GOLD: Position Squaring Ahead of Holidays

- Gold took a break in what looked like position squaring ahead of holidays, following a record week for the precious metal.

- As tariff headlines and trade discussions dominated markets, gold reached new highs of US$3,343.12 on Wednesday but slipped throughout Thursday to close at $3,326.85.

- US negotiators held discussion with Japanese representatives on tariffs with US President Trump stating that 'big progress' had been made and news out that Indian officials are likely next in line for discussions.

- Despite the decline, gold remains well above all major moving averages with the 20-day EMA closest at $3,136.07.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

AUSSIE 3-YEAR TECHS: (H5) Resistance Remains Exposed

- RES 3: 97.190 - High May 5 2023

- RES 2: 96.730/932 - High Sep 17 / 76.4% of Mar-Nov ‘23 bear leg

- RES 1: 96.360 - High Dec 11

- PRICE: 96.210 @ 15:43 GMT Mar 18

- SUP 1: 95.900 - Low Jan 14

- SUP 2: 95.760 - Low 14 Nov ‘24

- SUP 3: 95.480 - Low Jan 11 2023 and a major support

Aussie 3-yr futures have pulled back from their most recent highs - a correction. A resumption of gains would signal scope for 96.360, the Dec 11 high. Clearance of this level would open 96.730, the Sep 17 ‘24 high. On the downside, a stronger reversal lower from current levels would signal a resumption of the downtrend. A deeper sell-off would refocus attention on 95.760, the 14 Nov ‘24 low.

NEW ZEALAND: Strong Export Growth Drives Narrower Deficits

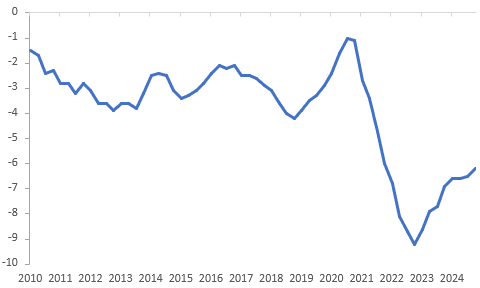

The Q4 current account deficit was slightly wider than expected at $7.037bn but significantly narrower than Q3’s $10.84bn. As a share of GDP it fell 0.3pp to 6.2% YTD, the lowest in three years and down 0.7pp from 2023. There was strong growth in both goods and services exports with the total up 5.4% q/q and 10.4% y/y. Imports were not as robust but still rose 2.9% q/q.

NZ current account to GDP % YTD

- Merchandise exports rose 3.8% q/q to be up 9.0% y/y in Q4 after 4.4% y/y, driven by dairy and meat. Services jumped 9% q/q to be up 13.4% y/y due to increased spending by overseas tourists while in NZ.

- Statistics NZ observed that travel exports were higher than Q4 2019 for the first time. Visitor numbers are still below pre-pandemic levels but spending is now stronger.

- Goods imports increased 3% q/q to be up 2.1% y/y after -2.4% y/y, while services rose 2.8% q/q to be up 8.7% y/y following 7.1% y/y.

- This resulted in the trade deficit narrowing $0.55bn to $1.71bn, the smallest since Q2 2021.

- There was a net outflow of $3.2bn from the financial account in Q4. As the deficit is expected to be financed by net inflows, Statistics NZ notes that the contradictions in the accounts show the difficulty in measuring investment transactions.

NZ exports vs imports y/y%

CNH: USD/CNH Holding Above Simple 200-day MA, CNY CFETS Basket To Fresh Lows

USD/CNH saw a brief dip towards the simple 200-day MA (7.2210/15) late in Asia Pac trade on Tuesday, but found support. Subsequent moves above 7.2300 drew selling interest though and we track near 7.2275 in early Wednesday dealings. The pair was unchanged for Tuesday's session. USD/CNY spot finished up at 7.2256. The CNY CFETS basket tracker, per BBG, slipped to 98.53 Tuesday, down 0.29%. This is fresh lows for the index since early Oct last year.

- For USD/CNH technicals, we are still within striking distance of the 200-day MA. A break sub this level may see round figure support at 7.2000 targeted. On the upside we have the 200-day EMA at 7.2390, but a move above 7.2500 (where the 20 and 100-day EMAs rest) is likely needed to shift the near term USD/CNH trend.

- In the cross asset space, China's equity to the rest of the world ratio continues to track higher, with a fresh wobble in US equity sentiment on Tuesday. Goldman Sachs also noted, "Foreign-exchange outflows from China plunged in February, according to a Goldman Sachs’ preferred gauge. Portfolio investments recorded net inflows, it said." (via BBG).

- USD/CNH also still looks too high relative to US-CH yield differentials, although such spreads have stabilized this past week (albeit more so in the 2yr space (last +248bps).

- There also seems little sponsorship from the CNY fixing for further strong yuan gains versus the USD. Broader USD softness may ultimately deliver lower USD/CNH and USD/CNY levels, but the yuan may continue to underperform such trends as per the continued move lower in the CNY CFETS basket.

- The data calendar is empty until tomorrow's loan prime rates, but no change is expected in the 1yr or 5yr.