EM CEEMEA CREDIT: New Issue APICOR $BM 5Y

The Arab Energy Fund (APICOR: Aa2/AA-/AA+)

Mandate Arab Energy Fund $BM 5Y

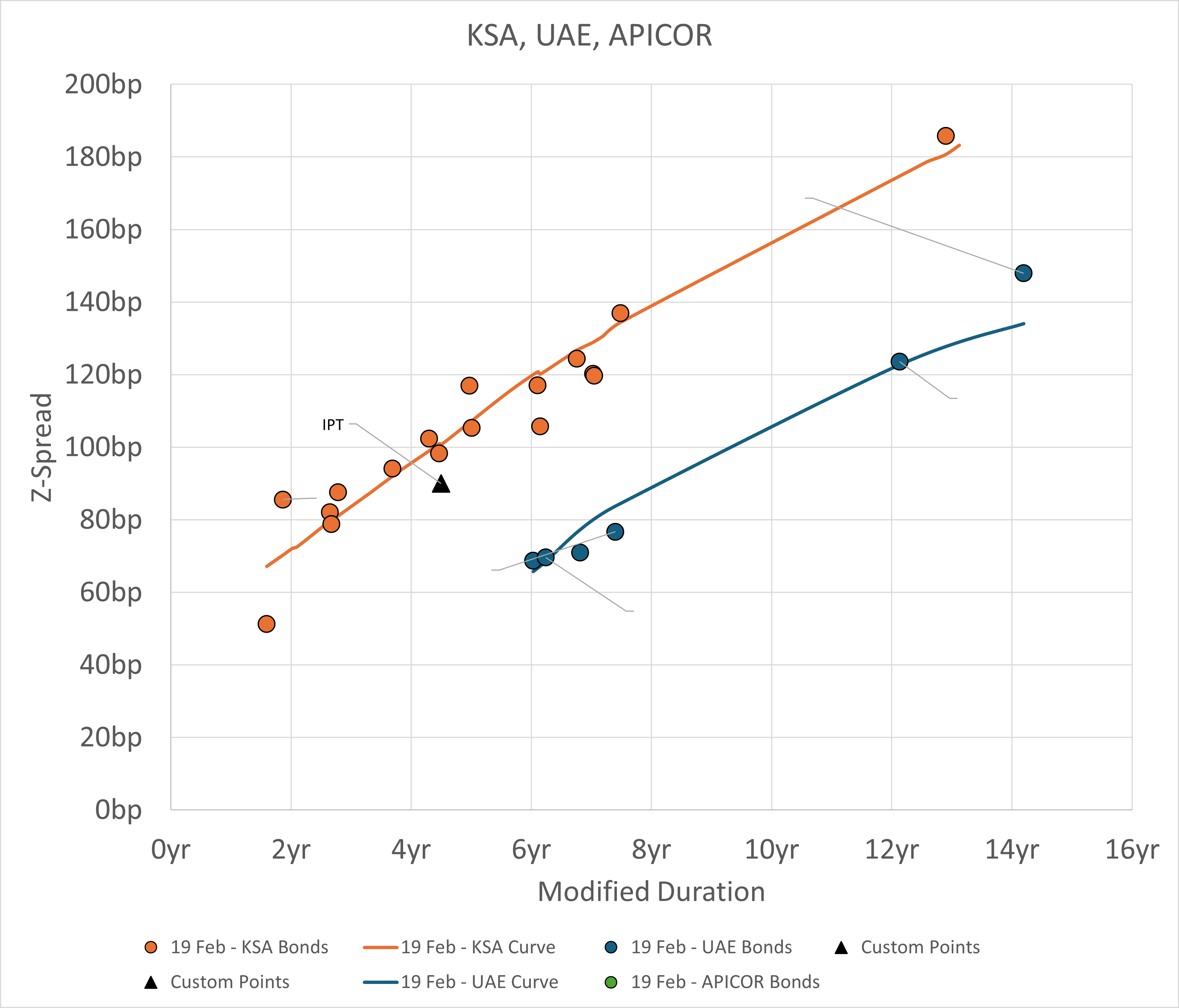

IPT: MS + 90bp

- Interesting IPT, APICOR’s 5.428 USD May29 bond are around Z+90bps. The biggest shareholders in APICOR are Kingdom of Saudia Arabia (Aa3/Apos/A+) and United Arab Emirate (Aa2/NR/AA-). KSA USD 4.75 Jan30 bonds are around Z+ 98bps and UAE USD 2% Oct 31 are around Z+65bps.

- Based on APICOR’s USD 29’s the IPT looks a little tight but based on UAE and Saudi sovereign spreads you could argue the IPT is in line. The difference may due to investors preferences in holding sovereign debt vs quasi sovereign.

- Founded initially to help member countries to finance oil- and gas-related projects but has more recently repositioned itself to help member countries with their long-term energy transitions. Top five exposures are to Saudi Arabia (17%), UAE (17%), Kuwait (17%) Libya (15%) Qatar (10%), Iraq (10%), and Algeria (5%). The fund maintains a conservative funding profile, strong CAR at 28.3%, modest leverage at 2.2x and strong shareholder support if needed.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

BUNDS: US Trump's inauguration Day

- A tight 17 ticks range for Bund Overnight, the US are out for MLK day and Trump's inauguration.

- While the contract is showing slightly in the red, it remains closer to Friday's high, where the initial resistance will be seen.

- The 131.97 high on Friday was also close to the 2.50% level in Yield terms.

- Initial small support comes at 131.50, Friday's low.

- The German PPI came below expectation on the Cash open, but was only worth a 8 ticks gain for the Bund, and there's no Data left for today's session.

- SPEAKERS: ECB Vujcic, Holzmann, Trump's Inauguration should start before noon Local time.

BTP TECHS: (H5) Testing Resistance At The 20-Day EMA

- RES 4: 122.85 High Dec 11

- RES 3: 120.98 61.8% retracement of the Dec 11 - Jan 13 bear leg

- RES 2: 120.45 High Jan 2

- RES 1: 119.33/35 20-day EMA / High Jan 17

- PRICE: 119.07 @ Close Jan 17

- SUP 1: 117.16 Low Jan 13 and the bear trigger

- SUP 2: 116.59 76.4% retrace of the Jun - Dec ‘24 bull cycle (cont)

- SUP 3: 116.07 Low Jul 8 ‘24 (cont)

- SUP 4: 115.45 Low Jul 3 ‘24 (cont)

The current bear cycle in BTP futures remains in play and last week’s fresh cycle low reinforces current conditions. However, from a short-term perspective, the latest rally highlights a corrective phase. Resistance to watch is 119.33, the 20-day EMA. A clear break of this level would signal scope for a stronger retracement. The bear trigger has been defined at 117.16, the Jan 13 low.

EURJPY TECHS: Pierces Support

- RES 4: 165.43 High Nov 8

- RES 3: 164.90 High Dec 30 and a key short-term resistance

- RES 2: 164.55 High Jan 7

- RES 1: 162.08/89 50-day EMA / High Jan 15

- PRICE: 161.10 @ 7:06 GMT Jan 20

- SUP 1: 159.73 Low Jan 17

- SUP 2: 159.51 61.8% retracement of the Dec 3 - 30 bull cycle

- SUP 3: 158.67 Low Dec 11

- SUP 4: 158.24 76.4% retracement of the Dec 3 - 30 bull cycle

EURJPY traded lower last Thursday marking an extension of the current bear cycle. The cross has pierced support at 160.04, the Jan 13 low. A clear break of this level would strengthen a bearish threat and signal scope for a deeper retracement. The next price point to watch is 159.51, a Fibonacci retracement. The cross has recovered from its recent lows, a move above 162.89, the Jan 15 high, would reinstate the recent bullish theme.