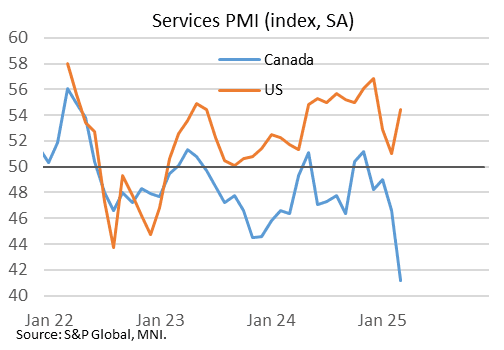

CANADA DATA: Services PMI Shows Sharp Contraction In March

The S&P Global Canada March Services PMI fell to 41.2 in March from 46.6 prior. That marks the lowest since June 2020 and the 4th consecutive figure below the 50 mark denoting contraction. The composite reading fell to 42.0 vs 46.8 prior.

- Unsurprisingly, the trade war with the US featured heavily. The report sums up the state of the service sector with: "Severe drops in activity and new business recorded in March... Tariffs and an uncertain outlook weigh heavily on demand...Confidence down to lowest level since May 2020...cost inflation accelerates, but output charges up only slightly"

- More detailed highlights: "Canada’s service sector economy endured in March its steepest cuts to activity and new business since the height of the COVID-19 pandemic. Tariff concerns, which led to a retrenchment of client spending, weighed on market demand and subsequently sector performance. With the

outlook also extremely uncertain, confidence about the next 12 months fell to a near five-year low. Modest job losses were also registered." - "Cost inflation meanwhile accelerated noticeably, but a challenging market environment meant service providers chose to broadly not pass on higher operating expenses to clients."

- "Tariffs were the principal driver of the steep fall in activity due to the negative impact these had on new business volumes. Latest data showed that new work received by service providers also fell at a broadly unprecedented pace."

- "With new business and confidence down noticeably, a third successive monthly decline in staffing levels was recorded in March, although the latest contraction was modest in nature and the slowest in the current downturn. Nonetheless firms had more than sufficient capacity to deal with overall workloads. Backlogs of work outstanding declined sharply in March and to the greatest degree since June 2020."

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US STOCKS: Late Equities Roundup: Chip Stocks Spur late Bounce, Nasdaq Leads

- Stocks are mixed in later trade, S&P Eminis managing to claw their way off January lows, while the Nasdaq is in the green led by semiconductor stocks. Little has changed regarding underlying risk sentiment, however, global markets still concerned over the impact of 25% US import tariffs against Canada & Mexico, 20% on China, not to mention agriculture products starting April 2.

- Currently, the DJIA trades down 314.99 points (-0.73%) at 42874.67, S&P E-Minis down 20.25 points (-0.35%) at 5840.0 (vs. 5744.00 low), Nasdaq up 101.8 points (0.6%) at 18450.86.

- Information Technology and Communication Services sectors led gainers in the second half, semiconductor makers buoyed the Tech sector: Super Micro Computer +10.20%, Enphase Energy +8.61%, First Solar +4.14% and NVIDIA +3.00%.

- Interactive media and entertainment shares buoyed the Communication Services sector with Match Group +3.38%, Warner Bros Discovery +2.90% and Alphabet +2.89%.

- Financial and Consumer Staples sectors lead the decline in late trade: banks and services led laggers in the former with Citigroup -5.07%, Ameriprise Financial -5.01%, Discover Financial Services- 4.95%, Capital One Financial Corp-4.87% and Bank of America -4.72%.

- Meanwhile, Target -3.10%, Coca-Cola -2.56%, Estee Lauder Cos -2.54% and Philip Morris International -2.46% weighed on the Consumer Staples sector.

- Earnings expected after the close include: Crowdstrike Holdings, Ross Stores, Foot Locker, Campbell's, Abercrombie & Fitch, Brown-Forman Corp, Marvell Technology and Victoria's Secret.

USDJPY TECHS: Bear Cycle Resumed

- RES 4: 154.80 High Dec 12 ‘24 and a key resistance

- RES 3: 152.83 50-day EMA

- RES 2: 151.30 High Mar 3 and a key near-term resistance

- RES 1: 149.65 Intraday high

- PRICE: 148.49 @ 16:29 GMT Mar 4

- SUP 1: 148.01 Low Oct 9 ‘24

- SUP 2: 147.02 2.0% 10-dma envelope

- SUP 3: 146.95 61.8% retracement of the Sep 16 ‘24 - Jan 10 bull leg

- SUP 4: 145.92 Low Oct 4 ‘24

USDJPY traded sharply lower Tuesday. The move down has resulted in a print below support at 148.57, the Feb 25 low, to confirm a resumption of the downtrend. The break lower has also resulted in a clear breach of 148.65, the Dec 3 ‘24 low. This paves the way for an extension towards 146.95, a Fibonacci retracement. On the upside, key short-term resistance has been defined at 151.30, the Mar 3 high. Clearance of this level is required to signal a base.

US STOCKS: Late Session Rebound

- US stocks are making a recovery since midday, Nasdaq in the green as Tech sector of all places lead the bounce with Super Micro Computer Inc, Enphase Energy Inc and First Solar Inc all up 5.5-8.5% at the moment.

- DJIA down 266.35 points (-0.62%) at 42503.93

- S&P E-Mini Future down 15.5 points (-0.26%) at 5774.5

- Nasdaq up 104.5 points (0.6%) at 18144.75