GBPUSD TECHS: Resistance Remains Intact

- RES 4: 1.3048 High Nov 6 and a key resistance

- RES 3: 1.2961 50.0% retracement of the Sep 26 - Nov 22 bear leg

- RES 2: 1.2821 50-day EMA

- RES 1: 1.2811 High Dec 6

- PRICE: 1.2658 @ 16:22 GMT Dec 13

- SUP 1: 1.2609/2487 Low Dec 13 / Low Nov 22 and the bear trigger

- SUP 2: 1.2446 Low May 9

- SUP 3. 1.2367 76.4% retracement of the Oct 4 ‘23 - Sep 26 uptrend

- SUP 4: 1.2300 Low Apr 22 and a key support

GBPUSD traded lower again Friday, extending the pullback from its recent high. The trend condition remains bearish and recent gains are considered corrective. A recovery has allowed an oversold trend condition to unwind. Key resistance to monitor is 1.2821, the 50-day EMA. First support has been cleared at 1.2617, the Dec 2 low. This exposes the bear trigger at 1.2487, the Nov 22 low.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

GBPUSD TECHS: Approaching Key Support

- RES 4: 1.3274 High Oct 3 and the bull trigger

- RES 3: 1.3175 High Oct 4

- RES 2: 1.2957/3048 20-day EMA / High Nov 6 and a key resistance

- RES 1: 1.2834 Low Nov 6

- PRICE: 1.2712 @ 16:21 GMT Nov 13

- SUP 1: 1.2687 Low Nov 13

- SUP 2: 1.2665 Low Aug 8 and key support

- SUP 3. 1.2636 2.0% 10-dma envelope

- SUP 4: 1.2613 Low Jun 27

GBPUSD traded sharply lower again Wednesday, solidifying the downtrend. Tuesday’s move resulted in a breach of support at 1.2834, the Nov 6 low. The clear break confirms a resumption of the downtrend, compounded by the weakness through 1.2762, the Aug 13 low. Moving average studies are in a bear-mode condition, highlighting a dominant downtrend. Sights are on 1.2665, the Aug 8 low. Key short-term resistance is at 1.3048, the Nov 6 high.

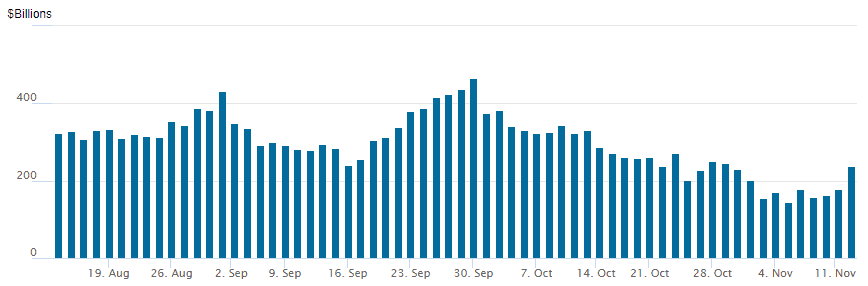

STIR: FED Reverse Repo Operation

RRP usage climbs back over $200B to $238.106B from $178.814B Tuesday. Compares to $144.243B on Tuesday, November 5 -- the lowest since May 6, 2021. The number of counterparties rises to 66 from 59 prior.

FED: St Louis's Musalem Echoes New Hawk Theme: High Long-End Rates Bad For Jobs

St Louis Fed President Musalem's prepared remarks are in this link He is typically cautious on future rate cuts, but less so than earlier this year when he was one of the most hawkish members of the FOMC, summing up his current view on policy: "I believe the FOMC can judiciously and patiently evaluate incoming information in considering further lowering of the policy rate. Future adjustments to the policy rate can be accelerated, slowed or paused as appropriate in response to new information about the outlook and risks for the price stability and employment objectives.""

- It's interesting that, like his fellow hawk Dallas's Logan earlier, points to downside risks to employment stemming from higher long-term rates, even as the Fed is attempting to ease restriction by cutting short-end rates. He goes a little further than Logan in tying the rise of long-end premia to the Fed potentially "easing too much too soon" - in other words, cutting the Fed funds rate too quickly or too much poses risks to the employment side of the mandate by increasing long-end borrowing costs.

- "Because the economy remains strong and inflation is above target, easing too much too soon could prompt an increase in demand that initially outpaces supply, further delaying inflation convergence. It could also be counterproductive for maintaining full employment. A rapidly declining federal funds rate could

increase real or inflation risk premia along the yield curve, thereby adversely impacting the housing market and other interest-sensitive sectors that depend on capital market financing. Of course, easing too little too late could be associated with an unwelcome deterioration in the labor market, even as inflation remains on a course toward 2%." - On inflation, he notes of today's CPI report "Today’s release indicates that core consumer price index (CPI) inflation, at 3.6% and 3.3% on a three- and 12-month basis

through October, also remains elevated." But "recent information suggests to me that the risk of inflation ceasing to converge toward 2%, or moving higher, has risen, while the risk of an unwelcome deterioration in the labor market has remained unchanged or possibly fallen."