EM LATAM CREDIT: New Deal Update: Avianca Midco 2 PLC $1b 5NC2 Sr Sec

Avianca Midco Senior Secured (AVIAGP; B2/-/B)

LAUNCH: Avianca Midco 2 PLC $1b 5NC2 Sr Sec to Yield 9.875%

GUIDANCE: Avianca Midco 2 PLC $1b 5NC2 Sr Sec 10%a (+/-12.5)

IPTs: Low 10% Area

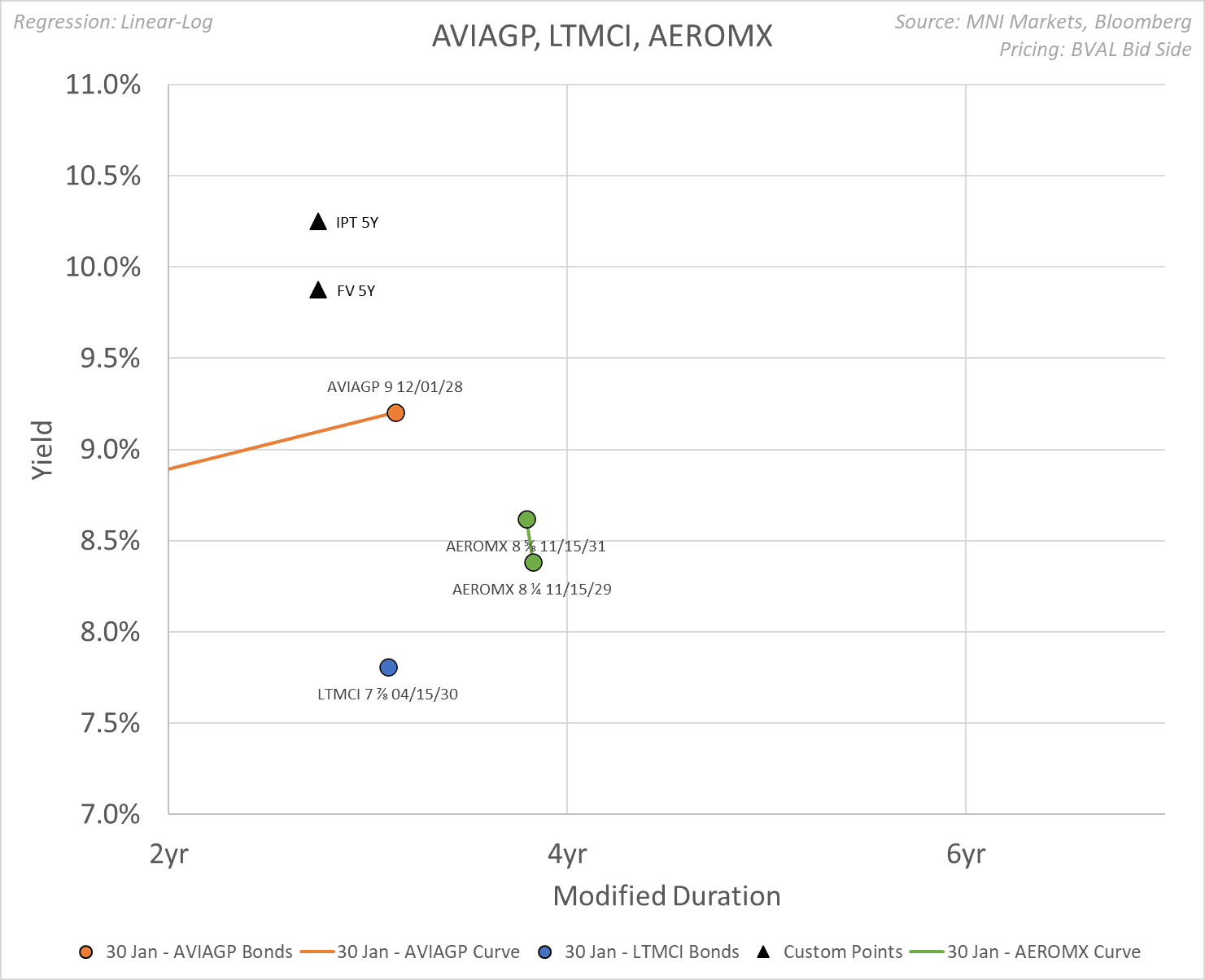

FV: 9.875%

- Colombian regional airline issuing USD1bn Senior Secured notes to refinance Chapter 11 era debt from when it emerged from bankruptcy in 2021. The Latin American regional airline sector has been challenging the past few years with Brazilian airline Gol filing for bankruptcy in Jan. 2024, Brazilian airline Azul restructuring debt last year and Latam Airlines emerging from bankruptcy in 2022. It seems you are getting paid for the business risk and liabilities have been termed out so the bonds look interesting.

- AVIAGP 2028s are trading 9.125%. Chilean based Latam Airlines Group (LTMCI; Ba2/BB+/-) issued a similar 5NC2 structure back in October at 7.875% now trading around 7.75%. Latam bonds are rated much higher with a stronger balance sheet. Also with a strong balance sheet, plentiful free cash flow generation and a better business position than Avianca, Mexican airline Grupo Aeromexico (AEROMX; Ba3/BB-) issued a 5NC2 late last year at 8.25% now trading around 8.3%.

A lot of Avianca’s debt is secured which leaves less flexibility in case of a change in circumstances. Avianca is part of the Abra Group and there are ongoing discussions about a possible merger between Gol and Azul. Abra has said if a deal were consummated it would operate all three airlines independently.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US TSYS: Tsy Curves Look To Finish 2024 at June'22 Highs

- Treasuries look to finish the last trading session of 2024 lower after reversing Tuesday morning support. Markets closed Wednesday for New Years day, resume full trade Thursday.

- The Mar'25 10Y contract trades 108-25.5 (-5.5) late in the day, 10Y yield near session high of 4.5871%. Curves bounced off flatter levels, 2s10s climbing to 34.344 -- the highest level since June 2022.

- Short end support, in turn, helped projected rate cuts into early 2025 gain momentum vs. late Monday levels (*) as follows: Jan'25 steady at -2.8bp, Mar'25 -14.6bp (-13.6bp), May'25 -20.6bp (-19.5bp), Jun'25 -29.8bp (-28.8bp).

- No substantive reaction to this morning's housing and regional Dallas Fed services activity data. Looking ahead to Thursday data (prior, est): Initial Jobless (219k, 221k) and Continuing Claims (1.910M, 1.890M) at 0830ET; S&P Global US Manufacturing PMI (48.3, 48.3) at 0945ET; Construction Spending MoM (0.4%, 0.3%) at 1000ET.

- Treasury supply: $85B 4- & $80B 8W bill auctions at 1130ET, $64B 17W bill auction at 1300ET.

COMMODITIES: WTI Futures, Gold Holding Higher

WTI futures are trading higher today as the contract extends recent gains. A stronger reversal to the upside would refocus attention on key short-term resistance at $76.41, the Oct 8 high. Initial firm resistance is unchanged at $71.97. A bear threat in Gold remains present. The yellow metal traded sharply lower on Dec 18 and the move undermines a recent bull theme. A resumption of weakness would open key support at $2536.9, the Nov 14 low.

- WTI Crude up $0.9 or +1.27% at $71.88

- Natural Gas down $0.32 or -8.13% at $3.618

- Gold spot up $19.24 or +0.74% at $2625.86

- Copper down $6.95 or -1.7% at $402.3

- Silver down $0.1 or -0.34% at $28.8383

- Platinum up $3.96 or +0.44% at $908.02

US STOCKS: Late Equity Roundup: Tech & Interactive Media Sectors Underperforming

- Stocks are trading near session lows after reversing early session gains. Though off this year's record highs (SPX Eminis 6178.75, DJIA 45,073.63, Nasdaq 20,204.58) major averages will finish the year with double digit gains: SPX Eminis +19.5%, DJIA +13.1%, while the Nasdaq gained 29.9%!

- Currently, the DJIA trades down 92.19 points (-0.22%) at 42474.46, S&P E-Minis down 28 points (-0.47%) at 5929.75, Nasdaq down 147 points (-0.8%) at 19337.13.

- Information Technology and Communication Services shares underperformed continued to underperform late Tuesday, shares of software and semiconductor makers weighing on the tech sector: Nvidia -1.61%, Advanced Micro Devices -1.36%, Crowdstrike Holdings -1.28%.

- Interactive media and entertainment shares weighed on the Communication Services sector: Alphabet -0.9%, Live Nation -0.76%, Netflix -0.60%, Meta -0.41%.

- On the positive side, Energy and Materials sectors outperformed in the second half, oil & gas stocks buoyed the Energy sector as crude prices continued to rise (WTI +1.0 at 71.99): APA Corp +3.59%, Marathon Petroleum +2.46%, Occidental Petroleum +2.15%.

- Meanwhile, shares of chemical & fertilizer makers supported the Materials sector: Mosaic +2.44%, Celanese +1.42%, Dow +1.37%.

- Looking ahead, the next round of quarterly earnings kicks off mid-January with Blackrock, Bank of NY Melon, Wells Fargo, JP Morgan, Goldman Sachs, Citigroup, US Bancorp, M&T Bank and PNC all reporting between January 13-16.