EM CEEMEA CREDIT: PDLLN: 1H25 operating update, pressure remains

Petra Diamonds (PDLLN; Caa2 neg/B-neg/-)

1H25 highlights: operating update

- PDLLN posted total diamond sales of 1,400,539 carats, in line with 1H24. Revenues are all about Q2 though and reflect the weakening demand and persisting pressures on price, showing USD136mn for H125, down from USD188mn in 1H24.

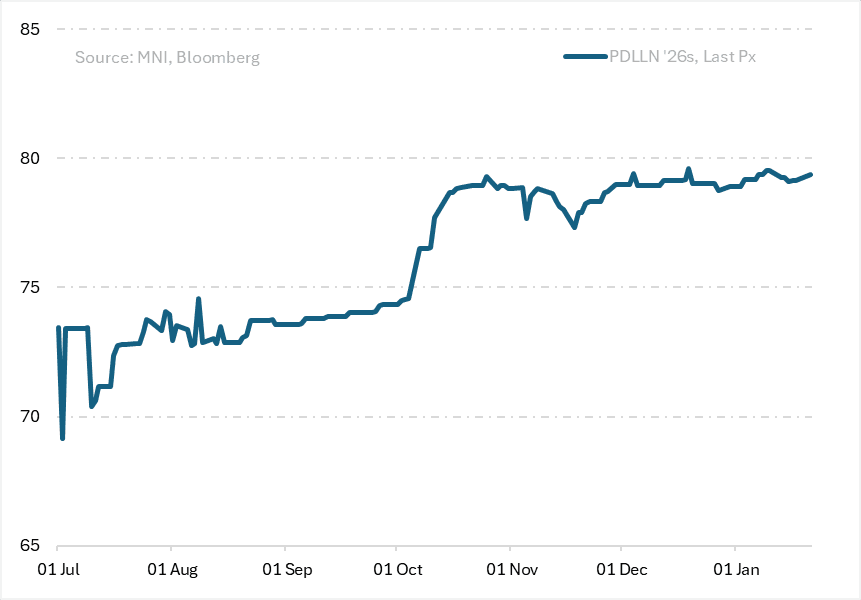

- Consolidated net debt is reported @ USD225mn at the end of the period, open market repurchases of ‘26s still a key focus, with limited refinancing opportunities at this stage. The bonds are charting @ 79.375 cash price area, indicatively low 30%s yield (see chart below).

- Focus remains on cost saving initiatives, centred around labour cost savings and capital optimisation among others.

- Negative FX impact for the period (Rand strengthened, averaging USD/ZAR @ 17.93) would have been partly mitigated by previously communicated ccy hedging activity.

- At the end of December, PDLLN credit ratings got downgraded by one-notch to B- and outlook negative by S&P. The agency cited several factors, which we had touched upon in our previous note (PDLLN “Chasing revenues may not suffice, pressure continues”). The gist of the matter was (and is) short term FCF generation to support debt buybacks and relieve pressure on refinancing needs.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

TRUDEAU SAYS `WE HAVE A LOT OF WORK TO DO'

- TRUDEAU SAYS `WE HAVE A LOT OF WORK TO DO'

- TRUDEAU WANTS GOVT TO PREPARE FOR NEW US ADMINISTRATION

- TRUDEAU DOESN'T ADDRESS QUESTIONS ABOUT HIS LEADERSHIP

USDCAD TECHS: A Pullback Would Be Considered Corrective

- RES 4: 1.4539 3.382 proj of the Oct 17 - Nov 1 - 6 price swing

- RES 3: 1.4537 2.0% 10-dma envelope

- RES 2: 1.4508 3.236 proj of the Oct 17 - Nov 1 - 6 price swing

- RES 1: 1.4467 High Dec 19

- PRICE: 1.4356 @ 16:56 GMT Dec 20

- SUP 1: 1.4301 Low Dec 18

- SUP 2: 1.4174/4014 20- and 50-day EMA values

- SUP 3: 1.3928 Low Nov 25 and a key support

- SUP 4: 1.3822 Low Nov 6

USDCAD bulls remain in the driver’s seat. While price faded into the Thursday close, the recent breach of 1.4178, the Nov 26 high, confirmed a resumption of the uptrend and this maintains the price sequence of higher highs and higher lows. The latest rally opens 1.4508 next, a Fibonacci projection level. Initial firm support to watch lies at 1.4174, the 20-day EMA. A pullback would be considered corrective.

AUDUSD TECHS: Bearish Trend Structure

- RES 4: 0.6550 High Nov 25

- RES 3: 0.6501 50-day EMA

- RES 2: 0.6429 High Dec 12

- RES 1: 0.6337/6396 Low Dec 11 / 20-day EMA

- PRICE: 0.6263 @ 16:55 GMT Dec 20

- SUP 1: 0.6199 Low Dec 19

- SUP 3: 0.6158 1.236 proj of the Sep 30 - Nov 6 - 7 price swing

- SUP 3: 0.6100 Round number support

- SUP 4: 0.6045 1.500 proj of the Sep 30 - Nov 6 - 7 price swing

The trend needle in AUDUSD continues to point south and this week’s fresh cycle lows and Wednesday’s sell-off, reinforce a bear theme. The move down maintains the price sequence of lower lows and lower highs. Note that moving average studies are in a bear-mode position too, highlighting a dominant downtrend. The break lower opens 0.6158 next, a Fibonacci projection. Initial firm resistance to watch is 0.6396, the 20-day EMA.