistics Information Centre announced on Monday. The trend reflects the weak recovery of the industry, said Pan Fujie, director at the Steel Logistics Committee of the China Federation of Logistics and Purchasing. “After the Spring Festival, the market showed stable production, slow demand and falling prices," Pan added, noting that steel prices are expected to rebound with seasonal peak demand in April.

JAPAN DATA (MNI): Japan Feb Factory Output Posts 1st Rise in 4 Months

- JAPAN FEB FACTORY OUTPUT +2.5% M/M; JAN -1.1%

Japan's industrial output rose 2.5% m/m in February for the first increase in four months following January's 1.1% decline due to higher production of machinery and electronic parts and devices, although the rise of automobile output was small, data released by the Ministry of Economy, Trade and Industry showed on Monday. Auto production rose 0.2% m/m in February for the second straight rise following 3.4% in January, clouding the outlook for demand amid U.S. tariff concerns. Production machinery rose 8.2% in February for the first rise in two months following -10.2% in January.

RATINGS: Affirmations on Friday

Sovereign rating reviews of note from after hours on Friday include:

- S&P affirmed the Czech Republic at AA-; Outlook Stable

- Scope Ratings affirmed the United Kingdom at AA; Outlook Stable

FOREX: Tariff Clouds Press AUD/JPY Toward Support

- The final shape and structure of Trump's reciprocal tariffs pledge on Wednesday remains to be seen, with little clarity from the White House on whether Liberation Day will entail blanket tariff rates set against all imports, or more targeted levies against specific countries. Should convention for the previous phases of tariffs be followed, tariffs will come into effect at 0001ET/0501BST on Wednesday - leaving a tight timeline for the White House to provide further details.

- As a result of the tariff-tied uncertainty, equities are slipping alongside high-beta, growth-oriented currencies - keeping AUD and NZD at the bottom of the G10 pile. the USD Index is lower, markets are still above the mid-March lows, meaning the 200-dma resistance holds firm for now; just above last week's 104.683 highs at 104.925.

- This has boosted the JPY in early trade, confirming the risk-off picture. US equity futures are markedly lower, and growth sensitive tech names are the hardest hit - keeping the NASDAQ future off 1.3% at typing. AUD/JPY is being pressed toward support of Y93.32 - the 61.8% retracement of the upleg posted off the March 11th low.

- The MNI Chicago PMI release for March is the data highlight Monday, with markets expecting activity to remain subdued across the month. Dallas Fed manufacturing activity follows shortly afterward - with to remain the key focus given the light central bank speaker slate today.

BONDS: Yields Hold Lower as Equities Sell Off Ahead of "Liberation Day"

Risk-off price action has been driven by tariff worry ahead of “Liberation Day” (Wednesday) and source reports pointing to the potential for deeper U.S. tariffs.

- A move away from lows in European equities & crude oil pushed bonds off session highs.

- Bund futures traded through key resistance at 129.41, peaking at 129.59, before fading back to 129.30 last. A fresh extension higher would target 130.00.

- Yields ~4bp lower across the German curve.

- Regional level German CPI data points to an inline national reading later today, while Italian CPI topped expectations.

- Eurozone HICP is tracking a little below consensus (+2.1-2.2% Y/Y vs. BBG median of +2.2%).

- EGB spreads to Bunds little changed to 2bp wider given the risk-off theme.

- There was no real initial reaction in OATs (both outright and in spread vs. Bunds) as RN leader Le Pen was found guilty in the RN embezzlement case. French political uncertainty and fiscal risks are set to remain evident in the near term, irrespective of who leads the RN through the next election cycle.

- Gilt futures have breached last week’s high and traded above 92.00.

- Initial Fibonacci resistance (92.17) protects trendline resistance drawn off the March 4 high (91.55).

- Yields 3-4bp lower across the UK curve.

- Dovish repricing in both the EUR (~85% odds of a cut showing for next month, 64bp cuts priced through Dec) & GBP (54bp of cuts showing through Dec) short ends given the prevailing risk-off theme.

- Comments from ECB’s Lagarde & Panetta failed to move markets.

EQUITIES: Eurosus toxx 50 Futures Breach Key Support, Undermining Bullish Theme

Eurostoxx 50 futures are trading lower today and this has resulted in a breach of key support at 5229.00, the Mar 11 low. The print below this support undermines a bullish theme and signals scope for a deeper retracement. Sights are on the 5200 handle next, where a break would open 5079.00, the Feb 3 low. It is still possible that recent weakness is part of a broader correction. Initial resistance to watch is 5359.39, the 20-day EMA. S&P E-Minis traded sharply lower Friday and the contract maintains a softer tone. Attention is on key support and the bear trigger at, 5559.75, the Mar 13 low. A break of this level would confirm a resumption of the downtrend that started Feb 19, and open 5483.30, a Fibonacci projection. Moving average studies are in a bear-mode position, highlighting a dominant downtrend. Key short-term resistance has been defined at 5837.25, the Mar 25 high.

- Japan's NIKKEI closed lower by 1502.77 pts or -4.05% at 35617.56 and the TOPIX ended 98.52 pts lower or -3.57% at 2658.73.

- Elsewhere, in China the SHANGHAI closed lower by 15.561 pts or -0.46% at 3335.746 and the HANG SENG ended 307.02 pts lower or -1.31% at 23119.58.

- Across Europe, Germany's DAX trades lower by 236.57 pts or -1.05% at 22254.1, FTSE 100 lower by 79.35 pts or -0.92% at 8591.89, CAC 40 down 99.8 pts or -1.26% at 7835.3 and Euro Stoxx 50 down 61.2 pts or -1.15% at 5278.03.

- Dow Jones mini down 203 pts or -0.49% at 41702, S&P 500 mini down 44.25 pts or -0.79% at 5589.5, NASDAQ mini down 239.5 pts or -1.23% at 19262.25.

Time: 09:50 BST

COMMODITIES: Despite Some Recent Gains, WTI Future Trend Remains Bearish

Despite recent gains, a bearish trend condition in WTI futures remains intact, and gains this month are considered corrective. However, a key resistance at $69.17, the 50-day EMA, has been pierced. The breach strengthens a bullish theme and opens $70.98, the Feb 25 high. For bears, a reversal lower would expose the bear trigger at $64.85, the Mar 5 low. Clearance of this level would resume the downtrend and open $63.73, the Oct 10 ‘24 low. The trend condition in Gold is unchanged, it remains bullish. Today’s strong gains highlight a bullish start to this week’s session and confirm a continuation of the primary uptrend. The rally also once again, highlights fresh all-time highs for the yellow metal. Sights are on the $3151.5, a Fibonacci projection. Support to watch lies at $2992.4, the 20-day EMA. A pullback would be considered corrective.

- WTI Crude up $0.42 or +0.61% at $70.02

- Natural Gas up $0.14 or +3.35% at $4.206

- Gold spot up $37.27 or +1.21% at $3122.36

- Copper down $6.95 or -1.35% at $507.4

- Silver up $0.12 or +0.35% at $34.3284

- Platinum up $7.56 or +0.77% at $995.67

Time: 09:50 BST

| Date | GMT/Local | Impact | Country | Event |

| 31/03/2025 | - | DMO Quarterly Investors/GEMM consultation | ||

| 31/03/2025 | 1200/1400 | *** | HICP (p) | |

| 31/03/2025 | 1345/0945 | *** | MNI Chicago PMI | |

| 31/03/2025 | 1430/1030 | ** | Dallas Fed manufacturing survey | |

| 31/03/2025 | 1530/1130 | * | US Treasury Auction Result for 13 Week Bill | |

| 31/03/2025 | 1530/1130 | * | US Treasury Auction Result for 26 Week Bill | |

| 31/03/2025 | 1600/1200 | ** | USDA GrainStock - NASS | |

| 31/03/2025 | 1600/1200 | *** | USDA PROSPECTIVE PLANTINGS - NASS | |

| 01/04/2025 | 2200/0900 | ** | S&P Global Manufacturing PMI (f) | |

| 01/04/2025 | 2301/0001 | * | BRC Monthly Shop Price Index | |

| 01/04/2025 | 2330/0830 | * | Labor Force Survey | |

| 01/04/2025 | 2350/0850 | *** | Tankan | |

| 01/04/2025 | 0030/1130 | ** | Retail Trade | |

| 01/04/2025 | 0030/0930 | ** | S&P Global Final Japan Manufacturing PMI | |

| 01/04/2025 | 0145/0945 | ** | S&P Global Final China Manufacturing PMI | |

| 01/04/2025 | 0330/1430 | *** | RBA Rate Decision | |

| 01/04/2025 | 0630/0830 | ** | Retail Sales | |

| 01/04/2025 | 0715/0915 | ** | S&P Global Manufacturing PMI (f) | |

| 01/04/2025 | 0745/0945 | ** | S&P Global Manufacturing PMI (f) | |

| 01/04/2025 | 0750/0950 | ** | S&P Global Manufacturing PMI (f) | |

| 01/04/2025 | 0755/0955 | ** | S&P Global Manufacturing PMI (f) | |

| 01/04/2025 | 0800/1000 | ** | S&P Global Manufacturing PMI (f) | |

| 01/04/2025 | 0815/0915 | BoE's Greene on ‘UK MP/macro conjuncture’ | ||

| 01/04/2025 | 0820/1020 | ECB's Cipollone At Croatian National Bank Meeting | ||

| 01/04/2025 | 0830/0930 | ** | S&P Global Manufacturing PMI (Final) | |

| 01/04/2025 | 0900/1100 | *** | HICP (p) | |

| 01/04/2025 | 0900/1100 | ** | Unemployment | |

| 01/04/2025 | - | *** | Domestic-Made Vehicle Sales | |

| 01/04/2025 | 1230/1430 | ECB's Lagarde At AI Conference | ||

| 01/04/2025 | 1255/0855 | ** | Redbook Retail Sales Index | |

| 01/04/2025 | 1300/0900 | Richmond Fed's Tom Barkin | ||

| 01/04/2025 | 1345/0945 | *** | S&P Global Manufacturing Index (final) | |

| 01/04/2025 | 1400/1000 | *** | ISM Manufacturing Index | |

| 01/04/2025 | 1400/1000 | * | Construction Spending | |

| 01/04/2025 | 1400/1000 | *** | JOLTS jobs opening level | |

| 01/04/2025 | 1400/1000 | *** | JOLTS quits Rate | |

| 01/04/2025 | 1430/1030 | ** | Dallas Fed Services Survey | |

| 01/04/2025 | 1530/1130 | * | US Treasury Auction Result for Cash Management Bill | |

| 01/04/2025 | 1630/1830 | ECB's Lane At AI Conference |