EU REAL ESTATE: Property: Week in Review

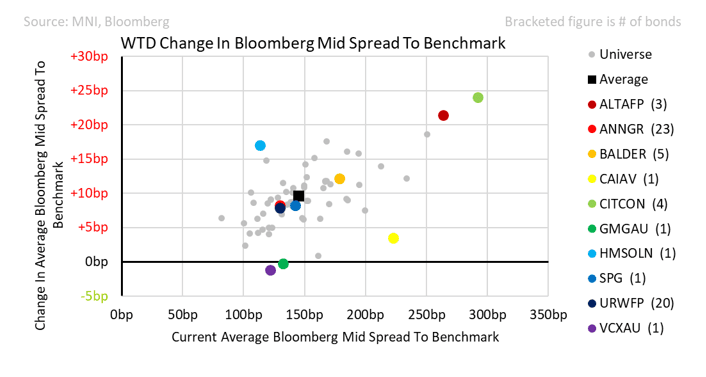

This week’s performance shows a near linear relationship between underlying spread and move.

• The Equity market discriminated between cyclically exposed names and more stable residential names with Unibail and Simon Property dropping 9% and 7% compared to Vonovia, Balder and Kojamo which rallied 8-10%. The residential sector has been very responsive to the rates market recently and lower bund yields helped stocks. Credit, in contrast, was wider regardless of the underlying business.

• CityCon brought a 6.5yr Senior Unsecured €450m deal to repay their Secured bank debt. The loans cost Euribor+230 Apr 27 and Stibor+250 May 29 – vs new debt at ms+315. Not an obvious decision. The bonds came 15bps wide to FV and did rally 14bps on day but sold off to around re-offer by the close of the week.

• Goodman and Vicinity closed the week slightly tighter. Whilst Australia may feel like a safe haven this still seems like an oversight by the market given the general repricing.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

FOREX: EURAUD Winning Streak Extends to Nine Sessions

- Last night’s German fiscal reform headlines have provided fresh impetus for a broad single currency rally, with analysts continuing to cite the historic unveiling of Germany’s potential fiscal policy shift. Developments have fostered the latest bullish narrative for a number of EUR crosses.

- Standing out on a short-term basis is EURJPY, which has extended its recovery from yesterday’s lows to 2.94%, and notably the cross is now back above the psychological pivot point of 160.00. Yesterday, we wrote about how dips below 155.00 have been well supported over the past 18 months. Spot has now broken back above key short-term resistance at 159.52, the 50-day EMA, signalling scope for a stronger recovery. 161.19, the Feb 13 high has been defined as the technical bull trigger.

- EURAUD appreciation is also gathering significant pace, and today’s 0.6% advance looks set to extend its winning streak to 9 consecutive sessions, and total gains of around 3.85%. The last time we had a longer winning streak was back in December 2012, where EURAUD advanced for 11 sessions in a row and rose 3.36%.

- The higher beta AUD remains sensitive to the outlook for global risk sentiment, being impacted by both the tariff narrative / impact on China and the imminent stagflationary concerns in the US. EURAUD momentum gained on a break of 1.6800 on Monday, and the cross is eroding the gap towards the blowout top seen prior to the US election, located at 1.7184.

EGBS: German Fiscal Reform and 30-year Syndication Set The Tone

German yields are sharply higher after incoming German Chancellor Merz announced a proposal to reform the debt brake and set up a E500bln infrastructure fund last night. Although today’s 30-year syndication has added extra pressure to the long-end, 10-year tenors underperform at typing (+19bps today), with Schatz yields up 13bps and 30-year yields up 17bps.

- Bund futures (RXM5) are -211 ticks below yesterday’s settlement levels at 129.24. The session low at 128.77 provides initial support, with 128.68 (1.618 proj of the Feb 5 - 19 - 28 price swing) seen next.

- German ASWs (vs 3-month Euribor) have registered fresh year-to-date or cycle lows this morning, with the long-end unsurprisingly leading the move.

- 10-year EGB spreads to Bunds tighten on the back of German paper’s underperformance, while rallying European equities provide an additional narrowing catalyst for peripherals.

- Eurozone January PPI was stronger-than-expected, while the February services PMIs also signalled increasing cost pressures.

- Broader macro focus remains on any further German fiscal details, fresh US tariff headline flow (after US Commerce Secretary Lutnick suggested Canada/Mexico tariffs could be rolled back to some extent yesterday evening) and today’s US data.

BONDS: 10-Year Gilt/Bund Spread Below 200bp, To Levels Not Seen Since Oct

Last night’s proposed German fiscal loosening continues to promote Bund underperformance vs. peers.

- The presence of the 30-Year German bond syndication adds further pressure to spreads.

- The 10-Year spread to UK paper is through the October 30 closing level (196.4bp), with clustered support seen just below at the Oct 25 close & 50% retracement of the July ’24 to Dec ’24 widening (194.2bp/194.1bp).

Fig. 1: 10-Year Gilt/Bund Spread (bp)

Source: MNI - Market News/Bloomberg