STIR: Negative SNB Rates Pricing Remains Despite Schlegel Pushback

Jun-19 12:01

Swiss OIS-implied terminal rates shifted higher following the hawkish-leaning SNB monetary policy outlook and press conference but remained in negative territory, standing at -0.22% through the March 2026 meeting (the highest since mid-May, vs -0.31% yesterday).

- That repricing happened throughout the press conference and accelerated on the back of Schlegel's 09:53 BST comment of the SNB seeing a "considerably higher hurdle" to cuts into negative rates than for cuts within positive territory. Note that we have flagged Schlegel's communication leaning hawkish amid his comment that the SNB is "aware that negative interest can have undesirable side-effects and presents challenges for many economic agents" already in his monetary policy outlook at 09:00 BST.

- For the next meeting in September, OIS-implied odds for another 25bp cut to -0.25% stand at almost 40% at the time of writing - which still appears quite aggressive to us given:

- a) the amount of concern the SNB's governing board had at the press conference against such a move

- b) the fact that the end-of-horizon (2027) conditional inflation forecast was only downwardly revised by 0.1pp to 0.7% ("hardly any change from March" - opening remarks) despite average Q2 inflation to date printing 0.37pp below March's forecast for the quarter - at 0.7%, to us, there appears to be some distance to mid-term Swiss price stability being threatened.

- Put differently, our assessment of SNB rhetoric is that we would have to see considerable downside surprises to the new conditional inflation forecasts through the September meeting for a renewed cut to materialize, and this against the background of the SNB removing a "downside inflation risks" reference from their press statement this time.

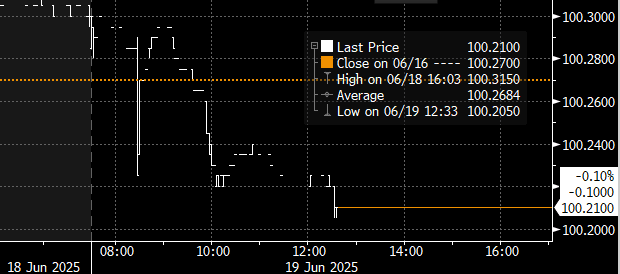

Figure 1: March-26 3m SARON Futures (SSYH6 Comdty, Bloomberg Finance L.P.)

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

SONIA: OPTIONS: SFIN5 95.90 Puts Lifted

May-20 12:01

SFIN5 95.90 puts paper paid 2.75 on 4K.

SONIA: OPTIONS: SFIQ5 96.10/96.25/96.40 Call Fly Lifted

May-20 11:58

SFIQ5 96.10/96.25/96.40 call fly paper paid 2.5 on 6K.

US TSY FUTURES: June'25-September'25 Roll Update

May-20 11:56

The latest Tsy quarterly futures roll volumes from June'25 to September'25 below. Percentage complete only 5%-10% across the curve ahead the "First Notice" date on May 30. Current roll details:

- TUM5/TUU5 appr 6,600 from -8.88 to -8.62, -8.75 last, appr 5% complete

- FVM5/FVU5 appr 44,300 from -3.75 to -3.25, -3.5 last, appr 10% complete

- TYM5/TYU5 appr 25,300 from -1.75 to -1.0, -1.5 last, appr 7% complete

- UXYM5/UXYU5 appr 4,100 from 3.25 to 3.5, 3.5 last, appr 2% complete

- USM5/USU5 appr 1,400 from 10.25 to 10.75, 10.25 last, appr 5% complete

- WNM5/WNU5 appr 1,400 from 6.0 to 7.0, 6.25 last, appr 5% complete

- Reminder, June futures won't expire until next month: 10s, 30s and Ultras on June 18, 2s and 5s on June 30. June Tsy options, however, expire May 23.