SWEDEN: PES Unemployment Claims Rate Steady At 7.0%; Soon Likely To Fall Back

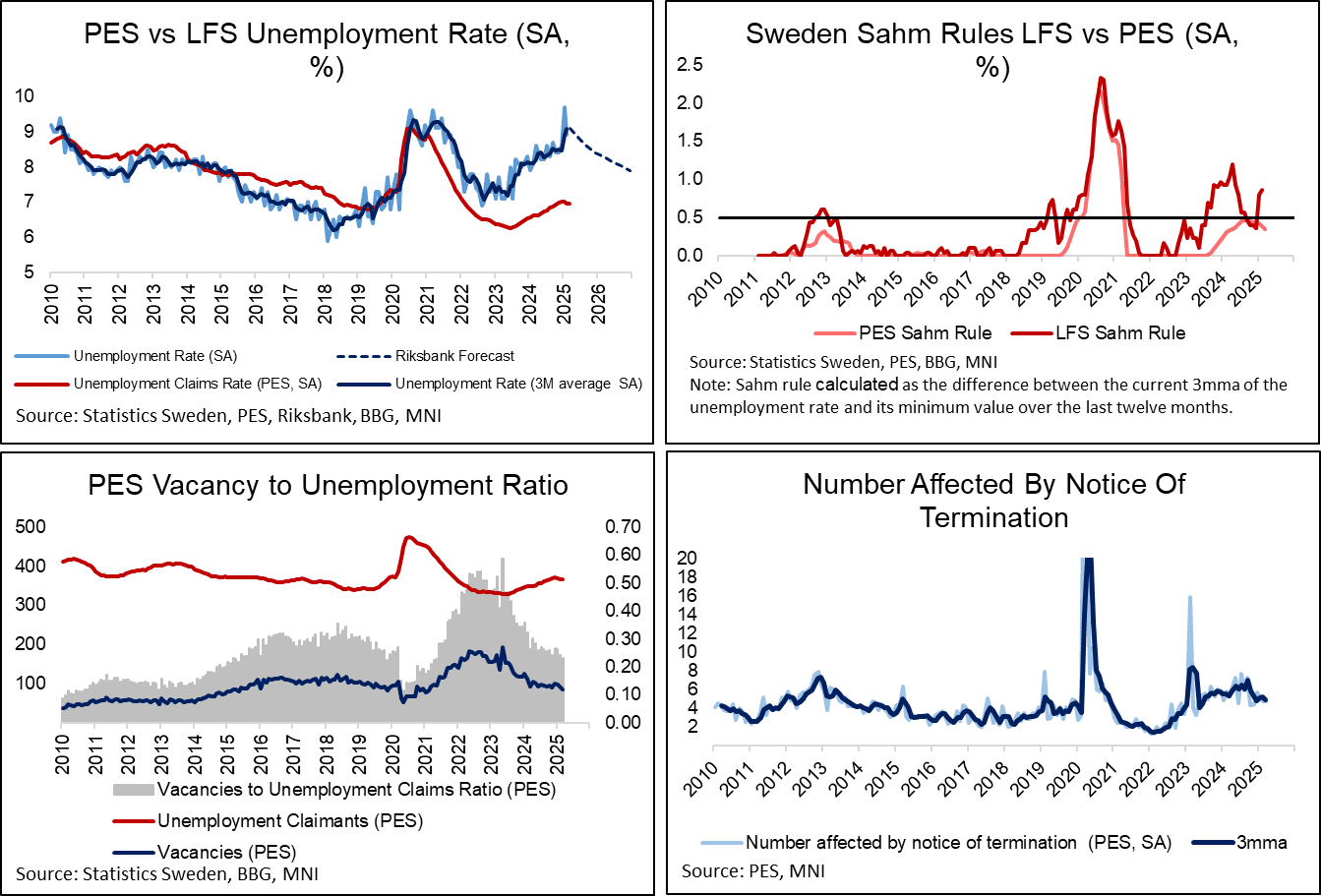

The Swedish Public Employment Service’s (PES) unemployment claims rate was steady at 7.0% for the fifth consecutive month in March. This suggests the labour market has reached its weakest levels, and should start to strengthen alongside the broader macroeconomy in the coming months (in line with Riksbank projections).

- Vacancies fell to 85k, down from February’s 89k and 92k in March 2024. That sees the PES vacancy-to-unemployment claims ratio fall to a four year low of 0.23, broadly in line with the 2010-2019 average.

- The number of people affected by redundancy notices was steady at 4.8k, helping the 3mma ease to 4.9k (vs 5.2k in February).

- Contextualising the impact of redundancy on broader labour market metrics, PES notes that “a new report shows that on average six out of ten people given notice are laid off, and only one out of four people given notice register as unemployed with the Swedish Public Employment Service within six months of the notice”. The full report is here.

- As such, small increases in redundancies are not necessarily indicative of labour market weakening, but may just represent healthy reallocations amongst workers and industries.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EUROZONE T-BILL ISSUANCE: W/C March 17, 2025

Germany, the Netherlands, France, the ESM, Portugal and the EU are all due to sell bills this week. We expect issuance to be E19.3bln in first round operations, down from E24.0bln last week.

- This morning, Germany will selll E3bln of the new 12-month Mar 18, 2026 Bubill

- Also this morning, the Netherlands will issue E1.0-1.5bln of the 2-month May 28, 2025 DTC and E1.0-1.5bln of the 5-month Aug 28, 2025 DTC.

- This afternoon, France will come to the market to sell a combined E8.0bln of the 14/25/27/49-week BTFs: E3.0-3.4bln of the new 14-week Jun 25, 2025 BTF, E0.5-0.9bln of the 25-week Sep 10, 2025 BTF, E1.6-2.0bln of the 27-week Sep 24, 2025 BTF and E1.3-1.7bln of the 49-week Feb 25, 2026 BTF.

- Tomorrow, the ESM will sell up to E1.1bln of the new 6-month Sep 18, 2025 bills

- On Wednesday, Portugal will issue E1.0-1.25bln of the new 12-month Mar 20, 2026 BT.

- Finally on Wednesday, the EU will sell up to E1.5bln of the 3-month Jun 6, 2025 EU-bill, up to E1.5bln of the 6-month Sep 5, 2025 EU-bill and up to E1.0bln of the 12-month Mar 6, 2026 EU-bill.

SCHATZ TECHS: (M5) Corrective Gains

- RES 4: 107.120 High Mar 4 and key resistance

- RES 3: 106.905 High Mar 5

- RES 2: 106.847 61.8% retracement of the Mar 4 - 6 bear leg

- RES 1: 106.762 50.0% retracement of the Mar 4 - 6 bear leg

- PRICE: 106.680 @ 06:17 GMT Mar 17

- SUP 1: 106.530/405 Low Mar 10 / 6 and the bear trigger

- SUP 2: 106.350 2.000% retracement proj of the Feb 19 - Mar 4

- SUP 3: 106.259 2.236% retracement proj of the Feb 19 - Mar 4

- SUP 4: 106.203 2.382% retracement proj of the Feb 19 - Mar 4

A bearish condition in Schatz futures remains intact with price still trading closer to its recent lows. Recent weakness resulted in a breach of key support at 106.735, the Feb 19 low. Clearance of this level strengthens a bearish theme and signals scope for a deeper sell-off, towards 106.350 next, a Fibonacci retracement. The trend is oversold and the latest bounce is allowing this to unwind. First resistance is 106.762, a Fibonacci retracement.

GBPUSD TECHS: Bull Cycle Remains In Play

- RES 4: 1.3175 High Oct 4 2024

- RES 3: 1.3119 76.4% retracement of the Sep 26 ‘24 - Jan 13 bear leg

- RES 2: 1.3048 High Nov 6 ‘24

- RES 1: 1.2988 High Mar 12

- PRICE: 1.2935 @ 06:32 GMT Mar 17

- SUP 1: 1.2862 Low Mar 12

- SUP 2: 1.2778 20-day EMA

- SUP 3: 1.2656 50-day EMA and a short-term pivot support

- SUP 4: 1.2556 Low Feb 28

GBPUSD is trading in a tight range and remains closer to its recent highs. The trend outlook is bullish - moving average studies are in a bull-mode position, highlighting a clear dominant uptrend. The pair has recently pierced a Fibonacci retracement at 1.2924, 61.8% of the Sep 26 ‘24 - Jan 13 bear leg. A clear break of this price point would open 1.3048, the Nov 6 2024 high. Initial firm support is 1.2656, the 50-day EMA.