AUSTRALIA DATA: Private Investment Weakened In Q4, GDP Out March 5

Feb-27 01:33

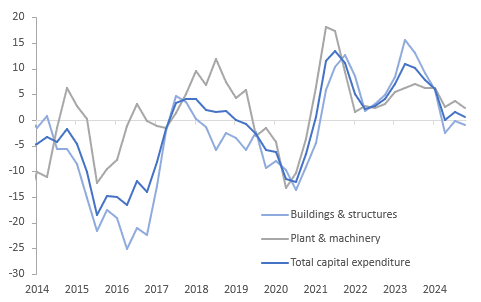

Private capital expenditure volumes unexpectedly fell 0.2% q/q in Q4 after an upwardly-revised +1.6% q/q in Q3. It looks like private investment will be soft in the Q4 national accounts published on March 5, especially plant and equipment. The RBA noted at its February meeting that “there has been continued subdued growth in private demand”. Q4 GDP may see stronger growth in private consumption.

- Investment volumes in building & structures rose 0.2% q/q after 1.9%, while plant & equipment fell 0.8% q/q following a 1.3% increase. This left the components down 1.0% y/y (Q3 -0.2%) and up 2.4% y/y (Q3 +3.8%) respectively. Total private capex rose 0.6% y/y following 1.6%.

- The weakness in plant& equipment was driven by non-mining (-1.0% q/q), and specifically the construction sector (-8.1%), with mining up 0.6% q/q.

- Buildings & structures were supported by a 1.1% q/q rise in non-mining, driven by electricity infrastructure, but mining fell 1.1% q/q.

- Investment intentions for FY25 were revised up 3.2% on the last estimate, while the first estimate for FY26 is 1.8% higher than FY25’s first estimate.

Australia private capex volumes y/y%

Source: MNI - Market News/ABS

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

JGBS: Rinban Purchase Offer

Jan-28 01:12

The BoJ offers to buy a total of Y750bn of JGBs from the market:

- Y300bn worth of JGBs with 1-3 Years until maturity

- Y300bn worth of JGBs with 3-5 Years until maturity

- Y150bn worth of JGBs with 10-25 Years until maturity

EQUITIES: Asian Equities Lower, Following DeepSeek Rise, Many Markets Closed

Jan-28 01:02

- Asian stocks fell sharply as a global tech selloff, triggered by Chinese AI startup DeepSeek’s rise, rattled investor confidence. Japan’s Topix and Nikkei indices dropped 0.6% and 1.5%, respectively, with chip-related stocks like Advantest and Disco Corp. sliding further. Concerns emerged over the sustainability of high AI valuations after DeepSeek's low-cost model topped Apple’s app store, while Nvidia saw a historic $589 billion market-cap loss.

- The yen strengthened, adding pressure on Japanese exporters, but strategists suggested the market could stabilize ahead of earnings season.

- Australia's ASX is trading little changed this morning, benefitting from its small exposure to tech stocks. Consumer Discretionary stocks are leading the gains, while Real Estate stocks, led by Goodman Group after concerns grow due to their large exposure to data centers, the stock was last 7% lower.

- US equity futures were flat after President Trump announced upcoming tariffs on foreign semiconductors and metals, fueling USD gains. Global attention is now focused on this week’s Big Tech earnings from Microsoft, Apple, and others, with slower profit growth expected amid stretched valuations. Lunar New Year holidays in many Asian markets limited trading activity.

AUSTRALIA DATA: NAB Business Surveys, Business Conditions Improve

Jan-28 00:42