EM ASIA CREDIT: Q3 Results: Bharti (BHARTI, NR/BBB-/BBB-) - positive for spreads

Bharti Airtel (BHARTI, NR/BBB-/BBB-)

- Bharti Airtel Q3 FY25 results were strong, positive for spreads.

- Bharti reported Q3 EBITDA up 24% YoY to INR249bn, with margins reaching 55.1% (52.9% year ago) on the back of strong momentum in India and continued growth in Africa. Indeed, mobile data usage is up 23.2% YoY, helping support a rise in ARPU (+18% YoY).

- In term of credit metrics, leverage was also lower, with reported LTM net debt/EBITDA at 2.3x versus 2.5x last quarter and 2.6x end FY24.

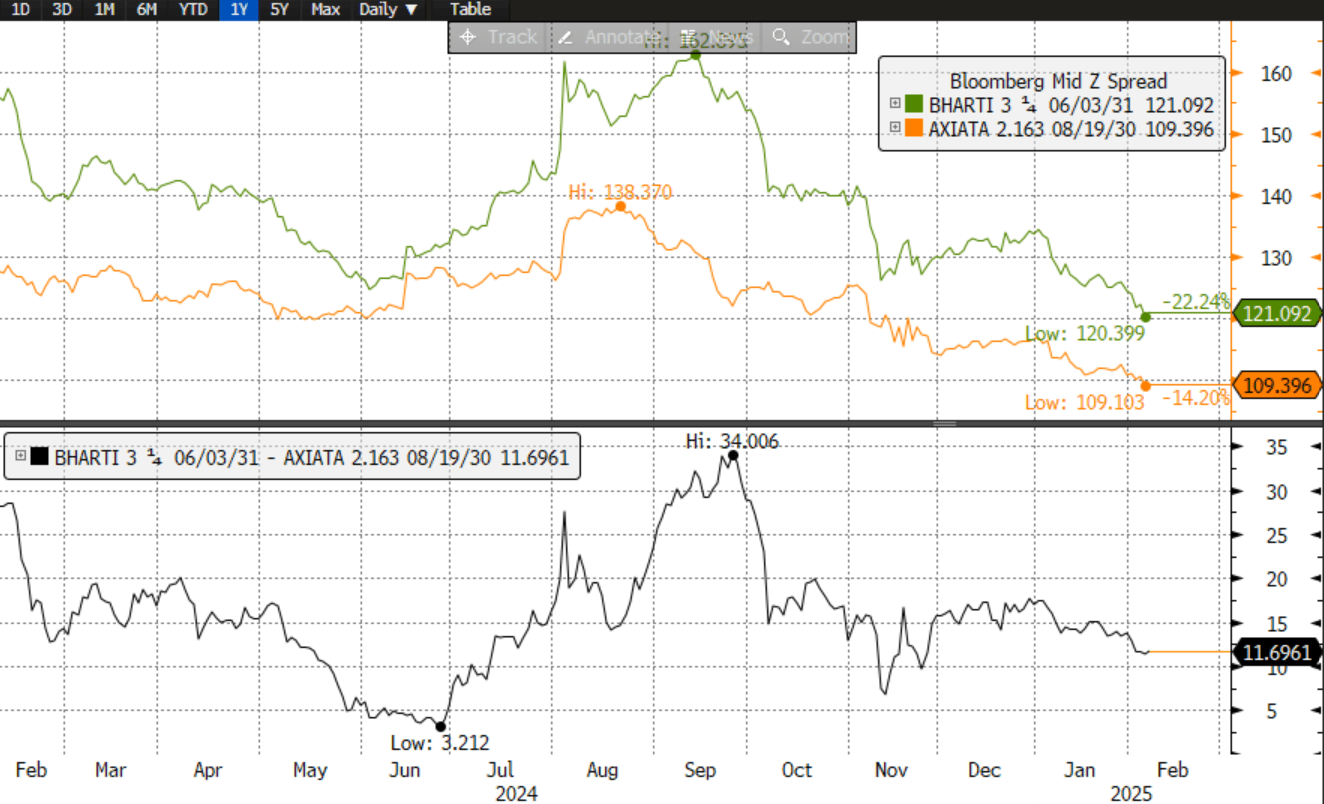

In terms of valuations, we note some outperformance in Bharti versus higher rated (Baa2/BBB) Malaysian peer Axiata recently. Spreads have compressed from the wides (35bp) last September to 12bp now (see chart).

Source: Bloomberg

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

AUD: A$ Weakens As Underlying Inflation Falls Towards Band

AUDUSD fell to 0.6212 following November CPI data showing a 0.3pp drop in trimmed mean inflation to 3.2% y/y, thus increasing rate cut expectations. The pair is currently down slightly today to 0.6228 after a high of 0.6242 before the data release. The USD index is range trading and little changed.

- While November headline inflation picked up 0.2pp to 2.3% y/y, the focus is on trimmed mean given current state & federal electricity rebates and this underlying measure eased to 3.2% y/y, where it was in September. Q4 vacancies rose 4.2% q/q, the first quarterly rise since Q2 2022.

- Aussie is also weaker against other major currencies with AUDJPY down 0.1% to 98.37 after a low of 98.16. AUDNZD is 0.1% lower at 1.1052. AUDEUR is down 0.2% to 0.6015 after falling to 0.6004 and AUDGBP -0.1% to 0.4987 following 0.4979.

- Equities are mixed with the ASX up 0.5% & S&P e-mini +0.2% but Hang Seng down 0.4%. Oil prices continue to rally with WTI +0.6% to $74.71/bbl. Copper is down 0.1% and iron ore is around $97.50/t.

- Later the Fed’s Waller speaks on the economic outlook and the December FOMC minutes are published. US jobless claims, December ADP employment and November consumer credit as well as November German orders & retail sales and December euro area European Commission survey print.

JGBS: Cash JGBs Heavy, Fresh Cyclical High For 10YY

Just ahead of the Tokyo lunch break, JGB futures are sharply weaker, -38 compared to the settlement levels, after extending overnight weakness sparked by US tsys.

- US tsys finished 2-7bps cheaper yesterday, with a steeper curve, following stronger-than-expected ISM services and JOLTS data. Currently, cash US tsys are ~1bp richer in today’s Asia-Pac session.

- Japanese yields are running at the highest since July 2011, which means Tuesday’s sale of 10-year debt is already underwater, so that may trigger knee-jerk selling from short-term traders.

- Cash JGBs are 1-3bps cheaper across benchmarks in today Tokyo session. The benchmark 10-year yield is 2.5bps higher at 1.61% after setting a fresh cycle high of 1.18%.

- Meanwhile, some investors aren’t giving up hope for a surprise BOJ interest-rate hike this month -- demand is picking up for downside JGB put options that expire just after this month’s meeting. (per BBG)

- Swaps are mostly cheaper, with rates flat to 4bps higher. Swap spreads are mixed.

China December FX Reserves Decrease Slightly

China’s foreign exchange reserves stood at USD3.2 trillion at the end of December, down USD63.5 billion from November, a decrease of 1.94%, Securities Daily reported citing data by State Administration of Foreign Exchange. The decline was mainly attributed to a stronger U.S. dollar which led to an overall fall in global asset prices. Export resilience, stable cross-border capital flows and the implementation of additional policies will help support the basic stability of fx reserves, the newspaper said citing analysts.