AUSSIE BONDS: Richer & Dealing At Highs Ahead Of RBA Policy Decision (Tues)

ACGBs (YM +4.0 & XM +4.5) are richer and at Sydney session highs on a data-light session.

- Australia will hold a Federal election on May 3. The election is expected to be close, with cost of living issues the main focus point.

- (AFR) “With a helpful kick from the RBA’s first interest rate cut in February, Sydney and Melbourne house prices are climbing once again after modest recent declines.” (see BBG link)

- Cash US tsys are flat to 2bps richer, with a flattening bias, in today's Asia-Pac session.

- Cash ACGBs are 4-5bps richer with the AU-US 10-year yield differential at +11bps.

- Swap rates are 3bps lower.

- The bills strip has bull-flattened, with pricing flat to +5 across contracts.

- RBA-dated OIS pricing is flat to 4bps softer across meetings today. A 25bp rate cut in April is given a 4% probability, with a cumulative 64bps of easing priced by year-end (based on an effective cash rate of 4.09%).

- On Tuesday, we will get the RBA's next Policy Decision.

- Next week, the AOFM plans to sell A$600mn of the 2.25% 21 May 2028 bond on Monday, A$800mn of the 3.75% 21 May 2034 bond on Wednesday and A$600mn of the 1.00% 21 November 2031 bond on Friday.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

AUSTRALIA: Function Signals Stable Rates On Persistent Positive Inflation Gap

The RBA cut rates 25bp to 4.10% at its February 18 meeting as the Q4 CPI data suggested that “inflationary pressures are easing a little more quickly” than it expected. It also updated its forecasts and extended them to Q2 2027. While Q2 2025 trimmed mean inflation was revised down 0.3pp to 2.7%, the rest of the forecast horizon had it stuck at this rate and no longer reaching the band mid-point. Our policy reaction function uses the 2.5% mid-point and the RBA’s projections to calculate the core inflation gap and as a result, it is not suggesting any further rate cuts, in line with “the Board remains cautious on prospects for further policy easing”.

- The equation uses the one quarter lead of the inflation gap using trimmed mean inflation.

- It also includes the contemporaneous output gap calculated with the RBA’s GDP forecasts, which were revised lower this month, and an estimated trend growth rate of 2.2%. This results in a negative output gap for around two years with it trending towards neutral over 2026. However, this is not enough to offset the positive inflation gap and signal further cuts.

- Thus the policy function has rates stable around 4.1% over 2025 resulting in Q4 2025 around 60bp higher than current AUD OIS market pricing.

- It is worth noting that econometric calculations are just estimates and not projections.

Australia policy reaction function with trimmed mean inflation %

STIR: RBA Dated OIS Pricing Mixed Vs. Pre-RBA Levels After CPI Monthly

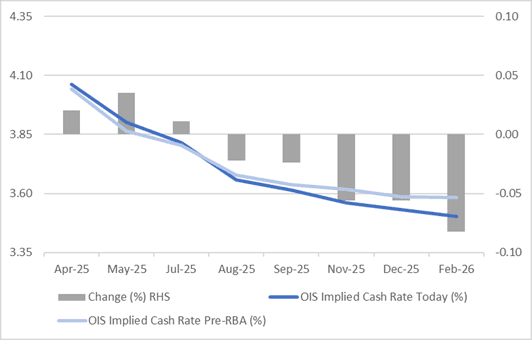

RBA-dated OIS pricing is softer for late 2025 / early 2026 meetings today.

- As a result, pricing remains mixed compared to last Tuesday’s pre-RBA levels—meetings through July are flat to 4bps firmer, while those beyond are 2-8bps softer.

- January headline CPI inflation printed slightly lower than expected at 2.5% y/y, in line with December. However, the underlying trimmed mean rose 0.1pp to 2.8%, but still below the top of the RBA’s 2-3% band. The first month of the quarter has limited updates for services inflation. The seasonally adjusted data is consistent with the RBA remaining cautious with it stating that “upside risks remain”.

- Markets assign an 11% probability to a 25bp rate cut in April, with a cumulative 56bps of easing priced by year-end, based on an effective cash rate of 4.09%.

Figure 1: RBA-Dated OIS – Today Vs. Pre-RBA Levels

Source: MNI – Market News / Bloomberg

AUSSIE BONDS: Richer But Off Bests, Tracking US Tsys

ACGBs (YM +3.0 & XM +4.0) are richer but off session bests.

- January headline CPI inflation printed slightly lower than expected at 2.5% y/y, in line with December. However, the underlying trimmed mean rose 0.1pp to 2.8%, but still below the top of the RBA’s 2-3% band. The first month of the quarter has limited updates for services inflation.

- The move away from the session’s bests, however, can be traced back to cash US tsys, which are currently 2-3bps cheaper in today’s Asia-Pac session. Earlier, the passage of the budget blueprint by the US House provided an upward backdrop for yields.

- "The House budget would pave the way for $4.5 trillion in tax cuts — about enough to pay for extending the expiring cuts but not enough to also cover Trump’s campaign promises for additional tax relief. The measure would add to the budget deficit despite calling for $2 trillion in overall spending cuts over ten years." (per BBG)

- Cash ACGBs are 3-5bps richer with the AU-US 10-year yield differential +3bps.

- The bills strip has bull-flattened, with pricing flat to +4.

- Tomorrow, the local calendar will see Private Capital Expenditure data and Michael Plumb, Head of Economic Analysis Department, deliver a speech at the ABE Annual Forecasting Conference, titled ‘Why is productivity important?’