OIL: NSEA CRUDE: Shell Offers Midland, Forties; Exxon Bids Higher: BBG

Mar-20 17:53

NSEA CRUDE: Shell Offers Midland, Forties; Exxon Bids Higher: BBG

- Shell offered WTI Midland and Forties in Platts window. ExxonMobil raised bid for Forties. Equinor sold first Johan Castberg cargo to Repsol.

- Forties, FOB: ExxonMobil bid at Dated +55c for April 8-14, vs +45c on Wednesday; Shell offered at +50c for April 14-16 and +25c for April 2-4.

- WTI Midland, CIF: Shell offered at +$2 for April 14-18, and +$1.90 for April 19-23.

- TENDER: Equinor sold one 700k bbl cargo of Johan Castberg crude for April 14-17 loading to Repsol, according to traders with knowledge of the tender; Johan Castberg loadings are planned at four cargoes of 700k bbl each in April, according to a loading program seen by Bloomberg. The April 14-17 shipment is the first in the program.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

OPTIONS: Bund Trades Prevalent Monday

Feb-18 17:52

Tuesday's Europe rates/bond options flow included:

- RXJ5 132.50c, bought for 46 in 6k.

- RXM5 127.50/126.50/125.50p fly, bought for 5.5 in 3k.

- RXM5 134.5/137.5 call spread sold at 30.5 in 3k

- ERZ5 98.25/9850 call spread bought for 5.5 in 5k.

CANADA: GoC Yields Fade Latest Climb In Tsy Yields

Feb-18 17:49

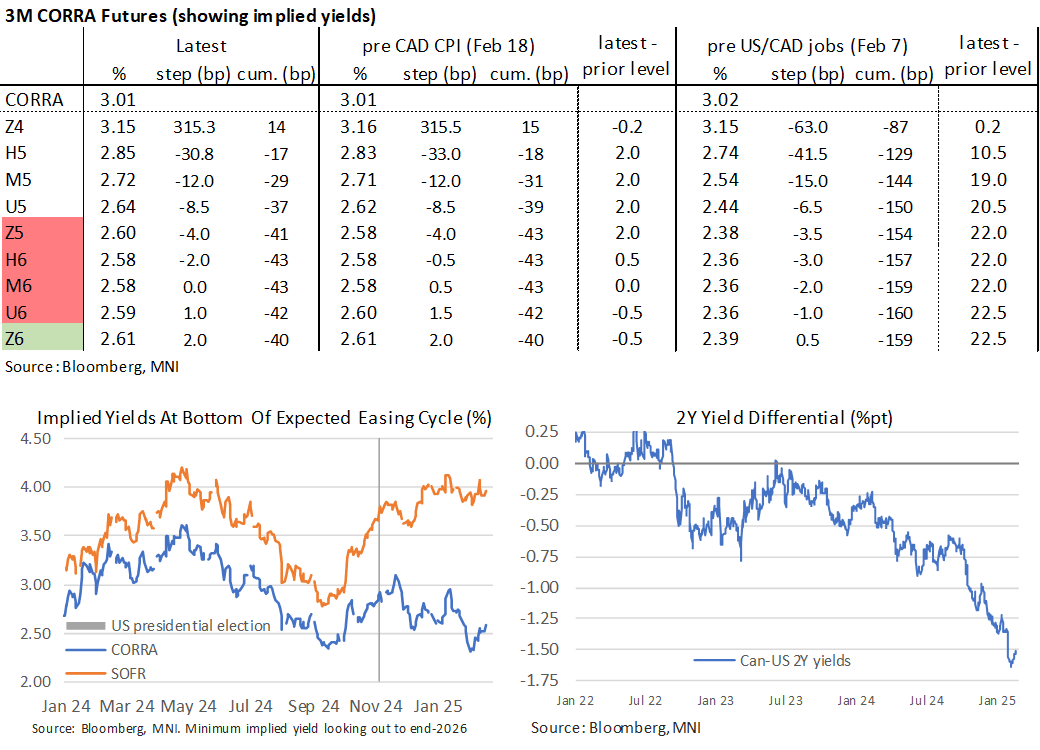

- GoC yields have completely faded the recent renewed climb in Treasury yields, unwinding the further increase in Can-US yield differentials seen after today’s stronger than expected CAD CPI inflation.

- 2Y yields have limited post-CPI releases to +1bp for +6.6bp from Friday’s close, vs +1.5bp and +3.4bp respectively for Treasuries (both following Family/Presidents’ Day holidays).

- Can-US 2Y yield diff at -150.5bps (+3.2bp since Fri) vs early Feb fresh multi-decade lows of -164bps.

- BoC-dated OIS sees 8-9bp of cuts for the Mar 12 decision vs 12-13bp pre-CPI.

- 3mth CORRA implied yields are 2bp higher post-CPI for 2025 contracts (for as much as 7.5bp higher on the day) whilst the terminal of ~2.6% in early 2026 points to ~40bp of cumulative cuts for the cycle (BoC neutral estimates between 2.25-3.25%).

FED: US TSY 52W AUCTION: NON-COMP BIDS $1.294 BLN FROM $48.000 BLN TOTAL

Feb-18 17:45

- US TSY 52W AUCTION: NON-COMP BIDS $1.294 BLN FROM $48.000 BLN TOTAL