EUROZONE DATA: Retail Sales Unlikely To Improve Notably In The Months Ahead

Apr-05 09:00

Eurozone February retail sales were -0.7% Y/Y WDA (vs -0.8% cons). January’s reading was revised 0.1pp higher to -0.9% Y/Y. On a monthly basis, sales were -0.5% M/M SA (vs -0.4% cons, 0.1pp downwardly revised 0.0% prior).

- All major subcomponents saw negative growth on an annual and monthly basis, though sales of non-food products rose to -0.1% Y/Y (vs -0.7% prior).

- At a country level, Germany saw the largest M/M fall in sales volumes (-1.9% M/M), while Belgium saw the largest Y/Y fall (-6.8% Y/Y).

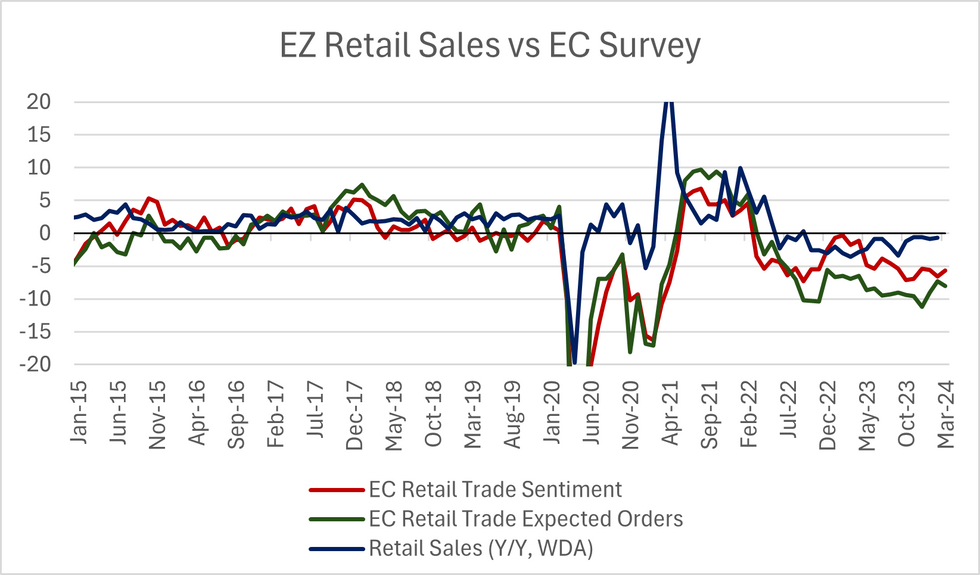

- Retail sentiment in the EC’s business survey has been in contractionary territory for over 2-years now, though the March reading improved a touch to -5.7 (vs -6.6 prior).

- However, expected orders from the EC’s survey fell to -8.0 (vs -7.3 prior) in March, leaving little optimism for a pickup in sales volumes in the coming months.

- Analysts currently expect Eurozone Q1 household consumption at 0.7% Y/Y, above the 0.4% Y/Y forecast seen in late-2023.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EUR: EURUSD targets Yesterday's high

Mar-06 08:57

- EURUSD is slowly edging towards 1.0876 (yesterday's high), but resistance is seen at 1.0888 (22nd Feb high), and where the pair was trading pre US February NFP.

- Risk On is keeping the lid on the Dollar, with Cable also targeting a test to the next immediate resistance at 1.2735 High Mar 05.

- The unwind lower in Bond futures (higher Yields), help USDJPY higher, but still short of its intraday high of 150.09, now at 149.74.

GERMAN DATA: Trade Balance All-Time High As China Imports Fall & Exports Rebound

Mar-06 08:52

The German trade surplus for January came in at an all-time high of +E27.5bln (seasonally-adjusted; vs E21.0bln cons; E23.3bln prior, revised from E22.2bln).

- Export growth outstripped import growth.

- Exports +6.3% M/M (sa; vs +1.5% cons; -4.2% prior, revised from -4.6%) and imports +3.6% M/M (sa; vs +1.8% cons; -6.7% prior).

- On a yearly, non-sa/ca comparison, exports increased +1.5% Y/Y and imports decreased -7.5% Y/Y.

- Looking at a geographical split, trade with other EU members was particularly strong as exports to the EU increased +8.9% M/M, while EU imports increased +10.8% Y/Y.

- With third-party countries, exports increased +3.1% M/M but imports decreased -4.5% M/M, driven by a further drop in Chinese imports, extending the recent trend.

- The numbers point to a positive start re: net export contribution to Q1 2024 GDP vs. the the 0.0pp contribution seen in Q4 2023.

- Import data provides positive signals for domestic demand.

- On a longer term view, exports and imports are both projected to rebound in 2024, with real exports seen at +0.3% Y/Y and real imports seen at +0.6% Y/Y, per Bloomberg consensus.

MNI, Destatis

MNI, Destatis

GILTS: Fiscal Speculation Trims Yesterday's Rally

Mar-06 08:46

Gilt markets give back some of yesterday’s rally, with focus on the potential for a cut to personal income tax on top of the widely expected 2ppt cut to national insurance.

- In terms of timelines surrounding any such personal income tax cuts, one Minister has suggested that the move could come today (per POLITICO).

- We assign relatively low odds to such a move given the limited fiscal headroom apparent at present and limited speculation.

- Broader focus seems to be on the potential for an income tax cut later this year, with suggestions that such a step will form part of the Conservative Party’s election manifesto.

- There is speculation that any related announcement could come via an additional pre-election Budget or the Autumn Statement (election timing dependent).

- Our full preview of today’s Budget can be found here.

- Gilt futures last -45 at 98.84 (range 98.79-99.22).

- Cash gilt yields are 3-4bp higher, with 10-Year yields at 4.05% after a brief and shallow foray below 4.00% on Tuesday.

- SONIA futures are flat to -5.5 through the blues, coming under pressure alongside gilts.

- BoE-dated OIS moves to price ~60bp of ’24 cuts vs. 62.5bp seen pre-open. Additional fiscal easing would support the higher for longer argument re: interest rates.

- The strip prices ~90% odds of a 25bp cut come the end of the June ’24 MPC.

- The major markers in that space stick to recent ranges.