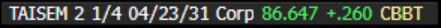

EM ASIA CREDIT: Q1 Sales: TSMC (TAISEM, Aa3/AA-/NR) - Beat

"*TSMC 1Q SALES NT$839.25B, +41.6% Y/Y" - BBG

- TSMC reporting Q21 sales up 42% YoY to NT$839bn, which is ahead of consensus (NT$831bn) and in line with the range provided by the company in January. Neutral for spreads.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

CHINA: Country Wrap: China’s Auto Sector Very Strong.

- China’s wholesale sales of passenger cars and exports surged to all-time highs in February as the country’s auto market got off to a strong start this year thanks to the government’s generous scrapping and trade-in policies and as car manufacturers continue to hold prices steady. (source: Yicai)

- China's top political advisory body on Monday concluded its annual session, calling on political advisors to make new and greater contribution to advancing Chinese modernization. (source: Xinhua)

- China’s key markets were all down, led by the Hang Seng which fell -0.75%. The CSI 300 was down -0.45%, Shanghai -0.33% and Shenzhen lost -0.43%.

- CNY: Yuan Reference Rate at 7.1741 Per USD; Estimate 7.2639

- Bonds: a strong sell off today with CGB10YR touching 1.90% for the first time this year as fears of issuance deluge grow.

EURUSD TECHS: Holding On To Its Recent Gains

- RES 4: 1.1040 High Oct 4 2024

- RES 3: 1.0961 76.4% retracement of the Sep 25 ‘24 - Feb 3 bear leg

- RES 2: 1.0937 High Nov 5 / 6 2024

- RES 1: 1.0889 High Mar 7

- PRICE: 1.0837 @ 05:51 GMT Mar 11

- SUP 1: 1.0766/1.0571 Low Mar 6 / 20-day EMA

- SUP 2: 1.0501 50-day EMA and a short-term pivot level

- SUP 3: 1.0360 Low Feb 28 and a key support

- SUP 4: 1.0317 Low Feb 12

A bullish theme in EURUSD remains intact and the pair is trading at its recent highs. Last week’s gains mark a continuation of the reversal on Feb 3. Note that moving average studies have crossed and are in a bull-mode position - this highlights a dominant uptrend. Sights are on 1.0937, the Nov 5 / 6 2024 high. Initial key support to watch lies at 1.0501, the 50-day EMA. The uptrend is overbought, a corrective pullback would allow this set-up to unwind.

BUND TECHS: (M5) Oversold But Remains Bearish

- RES 4: 130.40 Low Feb 19

- RES 3: 129.96 High Mar 5

- RES 2: 129.41 Low Jan 14

- RES 1: 128.33 High Mar 10

- PRICE: 128.07 @ 05:30 GMT Mar 11

- SUP 1: 126.64 Low Mar 6 and the bear trigger

- SUP 2: 126.56 2.500 proj of the Feb 5 - 19 - 28 price swing

- SUP 3: 126.28 2.618 proj of the Feb 5 - 19 - 28 price swing

- SUP 4: 126.00 Round number support

Bund futures are in consolidation mode and trading closer to their recent lows. A bearish theme remains intact. Last week’s impulsive sell-off signals scope for an extension towards 126.56 next, a Fibonacci projection. Further out, 126.00 is now within range. Note that the contract is in oversold territory, a recovery would allow this condition to unwind. Initial firm resistance to watch is seen at 129.41, the Jan 14 low.