USDJPY TECHS: Recovery Extends

- RES 4: 155.89/156.75 High Nov 20 / 15 and the bull trigger

- RES 3: 154.84 76.4% retracement of the Nov 15 - Dec 3 pullback

- RES 2: 153.69 High Dec 13

- RES 1: 153.66 61.8% retracement of the Nov 15 - Dec 3 pullback

- PRICE: 152.76 @ 16:32 GMT Dec 13

- SUP 1: 150.90 Low Dec 10

- SUP 2: 149.37/148.65 Low Dec 06 / 03 and the bear trigger

- SUP 3: 148.17 50.0% retracement of the Sep 16 - Nov 15 bull leg

- SUP 4: 147.77 2.0% 10-dma envelope

USDJPY traded higher into the Friday close and is holding on to its latest gains. The pair has breached both the 20- and 50-day EMAs. This undermines the recent bearish theme and for now, signals scope for an extension higher. The next firm short-term resistance is at 153.66, a Fibonacci retracement. A reversal lower would signal the end of the latest bounce and refocus attention on the bear trigger at 148.65, the Dec 3 low.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

USDJPY TECHS: Bullish Price Sequence Extends

- RES 4: 157.86 High Jul 19

- RES 3: 156.67 76.4% retracement of the Jul 3 - Sep 16 bear leg

- RES 2: 156.00 Round number resistance

- RES 1: 155.27 2.00 proj of the Sep 16 - 27 - 30 price swing

- PRICE: 155.16 @ 16:32 GMT Nov 13

- SUP 1: 152.03 20-day EMA

- SUP 2: 150.03 50-day EMA

- SUP 3: 149.09 Low Oct 21

- SUP 4: 147.35 Low Oct 8

The USDJPY trend condition is unchanged and remains bullish. This week’s climb has resulted in a breach of resistance at 154.71, the Nov 11 high, to confirm a resumption of the uptrend and maintain the price sequence of higher highs and higher lows. Sights are on 155.27, a Fibonacci projection. Initial firm support is 152.03, the 20-day EMA. A break of this average would signal the start of a short-term corrective cycle.

US: Pollsters Claim Industry Outperformed 2016/2020 Despite Popular Vote Miss

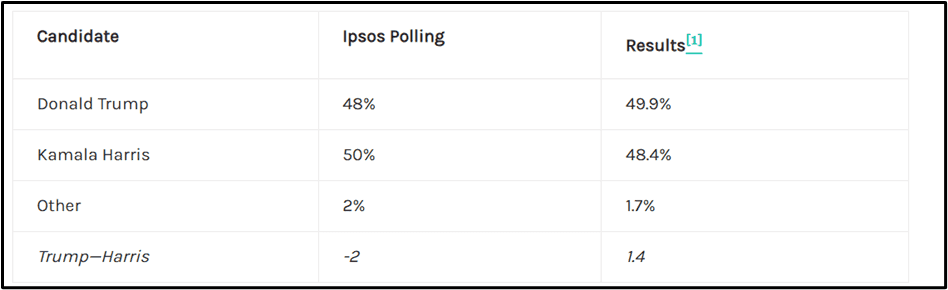

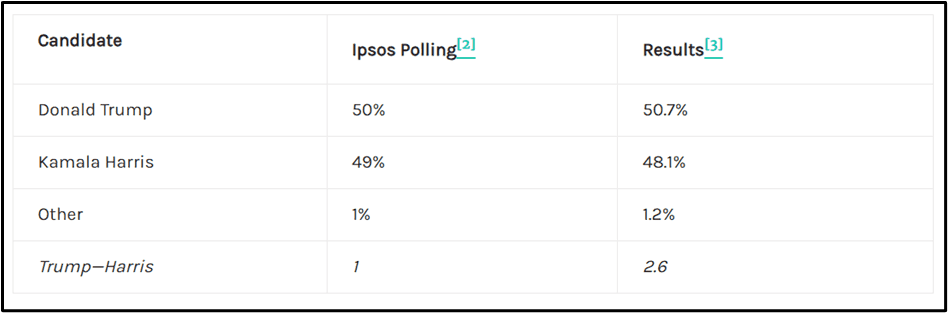

Ipsos has published analysis showing that their polling tracked relatively closely with the final results of the 2024 presidential election, supporting a claim by pollsters that the industry outperformed 2016 and 2020.

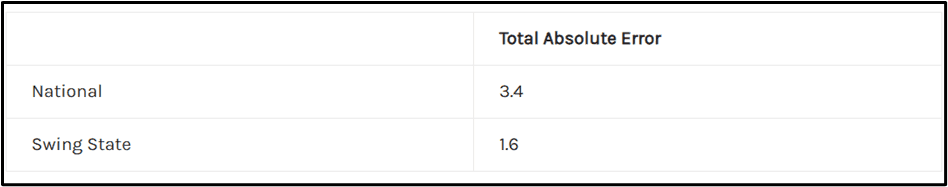

- Ipsos: “Compared to 2016 and 2020, the polling industry performed well. Our final poll estimates nationally and in the swing states were well within the margin of error (our total error was around 3.4 points nationally and 1.6 points in the aggregate of the swing states).

- “However, we acknowledge areas for improvement, as our national poll did not predict Trump winning the popular vote.”

Figure 1: National Polling Performance

Source: Ipsos

Figure 2: Swing State Polling Performance

Source: Ipsos

Figure 3: Total Absolute Error

Source: Ipsos

MNI: US OCT TREASURY BUDGET -$257.5B

- MNI: US OCT TREASURY BUDGET -$257.5B