EM LATAM CREDIT: “S&P Revises Rating Otlk On Raizen To Neg; Afrms Rtgs” – S&P

“X-S&PGR Revises Global Rating Otlk On Raizen To Neg; Afrms Rtgs” – S&P

Raizen SA (Baa3/BBB/BBB)

Neutral for spreads

- Raizen, a Brazil Fuels distributor and sugarcane processor, issued a long 10yr back in September at T+218bps and is currently trading at T+220bps.

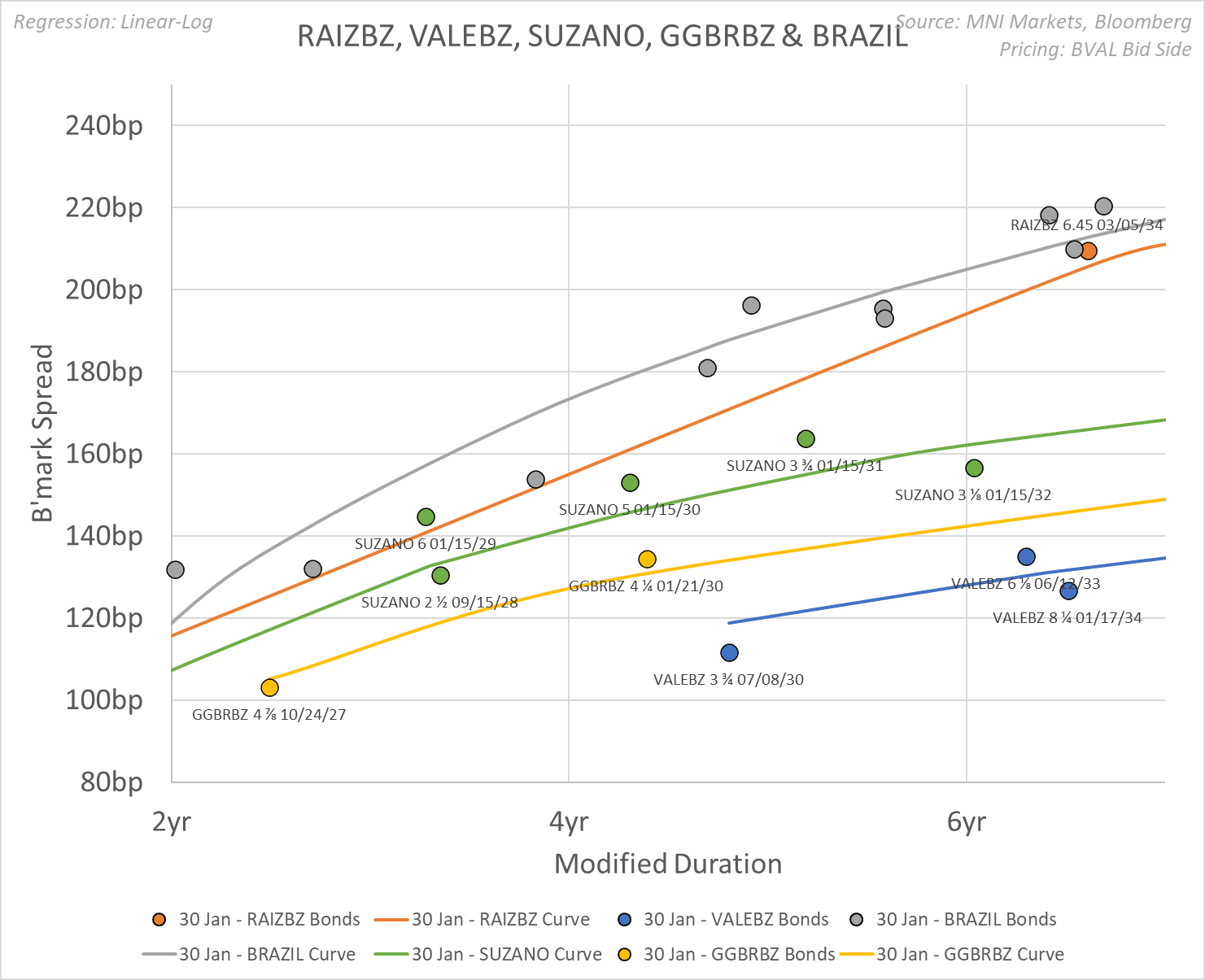

- The spread is wider than that of comparably rated Brazil corporate bonds such as iron ore miner Vale (VALEBZ; Baa2/BBB-/BBB), paper company Suzano (SUZANO; -/BBB-/BBB-) and steel company Gerdau (GGBRBZ; -/BBB/BBB) with comparable maturity interpolated spreads of T+142bps, T+192 and T+170 bps respectively. Raizen has tended to trade more in line with the Brazil (BRAZIL; Ba1pos/BB/BB) sovereign currently at give 10 bps differential.

Leverage elevated at 3-3.5x debt/ebitda with S&P preferring 2.5x for the ‘BBB’ rating with weaker Ebitda and high capex expected in the near term. The disappointing 3Q operational update on January 21st seemed to be the trigger with water shortages, wildfires and currency depreciation cited as some of the causes.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US TSYS: Tsy Curves Look To Finish 2024 at June'22 Highs

- Treasuries look to finish the last trading session of 2024 lower after reversing Tuesday morning support. Markets closed Wednesday for New Years day, resume full trade Thursday.

- The Mar'25 10Y contract trades 108-25.5 (-5.5) late in the day, 10Y yield near session high of 4.5871%. Curves bounced off flatter levels, 2s10s climbing to 34.344 -- the highest level since June 2022.

- Short end support, in turn, helped projected rate cuts into early 2025 gain momentum vs. late Monday levels (*) as follows: Jan'25 steady at -2.8bp, Mar'25 -14.6bp (-13.6bp), May'25 -20.6bp (-19.5bp), Jun'25 -29.8bp (-28.8bp).

- No substantive reaction to this morning's housing and regional Dallas Fed services activity data. Looking ahead to Thursday data (prior, est): Initial Jobless (219k, 221k) and Continuing Claims (1.910M, 1.890M) at 0830ET; S&P Global US Manufacturing PMI (48.3, 48.3) at 0945ET; Construction Spending MoM (0.4%, 0.3%) at 1000ET.

- Treasury supply: $85B 4- & $80B 8W bill auctions at 1130ET, $64B 17W bill auction at 1300ET.

COMMODITIES: WTI Futures, Gold Holding Higher

WTI futures are trading higher today as the contract extends recent gains. A stronger reversal to the upside would refocus attention on key short-term resistance at $76.41, the Oct 8 high. Initial firm resistance is unchanged at $71.97. A bear threat in Gold remains present. The yellow metal traded sharply lower on Dec 18 and the move undermines a recent bull theme. A resumption of weakness would open key support at $2536.9, the Nov 14 low.

- WTI Crude up $0.9 or +1.27% at $71.88

- Natural Gas down $0.32 or -8.13% at $3.618

- Gold spot up $19.24 or +0.74% at $2625.86

- Copper down $6.95 or -1.7% at $402.3

- Silver down $0.1 or -0.34% at $28.8383

- Platinum up $3.96 or +0.44% at $908.02

US STOCKS: Late Equity Roundup: Tech & Interactive Media Sectors Underperforming

- Stocks are trading near session lows after reversing early session gains. Though off this year's record highs (SPX Eminis 6178.75, DJIA 45,073.63, Nasdaq 20,204.58) major averages will finish the year with double digit gains: SPX Eminis +19.5%, DJIA +13.1%, while the Nasdaq gained 29.9%!

- Currently, the DJIA trades down 92.19 points (-0.22%) at 42474.46, S&P E-Minis down 28 points (-0.47%) at 5929.75, Nasdaq down 147 points (-0.8%) at 19337.13.

- Information Technology and Communication Services shares underperformed continued to underperform late Tuesday, shares of software and semiconductor makers weighing on the tech sector: Nvidia -1.61%, Advanced Micro Devices -1.36%, Crowdstrike Holdings -1.28%.

- Interactive media and entertainment shares weighed on the Communication Services sector: Alphabet -0.9%, Live Nation -0.76%, Netflix -0.60%, Meta -0.41%.

- On the positive side, Energy and Materials sectors outperformed in the second half, oil & gas stocks buoyed the Energy sector as crude prices continued to rise (WTI +1.0 at 71.99): APA Corp +3.59%, Marathon Petroleum +2.46%, Occidental Petroleum +2.15%.

- Meanwhile, shares of chemical & fertilizer makers supported the Materials sector: Mosaic +2.44%, Celanese +1.42%, Dow +1.37%.

- Looking ahead, the next round of quarterly earnings kicks off mid-January with Blackrock, Bank of NY Melon, Wells Fargo, JP Morgan, Goldman Sachs, Citigroup, US Bancorp, M&T Bank and PNC all reporting between January 13-16.