STIR: RBA Dated OIS Pricing Softer Ahead Of March Employment Report

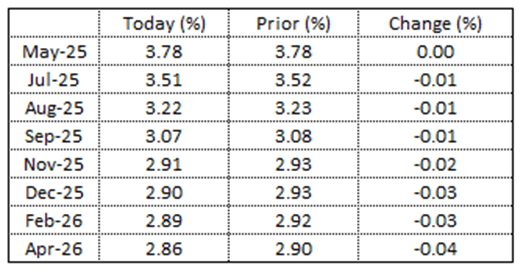

RBA-dated OIS pricing is flat to 4bps softer across meetings today ahead of March’s Employment Report. Bloomberg consensus expects +40k jobs created, but an increase in the unemployment rate to 4.2% from 4.1%.

- A 50bp rate cut in May is given a 24% probability, with a cumulative 119bps of easing priced by year-end (based on an effective cash rate of 4.09%).

Figure 1: RBA-Dated OIS – Today Vs. Prior

Source: MNI – Market News / Bloomberg

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

RBA: ‘Data Dependency’ Reflects More Than Real-Time Data

Assistant Governor (Economic) Hunter spoke at the AFR banking summit about how monetary policy can be both forward looking and data dependent given decisions are always made under uncertainty. The bank looks at the signal from data excluding the noise and uses that in determining its outlook which is then analysed under various scenarios and judgement. In February, the focus was on the impact of US policy and scenario analysis was an important part of this assessment.

- “The links between data, forecast and policy sit at the heart of us saying that policy is ‘data dependent’.”

- Hunter said that during times of “heightened uncertainty”, there is more weight put on “real time data” relative to forecasts.

- Hunter noted that it takes 9 to 12 months for a rate cut to have its maximum effect on GDP growth with the response from dwelling investment particularly timely. Inflation takes longer though at around 18 to 24 months due to the stickiness of prices and the indirect effects from a change in monetary policy on employment and wages.

- The RBA’s model also shows that trade responds “relatively quickly” through the exchange rate channel.

- However, consumers’ reaction is “initially small but grows over time” according to RBA modelling. There is some offset from lower debt payments by less interest income and households tend to smooth their spending.

- The RBA believed that Q4 consumption data showed an underlying pickup relative to Q3 with items not impacted by discounting, such as eating out, showing stronger growth as incomes rose. Its business liaison responses were consistent with this.

- See Hunter’s speech here.

MNI EXCLUSIVE: Different Perspectives On Pace Of Australian Wage Growth

JGB TECHS: (H5) Fresh Cycle Lows

- RES 3: 147.74 - High Jan 15 and bull trigger (cont)

- RES 2: 146.53 - High Aug 6

- RES 1: 142.73/144.48 - High Dec 9 / High Nov 11

- PRICE: 138.45 @ 16:51 GMT Mar 17

- SUP 1: 136.76 - 1.0% 10-dma envelope

- SUP 2: 136.57 - 1.382 proj of the Jan 28 - Feb 20 - Feb 26 bear leg

- SUP 3: 134.89 - 2.000 proj of the Jan 28 - Feb 20 - Feb 26 bear leg

JGBs have traded lower breaching recent key support at 138.71, the Feb 21 low. This confirms a resumption of the bear leg and note too that MA studies are in a bear-mode set-up, highlighting a downtrend. Sights are on 136.57, a Fibonacci projection. For bulls, a show through 140.33 resistance would signal a possible reversal, and open early December highs should the pace be maintained. 144.48 is the medium-term target on any recovery.