EU CONSUMER CYCLICALS: Revisit to short-end (consumer/transport)

Mar-20 12:19

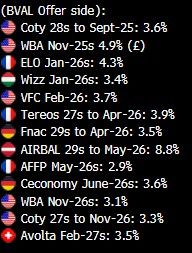

Not giving what they used to - Wizz was at 4% to start the year, Elo-26s above 8%.

AFFP-26s on SLB step possibility (+75bps) is only value view.

Elo-26s, Avolta-27s & VFC-26s (earnings ahead) look the most attractive on RV out of the remaining.

Bunds: 1y 2.1% / 2y 2.2% / 5y 2.4%

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

OPTIONS: Collapse in Implied May Mean market Left Underhedged

Feb-18 12:17

- The persistent and one-way slide in front-end implied vols signals the prevalence of vol-selling in G10 - a strategy that could be caught offguard by any renewed USD rally.

- No surprise to see atypically low FX options volumes yesterday given the US Presidents' Day holiday - and markets aren't doing much to make up for it today. Total notional traded is well below average for this time of day, and won't be helping the continued slide in vols: EUR/USD 1m implied has stabilised, but is still at a YTD low below 7 points.

- The persistent pullback in implied off January's highs may only run so far: realised 1m vols across EUR/USD and GBP/USD are still sticky and close to highs. While this will undoubtedly moderate given the recovery in spot, the realised/implied 1m vol ratio is abnormally high. This metric hit the highest level since 2022 this week - a further signal that the market's expectations for Trump to upend the market are yet to come to pass - likely due to the delayed installation of tariffs.

- That said, the pace of the decline in implied is significant: particularly as the market monitors a new tariff deadline for Canada & Mexico, an ECB projection meeting, the opening of US-Russia negotiations and the April 1st report on America First Trade Policy - all of which pose risks to the February fade in the USD Index, and present considerable event risk.

Figure 1: Realised/Implied vol rank, EUR/USD 1m realised/implied ratio

EQUITIES: EU Bank index highest since April 2011

Feb-18 12:13

- Although the Stoxx600 is mostly mixed at least for Today, the Banking Index {SX7E Index} is again leading in Europe, that's a whopping 28.44% taken from the December low.

- Next upside resistance is now just above the Psychological 180.00 level, at 181.50, the April 2011 high.

- Further out, the 2011 high would be situated at 197.88.

(Chart source: MNI/Bloomberg).

OUTLOOK: Price Signal Summary - Bunds Have Breached Trendline Support

Feb-18 12:10

- In the FI space, Bund futures have traded lower once again, today, as the contract extends the reversal that started Feb 5. Price is through an important short-term support at 132.12, a trendline drawn from the Jan 15 low. The breach strengthens a bearish theme and signals scope for an extension towards 131.59 next, the 61.8% retracement of the Jan 14 - Feb 5 bull leg. Below 131.59, lies 131.00, the Jan 25 low and a key support. Initial firm resistance to watch is 132.97, the Feb 13 high.

- A bull cycle in Gilt futures remains in play and recent weakness appears corrective for now. The climb on Feb 13 is a positive development and appears to be a bullish engulfing candle pattern. A continuation higher would open 94.35, the Feb 6 high and a bull trigger. Clearance of this level would open 94.75, the 76.4% retracement of the Dec 3 - Jan 13 bear leg. The next firm support to watch lies at 91.52, the Jan 24 low.