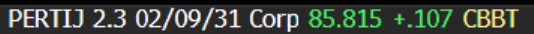

EM ASIA CREDIT: PT Pertamina Persero (PERTIJ, Baa2/BBB/BBB) under scrutiny

PT Pertamina Persero (PERTIJ, Baa2/BBB/BBB)

- Reports from Reuters that 2 more executives have been arrested, following the 4 individuals arrested a couple of days ago.

- The attorney general claims that between 2018-2023 executives preferentially pushed for crude imports rather that use domestic producers.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EQUITY TECHS: E-MINI S&P: (H5) Support Remains Intact For Now

- RES 4: 6200.00 Round number resistance

- RES 3: 6178.75 High Dec 6 and key resistance

- RES 2: 6163.75 High Dec 16

- RES 1: 6105.25/6162.28 High Jan 24 / 27

- PRICE: 6047.00 @ 07:25 GMT Jan 28

- SUP 1: 5961.75/5948.00 Low Jan 16 / 27

- SUP 2: 5943.94 61.8% retracement of the Jan 13 - 24 bull leg

- SUP 3: 5892.37 76.4% retracement of the Aug 5 - Dec 6 bull leg

- SUP 4: 5809.00 Low Jan 13 and a key support

The S&P E-Minis contract initially traded lower Monday extending the pullback from last Friday’s high. Key short-term support to watch lies at 5961.75, the Jan 16 low (pierced). For now, the move down appears corrective, however, a clear breach of 5961.75 would strengthen a bearish threat and signal scope for a deeper retracement, towards 5943.94, a Fibonacci retracement. Key resistance is 6178.75, the Dec 6 high.

GILT AUCTION PREVIEW: Tender on Thursday:

The DMO has announced that it will sell the 0.125% Jan-26 gilt (ISIN: GB00BL68HJ26) for GBP1.5bln via tender on Thursday. This is the gilt that we expected and in the middle of the GBP1.0-2.0bln size estimate that we pencilled in.

GOLD TECHS: Bull Phase Remains Intact

- RES 4: 2817.6 - 1.236 proj of the Nov 14 - Dec 12 - 19 price swing

- RES 3: $2800.0 - Round number resistance

- RES 2: $2790.1 - Oct 31 ‘24 all-time high

- RES 1: $2786.0 - HIgh Jan 24

- PRICE: $2742.6 @ 07:24 GMT Jan 28

- SUP 1: $2702.2/2671.6 - 20- and 50-day EMA values

- SUP 2: $2614.8/2583.6 - Low Jan 6 / Low Dec 19

- SUP 3: $2564.4 - Low Nov 18

- SUP 4: $2536.9 - Low Nov 14 and a key support

Despite yesterday’s pullback, Gold is trading closer to its recent highs. A bull cycle is in play and the breach of resistance at 2726.2, the Dec 12 high, reinforces current conditions. Sights are on $2790.1, the Oct 31 all-time high. A break of this hurdle would confirm a resumption of the primary uptrend. On the downside, the first key support to watch is $2671.6, the 50-day EMA. A reversal lower and a breach of this average would reinstate a bearish threat.