EM CEEMEA CREDIT: PKOBP: FY24 results, neutral for spreads

Mar-13 11:57

PKO Bank Polski (PKOBP; A2/-/-)

FY24 results, neutral for spreads

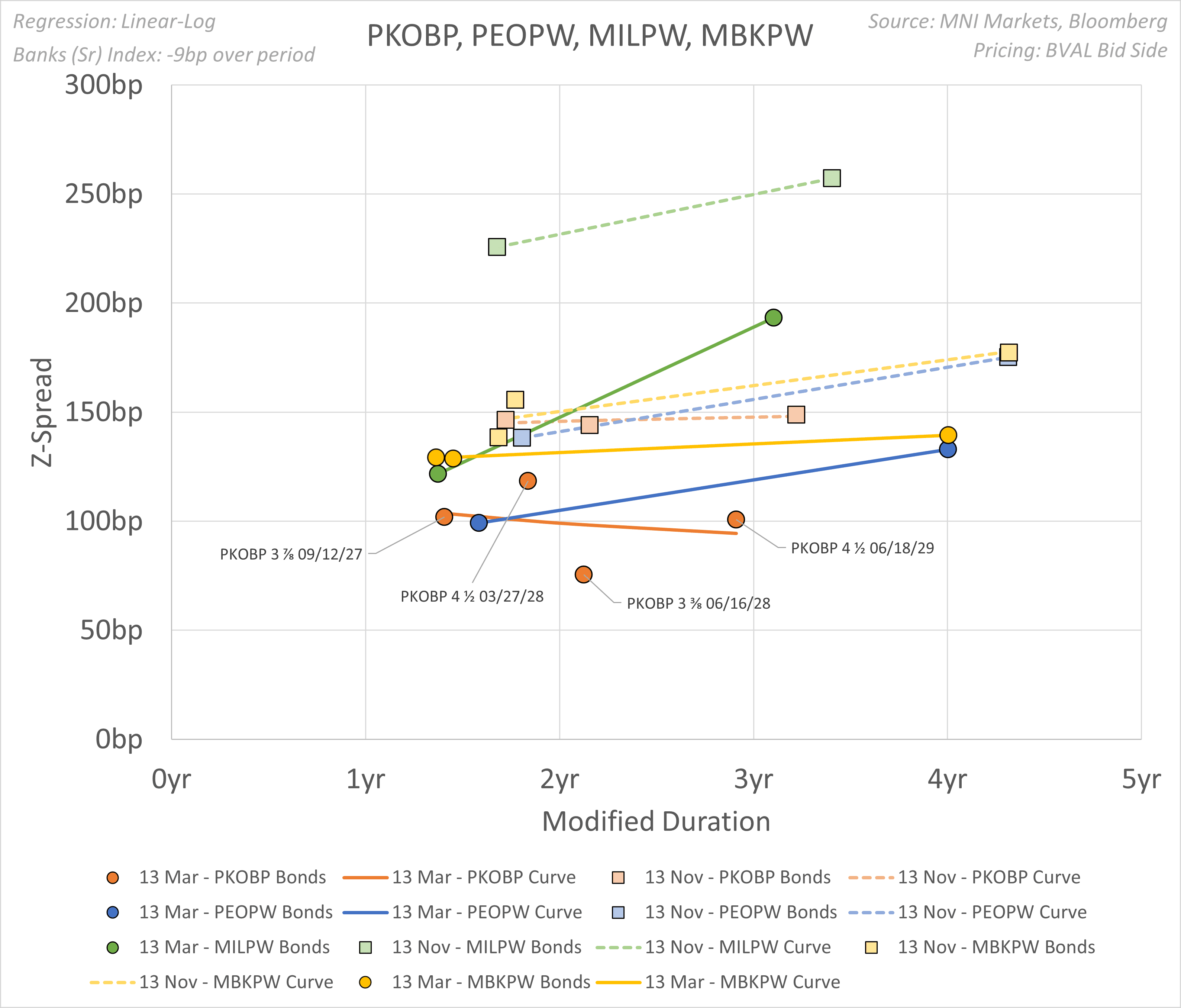

- Polish lender Bank Polski’s FY24 results prove a solid read for credit. Secondary z-spreads have tightened since the previous earnings’ release, in range with domestic peers (see chart below).

- PBT stood at PLN12.7bn +48.7% YoY continuing a growing quarterly trend. Quarterly, net profit shows sequentially stable, with FY +69.1% YoY at PLN9.3bn (incl PLN4.9bn impact of CHF provisions and PLN0.2bn of credit holidays). Quarterly beat for NII, exhibiting growth sequentially, with FY up 20.9% YoY at PLN22.1bn whilst F&C missed marginally reaching FY PLN5.1bn (+10.7% YoY, contribution from a mix of sources). NIM at 4.80% remains solidly on an upward trajectory.

- Asset growth continues with total assets at PLN525bn, +6% YoY supported by balanced lending and deposit growth. In line with estimates, asset quality exhibits a low NPL ratio with 4Q at 3.59% (Stage 3 coverage of 45.62%). Lowering YoY CoR @ 39bp remains elevated. Sound capital adequacy is supported by conservative CET1 at 17.39% (CAR at 18.58%).

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EGB SYNDICATION: Italy 15-year BTP: Final terms

Feb-11 11:47

- Size: E13bln (another large syndication after MNI expected)

- Spread set: 4.15% Oct-39 BTP +7bps (guidance was +9bps area)

- Books in excess of E133bln (inc JLM interest)

- Maturity: 1 October 2040

- ISIN: IT0005635583

- Settlement: 18 February, 2025 (T+5)

- Bookrunners: Barclays, Deutsche Bank, Intesa Sanpaolo, Morgan Stanley and Nomura

- Timing: Books open, pricing later today

From market source / Bloomberg

STIR: Powell Senate Testimony To Headline Docket – 1000ET

Feb-11 11:40

- Fed Funds implied rates have been little changed by Trump’s overnight upping of steel and aluminum tariffs to 25% from the previously touted 10%.

- Cumulative cuts from 4.33% effective: 1.5bp Mar, 7bp May, 15.5bp Jun, 21bp Jul and 37.5bp Dec.

- Today’s Fedspeak is firmly headlined by Fed Chair Powell at 1000ET where he’s expected to reiterate that there’s no rush to cut rates. See our previous preview bullet here and some analyst expectations on it here.

- As for other speakers, Hammack is watched for a hawkish take after her surprise dissent to the December cut and then saying Jan 17 that the Fed can be very patient on further cuts with mon pol “only moderately restrictive”. Williams meanwhile last spoke Jan 15, saying the Fed can take its time analyzing incoming data with the US economy once again proving resilient whilst the disinflation process remains “in train”. He saw signs of stabilization in the labor market, a view that was likely bolstered after last Friday’s payrolls report.

- 0850ET – Hammack (non-voter) on economic outlook (text + Q&A)

- 1000ET – Powell (voter) testimony to Senate Banking Committee (text + Q&A - no official confirmation but expecting text release at 1000ET)

- 1530ET – Williams (voter) keynote remarks (text + Q&A)

- 1530ET – Bowman (voter) on bank regulation (just text)

EURIBOR OPTIONS: Latest Condors

Feb-11 11:33

- ERK5 97.68/62/56/43 broken p condor bought for half in 3k.

- ERU5 97.87/98.00/98.12/98.25c condor, sold at 3.5 in 3k.