OIL: Russia Crude Shipments Fall Amid Challenges From US Sanctions

Feb-26 09:37

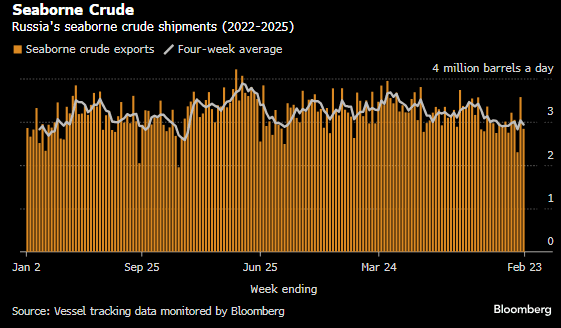

Russia’s seaborne crude shipments fell last week amid efforts to maintain exports while delivering cargoes to China and India is proving challenging due to US sanctions.

- Russia is using cargo transfers from specialized shuttle tankers and sanctioned ships to maintain oil exports from Pacific and Arctic ports despite sanctions.

- Weekly shipments fell 730kb/d in the week to Feb. 23 to 2.84mb/d following a spike higher by 55% the previous week. The four-week average fell 90kb/d, or 3%, w/w to 2.94mb/d.

- The weekly decline was driven by a drop in Novorossiysk shipments to zero and lower Arctic exports. Baltic exports were unchanged as operations at Primorsk increased to offset a decline at Ust-Luga.

- Nine tankers have left Murmansk after being sanctioned by the US last month but none have yet unloaded a cargo.

Source: Bloomberg

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EQUITIES: Estoxx calendar put spread

Jan-27 09:35

SX5E (21st Feb) 160p vs (20th Jun) 130p, bought the Feb for 0.70 as a 1x1.5 put spread in 12k (12kx18k).

GILT AUCTION PREVIEW: Potential short-dated conventional gilt tender Thursday

Jan-27 09:25

- The DMO announced earlier this morning that it would be looking to hold a tender on Thursday this week for a potential conventional sub-5 year gilt.

- We note that already in this fiscal year the 0.125% Jan-26 gilt (ISIN: GB00BL68HJ26) has been reopened via tender twice for GBP2.0bln in September and November.

- This gilt is still trading at a premium to the rest of the curve (even when taking into account its low coupon) and we think that there is still strong demand for this gilt in the market.

- We think the market agrees with our assessment as the 0.125% Jan-26 gilt is underperforming similar gilts around a similar maturity this morning.

- In terms of the size, there is only GBP2.6bln remaining in the unallocated bucket and we still have a 10-year syndication of GBP8.5bln and linker syndication of GBP4.5bln remaining this year. Given this tender and those two remaining syndications, we think it looks unlikely the linker syndication will be upsized if we see a sizeable tender this week, but still see a change of the 10-year syndication being increased to GBP10.0bln.

- If the DMO wanted to leave the option to upsize the 10-year syndication, the maximum size of the tender would be around GBP1.25bln nominal. With the two tenders being for GBP2.0bln, however, there is the chance of a larger size.

- We therefore pencil in a GBP1.0-2.0bln size for this week's transaction. Note that there is no PAOF applicable to gilt tenders.

- The DMO is open for consultation comments until 15:30GMT today and will make an announcement regarding the timing and size of the tender at 7:30GMT tomorrow.

Corrected to say "underperforming" rather than "outperforming" this morning.

GILT AUCTION PREVIEW: Potential short-dated conventional gilt tender Thursday

Jan-27 09:22

- The DMO announced earlier this morning that it would be looking to hold a tender on Thursday this week for a potential conventional sub-5 year gilt.

- We note that already in this fiscal year the 0.125% Jan-26 gilt (ISIN: GB00BL68HJ26) has been reopened via tender twice for GBP2.0bln in September and November.

- This gilt is still trading at a premium to the rest of the curve (even when taking into account its low coupon) and we think that there is still strong demand for this gilt in the market.

- We think the market agrees with our assessment as the 0.125% Jan-26 gilt is underperforming similar gilts around a similar maturity this morning.

- In terms of the size, there is only GBP2.6bln remaining in the unallocated bucket and we still have a 10-year syndication of GBP8.5bln and linker syndication of GBP4.5bln remaining this year. Given this tender and those two remaining syndications, we think it looks unlikely the linker syndication will be upsized if we see a sizeable tender this week, but still see a change of the 10-year syndication being increased to GBP10.0bln.

- If the DMO wanted to leave the option to upsize the 10-year syndication, the maximum size of the tender would be around GBP1.25bln nominal. With the two tenders being for GBP2.0bln, however, there is the chance of a larger size.

- We therefore pencil in a GBP1.0-2.0bln size for this week's transaction. Note that there is no PAOF applicable to gilt tenders.

- The DMO is open for consultation comments until 15:30GMT today and will make an announcement regarding the timing and size of the tender at 7:30GMT tomorrow.