RPT-MNI BOK WATCH: Rhee Flags More Cuts Following 25bp Move

(Repeats story first published earlier on May 29.)

Bank of Korea Governor Rhee Chang-yong on Thursday signalled the possibility of additional rate cuts due to worsening economic conditions, while stopping short of providing a clear timeline, noting that decisions would remain data-dependent.

“The Board will maintain its rate cut stance to mitigate downside risks to economic growth and adjust the timing and pace of any further Base Rate cuts,” Rhee said, following the Board’s largely anticipated, unanimous decision to reduce the rate 25bp to 2.5%. (See MNI BOK WATCH: Board To Cut On Q1 GDP Contraction Concerns)

Future rate cuts could be larger than previously assumed, but any moves must weigh financial stability risks and be based on evolving data, he cautioned.

The BOK’s reduction marks a pivot to more aggressive easing as economic momentum stalls and follows the Board's decision to hold in April. (See MNI BOK WATCH: Governor Flags Cut, But Timing Unclear) The next policy meeting is scheduled for July 10, coinciding with the end of U.S. President Donald Trump’s 90-day tariff reprieve.

“Although concerns about household debt growth and an increase in volatility of foreign exchange markets still persist, inflation stabilisation has continued and the economic growth rate is forecast to decline significantly,” Rhee said, noting the Board judged a rate cut necessary to ease mounting downward pressure on the economy.

WEAK GDP

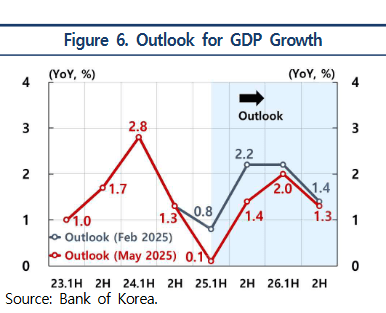

The BOK sharply revised down its 2025 GDP growth forecast to 0.8%, from the 1.5% projected in February, citing a significant drag from construction investment.

“Although trade negotiations between the U.S. and China have recently made progress and the government’s supplementary budget was approved, we still revised down our growth projection by 0.7 percentage points,” Rhee said.

South Korea’s domestic economy continued to contract in April after a weak first quarter, with private consumption remaining sluggish amid persistent uncertainty, Rhee continued, noting the recovery in Q2 consumption is now expected to be slower than previously assumed.

The International Monetary Fund downgraded its growth outlook for South Korea this year, now projecting 1.0% GDP growth for 2025 and 1.4% in 2026, from 2.0% and 2.1% previously, citing Korea’s export dependence on the U.S. as a key vulnerability.

STABLE INFLATION

Despite weaker growth, inflation remains within target, giving the BOK more room to ease. Headline CPI inflation held steady at 2.1% in April, with the bank maintaining its full-year projection at 1.9%, just below the BOK's . Core inflation is now expected at 1.9%, slightly higher than the 1.8% forecast in February.

Rhee said declining global oil prices and subdued domestic demand had offset upward pressure from processed food and services inflation.