SWITZERLAND DATA: Q4 GDP Stronger Than Expected, Appears Broad-Based

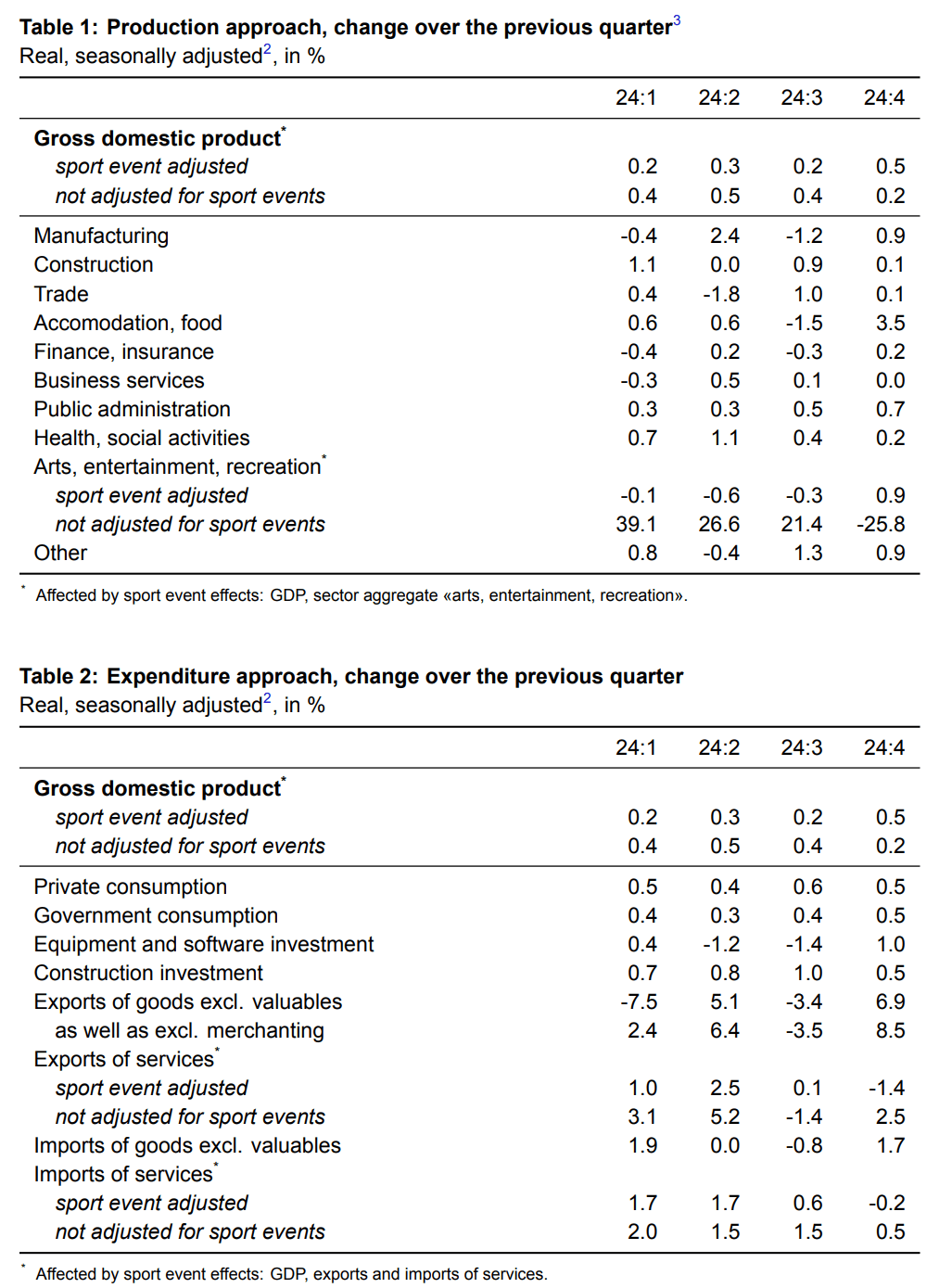

Swiss Q4 GDP came above the flash release at +0.5% Q/Q on a sports-event and seasonally adjusted basis. This follows Q3's +0.2%, and shows the Swiss economy is continuing its gradual growth trajectory amid significant growth concerns in the Eurozone.

- "Growth was driven roughly equally by industry and the services sector", SECO comments - that is in line with its conclusion from the flash release.

- Strong developments in the accommodation & food sector stand out - one potential driver here might have been a strong ski tourism season.

- Across expenditure categories, both consumption and investment were positive. See the table for details.

- For 2024 as a whole, this brings in real GDP at +0.9% vs 2023 (seasonally, calendar and sport event adjusted; +1.2% 2023).

- Sentiment suggests further moderate growth ahead in Switzerland - the KOF indicator has been hovering broadly around its neutral mark recently, as have the UBS survey expectations. The KOF will see its February release tomorrow, expected at 102.0 (101.6 Jan).

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

GILTS: A Little Lower Early On, I/L Supply Due

Gilts tick lower on spillover from Trump’s latest comments on tariffs, although the move is modest.

- The uptick in e-mini futures since yesterday’s gilt close will also be adding some light pressure.

- Futures -16 at 92.26 vs. lows of 92.15.

- The medium-term trend condition in the contract remains bearish. However, recent gains continue to highlight a corrective phase and signal scope for a continuation higher near-term.

- Initial support and resistance located at 91.10/92.68.

- Yields little changed to ~1bp higher across the curve.

- BRC shop price data was released overnight but isn’t a market mover.

- The DMO will come to market with GBP1.5bln of the 1.125% Sep-35 linker today.

- A reminder that the DMO has announced that it will sell GBP1.5bln of the 0.125% Jan-26 gilt (ISIN: GB00BL68HJ26) via tender on Thursday. This is the gilt that we expected to be sold and the amount on offer is in the middle of the GBP1.0-2.0bln estimate that we pencilled in.

SILVER TECHS: Recent Gains Considered Corrective

- RES 4: $34.903 - High Oct 23 and the bull trigger

- RES 3: $33.125 - High Nov 1

- RES 2: $32.338 - High Dec 12 and a key resistance

- RES 1: $31.022 - High Jan 24

- PRICE: $29.961 @ 08:12 GMT Jan 28

- SUP 1: $29.509/28.748 - Low Jan 13 / Low Dec 19 and bear trigger

- SUP 2: $28.446 - 76.4% retracement of the Aug 8 - Oct 23 bull cycle

- SUP 3: $27.686 - Low Sep 6

- SUP 4: $26.451 - Low Aug 8

A bear cycle in Silver that started Oct 23 last year remains in play and recent gains are considered corrective. However, recent gains do suggest scope for a continuation higher near-term. An extension would expose key resistance at $32.338, the Dec 12 high. Clearance of this level would highlight a reversal. On the downside, support to watch is $29.509, the Jan 13 low, and $29.748, the Dec 19 low and the bear trigger.

BONDS: Some elevated Volumes in US Treasuries

- It is another decent start for US Treasuries in terms of early volumes, TYH5 is sold in over 7k, FVH5 5k, TUH5 3k, all cumulative Volumes as Europe continues to join the session.

- There's some small spillovers into Bund and the BTP, the latter is sold in over 1k.

- Still, overall some two way early price action, with Bund sticking to a very tight 18 ticks range.