MNI US OPEN - USD Tumbles as Tariffs Stoke Growth Concerns

EXECUTIVE SUMMARY

- CHINA TO FIGHT AGAINST US RECIPROCAL TARIFF; EC PREPARING RESPONSE

- AUTO TARIFFS TAKE EFFECT, PUTTING PRESSURE ON NEW CAR PRICES

- RUBIO VISITS NATO AMID EUROPEAN ALARM OVER TRUMP’S AGENDA

- BOJ MAY RATE HIKE HOPES FADE AS RISK MOUNTS – MNI EXCLUSIVE

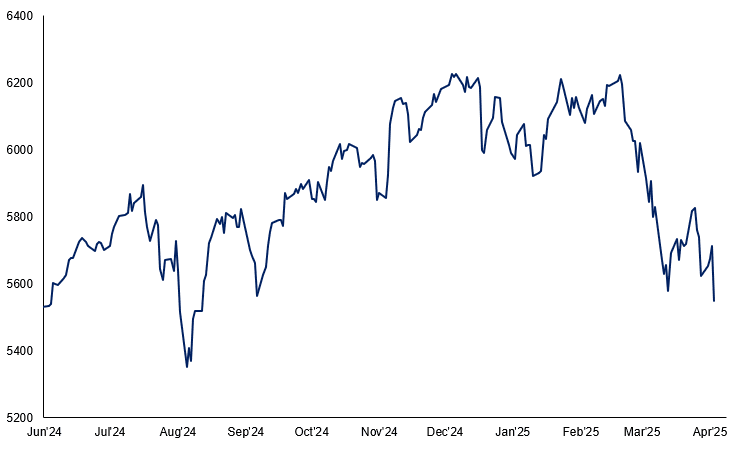

Figure 1: E-Mini S&P tumbles following reciprocal tariff announcement

Source: MNI/Bloomberg

NEWS

US/CHINA (MNI): China to Fight Against US Tariff - MOFCOM

MNI (Beijing) China will fight back against the U.S.'s so called reciprocal tariffs revealed Wednesday local time and take decisive countermeasures to safeguard its interests, said the Ministry of Commerce in a statement on Thursday. “China urges the U.S. to immediately revoke its unilateral tariffs and address disputes with trade partners through equal dialogue,” it stated, noting the approach based on “subjective and self-serving assessments” violates international trade rules, infringes on the rights of affected parties, and epitomises bullying.

US/EUROPE (MNI): EC Preparing Response to US Tariffs - Von Der Leyen

Brussels is ready to negotiate with the US to reduce barriers to EU-US trade but is already preparing countermeasures to the 20% tariffs on EU imports which President Trump announced on Wednesday evening, European Commission President Ursula von der Leyen said in a statement. The EC chief said she agreed with Trump that some countries had been taking "unfair advantage" of the current rules of the global trading system, but insisted that tariffs were not the way to fix the problem.

US (NYT): Auto Tariffs Take Effect, Putting Pressure on New Car Prices

Tariffs on imported vehicles took effect Wednesday, a policy that President Trump said would spur investments and jobs in the United States but that analysts say will raise new car prices by thousands of dollars. The 25 percent duty applies to all cars assembled outside the United States. Starting May 3, the tariff will also apply to imported auto parts, which will add to the cost of cars assembled domestically as well as auto repairs.

US/NATO (NYT): Rubio Visits NATO Amid European Alarm Over Trump’s Agenda

Secretary of State Marco Rubio traveled to Brussels on Thursday for a gathering of NATO foreign ministers amid high anxiety over the Trump administration’s approach to Europe, including the war in Ukraine, relations with Russia and President Trump’s growing trade war with the continent. Mr. Rubio’s visit to the alliance’s headquarters, the first by a senior Trump administration official this year, comes as relations between the United States and Europe have abruptly shifted from the close cooperation of the Biden era to mistrust and acrimony under Mr. Trump.

US (BBG): Bessent Signals US on Debt-Limit ‘Warning Track’ for May or June

Treasury Secretary Scott Bessent indicated that the federal government is at risk of running out of room to make good on all of its payment obligations on time as soon as May or June. “We are going to go onto the warning track sometime in May or June,” Bessent said in an interview with Bloomberg Television Wednesday. “If the debt ceiling is resolved via reconciliation, then it has to be done” before the so-called X-date is reached, he said.

US (FT): Elon Musk Denies Role in Trump Administration Is Under Pressure

Elon Musk has rubbished claims that his role in the Trump administration is coming to a premature end, after the billionaire’s unpopularity was seized upon by Democrats to clinch a crucial state supreme court race. In a post on X, he decried as “fake news” a report by Politico, which said Trump had told confidants he expected Musk to leave as head of the so-called Department of Government Efficiency (Doge) within weeks.

FED (MNI): Kugler Wants Fed Framework to Be More Lasting

Federal Reserve Governor Adriana Kugler said Wednesday the central bank's framework, which is currently under review, must be broad enough to apply to varying economic scenarios. "We need to have a framework that is resilient and that can help us move forward in terms of considering many potential situations that need to be faced," she told an event at Princeton University. "We need to make it as resilient as possible in the sense that we cannot focus on zero lower bound issue. We need to consider all potential situations and economic conditions."

ECB (BBG): Nagel Says US Tariffs Will Put ECB Policy Progress to Test

US President Donald Trump’s array of tariffs threatens the global economy and calls into question the European Central Bank’s achievements in fighting inflation, according to Governing Council member Joachim Nagel. “The US administration’s decisions to impose tariffs endanger global economic stability,” the Bundesbank president said in a statement on Thursday. “The result will be an attack on the prosperity of all. Global economic growth will decline. Prices will rise.”

ECB (BBG): ECB’s Stournaras Says US Tariffs No Obstacle to April Rate Cut

The tariffs announced by the US administration are expected to “negatively influence the euro-area’s GDP growth rate with a first estimate of the order of 0.3% to 0.4% in the first year,” European Central Bank Governing Council member Yannis Stournaras tells Bloomberg News. “The downward path on inflation is expected to continue,” says Stournaras, who heads the Bank of Greece.

GERMANY/FRANCE (MNI): US Tariffs a 'Catastrophe for Economic World' - French PM

Germany's caretaker Chancellor Olaf Scholz speaking for the first time since the US' announcement of 'reciprocal' tariffs on the world, says that President Donald Trump's decision on tariffs is "fundamentally wrong", and that "the entire world economy will suffer from this". Scholz says that "Europe will respond appropriately and proportionately". Scholz: "Even if we did nothing in ,response, the tariffs will cause problems for the US economy...There are intricate supply chains that you can't simply sever."

Scholz's comments are slightly less doom-mongering than those of French PM Francois Bayrou, who said earlier in a meeting at the Senate, "This decision is a catastrophe for the economic world. It is a huge challenge for Europe. I believe it is also a catastrophe for the United States and for American citizens."

JAPAN (BBG): Japan Says Trump’s 24% Tariff Disappointing, Vows Domestic Aid

Japan’s Prime Minister said the Trump administration’s latest tariff broadside is disappointing and vowed support for domestic industries, after the US announced new levies on Japan that were much higher than expected. Japan will be subject to a 24% across-the-board tariff starting next week, US President Donald Trump said on Wednesday in Washington, just hours before a previously announced 25% levy on all car imports was set to take effect.

BOJ (MNI EXCLUSIVE): BOJ May Rate Hike Hopes Fade as Risk Mounts

MNI discusses the BOJ's near-term rate hike chances. On MNI Policy MainWire now, for more details please contact sales@marketnews.com.

BOJ (MNI EXCLUSIVE): BOJ Rate Hike Likely in June - Kameda

MNI discusses the BOJ's policy rate strategy with a former bank economist. On MNI Policy MainWire now, for more details please contact sales@marketnews.com.

RBA (MNI EXCLUSIVE): RBA to Reveal Board Transparency Plans in H2

MNI looks at the RBA board's impending plans for greater transparency. On MNI Policy MainWire now, for more details please contact sales@marketnews.com

AUSTRALIA (BBG): Albanese Slams Trump Tariffs on Australia as ‘Poor Decision’

Prime Minister Anthony Albanese said the US announcement of a 10% tariff on Australian goods was a “poor decision,” adding he would not respond with reciprocal levies. The measures unveiled by President Donald Trump are “not the act of a friend,” Albanese told reporters in Melbourne on Thursday, pointing out Australia has no tariffs on American products. The levies were part of a global tariff rollout on US trading partners worldwide.

ASIA (MNI): Little in the Way of Concrete Responses to US Tariffs So Far

Responses coming through from some major Asian economies' gov'ts regarding the US tariffs announced on 2 April. As would be expected, countries are still in the process of digesting their impact. Despite the widespread knowledge of 'Liberation day', many countries appear not to have retaliatory measures 'locked and loaded'. The Indian Trade Ministrysays that they are "engaged with all stakeholders [...] taking feedback of their assessment of tariffs and assessing the situation." Ends by saying they remain in touch with the White House on the issues and "expect to take them forward in the coming days".

SOUTH AFRICA (MNI): DA Said to Be Readying for GNU Exit After Budget Stand-off

The National Assembly passed the fiscal framework underpinning the 2025 National Budget, as the African National Congress's (ANC's) deal with ActionSA allowed them to overpower resistance from the Democratic Alliance (DA), the second-largest party in the coalition government. Earlier press reports noted that President Cyril Ramaphosa told the ANC's caucus that it the DA vote against the fiscal framework, they would define themselves outside of the Government of National Unity (GNU). The fiscal framework was adopted with 194 votes in favour, 182 against, and no abstentions.

DATA

EUROZONE DATA (MNI): EZ PPI Y/Y Accelerates Again on Energy Increase

- EUROZONE FEB PPI +0.2% M/M, +3% Y/Y

Eurozone PPI inflation rose in-line with expectations in February at 3.0% Y/Y (vs 1.7% revised prior from 1.8%). This is the third non-deflationary Y/Y print since 2023, as energy prices have shifted from dragging down producer prices. PPI ex energy increased only marginally to 1.4% Y/Y from 1.3% in January. All five sub-components saw Y/Y increases again, though consumer and capital

goods both saw a slower pace of growth than January. Energy producer prices were again solid rising 7.4% Y/Y after 3.4% in January the second increase since early 2023.

SPAIN DATA (MNI): Services PMI Details Decent Despite Miss Versus Expectations

- SPAIN MAR SERVICES PMI 54.7 (FCST: 55.5); FEB 56.2

The underlying details of the Spain services PMI remain relatively positive, despite the lower than consensus reading of 54.7 (55.5 expected, 56.2 prior). The only real notable negative is in new work. See details: "The growth trend in new work remained downward, easing further on January's recent high to its softest since last August."

ITALY DATA (MNI): Services PMI Mixed Details; Price Rises “Most Pronounced” in a Year

- ITALY MAR SERVICES PMI 52.0 (FCST: 52.5); FEB 53.0

There were some mixed details in the Italian services PMI report (with the index 0.5 points below consensus at 52.5, 53.0 prior). The most significant in our view was the increase in output prices rising at the "most pronounced" in a year. "Amid reports of increased wage burdens, overall operating expenses ticked higher, with the rate of inflation at its strongest in nearly a year. Companies raised their charges in response, and at a pace that was among the most pronounced seen over the past year."

EUROZONE FINAL MAR SERVICES PMI 51.0 (FLASH: 50.4); FEB 50.6 (MNI)

GERMANY FINAL MAR SERVICES PMI 50.9 (FLASH: 50.2); FEB 51.1 (MNI)

FRANCE FINAL MAR SERVICES PMI 47.9 (FLASH: 46.6); FEB 45.3 (MNI)

UK MAR FINAL SERVICES PMI 52.5 (FLASH: 53.2); FEB 51.0 (MNI)

UK DATA (MNI): DMP: Similar Picture to Last Month - No Real Progress Since Oct Budget

No huge developments in the DMP survey: expected price and wage growth remain broadly at the same levels they have for a few months now. Progress on disinflation in these metrics seems to have stalled post-October Budget. Mean expected price growth: The single month measure has ranged from 3.9-4.0% for four consecutive months now (after reaching 3.3% in August and rising from 3.6% pre-October Budget). Realised price growth was 3.7% on the single month measure (the same as in January and November but above February's 3.5% and below December's 4.0%).

SWITZERLAND DATA (MNI): CPI Headline 'Miss' Driven by Airfares

- SWISS MAR CPI +0% M/M, +0.3% Y/Y

Looking at the details of the Swiss March CPI print suggests that the low-volatility services subcategories have been a bit firmer than before, while (volatile) airfares dragged down headline - this means that from an mid-term inflationary pressure standpoint, which the SNB appears to consider key in their rate decisions, the print might have been firmer than the headline 'miss' suggests.

JAPAN DATA (MNI): Output Gap -0.27% in Q4, 19th Straight Drop

Japan's output gap was estimated at -0.27% in Q4, narrowing from -0.55% in Q3 but posting its 19th straight negative print, indicating upward pressure on prices continues with a time lag, data released by the BOJ showed on Thursday. The BOJ's estimate of the output gap, based on capital and labour stocks, is smaller to the Cabinet Office's last estimate of +0.2% in Q4 (vs. -0.2% in Q3), which is based on revised second preliminary Q4 GDP data showing a 0.6% rise q/q, or an annualised rate of 2.2%.

AUSTRALIA DATA (MNI): Trade Surplus Trending Lower as Commodity Exports Fall

- AUSTRALIA FEB TRADE BALANCE A$+2968

Australia's merchandise trade surplus narrowed significantly more than expected to $2.97bn in February from $5.16bn as exports fell 3.6% m/m while imports rose 1.6%. This was the smallest surplus since August 2020 and after stalling in 2024, it appears that the downtrend may have resumed. Goods exports fell 6.6% y/y in February down from -3.6%. They have contracted for almost two years, predominantly driven by weak demand from China and a moderation in commodity prices.

FOREX: EUR/USD Rips Through $1.10 as USD Over 1% Lower Than Election

- The greenback's step lower on yesterday's tariff announcement is extending into Thursday's NY crossover, prompting the USD Index to break comfortably through 103.00 and plumb the lowest levels since early October. This puts the currency over 1% lower relative to Trump's election and near 7% lower since his inauguration in January.

- Dwindling Fed pricing is largely responsible here, with markets adopting the view that softer-than-expected global economic growth with counter the inflationary pressure of levies, and force the Fed's hand in cutting rates more aggressively for the remainder of 2025.

- Unsurprisingly then, the greenback is by a distance the weakest currency in G10 - with haven currencies JPY and CHF firmer. Interestingly, the single currency is rallying sharply as markets look to the EU for their countermeasure response, which is likely to pressure US services and tech firms on top of measures to support local growth and domestic businesses. As a result, EUR/USD has rallied through the $1.10 handle, breaking mid-March resistance in the process.

- Antipodean currencies are not benefiting, however, with AUD and NZD among the weakest in G10 as APAC trade partners are hit with among the most punitive tariff measures on Trump's table - with China, Vietnam and Cambodia seeing the sharpest rates, on top of the 10% levy for Australia itself.

- Any further commentary from Trump's team is unlikely Thursday, with his schedule light on public events. Topically, trade balance data from the US and Canada crosses as well as ISM Services data and the weekly jobless claims release. Fed's Jefferson & Cook will be watched carefully, however it's Powell's speech on the economic outlook on Friday that takes primary focus.

BONDS: Off Highs, But Most of Tariff-Driven Rally Sticks

A move off session lows in European equities and the lack of willingness to challenge 2.60% in Bund yields sees EGBs back from best levels.

- Bund futures traded as high as 129.94 before fading back to 129.71 last.

- Marks higher in the final round of services PMI readings will have provided some modest background pressure as well.

- Still, EGBs hold onto the bulk of the rally triggered by the imposition of U.S. tariffs.

- German yields 3-11bp lower on the day, curve bull steepens.

- EGB spreads to Bunds little changed to 2.5bp wider, with GGBs & BTPs seeing the most notable rounds of underperformance. Note that the major spreads that we monitor remain within their respective multi-week ranges.

- ECB pricing is 4-10bp more dovish across ’25 meetings, ~70bp of cuts showing through the December decision.

- Gilt futures traded as high as 93.14 but have faded back to 92.70 last.

- Yields 3-8bp lower, curve bull steepens.

- 5s30s threatens the first close above 100bp since ’21, last ~105bp.

- UK 10s are ~1bp wider to Bunds, probably owing to the harsher U.S. trade levies imposed on the EU vs. the UK.

- Soft reception of the latest 15-Year gilt auction also factors into that move.

- BoE-dated OIS 2-8bp more dovish across ’25 meetings, showing ~61bp of cuts through year-end.

- Expect continued reaction to the U.S. tariffs to drive markets for much of the remainder of the session. U.S. ISM and weekly jobless claims headline the global data calendar.

EQUITIES: Fresh Cycle Lows in E-Mini S&P Strengthens Bearish Theme

Eurostoxx 50 futures remain in a bear cycle following recent weakness and today’s fresh cycle low strengthens the bearish condition. Recent weakness resulted in a break of support at 5229.00, the Mar 11 low. This signals scope for an extension towards 5079.00, the Feb 3 low. Initial firm resistance is 5325.98, the 20-day EMA. A clear break of this average is required to highlight a reversal. S&P E-Minis are trading in a volatile manner. A bearish theme remains intact and today’s fresh cycle low, strengthens current conditions. A resumption of weakness would signal scope for an extension towards 5396.00, a Fibonacci projection. Moving average studies are in a bear-mode position, highlighting a dominant downtrend. Key short-term resistance has been defined at 5837.25, the Mar 25 high.

- Japan's NIKKEI closed lower by 989.94 pts or -2.77% at 34735.93 and the TOPIX ended 81.68 pts lower or -3.08% at 2568.61.

- Elsewhere, in China the SHANGHAI closed lower by 8.119 pts or -0.24% at 3342.008 and the HANG SENG ended 352.72 pts lower or -1.52% at 22849.81.

- Across Europe, Germany's DAX trades lower by 298.96 pts or -1.34% at 22092.8, FTSE 100 lower by 86.91 pts or -1.01% at 8521.47, CAC 40 down 132.74 pts or -1.69% at 7728.35 and Euro Stoxx 50 down 96.59 pts or -1.82% at 5207.36.

- Dow Jones mini down 993 pts or -2.34% at 41499, S&P 500 mini down 159.25 pts or -2.79% at 5553.25, NASDAQ mini down 596.75 pts or -3.02% at 19162.75.

Time: 09:50 BST

COMMODITIES: WTI Futures Sharply Reverse This Week's Earlier Move Higher

WTI futures traded sharply higher earlier this week. This continues to signal scope for an extension of the bull cycle near-term, and the latest pullback is considered corrective - for now. A resumption of gains would refocus attention on key resistance at $72.91, the Feb 11 high. Clearance of this level would strengthen a bullish theme. Support to watch is $69.26, the 20-day EMA. It has been pierced, a clear break of it would highlight a reversal. The trend condition in Gold is unchanged, it remains bullish and today’s fresh cycle high reinforces current conditions. Moving average studies remain in a bull-mode position highlighting a dominant uptrend and positive market sentiment. The next upside objective is $3196.2, a Fibonacci projection, ahead of the $3200.0 handle. On the downside, key short-term support lies at $3026.6, the 20-day EMA.

- WTI Crude down $2.38 or -3.32% at $69.35

- Natural Gas down $0.02 or -0.47% at $4.036

- Gold spot down $6.89 or -0.22% at $3127.77

- Copper down $10.5 or -2.08% at $493.3

- Silver down $0.78 or -2.31% at $33.102

- Platinum down $1.51 or -0.15% at $975.24

Time: 09:50 BST

| Date | GMT/Local | Impact | Country | Event |

| 03/04/2025 | 1000/1200 | ECB's Schnabel At OECD Seminar | ||

| 03/04/2025 | 1230/0830 | *** | Jobless Claims | |

| 03/04/2025 | 1230/0830 | ** | WASDE Weekly Import/Export | |

| 03/04/2025 | 1230/0830 | ** | International Merchandise Trade (Trade Balance) | |

| 03/04/2025 | 1230/0830 | ** | Trade Balance | |

| 03/04/2025 | 1345/0945 | *** | S&P Global Services Index (final) | |

| 03/04/2025 | 1345/0945 | *** | S&P Global US Final Composite PMI | |

| 03/04/2025 | 1400/1000 | *** | ISM Non-Manufacturing Index | |

| 03/04/2025 | 1430/1030 | ** | Natural Gas Stocks | |

| 03/04/2025 | 1530/1130 | ** | US Bill 04 Week Treasury Auction Result | |

| 03/04/2025 | 1530/1130 | * | US Bill 08 Week Treasury Auction Result | |

| 03/04/2025 | 1630/1230 | Fed Vice Chair Philip Jefferson | ||

| 03/04/2025 | 1830/1430 | Fed Governor Lisa Cook | ||

| 04/04/2025 | 2330/0830 | ** | Household spending | |

| 04/04/2025 | 0545/0745 | ** | Unemployment | |

| 04/04/2025 | 0600/0800 | Flash CPI | ||

| 04/04/2025 | 0600/0800 | ** | Manufacturing Orders | |

| 04/04/2025 | 0600/0800 | *** | Flash Inflation Report | |

| 04/04/2025 | 0630/0730 | DMO announce Apr-Jun issuance operations | ||

| 04/04/2025 | 0645/0845 | * | Industrial Production | |

| 04/04/2025 | 0700/0900 | ** | Industrial Production | |

| 04/04/2025 | 0730/0930 | ** | S&P Global Final Eurozone Construction PMI | |

| 04/04/2025 | 0800/1000 | * | Retail Sales | |

| 04/04/2025 | 0800/1000 | ECB's De Guindos Gives Lecture In Barcelona | ||

| 04/04/2025 | 0830/0930 | ** | S&P Global/CIPS Construction PMI | |

| 04/04/2025 | 1230/0830 | *** | Employment Report | |

| 04/04/2025 | 1525/1125 | Fed Chair Jerome Powell | ||

| 04/04/2025 | 1600/1200 | Fed Governor Michael Barr | ||

| 04/04/2025 | 1645/1245 | Fed Governor Chris Waller | ||

| 04/04/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 04/04/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly |