FED: Reserves Pull Back, Continuing Tax Season Dynamics (2/2)

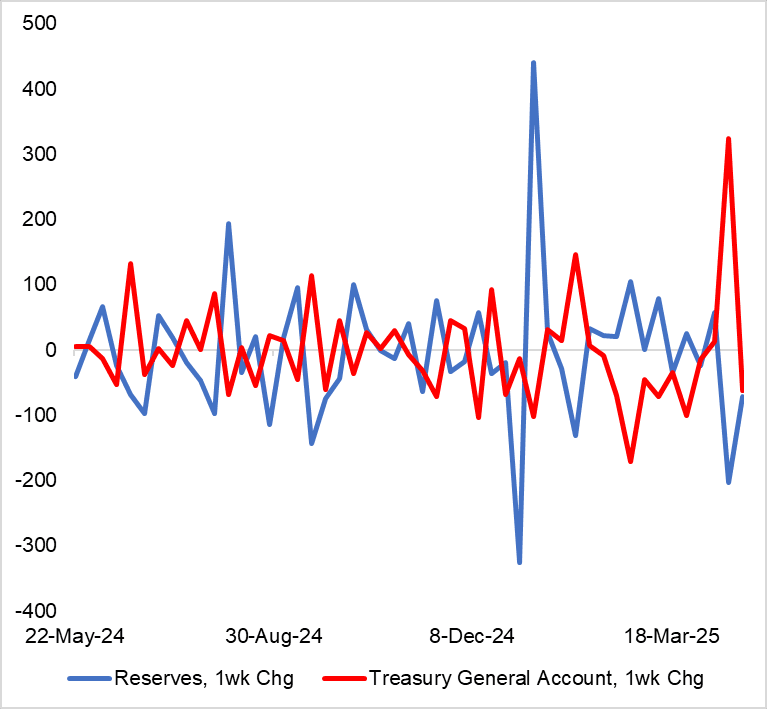

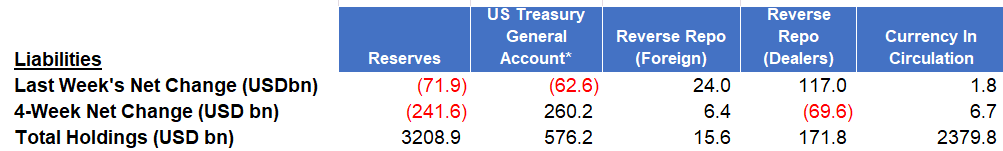

Reserves meanwhile fell by $72B in the latest week, with an accompanying fall in the Treasury General Account, offsetting a rebound in reverse repo takeup.

- The 4-week rise in the TGA of $247B is mirrored by a pullback in reserves ($242B), though overall RRP usage has pulled back ($63B).

- This leaves reserves at levels last seen in late January, and down around $300B from the recent peak, although the rise and fall were to be expected given the increase in the TGA around tax season (the TGA increased over $300B the week prior which included the April 15 tax deadline).

- In any event reserves appear to remain "abundant", and this effect will reverse once again over the course of the summer until the next major tax date in June.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

ASIA: Coming Up In Asia Pac Markets On Wednesday

| 2350GMT | 0750HKT | 1050AEDT | Japan Feb PPI Services |

| 0000GMT | 0800HKT | 1100AEDT | Australia 2034 Bond Sale |

| 0030GMT | 0830HKT | 1130AEDT | Australia Feb CPI |

| 0500GMT | 1300HKT | 1600AEDT | Japan Jan F Leading Index |

USDCAD TECHS: MA Studies Remain In A Bull-Mode Position

- RES 4: 1.4793 High Feb 3 and key resistance

- RES 3: 1.4700 Round number resistance

- RES 2: 1.4641 76.4% retracement of the Feb 3 - 14 bear leg

- RES 1: 1.4452/4543 High Mar 13 / 4 and a bull trigger

- PRICE: 1.4304 @ 16:22 GMT Mar 25

- SUP 1: 1.4242 Low Mar 6 and a key near-term support

- SUP 2: 1.4151/4107 Low Feb 14 / 50.0% of Sep 25 - Feb 3 bull run

- SUP 3: 1.4011 Low Dec 5 ‘24

- SUP 4: 1.3944 61.8% retracement of the Sep 25 ‘24 - Feb 3 bull cycle

USDCAD continues to trade closer to its recent lows. The bull cycle that started Feb 14 is intact and moving average studies remain in a bull-mode position, highlighting a dominant uptrend. A near-term key support to watch lies at 1.4242, the Mar 6 low. Clearance of this level would undermine the bull theme and instead highlight potential for a test of 1.4151, the Feb 14 low and a bear trigger. The bull trigger is 1.4543, the Mar 4 high.

OIL: US Crude & Product Inventories Lower Last Week

Bloomberg reported that there was a US crude inventory drawdown of 4.6mn barrels last week with 600k at Cushing, according to people familiar with the API data. Products continued to decline with gasoline down 3.3mn and distillate 1.3mn. The official EIA data is out later today.