EU TRANSPORTATION: Mobico | Sells NA School Bus Business (x3)

Apr-25 12:29

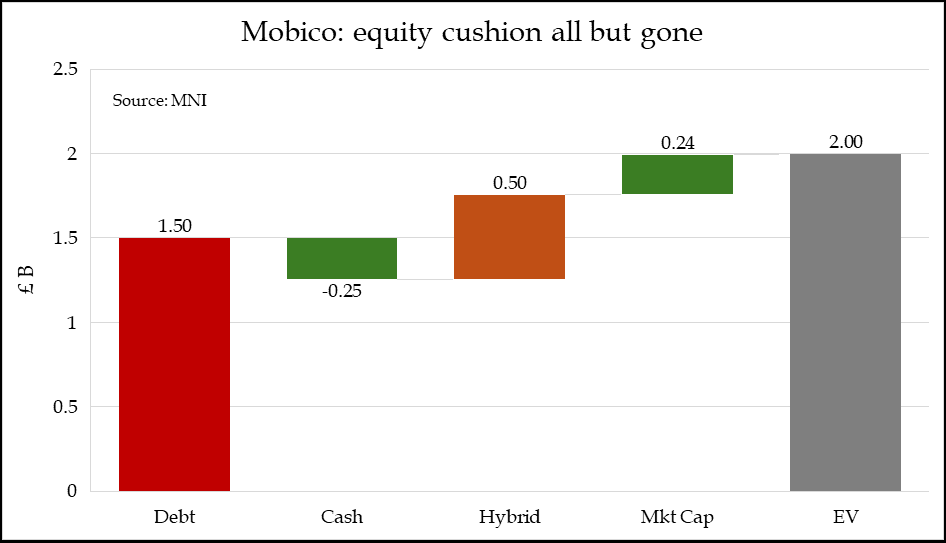

(MCGLN; Ba2/NR/BBB-; Stable) (equities -39%)

We do not see value on £28s or €31s and encourage caution for those without a firm view.

- The £28s and €31s are 15-20bps tighter - perhaps reflecting resolution of uncertainty on sale closing.

- We would caution this is at best a leverage neutral transaction.

- As it reduces scale (by 25%) and geographical diversification (to Spain) net it is a credit negative.

- Mobico had some of the worst governance across consumer/transport last year - holding most of the proceeds in cash and guiding to not pulling the perps does little to change this.

- Moody's will not like this and we see no rating upside there.

- We still see it holding above Fitch's rating threshold - it may be lenient given leverage is trending down yoy (from earnings growth).

- The €31s are tough to RV given long duration but extrapolating shorter dated HY risk and looking at similar rated fallen angels - it does not look attractive.

- The £28s have a coupon step down on all rating agencies moving back into IG - that likely does not need to be priced for next coupon period (i.e. 3.625% for Nov 2025-26 interest period) - but please keep in mind.

- Even assuming the 3.625% coupon stays till maturity, we do not see value on £28s either.

- Re. equities, it is small cap and does swing around. They are likely disappointed at the multiple achieved (5x on EBITDA). We see few peer transactions on high single-digit multiples in recent years. Mobico itself has moved to trade on a 5x (EV) multiple.

- Given governance history, we would caution investors to have a firm view on this name before touching it.

- Next catalyst is FY earnings on Tuesday and does not look great on increasing loss provisions for German Rail contracts (£85m provision increase, which will be adjusted out of earnings, but is a real credit negative).

- It says adjusted EBIT will come in at lower end of £185-205m guidance. Stripping out the sold business (for which it has given FY EBIT estimate), continuing business adj. EBIT likely rose ~10%yoy.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

FOREX: AUDJPY Pressuring the 50-Day EMA Once More

Mar-26 12:27

- Major US equity benchmarks have been consolidating Monday’s solid recovery, and this dynamic has supported a 1.35% advance for AUDJPY from last Friday’s close, and a 3.3% bounce from the double bottom low ~92.00. Notably, the pair shrugged off the softer-than-expected Australia CPI data overnight, where the focus remains on the underlying trimmed mean which moderated 0.1pp to 2.7% y/y and has been under 3% now for three straight months.

- For AUDJPY specifically, today’s high of 95.19 matched closely with the 50-day exponential moving average, which has proved significant in recent months. Importantly, we have not closed above this average since January. Should a more optimistic tone for risk prevail and AUDJPY breach the 50-day on a closing basis, the cross would quickly encounter downtrend resistance (drawn from the July ’24 high) around 95.50, and the March high at 95.75.

- In Japan, BoJ’s Ueda said on Wednesday that the real short-term interest rate is below -2.0%, slightly lower than the latest BOJ estimate, and the bank will raise the policy rate to adjust the degree of accommodative financial conditions. Ueda told lawmakers that the BOJ is always paying attention to the risk that the pace of underlying CPI inflation will accelerate above forecasts.

- The Australia economic calendar remains very light until the Melbourne institute’s inflation gauge and retail sales, both due early next week.

COPPER TECHS: Price Remains Overbought, But History Shows it Can Go Further

Mar-26 12:22

- The copper price chart continues to shoot higher (printing higher highs in 11 of the past 12 sessions), with futures today again hitting a contract high of $518.85 to add additional pressure to the 2024 highs and key resistance at $519.90 - an alltime high on the COMEX-listed generic contract.

- Tariffs remain the key driver, with Bloomberg reporting overnight that US tariffs on copper imports headed to the US could be coming "within several weeks", far earlier than the likely delivery of a report into copper import practices, for which the White House allowed a 270 day turnaround. As a result, US-listed copper has outperformed London-listed copper considerably (COMEX contracts up over 30% YTD vs. 15% for LME contracts) on scarcity concerns.

- This leaves currencies and assets with a high correlation to copper prices considerably firmer on the year: CLP, COP and ZAR are higher by 8%, 7% and 3% respectively against the USD this year - and highly exposed to any subsequent tariffs-driven pullback in prices. Knowing the frequent occurrences of White House U-turns and tariff resets, this is likely already partially-baked into prices.

- While Copper prices are technically overbought - history shows the price can tolerate extended periods of stronger prices for a longer duration that the current rally. In the past 5 years there are 13 occasions of a higher RSI not subsequently followed by a material drawdown in prices.

EGB SYNDICATION: Belgium 10-year USD benchmark: Final terms

Mar-26 12:16

- Size: USD1.0bln (MNI expected USD 1.0-1.5bln)

- Maturity: 2 April 2035

- Settlement: 2 April 2025 (T+5)

- Coupon: Fixed, SA 30/360

- Final Spread set earlier: MS + 67 bps (in line with IPTs yesterday)

- Bookrunners: CITI(DM/B&D)/JPM/MS

- ISINs: RegS: BE6362168351 / 144A: BE6362169367

- Timing: Books to close at 12:30GMT / 8:30CET, today's business.

From market source / MNI colour