BOE: Sellside expectations for the MPR CPI Projections: Below Target in 2/3-Year

Feb-05 16:24

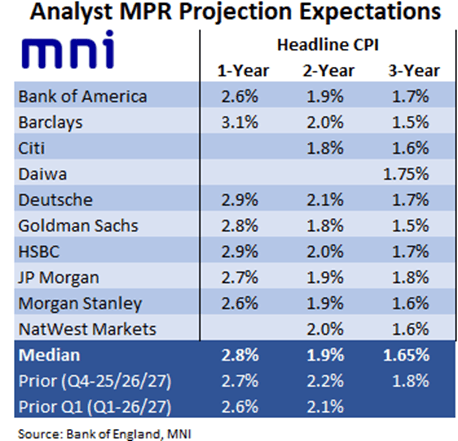

- Looking at sellside analyst expectations for this week's MPR projections, all analysts expect an upward revision to near-term CPI forecasts. This is no surprise with things like water bills and energy prices now expected to see much larger increases than previously and with core goods and food prices having surprised to the upside recently.

- With forecasts being based on the market curve which has around 40bp or so less cuts across the horizon, most analysts expect downward revisions at the 2/3-year horizons.

- At the 2-year horizon, the median of the previews that we have read sees inflation coming in at 1.9% (a tenth below the Bank’s target). All of the estimates that we have seen are between 1.8% and 2.1%. Note that 2.1% would still be below the 2-year forecast made in the November MPR (of 2.2%) but would see no revision to the Q1-26 forecast (which will now mark the 2-year horizon).

- The majority of analysts (9/10) also look for a downward revision to the 3-year forecast from the previous 1.8%. The median comes in at 1.65% with analyst estimates as low as 1.5%.

- Anything above / below these numbers is likely to elicit a hawkish / dovish reaction from the market.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

FED: US TSY 13W AUCTION: NON-COMP BIDS $2.319 BLN FROM $84.000 BLN TOTAL

Jan-06 16:15

- US TSY 13W AUCTION: NON-COMP BIDS $2.319 BLN FROM $84.000 BLN TOTAL

FED: US TSY 26W AUCTION: NON-COMP BIDS $1.798 BLN FROM $72.000 BLN TOTAL

Jan-06 16:15

- US TSY 26W AUCTION: NON-COMP BIDS $1.798 BLN FROM $72.000 BLN TOTAL

JUSTIN TRUDEAU TO STEP DOWN AS CANADA LIBERAL LEADER AND PM

Jan-06 16:04

- JUSTIN TRUDEAU TO STEP DOWN AS CANADA LIBERAL LEADER AND PM

- CANADA'S TRUDEAU SAYS PARLIAMENT SUSPENDED UNTIL MARCH 24