MNI US OPEN - Trump Considers Naming Next Fed Chair Early

EXECUTIVE SUMMARY

- TRUMP CONSIDERS NAMING NEXT FED CHAIR EARLY IN BID TO UNDERMINE POWELL

- FED GOVS APPROVE DRAFT RULE TO EASE LEVERAGE RATIO

- EUCO STARTS w/SANCTIONS, SECURITY & COMPETITIVENESS ON AGENDA

- INCREASING WILLINGNESS TO SAVE DAMPENS GERMAN CONSUMER CLIMATE

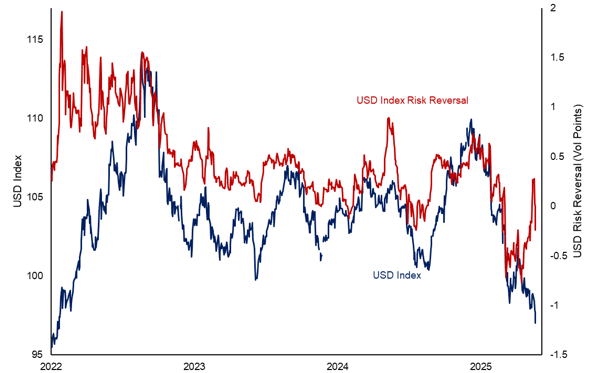

Figure 1: USD risk reversals catch-down as spot prices sink

Source: MNI/Bloomberg Finance L.P.

NEWS

FED (WSJ): Trump Considers Naming Next Fed Chair Early in Bid to Undermine Powell

President Trump’s exasperation over the Federal Reserve’s take-it-slow approach to cutting interest rates is prompting him to consider accelerating when he will announce his pick to succeed Chair Jerome Powell, whose term runs for another 11 months. In recent weeks, the president has toyed with the idea of selecting and announcing Powell’s replacement by September or October, according to people familiar with the matter. One of these people said the president’s ire toward Powell could prompt an even-earlier announcement sometime this summer.

FED (MNI): Fed Govs Approve Draft Rule to Ease Leverage Ratio

The Federal Reserve Board of Governors on Wednesday voted 5-2 to approve a draft rule to ease leverage rules for big banks, a shift regulators hope will free up more cash for facilitating Treasury market trading and ensure the rules serve as a backstop to risk-based capital requirements rather than a binding constraint. Fed Chair Jerome Powell and Vice Chair for regulation Miki Bowman backed the proposal, as did governors Lisa Cook, Phil Jefferson and Chris Waller. Governors Michael Barr and Adriana Kugler voted against the SLR change, arguing it would significantly reduce capital requirements with dubious benefits for Treasury market intermediation.

US/MIDEAST (NYT): In New Assessment, C.I.A. Chief Says U.S. Strikes ‘Severely Damaged’ Iranian Program

Classified intelligence about the damage to Iran’s nuclear program from U.S. strikes was at the center of a political tempest on Wednesday as spy chiefs pushed out new assessments and President Trump continued to defend his assertion that Iran’s key facilities had been “obliterated.” The C.I.A. director, John Ratcliffe, said the strikes had “severely damaged” Iran’s nuclear program, and the administration suggested that the initial report, by the Defense Intelligence Agency, was based on preliminary assessments and was already outdated.

IRAN (X): Supreme Leader to Speak Soon

"Imam Khamenei's important televised message will be released in minutes." - @khamenei_ir

US/INDIA (RTRS): India, U.S. Trade Talks Face Roadblocks Ahead of Tariff Deadline

Trade talks between India and the U.S. have hit a roadblock over disagreements on import duties for auto components, steel and farm goods, Indian officials with direct knowledge said, dashing hopes of reaching a deal ahead of President Donald Trump's July 9 deadline to impose reciprocal tariffs.

US (WaPo): White House to Limit Intelligence Sharing, Skip Gabbard at Senate Iran Briefing

The White House plans to limit classified intelligence sharing with Congress after leaks to the press of an early assessment undermined President Donald Trump’s claim that U.S. airstrikes obliterated Iranian nuclear facilities, a senior Trump administration official said, setting the stage for a contentious classified briefing before senators Thursday.

EUROPEAN COUNCIL (MNI): EUCO Starts w/Sanctions, Security & Competitiveness on Agenda

Leading straight out of the NATO leaders' summit in The Hague, the European Council summit is underway in Brussels. The main topics of discussion are set to be the next round of sanctions on Russia, efforts to bolster security at the EU level, and EU competitiveness. The prospect of an agreement on an 18th package of EU sanctions against Russia being agreed at the summit remains in the balance.

EUROPE (FT): Ursula von der Leyen Faces No-Confidence Vote Over Pfizergate

European Commission president Ursula von der Leyen is facing a no-confidence vote over a Covid-19 pandemic scandal that threatens to scupper her second-term policy agenda. Far-right lawmakers in the European parliament claim they have secured sufficient support for their motion demanding the commission’s resignation after an EU court ruled against her handling of private messages with the chief executive of a pharmaceuticals company. While von der Leyen is likely to survive the vote, which could take place next month, it may force her to make more compromises both to the left and the right to secure their support.

UK (The Times): Reform UK Would Be Largest Party if General Election Held Today

Reform UK would become Britain’s largest political party if an election were held today, putting Nigel Farage in pole position to become Britain’s next prime minister, a major survey suggests. YouGov’s first MRP poll since Labour’s landslide election victory last year reveals the extent of Sir Keir Starmer’s fall from grace and suggests the party would lose 233 of the 412 seats it won. Reform, meanwhile, is on track to have 271 new MPs, up from the five that it has now, which would make it the largest party in a hung parliament.

SPAIN (MNI): Sanchez Says US Tariffs "Unjust" and "Doubly Unfair"

Delivering doorstep comments at the European Council summit in Brussels, PM Pedro Sanchez says that US tariffs on Spain are "very unjust" and "doubly unfair". At the NATO summit, Sanchez says he is "very satisfied" with the outcome, claiming that "we will achieve capabilities required while maintaining our social cohesion and welfare". There are major doubts within the defensive alliance that Spain will stick to the '3.5%+1.5%' defence spending target agreed to by NATO leaders, with Sanchez saying to NATO that he will hit the target, but domestically saying there is no need for Spain to spend above 2.1% of GDP on defence.

CHINA (MNI): NDRC Securing Power Supply Amid Heat Waves

MNI (Beijing) The government is working to ensure stable power supply and accelerate the development of energy production and infrastructure amid heatwaves sweeping the country, said Li Chao, deputy director and spokesperson for the National Development and Reform Commission, on Thursday. Coal reserves remain at a high level, which provides strong support for the peak summer power supply, Li said, noting recent netizens' comments that air conditioners in every household were running non-stop.

JAPAN (BBG): Japan’s Smooth Two-Year Note Auction Calms Nerves About Demand

Japan’s auction of two-year government bonds went off without a hitch on Thursday, helping to calm nerves in a market that’s been rattled by weak demand for longer-maturity debt. The bid-to-cover ratio was close to the 12-month average, even after the government announced a plan to increase issuance of shorter-term securities to offset the decrease offers of super-long securities. The ratio was 3.9, its highest since January, versus 3.77 last month. That compares with a 12-month average of 3.98.

HONG KONG (MNI): Further HKD Buys May be Forthcoming to Boost Local Rates

Just ahead of the APAC open Thursday, HKMA confirmed they intervened on the weak side of the band, buying HKD 9.42bln (~ $1.2bln) to defend the trading band - the first intervention on this side of the band since early 2023, but follows action on the strong-side just 8 weeks ago. We see this as the shortest gap on record between intervention on each side of the band in it's current form. The intervention settles on Friday, meaning Hong Kong's aggregate balance should shrink by ~HKD10bln to ~HKD 164bln.

BRAZIL (BBG): Brazil’s Congress Blocks Tax Decree in Fiscal Blow to Lula

Brazil’s Congress voted to block President Luiz Inacio Lula da Silva’s proposed tax increases on some financial transactions, dealing a major blow to the government’s efforts to shore up its budget. Lower house lawmakers on Wednesday voted 383-98 to overturn a presidential decree raising so-called IOF taxes, part of a broader fiscal package that seeks to generate new revenues to help reach fiscal targets this year and next.

CORPORATE (BBG): Shell Says It Has No Intention of Making an Offer for BP

Shell Plc said it has no intention of making a takeover offer for BP Plc, refuting an earlier report that two of Europe’s biggest companies were in active merger talks. The announcement quells speculation that the UK’s two oil majors would end up combining, following several years of poor performance from BP and rising pressure from activist shareholder Elliot Investment Management. Shell’s statement means it is bound by the UK Takeover Code, largely preventing it from submitting an offer for BP for six months.

DATA

GERMANY DATA (MNI): Increasing Willingness to Save Dampens Consumer Climate

- GERMANY JULY GFK CONSUMER CLIMATE -20.3

The GfK consumer climate sees a slight decrease of 0.3 points to -20.3 for the advance July reading (June revised -0.1p to -20.0). Commercial sentiment in Germany (IFO, PMIs) has been trending up recently, but the consumer sector appears to not really follow here. "Consumer sentiment in Germany shows no clear trend in June. Economic and income expectations are improving. In contrast, the willingness to buy remains virtually unchanged and the willingness to save is increasing", GfK comments.

SWEDEN DATA (MNI): Goods Trade Surplus Narrows; US Exports Show Signs of Softening

The Swedish goods trade surplus fell to SEK3.9bln in May (vs SEK6.2bln prior), the lowest monthly reding since December. On a 12m rolling basis, goods net trade was SEK66.4bln (vs SEK73.1bln prior). Detailed trade data is still too lagged to fully analyse the impact of US Liberation Day tariffs and subsequent rollbacks, but will be important to track in the coming months as the Riksbank assesses whether downside growth risks are materialising. Markets currently fully price one more 25bp rate cut this year, while the June MPR rate assigned a 50% implied probability of such an outcome.

SWEDEN DATA (MNI): June Business Sentiment Weak; Concerning to Riksbank

The June Economic Tendency Indicator (ETI) will be concerning to the Riksbank, and support market pricing for one more cut this year. The decline in business sentiment, alongside very soft (albeit slightly improving) consumer sentiment encapsulates the Riksbank's June MPR dovish scenario, which if realised could imply a policy rate as low as 1% . This scenario assumed that "the uncertainty regarding the trade conflict and the security policy situation will gradually lead to increasingly large falls in confidence among households and companies", weighing on growth in Q3.

NORWAY DATA (MNI): Another Rise in LFS Trend Unemployment Rate

The Norwegian trend unemployment rate ticked up to 4.5% May, the third consecutive increase from 4.2% in Feb, 4.3% in Mar and 4.4% in Apr. Although last week's surprise rate cut was mostly a function of softer-than-expected inflation pressures, some attention was given to the gradual rise in unemployment rates since March.

AUSTRALIA DATA (MNI): Vacancies Appear to Be Stabilising

Vacancies in the 3-months to May (Q2) rose 2.9% q/q resulting in an improvement in the annual rate to -2.8% from -9.2% in Q1. The ratio to unemployment rose 1.3pp to 54.8%, in line with the four quarter average. It fell consistently for two years from Q3 2022 after reaching an unusual 92.5% but the vacancy environment now appears to have stabilised. The RBA doesn't just consider headline jobs and unemployment data but also indicators such as vacancies. The market expects a July rate cut but data suggest the labour market remains tight.

FOREX: USD Decline Accelerates on Fed Speculation

- The weakness for the USD persists through the European morning, with the greenback comfortably lower against all others in G10. As such, the impulsive bull phase across most major pairs continues, resulting in EUR/USD, GBP/USD and others breaking to new highs.

- For GBP, the price has shown through 1.3750 and, as such, above the January 2022 high - this is keeping resistance at 1.3757 under pressure, above which resistance is scant through 1.38. In line with the extension of USD weakness, EURUSD has pushed through the overnight highs and now trades at the highest level since September 2021. While Trump’s rhetoric regarding the Federal reserve remain a key driver of the moves in G10 FX this morning, the Euro has been consistently displaying resilience.

- Dips for EURUSD have remained shallow, and short-term moving averages have underpinned the move well, best evidence being Monday’s test and subsequent surge off the 20-day EMA.

- For USD/CHF, meanwhile, the latest weakness has extended on a break of key support at 0.8040, the Apr 21 low, confirming a resumption of the medium-term technical downtrend. Furthermore, the pair has breached the psychological 0.8000 mark, representing the lowest recorded level since the removal of the EURCHF floor in 2015.

- Focus ahead turns to the advance US retail sales release, tertiary GDP stats and weekly jobless claims for the latest week. BoE's Bailey is set to speak again, while ECB's Schnabel speaks from Frankfurt. The Fed schedule is busier, with Goolsbee, Barkin, Daly, Hammack and Barr all on the docket.

EGBS: Bund Futures Fade Early Rally; BTP/Bund Below 90bps

Bund futures have faded the early rally, which was seemingly a catch-up to UST strength overnight on reports that US President Trump is considering an accelerated announcement of Fed Chair Powell’s replacement. Bunds are now +10 ticks at 130.56, on relatively light volumes compared to the last few sessions. The June 16 low at 130.17 provides initial support, but better is seen around 130.12 (June 5 low) and 130.11 (2.60% 10-year yield level).

- German yields are up to 1bp lower across the curve. Note that German 5-/10-/30-Year fly has registered the lowest close of ’25 in recent sessions, retracing the entirety of the “whatever it takes” fiscal moment move, as well as countering much of the 10-Year cheapening that came on the back of the political unrest in late ’24.

- Modest long end outperformance evident in German ASWs today, with core global FI firmer and perhaps a degree of spill over from yesterday’s SLR reform-driven widening in long end U.S. swap spreads.

- The 10-year BTP/Bund spread has inched below the psychological 90bp handle (-2bps at 89.5bps), likely aided by a further moderation in 3m10y EUR swaption vol.

- Meanwhile, amid an environment of increasing French political risks, the Government has said that the 2025 deficit target of 5.4% GDP is still achievable if E5bln more in spending cuts can be delivered. The 10-year OAT/Bund spread is 1bp narrower at 68bps.

- Today’s regional data calendar is light, leaving focus on comments from ECB’s de Guindos (1045BST), Schnabel (1200BST) and Lagarde (1930BST). We don’t expect too many new signals.

GILTS: Off Highs Alongside Peers & After Soft Long End Tender

Gilts continue to follow global cues in the main.

- The long end had already pulled back from early highs before the very soft tender results for the off-the-run 20-year gilt (4.25% Dec-46) added further pressure.

- Gilt futures closed the opening gap higher before stabilising.

- Contract last +3 at 93.21.

- Bullish technicals remain intact.

- Initial resistance at the June 25 high (93.57), initial support at the 20-day EMA (92.58).

- Yields 2bp lower to 1bp higher, curve twist steepens. Fundamentals continue to point towards further steepening risks.

- 10s vs. Bunds little changed around 192bp.

- Spread registered the lowest close since early April yesterday, with German issuance matters factoring into 10bp of compression since Friday’s close.

- SONIA futures flat to +3.0

- SFIZ5 registers fresh highs for the month of June, with the May 9 high (96.400) providing immediate resistance.

- BoE-dated OIS moves to price ~54bp of cuts through year-end vs. ~55bp earlier today (in line with most dovish levels of the month).

- Market still attributes 80% odds to the next cut coming in August, with such a step fully discounted through the end of the September MPC.

- We look for cuts in August and November at this stage.

- CBI sales data and comments from BoE’s Bailey due today. BoE’s Greene & Lombardelli are also scheduled to chair panels.

EQUITIES: Fresh Cycle Highs in E-Mini S&P Reinforces Bullish Conditions

A short-term bear cycle in Eurostoxx 50 futures remains intact, however, the recovery from Monday’s low appears to be a potential reversal. The contract has traded through the 20- and 50-day EMAs. A clear break of both averages would strengthen a reversal theme and signal scope for a stronger recovery. This would open 5486.00, the May 20 high and bull trigger. On the downside, a breach of Monday’s 5194.00 low would reinstate a bearish theme. The trend condition in S&P E-Minis is unchanged, it remains bullish and this week’s fresh cycle high reinforces current conditions. Short-term resistance and a bull trigger at 6128.75, the Jun 11 high, has been breached. The clear break confirms a resumption of the uptrend that started Apr 7. Sights are on the 6200.00 handle, a Fibonacci projection. Key support is at the 50-day EMA - at 5931.43. A clear break of it would signal a reversal.

- Japan's NIKKEI closed higher by 642.51 pts or +1.65% at 39584.58 and the TOPIX ended 22.45 pts higher or +0.81% at 2804.69.

- Elsewhere, in China the SHANGHAI closed lower by 7.521 pts or -0.22% at 3448.453 and the HANG SENG ended 149.27 pts lower or -0.61% at 24325.4.

- Across Europe, Germany's DAX trades higher by 165.3 pts or +0.7% at 23663.66, FTSE 100 higher by 12.15 pts or +0.14% at 8731.25, CAC 40 up 8.78 pts or +0.12% at 7566.94 and Euro Stoxx 50 up 7.02 pts or +0.13% at 5259.03.

- Dow Jones mini up 110 pts or +0.25% at 43416, S&P 500 mini up 20.5 pts or +0.33% at 6167.5, NASDAQ mini up 106 pts or +0.47% at 22567.

Time: 09:50 BST

COMMODITIES: WTI Futures Maintain a Softer Tone Following Reversal From Highs

WTI futures maintain a softer tone following the reversal from Monday’s high. Support to watch is at the 50-day EMA, at $64.52. It has been pierced, a clear break of it would signal scope for a deeper retracement. This would expose $58.87, the May 30 low. On the upside, initial resistance to watch is $71.20, the 50.0% retracement of the Jun 23 - 24 high-low range. Key resistance is at $78.40, the Jun 23 high. The trend condition in Gold remains bullish and the latest pullback is considered corrective. Note that moving average studies are in a bull-mode position, highlighting a dominant uptrend. Resistance at $3435.6, the May 7 high, has recently been pierced. A clear break of this level would strengthen the uptrend and open $3500.1, the Apr 22 all-time high. Initial key support to monitor is $3289.4, the 50-day EMA.

- WTI Crude up $0.04 or +0.06% at $64.94

- Natural Gas down $0.08 or -2.26% at $3.329

- Gold spot up $15.73 or +0.47% at $3348.59

- Copper up $8.45 or +1.7% at $505.6

- Silver up $0.22 or +0.59% at $36.4603

- Platinum up $49.48 or +3.65% at $1401.05

Time: 09:50 BST

| Date | GMT/Local | Impact | Country | Event |

| 26/06/2025 | 1100/1300 | ECB Schnabel At 'Wirtschaftsrat der CDU' Finanzmarktklausur | ||

| 26/06/2025 | 1100/1200 | BOE Bailey Keynote Speech At BCC Conference | ||

| 26/06/2025 | 1230/0830 | *** | Jobless Claims | |

| 26/06/2025 | 1230/0830 | ** | WASDE Weekly Import/Export | |

| 26/06/2025 | 1230/0830 | * | Payroll employment | |

| 26/06/2025 | 1230/0830 | ** | Durable Goods New Orders | |

| 26/06/2025 | 1230/0830 | *** | GDP / PCE Quarterly | |

| 26/06/2025 | 1230/0830 | ** | Advance Trade, Advance Business Inventories | |

| 26/06/2025 | 1230/0830 | ** | Durable Goods New Orders | |

| 26/06/2025 | 1245/0845 | Richmond Fed's Tom Barkin | ||

| 26/06/2025 | 1300/0900 | Cleveland Fed's Beth Hammack | ||

| 26/06/2025 | 1400/1000 | ** | NAR Pending Home Sales | |

| 26/06/2025 | 1430/1030 | ** | Natural Gas Stocks | |

| 26/06/2025 | 1430/1530 | BOE Lombardelli Chairs Panel On Communicating Uncertainty | ||

| 26/06/2025 | 1500/1100 | ** | Kansas City Fed Manufacturing Index | |

| 26/06/2025 | 1530/1130 | * | US Bill 08 Week Treasury Auction Result | |

| 26/06/2025 | 1530/1130 | ** | US Bill 04 Week Treasury Auction Result | |

| 26/06/2025 | 1700/1300 | ** | US Treasury Auction Result for 7 Year Note | |

| 26/06/2025 | 1700/1300 | * | US Treasury Auction Result for Cash Management Bill | |

| 26/06/2025 | 1715/1315 | Fed Governor Michael Barr | ||

| 26/06/2025 | 1830/2030 | ECB Lagarde Opening Speech at Münchner Opernfestspiele | ||

| 26/06/2025 | 1900/1500 | *** | Mexico Interest Rate | |

| 27/06/2025 | 2330/0830 | * | Labor Force Survey | |

| 27/06/2025 | 2330/0830 | ** | Tokyo CPI | |

| 27/06/2025 | 2350/0850 | * | Retail Sales (p) | |

| 27/06/2025 | 0600/0800 | ** | PPI | |

| 27/06/2025 | 0645/0845 | *** | HICP (p) | |

| 27/06/2025 | 0645/0845 | ** | PPI | |

| 27/06/2025 | 0645/0845 | ** | Consumer Spending | |

| 27/06/2025 | 0700/0900 | *** | HICP (p) | |

| 27/06/2025 | 0800/1000 | ** | ISTAT Consumer Confidence | |

| 27/06/2025 | 0800/1000 | ** | ISTAT Business Confidence | |

| 27/06/2025 | 0900/1100 | * | Consumer Confidence, Industrial Sentiment | |

| 27/06/2025 | 1000/1200 | ** | PPI | |

| 27/06/2025 | 1130/0730 | New York Fed's John Williams | ||

| 27/06/2025 | 1230/0830 | *** | Gross Domestic Product by Industry | |

| 27/06/2025 | 1230/0830 | *** | Personal Income and Consumption | |

| 27/06/2025 | 1230/0830 | *** | Gross Domestic Product by Industry | |

| 27/06/2025 | 1315/0915 | Cleveland Fed's Beth Hammack | ||

| 27/06/2025 | 1400/1000 | *** | U. Mich. Survey of Consumers | |

| 27/06/2025 | 1400/1000 | ** | University of Michigan Surveys of Consumers Inflation Expectation | |

| 27/06/2025 | 1500/1100 | Finance Dept monthly Fiscal Monitor (expected) | ||

| 27/06/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 27/06/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly |