EU CONSUMER CYCLICALS: PostNL: 4Q trading update (x2)

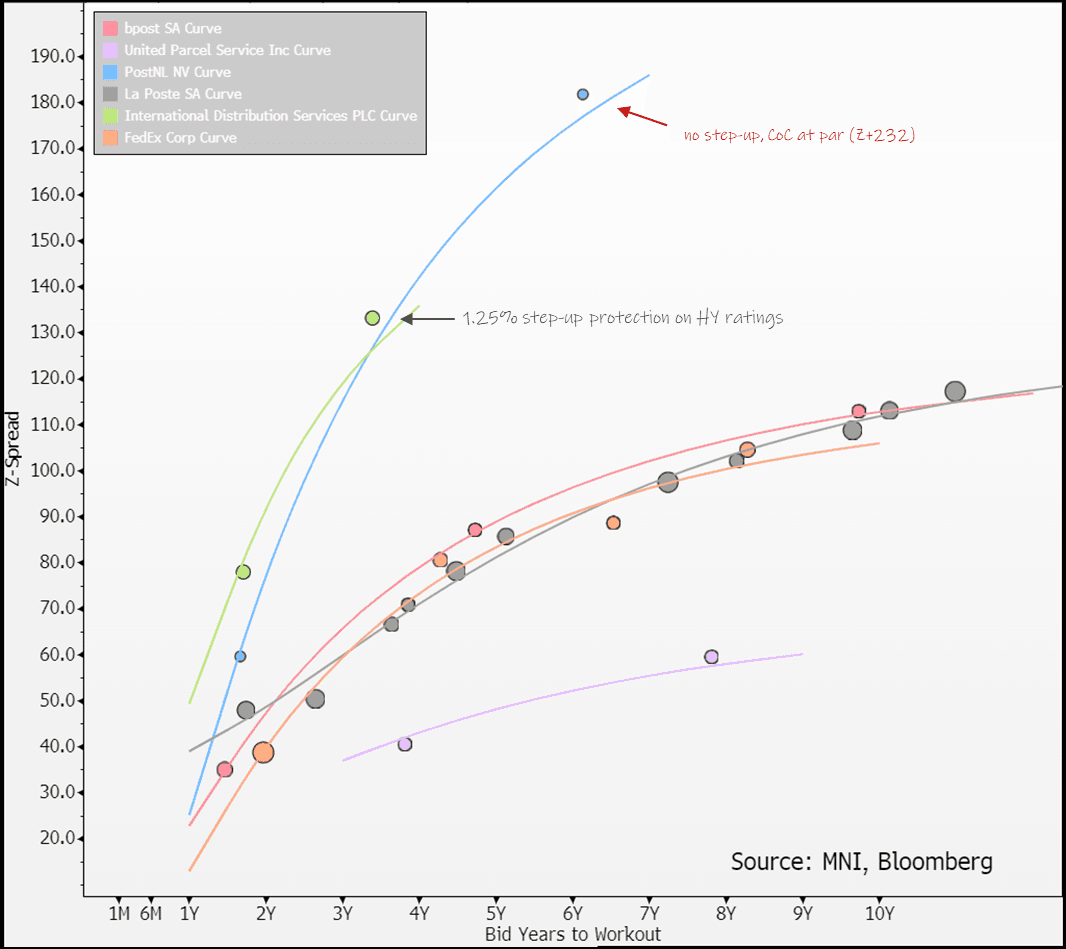

We are quite surprised with the resilience the 31s are showing - particularly given the opportunity to roll into IDSLN 28s (has step-up protection) and potential for IDS supply.

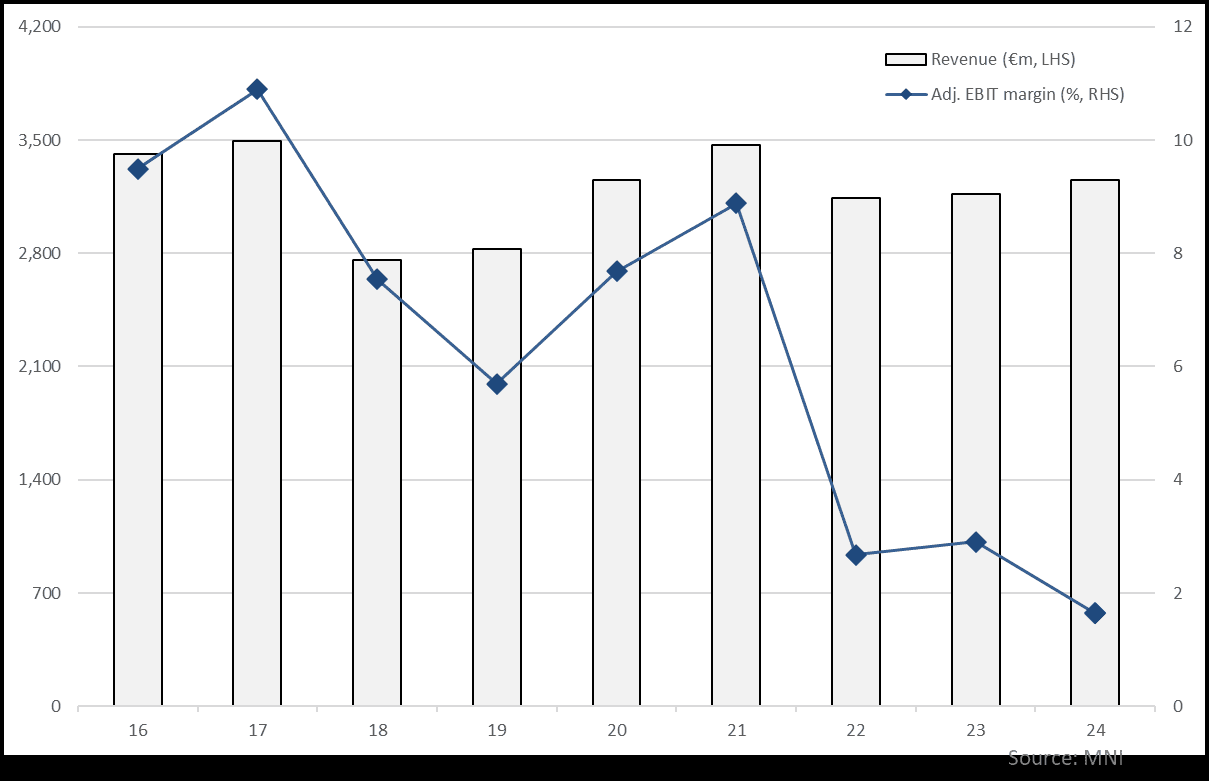

It says headline revenues not a issue/market share being maintained. The margin falls (see below) seem structural and on the efficiency/cost side (based on mgmt remarks). Solution is unclear. Despite the equity sell-off (1y -30%) it still trades at respectable 13x forward earnings multiple (keep in mind EBIT has fallen -42%yoy). Share price may be baking in a takeover premium - Daniel K who has just bought Royal Mail parent IDS, owns 30% of it, UPS (A2/A) has also been rumoured as a buyer in the past. CoC protection is at par, or -2.7pts/+50bps from mids.

Leverage is guided to end net 1.95x (target <2x) and we see gross at 3.2x (this is much lower levered than IDS). We expect S&P downgrade and see stable outlook requiring a guided numeric turnaround for this year. It will report full FY results on the 24th Feb.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US DATA: Richmond Fed Index Pickup Still Consistent With Soft ISM Manufacturing

The Richmond Fed's regional manufacturing survey index came in in at -10 as expected in December, the best reading since June (-14 prior). The shipments and employment subindices were flat, but new orders saw a solid improvement to -11 from -19 prior.

- At the same time, the regional service sector local business conditions index likewise showed improvement, to 14 from 10 prior, with both demand and revenues improving.

- The broad themes of the underlying survey data across both Services and Manufacturing are a continued slowing in price, activity, wage, and employment trends since 2021/2022, albeit now stabilizing a bit higher than recent lows, and with optimism picking up among respondents. The big exception is services sector revenues which rose sharply to 25 from 14, bringing it to levels not seen since early 2021.

- While the report doesn't mention it, the Richmond Fed noted in the October Beige Book that "parts of our District were heavily affected by Hurricane Helene", while recent weak manufacturing readings may have potentially been influenced by previously striking workers at Boeing which is headquartered in Virginia.

- As such these readings represent an improvement from soft conditions but shouldn't be read through directly to broader national conditions.

- Note for manufacturing, the Richmond Fed's improvement bucked the trend of the Philadelphia and Empire surveys deteriorating in December. Overall, those surveys are consistent with a national ISM Manufacturing reading in the high 40s, where it has been for the last 8 months.

STIR: Early SOFR Options

- Pick-up in call structure buying since the open, underlying futures steady to mixed through Jun'25:

- +10,000 0QZ5 96.25/96.75/97.25/97.75 call condors 4.25 over SFRZ5 96.50/97.00/97.50/98.00 call condors

- +2,000 0QF5 96.25/96.31 call spds, 0.5 ref 95.925/0.05%

- +2,000 SFRM5/SFRU5 97.00 call spds 4.25

US STOCKS: Making Modest Gains Ahead Early Close

- Stocks are trading modestly higher early Tuesday, Consumer Discretionary and Information Technology sectors outperforming on the shortened Christmas eve session (1300ET). Currently, the DJIA trades up 13.35 points (0.03%) at 42919.84, S&P E-Minis up 21.75 points (0.36%) at 6057.75, Nasdaq up 130 points (0.7%) at 19895.06.

- Autos and broadline retailers buoyed the Consumer Discretionary sector in the first half: Tesla +3.1%, AutoZone +0.83%, Amazon +0.64%. Semiconductor stocks supported the IT sector for the second day running: Palantir Technology +3.48%, Broadcom +2.16%, Nvidia +1.08%.

- On the flipside, Health Care and Energy sectors underperformed in the first half, pharmaceutical shares weighing on the former: Moderna -1.87%, Viatris -1.84%, Incyte -1.30% and Biogen -1.25%. Despite decent gains in crude (WTI +0.78 at 70.02) oil and gas shares weighed on the Energy sector: Devon Energy -0.90%, APA Corp -0.69%, Occidental Petroleum -0.56%.